Introduction

Canada is one of the world’s top producers of natural gas, with a reported 184.7 billion cubic meters produced in 2018 and 1.9 trillion cubic meters of proven reserves at the end of 2018.1 Most of the marketable production in Canada comes from onshore reserves in British Columbia and Alberta, but reserves are found across the country both onshore and offshore. Canada has historically been a natural gas exporter, with most exports being transported south via pipeline to the United States. In the last 15 years, however, technological advancements and abundant supplies have shifted market dynamics, reducing American demand for Canadian natural gas.

These market factors have hurt many western Canadian producers, causing some to look for alternate markets overseas. With low commodity prices, a stable political regime, and proximity advantages, Canada is well-positioned to compete in markets beyond North America. However, as has been seen in recent years, the development of infrastructure projects in Canada can face a variety of challenges including regulatory obstacles, requirements to engage with Indigenous groups, and the risk of protests and blockades by those opposing such projects. Nevertheless, the impetus of growing global energy demand and the aspiration to supply that demand with cleaner-burning and responsibly sourced fuel has generated significant momentum in the Canadian natural gas industry, particularly with respect to liquefied natural gas (LNG).2

Canada’s LNG industry began decades ago, with small-scale facilities serving local markets, including as peak-shaving facilities (due to the relative ease by which LNG can be stored and regasified to meet demand) and to provide fuel to remote areas without gas pipeline infrastructure.3 There are also existing LNG import and export operations in Canada. On the import side, in 2009, prior to the shift in Canadian energy strategy, the first large-scale Canadian LNG regasification terminal, Canaport LNG, began operations in Saint John, New Brunswick, importing LNG from overseas and supplying gas to eastern Canada and the northeastern US. With the growing demand for export capacity, it was proposed that this facility would be converted into an export terminal, but the proposal was reportedly put on hold in 2016.4 On the export side, FortisBC’s Tilbury liquefaction facility in Delta, British Columbia has been operating since 1971 and reportedly exported its first shipment of LNG to China by ISO container in 2017.5 While this facility is currently relatively small, plans exist for its expansion.6 Additionally, in order to maximize the potential of Canada’s LNG export industry, the development of additional liquefaction capacity has been proposed on

both the east and west coasts.

Emissions imperatives and the need for cheaper energy to support a growing population with higher living standards have fortified global demand for LNG, which has become the fastest-growing commodity market in the world.7 In 2019, global demand was reported to have increased by 12.5 percent to 359 million tonnes, and is expected to reach 700 million tonnes by 2040.8 Asia, and particularly China, is expected to remain the dominant market for LNG exports from western Canada; however, European demand is also significant with many countries taking steps to reduce their reliance on natural gas transported by pipeline

from Russia. This is driving demand for LNG from eastern Canada.

To address the increasing demand, at least 18 LNG export facilities have been proposed in Canada to date: 13 in British Columbia, two in Quebec, and three in Nova Scotia.9 Several projects have since been reported to have been cancelled or put on hold due to financial or regulatory obstacles, low natural gas and LNG prices, and other market factors. Many commentators have expressed frustration over the length of time it has taken to develop these projects in Canada. They have raised concerns that, with large-scale liquefaction facilities already having been operating for many years in other major gas-producing countries such

as the US, Qatar, and Australia, and other projects expected to come on stream in the near future and capture market share, the window of opportunity for Canadian projects to satisfy Asian and European LNG demand may be narrowing. The plentiful supply of LNG on the market that has been created by existing projects, together with concerns over demand (both in the short-term due to events such as the COVID-19 pandemic and in the longer-term, for example, due to the slowing of China’s economic growth) have led to a softening of global LNG prices. This has caused investor apprehension over the relatively high cost and long lead times associated with the development of LNG projects in Canada.

The COVID-19 pandemic has had a significant impact on the LNG market globally, including with respect to the projects proposed in Canada. The disruption to businesses and other gas consumers resulting from the pandemic has reduced demand for LNG and caused many of the world’s leading buyers of LNG to declare force majeure or seek to defer shipments. In Canada, the economic impacts of COVID-19 and the measures taken to reduce the spread of infection have resulted in delays to investment decisions and construction.10 However, there remain many factors supporting the development of LNG projects in Canada in the longer-term, including the desire to supply the world with responsibly sourced, costeffective, and relatively clean fuel. Given the expectation that the market will rebalance over the coming years and global demand for LNG will continue to increase over the long-term, many remain positive about the future and potential benefits of the Canadian LNG industry. With at least one major project already under construction and others likely to follow in the near future, Canada is expected to join the large-scale global LNG export trade within the first half of this decade. At the time of writing, the status of the Canadian LNG export projects appear to be as follows.11

Table 1: Status of proposed Canadian LNG export projects

| Project Name and Proponents |

Province |

Status |

| LNG Canada – Shell, PETRONAS, PetroChina, Mitsubishi Corporation, and KOGAS |

British Columbia |

Final investment decision made on 1 October 2018. Construction of Phase 1 is underway and, while the construction workforce has been reduced due to the COVID-19 pandemic, the project is still expected to begin exporting LNG by 2025.12 |

| Woodfibre LNG – subsidiary of Singapore-based Pacific Oil and Gas Ltd. |

British Columbia |

Approvals are in place, but the project is still awaiting a final investment decision. On 24 March 2020, Woodfibre LNG applied for a five-year extension to its Environmental Assessment Certificate as a result of delays caused by COVID-19 and the bankruptcy of a preferred contractor. Construction is reportedly expected to begin in the summer of 2021.13 |

| Kitimat LNG – Chevron Corp. and Woodside Petroleum Ltd.14 |

British Columbia |

Proposed. A final investment decision has not been made, but is expected by some analysts to be made in the middle of this decade.15 |

| Tilbury LNG – FortisBC -and- Tilbury Pacific LNG Jetty – WesPac Midstream |

British Columbia |

FortisBC’s facility is currently operational, with an initial phase of expansion underway. A second phase of expansion has been proposed and is under environmental review, but appears to be awaiting a final investment decision.16 WesPac’s proposed marine jetty which would be utilized by the LNG terminal is also under environmental review.17 |

| Énergie Saguenay – GNL Québec Inc. |

Quebec |

Proposed. Environmental Assessment in progress. Final investment decision expected at the end of 2021.18 |

| Bear Head LNG – Liquefied Natural Gas Limited |

Nova Scotia |

Proposed. Planned target date for reaching a final investment decision is uncertain and the project proponent is reported to have entered voluntary administration on 30 April 2020.19 |

| Goldboro LNG – Pieridae Energy Limited |

Nova Scotia |

Proposed. A final investment decision has reportedly been delayed due to the COVID-19 pandemic and key deadlines have been extended under the project’s 20-year offtake agreement with Uniper Global Commodities.20 A final investment decision is now expected to be made by 30 June 2021 and, if the project proceeds, commercial deliveries of gas are expected to start between 31 August 2025 and 28 February 2026.21 |

| |

|

|

While the future of some of these projects remains uncertain, it is hoped that many will proceed with development in the near future. For the projects that do go forward, it is expected that they will be developed primarily for the export of LNG to other markets, but some will also supply LNG to meet Canada’s domestic demands and the growing LNGbunkering sector. In any case, there is expected to be an increasing number of LNG carriers and other vessels calling at Canadian ports to load LNG once these facilities become operational.

Transportation of LNG from shore-based liquefaction facilities will engage a broad range of rules and regulations in Canada governing the operation of ships in Canadian waters and, where relevant, the export of LNG. A variety of non-regulatory requirements will also apply to those involved in such activities as a result of the contractual arrangements invariably entered into when using terminals, port facilities and related services, when chartering and operating ships, and when buying and selling LNG.

This article provides an overview of the key areas of the legal landscape, including both regulatory and other requirements downstream of liquefaction terminals in the context of Canadian LNG projects. The supply and transportation of LNG and their associated legal concepts exist within the larger framework of the LNG value chain — a sequence of largescale operations with co-dependent processes and economics.

The LNG value chain

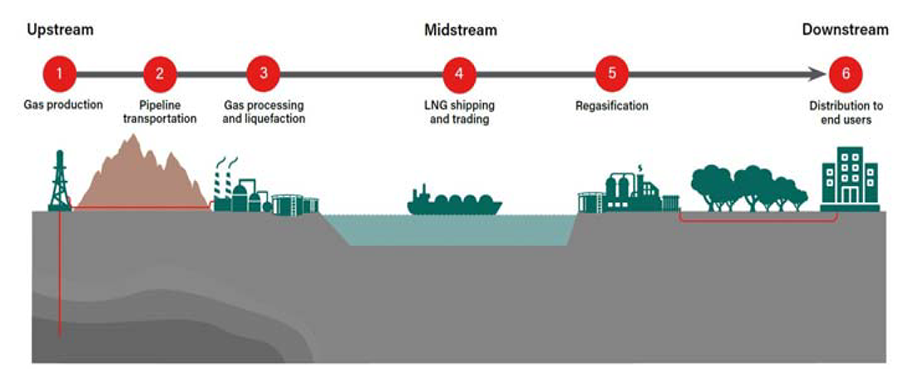

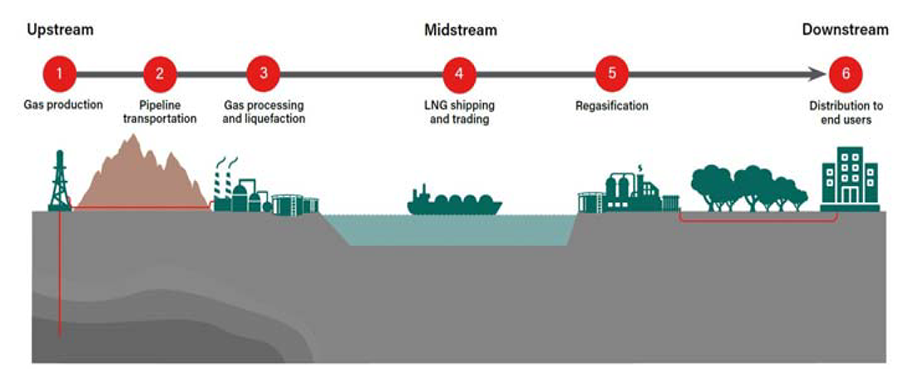

In order to contextualize the supply and transportation of LNG from Canadian ports, as well as introduce some of the participants who may be involved, the first part of this article provides a general overview of the LNG value chain, which is typically comprised of the following elements running between the wellhead and the end user: (1) gas production; (2) pipeline transportation; (3) gas processing and liquefaction; (4) LNG shipping and trading; (5) regasification; and (6) distribution to end-users.

Figure 1: The LNG Value Chain

Each element of the value chain is intended to add economic value, and although each of

these phases are linked, each is a substantive, capital-intensive operation in its own right. The

manner in which the value chain ties together, and the related contractual arrangements,

depend on the financial and operational structure of the project and the individual risk profile

and capabilities of the various participants. There are myriad ways in which the LNG value

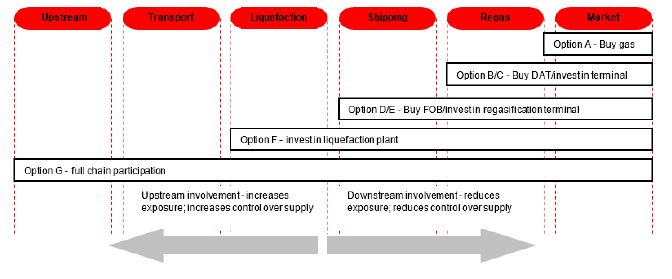

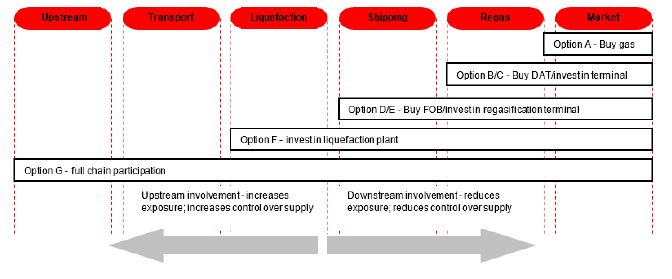

chain can be structured among multiple participants. From the perspective of a downstream

utility or other energy company requiring a supply of LNG or gas, for example, there are

various ways for it to enter the value chain in order to ultimately source such LNG or gas,

including those illustrated in the figure below, that will offer varying degrees of control over

supply and associated risk.

Figure 2: Illustration Of Options For Participation In Multiple Elements Of The Lng Value Chain

While a single sponsor could theoretically invest in the development of an entire value

chain for secure supply (including the gas production assets, pipeline, liquefaction facility,

LNG carriers, regasification facility, and even downstream pipeline and power generation

facilities), in practice it is more common for one or more sponsors to invest in only certain

portions of the value chain. For instance, there have been a number of examples of multiple

participants investing in the upstream portions (with co-ownership of production assets,

pipelines, or liquefaction facilities). Full chain participation by multiple sponsors is less

common, as proponents will usually have downstream commitments in different locations,

requiring the use of different shipping routes, regasification facilities, and downstream

pipelines. Generally speaking, the fewer the participants involved and the more integrated

the chain, the more control the participants will have over the supply, but the higher their

capital investment (and associated exposure) is likely to be.

Other LNG projects may be structured with less integration and each element of the value

chain may be an independent and free-standing operation by independent participants, who

are driven by the economics of their individual operation rather than the LNG project as a

whole. For instance, a gas producer may sell gas to a liquefaction facility operator, who may

sell LNG to a buyer (transported by LNG carriers chartered from a third party shipowner),

who may regasify the LNG using third party owned facilities to fulfil gas supply

commitments in the destination country. For this type of structure, contractual commitments

play a particularly crucial role in managing competing interests and allocating risk among

the participants.

Irrespective of whether or not the elements are integrated, the LNG value chain ultimately

links together through connections between the infrastructure of each successive phase, and

contractually at each interface between two or more participants. Each element is codependent

on the others. If, for instance, gas pipeline transportation to the liquefaction plant

is interrupted, this may impact all other elements of the value chain both upstream and

downstream of the pipeline, making alignment between contractual arrangements at each

stage of the value chain desirable where possible.

A. Gas Production

The upstream segment of the natural gas industry typically refers to the operations

involved in exploration, development, and production of natural gas. In Canada, a gas

producer will generally first obtain rights (either directly or indirectly) under a mineral

permit, licence or lease from the Crown, or a freehold lease if the minerals are privately held.

The vast majority of gas that is expected to be fed into LNG projects in Canada is expected

to be sourced from onshore reserves, but, if the reserves are offshore, their development will

be subject to a different legal regime requiring exploration, significant discovery, and

production licences.22 In any case, once a deposit has been selected for development, a production well will need to be drilled. The method of developing the well will be dependent

on the geology of the reserve. For conventional natural gas, where the formation exists

directly below the earth’s surface, vertical wells may be drilled straight down into the rock

formations. Where the formation cannot be accessed vertically, the producer may extract the

gas using horizontal drilling. This method incorporates a flexible drill pipe that can be

directed horizontally at a desired depth. In the case of unconventional gas, primarily shale

gas that is trapped in less porous rock, producers may use multi-stage hydraulic fracturing.

This relatively new production method has contributed to the changing economics of the

natural gas market, particularly in the US, transforming it from an importer to one of the

largest exporters of LNG in a short period of time. However, this production method has not

been universally popular, which has created an important role for conventionally sourced

natural gas, and the LNG derived from it.23

B. Pipeline Transportation

Once natural gas has been extracted, it will typically be transported via one or more

pipelines to a liquefaction facility to be processed and liquefied into LNG. If the pipelines

are owned by third parties, gas transportation agreements will typically be entered into

between the gas pipeline operators and the shippers of the gas (which could be the owner of

the gas or the operator of the liquefaction facility if, for instance, it has agreed to receive gas

upstream of the plant and arrange some or all of the pipeline transportation). The gas shipper

will generally pay the pipeline tariffs, which factor into the economics of the sale and

purchase of gas or LNG downstream and the project as a whole. As with gas production, it

is critical to the reliability of any downstream commitments to supply LNG or gas that

sufficient firm pipeline capacity be secured in order to ensure the reliable transportation of

gas to the liquefaction facility.

C. Gas Processing And Liquefaction

The processing and liquefaction of natural gas at a liquefaction terminal can be structured

in a variety of ways, but most projects will be structured based on one of the following

fundamental models.

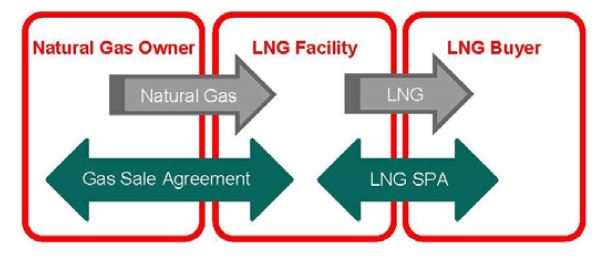

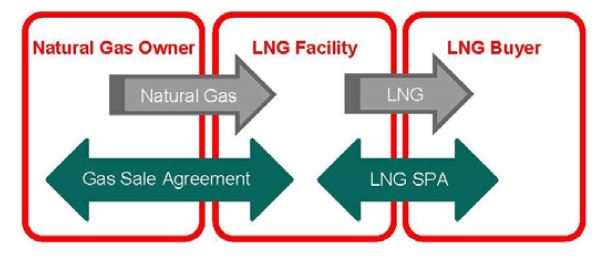

1. MERCHANT MODEL

In this model, the LNG terminal operator purchases and takes title to the natural gas

upstream of the facility (typically by way of a natural gas sale and purchase agreement,

which, in Canada, will often be based on one of the GasEDI or NAESB standard forms),

processes and liquefies the gas, and sells it as LNG downstream of the facility (typically by

way of an LNG sale and purchase agreement (SPA)). Any LNG offtaker (which may not be

the same person that sold the corresponding volumes of gas to the LNG terminal operator)

will contract directly with the operator of the LNG terminal for the purchase of LNG and the

cost of the gas and liquefaction process will generally be incorporated into the price of the

LNG.

Figure 3: The Merchant Model

2. Tolling Model

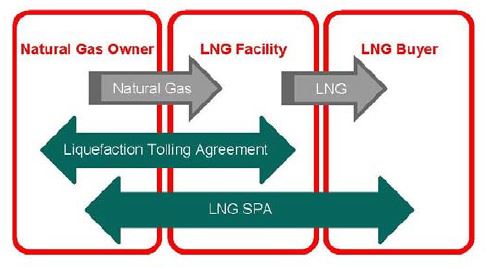

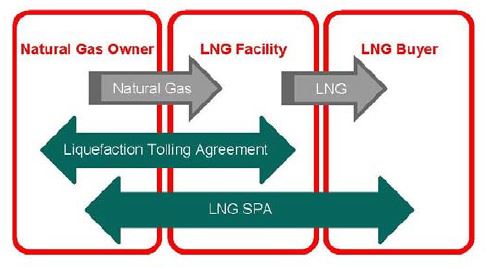

In this model, title to the natural gas (and LNG derived from it) generally remains with

the customer using the LNG terminal during the liquefaction process (subject to any

quantities the LNG terminal operator is entitled to use as fuel gas). Under a liquefaction

tolling services agreement or other form of terminal use agreement between the customer and

LNG terminal operator, the customer will be required to deliver its gas (while retaining title

to it) upstream of the LNG terminal and, in return for payment of a tolling fee to the LNG

terminal operator, the operator will process and liquefy the gas and deliver LNG to the

customer downstream of the plant. The customer will then typically either sell its LNG to an

offtaker at the outlet of the LNG terminal (as would be the case if the customer was selling

the LNG on a Free On Board (FOB) basis) or arrange for the LNG to be transported to

another location (as would be the case if the customer was selling the LNG on a Delivered

Ex Ship (DES) or Delivered At Place (DAP) basis).24 Either way, the customer would pay

a tolling fee to the LNG terminal operator and would generally seek to recover this cost

(together with the cost of producing or purchasing the gas and any transportation costs)

through the price at which it ultimately sells the LNG or gas downstream of the LNG

terminal.

Figure 4: The Tolling Model

While the above models are the primary structures most often used for LNG terminals,

many variants and hybrids may be used depending on commercial, operational, financial, and

other factors. For example, where multiple proponents wish to develop an LNG terminal and

participate in two or more components of the LNG value chain, it is not uncommon for

integrated project structures to be used that essentially incorporate either the merchant or

tolling model for the LNG terminal component. In such a case, the LNG terminal may be

owned and operated by a project company which either provides each of the participants with

a portion (based on its equity participation) of the terminal’s liquefaction capacity on a

tolling basis (for example, with each participant supplying its own volumes of gas and

marketing its own LNG) or operates essentially on a merchant basis for the benefit of each

of the participants (potentially with the project company sourcing gas from a related

upstream joint venture and marketing all of the LNG on behalf of the participants).

D. LNG Shipping and Trading

Where LNG is produced at a marine terminal for export, it will generally be stored and

loaded onto LNG carriers so that it can be transported by sea to the relevant regasification

terminal. It is this marine transportation component of the LNG value chain with which the

next two parts of this article are primarily concerned.

LNG carriers are specially designed vessels with insulated cargo tanks that are intended

to carry LNG and keep it cool during a voyage. Despite having insulated tanks, quantities

of LNG will inevitably convert to gas during a voyage, which is referred to as “boil-off.”

LNG carriers are often fitted with dual-fuel engines in order that their propulsion systems can

run off boil-off gas (as an alternative to fuel oil). They may also be fitted with reliquefaction

systems so that boil-off gas can be reliquefied and pumped back into the vessel’s cargo tanks.

Due to the nature of the LNG market, each voyage undertaken by an LNG carrier will

typically involve two legs: (1) a “laden” voyage from the loading port where the liquefaction

terminal is located to the discharge port where the regasification terminal is located; and (2)

a “ballast” voyage from the discharge port to the next loading port. Since the tanks of an

LNG carrier must be cooled before loading bulk LNG, a quantity of LNG (referred to as

“heel”) is often retained on board following discharge, which is used to maintain the cargo

tanks in a cooled state during the ballast voyage in order that the vessel’s tanks are ready to

load LNG when they reach the loading port. Otherwise, an LNG carrier’s cargo tanks will

need to be cooled down (typically by spraying LNG into the tanks) prior to loading LNG

once the vessel reaches a loading port. If a vessel’s cargo tanks are “gas-free” (that is, full

of air), which may be the case if the vessel is a newbuild or has had its tanks gas-freed in

order to allow maintenance to be carried out on the tanks, then, prior to cooling-down, the

tanks will also need to be “inerted” (by filling them with inert gas to remove oxygen) and

then gassed-up (by filling them with methane to displace the inert gas). Gassing-up and

cooling-down services are often provided at LNG terminals for this reason.

Which participant in the LNG value chain arranges shipping will depend on the structure

of the particular project and, in particular, the terms of any LNG sale and purchase agreement

LNG SPA. LNG SPAs commonly incorporate Incoterms in order to address the place of delivery and various other terms.25 The Incoterms that are most commonly used in LNG

SPAs include:

- FOB (named port of shipment): in this case, delivery of the LNG will be effected

and the risk of loss of or damage to the LNG will generally pass to the buyer as the

LNG is loaded onto the LNG carrier at the LNG liquefaction terminal. The LNG

seller (which may be the customer of the LNG liquefaction terminal in the case of

the tolling model or the LNG terminal operator in the case of the merchant model)

will generally be responsible for all costs up to that point and the buyer will be

responsible for transporting the LNG to the discharge port at its own risk and cost.

The seller will be responsible for obtaining, at its own cost, any export licence and

other authorizations required for the export of the LNG. The buyer will be

responsible for obtaining, at its own cost, any import licence and other

authorizations required for the import of the LNG and for its transport through any

country.

- DAP (named place of destination): in this case, delivery of the LNG will be

effected and the risk of loss of or damage to the LNG will generally pass to the

buyer as the LNG is unloaded from the LNG carrier at the discharge port where the

LNG regasification facilities are located. The LNG seller will generally be

responsible for all costs up to that point and will be responsible for transporting the

LNG to the discharge port at its own risk and cost. The seller will be responsible

for obtaining, at its own cost, any export licence and other authorizations required

for the export of the LNG and for its transport through any country. The buyer will

be responsible for obtaining, at its own cost, any import licence and other

authorizations required for the import of the LNG. It is not uncommon for the DES

term (which refers to Incoterms 2000) to be used as an alternative to DAP, although

this term has technically expired and does not feature in either the 2010 or 2020

versions of Incoterms.

Historically, LNG has been traded predominantly under long-term SPAs continuing for

the life of a particular LNG liquefaction project, which was often required in order to secure

project financing. However, due to a number of factors including the increasing number of

proponents such as oil majors and large trading houses funding LNG projects without the use

of project finance and a supply-driven market with LNG buyers requiring greater volume and

destination flexibility, LNG is increasingly traded on a short-term or spot basis. This has

resulted in a degree of standardization of the terms of the Master LNG SPAs that are

commonly used in such short-term and spot trading of LNG, with a number of standard

forms having been published by traders of LNG such as Trafigura and BP and industry

associations such as the Association of International Petroleum Negotiators (AIPN) and the

International Group of Liquefied Natural Gas Importers (GIIGNL).

Whether it is the buyer (in the case of a FOB sale) or the seller (in the case of a DAP or

DES sale) that is responsible for transporting the LNG from the LNG liquefaction terminal,

it will typically do so using an LNG carrier that it owns or has chartered. In some cases, LNG

project proponents may wish to invest in LNG carriers and integrate the marine

transportation component of the LNG value chain with other parts of the project. This has

been seen in some cases, for example, where companies which have traditionally owned and

operated ships have wanted to diversify and invest in other parts of the LNG value chain

such as liquefaction, regasification, or power generation. However, given that many, if not

most, buyers and sellers of LNG are not in the business of owning and operating LNG

carriers — which involves significant capital costs, technical capabilities, and commercial

and operational risk — it is common for traders of LNG to charter LNG carriers from

shipowners whose principal business is the ownership and operation of such vessels.

Chartering refers to the procurement of the services of a ship such as an LNG carrier by

way of a charter party, which is essentially a contract for the hire of a ship for a period of

time or for one or more particular voyages. Traditionally, LNG carriers have been chartered

under long-term time charter parties in order to fulfil obligations under long-term SPAs,

often operating between a single loading port and a single discharge port for 20 years or

more.26 However, with the increasing volumes of LNG traded on a short-term or spot basis,

it is becoming more common for LNG carriers to be chartered under shorter-term time

charter parties, voyage charter parties, or contracts of affreightment.27 In any case, there will

be a significant cost associated with engaging a LNG carrier to transport LNG from a LNG

liquefaction terminal and the buyer or seller (as the case may be) will have a significant

interest in avoiding any delay in loading that could result in wasted hire (in the case of a time

charter party) or liability to the shipowner for demurrage (in the case of a voyage charter

party), along with additional boil-off of any LNG heel on the LNG carrier.

Users of an LNG terminal will therefore need to structure their offtake arrangements and

schedule their deliveries of gas and LNG carefully in order to minimize the risk of delay and

ensure that they have rights of recourse against their counterparties in the event of any

unexcused delay. LNG SPAs will typically provide the buyer in a FOB sale with a right to

receive demurrage and compensation for excess boil-off from the seller in the event the seller

fails (other than by reason of force majeure or another excusable event) to complete delivery

of the LNG within an allowed period of laytime, which is intended to compensate the buyer

for the resulting wasted hire or demurrage and additional boil-off. LNG sellers will wish to

ensure that such liabilities are covered up the value chain where possible and, if the seller is

the customer of the LNG liquefaction facility under a tolling arrangement, it may seek to

negotiate a right to receive compensation from the LNG facility operator if it fails without excuse to make a cargo of LNG available for lifting at the scheduled time. As with the rest of the LNG value chain, maximizing the alignment between contractual arrangements at each point is key.

E. Regasification

Once the LNG carrier completes its voyage from the LNG liquefaction terminal and

arrives at the destination port, the LNG will typically be unloaded and regasified at the

receiving terminal in order that the gas can be transported further downstream by pipeline.

In the event that the LNG is sold on a DAP or DES basis, it will be delivered by the seller

to the buyer as it is unloaded from the seller’s LNG carrier at the unloading port or, in the

case of an FOB sale, the LNG would already have been delivered to the buyer at the loading

port and would be unloaded from the buyer’s LNG carrier at the unloading port. In either

case, the LNG buyer would be responsible for arranging the receipt and regasification of the

LNG.

Regasification facilities can take a number of different forms, and, by way of illustration,

may be floating (as is the case with a floating storage and regasification unit (FSRU)),

situated on a jetty, or located onshore. FSRUs are often converted LNG carriers with

regasification equipment installed on their decks, but may also be purpose-built. They are

moored offshore and connected to the shore by pipeline, enabling them to receive LNG from

LNG carriers, regasify such LNG onboard, and then send the resulting natural gas onshore

by pipeline.

Regasification facilities share a number of similarities with liquefaction facilities

(essentially performing the opposite function by converting LNG back into natural gas). As

with liquefaction facilities, they may be structured based on a merchant model (such that the

operator of the facilities, if it does not already own the LNG, would purchase the LNG

upstream of the regasification facilities, regasify it, and either use or sell the resulting gas

downstream of the facilities) or a tolling model (such that the owner of the LNG would retain

title to the LNG and resulting gas during the regasification process and pay the operator of

the facilities a tolling fee for the regasification service provided under a terminal use

agreement). They may also be part of an integrated project. There have been examples, for

instance, of participants having interests in both the regasification facilities, downstream

pipeline, and power generation facilities (for example, in gas to power projects).

F. Distribution to end user

Once the LNG has been regasified, the gas will usually be transported by pipeline to its

point of consumption, which marks the end of the value chain. Within this section of the

value chain downstream of the regasification terminal, there may potentially be multiple

further contractual arrangements with respect to the storage, pipeline transportation,

processing, and sale of the gas under one or more gas sale and purchase agreements.

Alternatively, the gas may be fed directly from the regasification terminal to a single user.

The downstream arrangements will depend largely on how the gas will ultimately be

consumed.

For example, it may be that the gas will be sold to a utility, fed into the natural gas grid,

and ultimately sold to consumers for domestic heating and cooking purposes and businesses

for industrial purposes. It may be used to feed a gas-to-power project, delivering power to

a market with insufficient existing generation capacity, or it may be used as a chemical

feedstock in the manufacture of plastics or other chemicals.

The economics of this component of the value chain are fundamental to the project as a

whole. Without a ready market for consumption of gas and a demand for LNG to supply that

market, the LNG project would not exist.

G. Alternative applications for LNG

The above discussion has focussed on the traditional LNG value chain which has emerged

based on the relative ease by which LNG (as compared to natural gas in its gaseous state) can

be transported by ship to overseas markets, linking producers of gas in one part of the world

with consumers of gas in another. However, LNG has a number of other potential

applications, with value chains that may look significantly different from the traditional one

discussed above.

One such application is LNG bunkering, which refers to the use of LNG as “bunker” fuel

for marine transportation. While LNG carriers have long been fitted with dual-fuel engines

that can run on LNG in order to utilize the boil-off gas that naturally results from the carriage

of LNG as cargo, due to the relatively low price of LNG in recent years and the increasingly

stringent emissions standards that apply to ships and marine fuels, owners of other types of

vessels are increasingly considering the use of LNG as an alternative to traditional heavy

diesel fuel and marine gas oil and building or converting ships to run on LNG.

On 1 January 2020, a new cap imposed by the International Maritime Organization (IMO)

on the sulphur content of marine fuels came into effect, limiting the maximum sulphur

content in marine fuels to 0.5 percent globally (referred to as low sulphur fuel oil (LSFO)).28

As discussed in the next part of this article, even more stringent sulphur emissions standards

apply in Canadian waters falling within the North American Emission Control Area (ECA).

According to a study published by the IMO, switching to LNG “reduces the emissions of

NOx [nitrogen oxides] by 85% to 90% (using a gas only engine), and SOx [sulphur oxides]

and particles by close to 100% compared to today’s conventional fuel oil.”29 With virtually

no sulphur or particulates, converting to LNG is a viable way to meet these emissions

standards, while also benefiting from the current relatively low cost of LNG and lower risk

of pollution as a result of any spill of bunkers (unlike traditional marine fuels, if LNG is

released, it warms, evaporates, and dissipates).

Container shipping fleets, passenger ferries, and cruise liners are examples of the various

type of vessels that are turning to LNG with Seaspan and a number of other shipowners already reported to be leading the transition in North America.30 Proposals have also been

made to develop LNG bunkering facilities in order to supply the growing number of LNGpowered

vessels expected to be traversing Canadian waters, including on both the east and

west coasts.31

LNG also has a number of domestic onshore applications. For instance, LNG may also

be used as fuel for other areas of transportation, including trucks and locomotives, where

similar emissions and cost incentives exist. It may also be transported by truck and used as

fuel for power generation and domestic purposes in remote areas without a supply of piped

natural gas.

In each of these cases, the LNG value chain will differ from the traditional model

described above and will not involve marine transportation of the LNG as cargo. These

applications, however, represent important potential areas of supply for many of the

Canadian LNG projects that have been proposed, and vessels calling at Canadian ports to

load LNG bunkers will be subject to many of the same regulations that apply to the bulk

export of LNG by ship.

Maritime and Export Regulations

A. Jurisdiction

Navigation, shipping, and international trade and commerce generally fall under federal

jurisdiction in Canada,32 such that the regulations that apply to marine transportation and

export of LNG fall primarily within the responsibility of Canada’s federal authorities,

including the Canada Energy Regulator (CER), Transport Canada, and Environment and

Climate Change Canada.

There are limited exceptions whereby provincial laws may have an impact on marine

transportation of LNG (at least indirectly). One notable exception is with respect to the

environment due to the power of the provinces (which is shared with the federal government)

to regulate with respect to environmental matters.33 Another notable exception is the health

and safety of workers. While federal occupational health and safety (OH&S) legislation will

generally apply to employees of companies or sectors operating across provincial or

international borders, including with respect to ferries, port services, shipping, and shipping services, there remains significant scope for provincial OH&S laws to apply to maritime matters.34

B. Regulatory burden

The vast majority of the regulatory burden relating to the transportation of LNG by ship

will be borne by the owners and operators (including bareboat or demise charterers) of such

vessels. The owners of LNG cargoes and the charterers of any LNG carriers used to transport

them will generally be relatively free from any regulatory obligations that apply directly to

them in such capacity, but may have contractual obligations to comply with such

requirements (e.g. under any LNG SPA or LNG tolling services agreement), and a significant

interest in knowing what the relevant rules and regulations are and ensuring compliance by

a vessel’s owners and operators.

With respect to the export of LNG, the majority of the regulatory burden will be borne

primarily by the holder of the export licence. Due to its importance to an LNG export project,

an export licence will typically be obtained by the project proponents and held by the

operator of the LNG facilities, which may not be the same person who ultimately exports the

LNG. However, the persons actually exporting LNG who will need to rely on such an export

licence may nevertheless bear some of the regulatory burden indirectly by way of contractual

obligations (for example, contained in a tolling services agreement) to comply with the terms

of the licence and provide the licence holder with the information it will need in order to

satisfy its reporting obligations to the CER.

C. Export of LNG from Canada

Exportation of gas (which, in this context, includes LNG) falls under the federal

regulatory authority of the CER, which replaced the National Energy Board (NEB) on 28

August 2019. Regulations made under the National Energy Board Act35 will remain in force

under the Canadian Energy Regulator Act36 until they are repealed or others made in their

stead.37 The CER Act grants regulatory authority to the CER as the NEB Act did for the NEB

with respect to the federal export and import regulatory framework for oil and gas. It is

understood that new regulations and updates to existing regulations are being implemented

through a phased approach and the CER anticipates updated regulations will be available in

the summer of 2020.38 This area of the law is therefore in a state of flux and the discussion

below is based on the law as it stands at the time of writing.

Export of gas from Canada is prohibited unless it is in accordance with an export licence

or otherwise authorized under the regulations made under Part 7 of the CER Act.39 Export authorizations include export licences and export orders, which are issued by the CER.

Export orders authorize export of LNG in prescribed volumes for anywhere from zero to 20

years.40 An export licence is typically used for long-term applications and is subject to

conditions imposed by the CER in the licence.41 To date, export authorizations for LNG have

generally taken the form of export licences (due to the long-term nature of the LNG projects

that have been proposed), and in recent years the regulation of gas export licences has

changed to be more accommodating to the developing LNG industry in Canada. As

mentioned above, an export licence under section 344 of the CER Act will typically be

obtained by the proponents of an LNG export project at an early stage in its development to

ensure the feasibility of the proposed terminal.42 The process of obtaining the licence is

therefore unlikely to be a significant concern for transporters of LNG, who will typically rely

on the terminal’s export licence, but they will have an interest in ensuring that the licence is

maintained such that they are permitted to export LNG throughout the relevant term.

Export licence applicants must obtain two approvals before licences are issued.43 First,

applicants must satisfy the CER that the proposed volume of gas to be exported “does not

exceed the surplus remaining after allowance has been made for the reasonably foreseeable

requirements for use in Canada, having regard to trends in the discovery of oil or gas in

Canada.”44 This is known as the “Surplus Criterion.”45 Second, the Minister46 and Governor

in Council47 must approve the CER’s issuance of the export licence.

Export licences issued by the CER may contain conditions related to any of the following:

(1) the duration of the licence; (2) a deadline for commencement of gas (or LNG) exportation

in order for the licence to remain in effect; (3) the quantities of gas (or LNG) that may be

exported during the term of the licence; (4) maximum volumes of gas (or LNG) that may be

exported in a daily, monthly, or annual period; (5) the tolerance levels necessary to

accommodate temporary operating conditions; (6) the points of exportation of gas (or LNG)

from Canada; and (7) the environmental requirements that must remain in effect in order for

the licence to remain in effect.48 Based on the LNG export licences recently issued by the

CER and its predecessor, the NEB, the most common condition types imposed are as

follows: the duration of the licence, tolerances, annual volume caps, early expiration in the

event that exports have not commenced, and the point of export.

The point of export may raise interesting considerations for LNG terminals and LNG

offtakers. Illustrative of the issue is the application by WesPac Midstream Vancouver LLC

(WPMV) in 2014 for an export licence in connection with the WesPac Tilbury Marine Jetty.49 WPMV’s application proposed a point of export that varied from the point

conventionally considered by the NEB and CER. Conventionally, the point of export occurs

at the “last land-based locations of the gas before it begins its marine journey to depart

Canadian waters”50 for exports by sea or at the highway border crossing for land-based

exports. However, to allow for the flexibility WPMV needed to export LNG using different

modes of transportation, WPMV requested the point of export to be at (1) the outlet of the

loading arm of the WesPac LNG Marine Terminal adjacent to the liquefaction plant located

at Tilbury Island, or (2) at the hose connector of the pump at the truck rack at the liquefaction

terminal where ISO LNG shipping containers or tanker trucks are filled with LNG for export

by ship or truck. This modification would allow for multimodal transportation of LNG.

In its reasons for the decision approving WPMV’s export licence application, the NEB

stated:

Historically, the Board considered the act of exporting to occur when gas was sent or removed from Canada

and not when gas was loaded into a mode of transport. The exception to that approach is an export point

designated to be the outlet of a loading arm of a terminal at which LNG is loaded directly into marine vessels

for export. The Board has previously stated that the point at which LNG tankers pass into international waters

is not a precise location.

In requesting an export point located at the pump of the truck rack where ISO shipping containers are filled

with LNG, WPMV requested a level of flexibility that is not demonstrative of the act of exportation from

Canada. In authorizing the following export points, the Board is balancing its practice of conditioning precise

locations on an export licence with the flexibility needed to export LNG in ISO containers using different

modes of transportation.

For marine exports, the Board approves the last land-based locations of the gas before it begins its marine

journey to depart Canadian waters. Therefore, the Board approves the following marine export points:

- The outlet of the loading arm at the WesPac LNG Marine Terminal in Delta, British Columbia;

and

- The marine cargo terminals in the metropolitan area of Vancouver, British Columbia.

For land based exports, the Board approves the following export point:

- The highway border crossings along the international boundary between British Columbia and the

U.S.

The Board accepts WPMV’s evidence that it requires the flexibility to access various markets and the

certainty of a long-term export licence to enter into long-term commercial contracts and finance capital

investments.51

While the NEB modified WPMV’s requested export points such that they are effectively

the last land-based locations of the LNG before export from Canada by sea or land, in

authorizing these export points, the NEB balanced its practice of conditioning precise

locations with the flexibility needed to export LNG using different modes of transportation,

including ISO containers and trucks.

Under WPMV’s export licence, once LNG is loaded onto an LNG carrier, an ISO LNG

container reaches the marine cargo terminal in Vancouver to be loaded onto a ship or LNG

crosses the highway border with the US in a truck, it will be regarded as having been

“exported” for the purposes of the export licence. A canvass of the export licences issued in

the last five years reveals that no other licence holder has availed itself of such flexibility.

WPMV’s export licence may also be used to illustrate another issue related to LNG export

regulations that may be of concern to LNG offtakers: who holds the export licence. WPMV

applied for an export licence on its own behalf and as an agent acting on behalf of affiliates

and third parties, which reflects the fact that while WPMV owns the Tilbury Marine Jetty,

FortisBC owns the Tilbury liquefaction terminal located adjacent to it and third parties are

likely to own the majority of the LNG exported from it.

The NEB granted this request and, in its reasons for the decision, confirmed that WPMV

is not required to be the owner of the natural gas (or LNG), and can act as an agent on behalf

of the owner of the LNG. The NEB determined it did not need to identify this as a term in

the export licence, but that WPMV would be responsible for complying with reporting

requirements:

Section 116 of the NEB Act prevents any person, except as otherwise authorized by the regulations, from

exporting gas except under and in accordance with a licence issued by the Board. In the Board’s view, this

section of the NEB Act does not require the holder of the export licence to also be the owner of the natural

gas; therefore, the Board does not find it necessary to include a term on the Licence permitting WPMV to

act as agent on behalf of the owners of the natural gas. The Board notes that WPMV, acting in its capacity

as an agent, would be exporting natural gas under its Licence which requires it to report those exports in

accordance with the National Energy Board Export and Import Reporting Regulations.52

It is, therefore, possible under the legislative framework for an export licence to be held

by a different person to the person exporting LNG, but from the perspective of the person

exporting LNG, it will be important that contractual arrangements are in place to ensure that

the export licence holder maintains the licence during the relevant term. From the export

licence holder’s perspective, contractual arrangements will also be required to ensure that

users of the licence comply with its terms and that it receives the information it needs from

such users in order to meet its reporting obligations. Such reporting obligations include the

requirement to provide monthly activity reports to the CER, including details with respect

to, among other things, the volumes of gas exported, the price, the province of origin of the gas, the name of the export customer, and the geographical region within a country of destination to which gas was exported.53

The export licence is one requirement for the export of LNG, but there is an additional requirement to file all gas (or LNG) export sales contracts pursuant to which the LNG is exported with the CER for its approval.54 Any amendment to such contracts would require further approval by the CER.55 Submission to the CER of copies of export sales contracts may also be required as part of the export licence application process.56

Historically, the requirement to submit export sales contracts was part of the NEB’s comprehensive “Market Based Procedure,” which was designed to evaluate whether the proposed export would meet the Surplus Criterion and be in the public interest.57 The requirement to file export sales contracts grew out of the mandate to examine public interest considerations. In Re KM LNG Operating General Partnership, the NEB described the threepart public hearing component of the Market Based Procedure.58 The first part, the complaints procedure, was “based on the principle that gas should not be authorized for export if Canadians have not had an opportunity to buy gas for their needs on terms and conditions similar to those contained in the export application.”59 The second part, the export impact assessment, examined the Surplus Criterion. The third part, other public interest considerations, considered any other relevant factors, including:

- the durability of the export sales contract;

- whether the export sales contract was negotiated at arm’s length;

...

- provisions in the export sales contract for the payment of the associated transportation charges on Canadian pipelines over the term of the export sales contract; [and]

- the appropriate length for an export licence having regard to the adequacy of gas supply and associated export sales and transportation contracts.60

Consideration of these factors clearly required the ability to review the terms of gas export sales contracts. However, in 2012, the Jobs, Growth and Long-term Prosperity Act61 amended the NEB Act and removed the requirement in section 118 (now section 345 of the CER Act) that, “in addition to the surplus criterion, the [NEB has] regard to ‘all considerations that appear to it to be relevant’ when assessing an application for a gas export licence.”62 Since the 2012 amendments, the regulator’s mandate63 on export licence applications has been limited solely to the Surplus Criterion, and the public interest aspect is not examined by the regulator.64 Instead of the strict form and substance requirements of the Market Based Procedure, the CER now only requires the information detailed in Guide Q of the Filing Manual for its assessment of the Surplus Criterion.65 Guide Q does not prescribe a specific format or specific content, and its information requirements may be met in a variety of ways. As such, not all of the requirements of section 12 of the NEB Oil and Gas Regulations, such as export sales contracts, are relevant to its assessment of export licence applications.66

As a result, export licence applicants have been requesting relief from some of the information requirements set out in section 12 of the NEB Oil and Gas Regulations.67 In Re Chevron Canada Ltd, the CER noted that such relief has been granted in numerous LNG export applications.68 In that decision, Chevron requested and was granted relief from filing supply contracts on the basis that such contracts did not exist.69 Of greater significance, the CER held that, because not all of the filing requirements are relevant to the CER’s assessment of the application, Chevron was exempted from, among other things, the requirement to file gas export sales contracts.70 In Re LNG Canada, the NEB also advised that because the focus of the regulator is limited to the Surplus Criterion on gas export applications, the regulator does not require all of the information that must be filed pursuant to the NEB Oil and Gas Regulations. Therefore, the regulator may exempt applicants from the information requirements.71

The CER stated in Re Chevron that it is in the process of updating the regulations to align with the changes to the new CER Act.72 Given that no changes have been made to the Surplus Criterion since the amendments to the NEB Act in 2012, and the NEB Oil and Gas Regulations were not updated to align with such amendments,73 it is hoped that the CER’s update to the regulations will reflect the narrowing of the scope of consideration resulting from the shift from the Market Based Procedure to the requirements of Guide Q of the Filing Manual. A letter from the NEB dated 29 June 2015 suggests this may be the intention as the NEB proposed a number of regulatory amendments which would have removed the requirement to file gas export sales contracts as part of the licence application.74

With respect to the requirement for licence holders to file all gas export sales contracts and amendments thereto with the CER for its approval, the position may be similar. By removing the public interest mandate of the regulator when considering gas export licence applications, the rationale for requiring licence holders to subsequently file export sales contracts for approval may correspondingly have ceased to exist. However, a secondary rationale for this requirement may be that the filing of export sales contracts is part of the regulator’s ongoing monitoring of Canada’s natural gas supply and demand, including LNG developments.75 The regulator monitors the market so that it can identify where markets may not be functioning properly or where the evolution of supply and demand casts doubt on the ability of Canadians to meet future energy requirements, which could be relevant to consideration of the Surplus Criterion in future export licence applications.76 However, given the abundance of data in the current energy market, it is questionable whether the regulator needs to require the filing and approval of gas export sales contracts in order to perform this function. Further, in recent years, the regulator has repeatedly recognized in the context of the Surplus Criterion that Canadian gas requirements are satisfied because the North American market is integrated, the North American gas resource base is large, the North American gas marketplace is robust and sophisticated, and the North American gas market functions efficiently and there is no evidence to suggest that it will not continue to do so in the future.77

The requirement for CER approval of any LNG SPAs and amendments thereto may be problematic for LNG terminal operators and LNG offtakers, both in terms of the requirement to submit potentially commercially sensitive information to the CER and given the risk that such approval will not be granted, potentially making an LNG project no longer viable. It is noted that Prince Rupert LNG Inc. sought exemption from the NEB from certain monthly reporting requirements on the basis that “the effect of exporting from a unique export point is that … Prince Rupert LNG would be unable to maintain the confidentiality of the details of export sales contracts … which are commercially sensitive documents.”78 While the NEB declined to grant such exemption, the NEB noted that “the information supplied by an export licence holder to the Board is not necessarily the information that is published by the Board. The Board will continue to support market transparency while exercising discretion with respect to the information it chooses to release to the public.”79

The NEB previously exempted KM LNG Operating General Partnership from the requirement to file copies of export sales contracts. According to KM LNG, it was unable to file LNG SPAs because LNG buyers would find the public disclosure of SPAs unacceptable to the point that the requirement to file SPAs “could thwart any opportunity of successfully [negotiating] agreements.”80 The NEB agreed, stating that the NEB was “cognizant that adhering to the filing requirements may introduce an unwarranted level of risk for the Applicant.”81

The CER Act provides an alternative mechanism for protecting commercially sensitive information. Under section 60, the CER may designate information as confidential if it is satisfied that:

- the disclosure of the information could reasonably be expected to result in a material loss to a person directly affected by the proceedings (such as a licence holder or applicant) or prejudice its competitive position; or

- the information is financial, commercial, scientific or technical information that is confidential information provided to the CER, such information has consistently been treated as confidential information by a person directly affected by the proceedings and the CER considers such confidentiality interest to outweigh the public interest in disclosure.82

Accordingly, to the extent the holders of any export licences are required to file and seek CER approval of any export sales contracts or amendments thereto (which it appears may not be a strict requirement of the CER in certain cases), a mechanism exists to ensure that the terms of any such contracts will remain confidential.

Another area on which guidance is required from the CER is how LNG bunkering will be dealt with under the export regulatory framework. At the time of writing, the CER has not provided any direction on this issue, but there is evidence that suggests that the NEB and CER are at least aware of it. Turning again to the initial WesPac Tilbury Marine Jetty export licence application, WPMV indicated in its application that the terminal “will also provide a means of loading LNG onto barges for marine bunkering (ship fueling) activities, which may also involve the export of LNG.”83 In response, the NEB issued an Information Request asking whether or not such volumes of LNG used for LNG bunkering were included in the export volumes specified in WPMV’s application.84 WPMV confirmed in its response that such LNG bunkering volumes were included in the export volumes and, as a result, the NEB did not need to directly consider whether or not these volumes ought to be included in export volumes, leaving open the question of whether an export licence would in fact be required for the supply of LNG as bunkering fuel.85

While oil has been supplied as bunker fuel from Canadian ports for a long time, the same question does not arise because the NEB Oil and Gas Regulations provide that the exportation of any oil carried by ships in their own tanks for their consumption are exempt from the operation of Part VI of the NEB Act (now Part 7 of the CER Act).86 There is currently no similar exemption in respect of LNG supplied as bunker fuel and, arguably, the position should be no different. However, as matters stand, there is an apparent legislative gap with respect to LNG bunkering, such that an export licence may be required in order to supply LNG bunkers, at least to the extent it is supplied to vessels trading internationally.

The regulation of LNG bunkering is a complex area on which legislative amendments and guidance from the relevant authorities will clearly be required in a timely fashion as the Canadian LNG bunkering industry continues to develop. It was noted by the Vancouver Fraser Port Authority in its response to an Information Request by the NEB in relation to the TransMountain Pipeline Expansion Project that the regulatory framework for LNG bunkering is unclear in Canadian legislation and policy.87 It was suggested that regulation of vessel design and bunkering operations likely resided most effectively with Transport Canada pursuant to the Canada Shipping Act, 2001.88

D. Vessel security

The Marine Transportation Security Act89 governs safety and security relating to ships, crews, cargo handling, vessel supply, vessel access, ports, and terminals, and the Marine Transportation Security Regulations90 (which closely follow the IMO’s International Ship and Port Facility Security (ISPS) Code framework) require ships to have an approved security plan and various certificates on board.

E. Vessel certification

LNG carriers require a number of operational certificates to operate in Canadian waters, which may be reviewed upon inspection of the vessel under various inspection regimes (Port State Control, Canada Shipping Act,91 Canada Labour Code,92 Vessel Certificates Regulations,93 Vessel Clearance Regulations,94 etc.) based on the standards that apply under the international maritime conventions to which Canada has acceded, including:

- International Convention for the Safety of Life at Sea;95

- International Management Code for the Safe Operation of Ships and for Pollution Prevention (International Safety Management (ISM) Code);96

- International Convention for the Prevention of Pollution from Ships, 1973;97

- International Convention on Standards of Training, Certification and Watchkeeping for Seafarers98 (STCW);

- International Convention on Load Lines;99

- Convention on the International Regulations for Preventing Collisions at Sea100 (COLREGs); and

- Maritime Labour Convention.101

The certificates that LNG carriers will be required to carry to operate in Canadian waters will typically include:

- an International Oil Pollution Prevention Certificate and a Shipboard Marine Pollution Emergency Plan incorporating the Shipboard Oil Pollution Emergency Plan, as required under MARPOL;102

- a Wreck Removal Convention Certificate, which, as of 31 July 2019, is required for vessels of 300 gross tonnage and above under the Wrecked, Abandoned or Hazardous Vessels Act,103 which implemented the Nairobi International Convention on the Removal of Wrecks;104 and

- a Bunkers Convention Certificate, which is required for vessels of 1,000 gross tonnage or more carrying bunker oil for propulsion or operation (so are not required for vessels fuelled exclusively by LNG) under the Marine Liability Act,105 which implemented the International Convention on Civil Liability for Bunker Oil Pollution Damage.106

Transport Canada may issue Wreck Removal Convention and Bunkers Convention Certificates (if a vessel does not have such certificates issued by its flag state) based on evidence of the compulsory insurance coverage required under such conventions (typically evidenced by the corresponding “Blue Cards” issued by the vessel’s Protection & Indemnity (P&I) Club).

Under the Canada Shipping Act, Vessel Certificates Regulations and Vessel Clearance Regulations, LNG carriers will need to have been constructed in accordance with the applicable edition of the International Code for Construction and Equipment of Ships Carrying Liquefied Gases in Bulk (IGC Code).107 If an LNG carrier meets such requirements, Transport Canada (or a Classification Society on its behalf) will issue a Certificate of Fitness for the Carriage of Liquefied Gases in Bulk which will be valid for 5 years.

Other types of vessels loading LNG as fuel in Canadian waters will need to comply with other requirements depending on the type of vessel and with the International Code of Safety for Ships Using Gases or Other Low-flashpoint Fuels (IGF Code),108 which provides an international standard for ships, other than vessels covered by the IGC Code (which addresses the use of cargo as fuel on LNG carriers), which operate using gas (or other lowflashpoint liquids) as fuel.

F. Port state control

Port State Control refers to the program administered by Transport Canada’s Marine Safety Division whereby foreign vessels entering Canadian waters are boarded and inspected by Marine Safety inspectors to ensure they comply with the applicable international and Canadian requirements, including the international conventions referred to above.

Before a vessel enters Canadian waters, Port State Control officers check its safety and inspection record using international databases and it is Transport Canada’s policy to inspect every foreign tanker vessel (including LNG carriers) calling at a Canadian port on its first visit to Canada and at least once a year thereafter.

Canada has grouped together with other countries which share common waters with Canada and has entered into the Paris Memorandum of Understanding on Port State Control (referred to as the Paris MOU),109 which covers the waters of the European coastal States and the North Atlantic basin from North America to Europe, and the Memorandum of Understanding on Port State Control in the Asia-Pacific Region (referred to as the Tokyo MOU),110 which covers the Asia-Pacific region. These agreements are intended to establish harmonized systems of Port State Control, facilitate the sharing of relevant information, and eliminate substandard shipping in the relevant regions.

G. Emissions

The IMO emissions regulations under MARPOL relating to the sulphur oxides and nitrogen oxides content of fuels have been adopted under the Canada Shipping Act.111 LNG carriers and other vessels calling at Canadian terminals will be required to comply with these provisions and carry on board an Air Pollution Prevention Certificate.112 As of 1 January 2020, the IMO has imposed a 0.5 percent cap on the sulphur content of marine fuels. However, Canada’s east and west coasts fall within the North American ECA, in which stricter emissions standards apply.113 The North American ECA comprises a 200nm zone around the east and west coastlines of North America and around the Hawaiian Islands within which a sulphur cap of 0.1 percent applies.114 More stringent requirements also apply within the ECA with respect to nitrogen oxides emissions.115

The sulphur content requirements that apply within the North American ECA and elsewhere effectively require ship operators to use low sulphur fuels or install exhaust gas cleaning systems (referred to as “scrubbers”) or other abatement systems achieving the same emissions reductions. As mentioned above, this is one reason (among others such as reduction of pollution risk, reduction of carbon dioxide emissions, and cost-effectiveness) why many ship-owners (not only owners of LNG carriers) are increasingly transitioning to the use of LNG as fuel and why a number of LNG bunkering hubs have been proposed on Canada’s east and west coasts.

H. Ballast water treatment116

The Ballast Water Control and Management Regulations117 require that all vessels prepare and carry a ballast water management plan and set out requirements with respect to the exchange and treatment of ballast water in Canadian waters. Canada acceded to the International Convention for the Control and Management of Ships’ Ballast Water and Sediments, 2004118 in 2010, which imposes additional requirements. These requirements have not yet been incorporated into domestic law and, in the meantime, the Ballast Water Regulations continue to apply.119 It is possible that LNG terminal operators will contractually require LNG carriers to comply with the requirements of the Ballast Water Convention in any event.

I. Transportation of dangerous goods

Canada generally applies the International Maritime Dangerous Goods Code (IMDG Code)120 which is incorporated into Canadian law and regulated through two different Acts and related safety regulations:

- the Canada Shipping Act,121 and the Cargo, Fumigation and Tackle Regulations,122 which are administered by Transport Canada’s Marine Safety and Security Directorate; and

- the Transportation of Dangerous Goods Act, 1992,123 and the Transportation of Dangerous Goods Regulations,124 which are administered by Transport Canada’s Transportation of Dangerous Goods Directorate.

Such regulations apply to the transportation of LNG within Canadian waters and impose a number of requirements on persons undertaking such activities, including with respect to safety and security standards, emergency response plans, and financial responsibility.

J. Navigation and pilotage

A range of rules and regulations apply to navigation and pilotage in Canadian waters,125 including with respect to:

- compulsory pilotage areas, in which many of the planned LNG terminal facilities are located and which are administered by designated pilotage authorities under the Pilotage Act and related regulations.126 The designated pilotage authorities comprise:

(i) the Pacific Pilotage Authority, with respect to the Pacific coast and Fraser

River. Enhanced pilotage requirements will likely apply to LNG carriers

operating on the west coast, requiring a minimum of two pilots;127

(ii) the Atlantic Pilotage Authority, with respect to the Atlantic Coast;

(iii) the Laurentian Pilotage Authority, with respect to the Laurentian region, in

particular the St. Lawrence and Saguenay rivers; and

(iv) the Great Lakes Pilotage Authority, with respect to the Great Lakes and

pilotage waters of Churchill, Manitoba;

- vessel traffic services zones, within which vessels must comply with the Vessel Traffic Services Zones Regulations;128 and

- the Automatic Identification System (AIS), with which LNG carriers must be fitted under the Navigation Safety Regulations129 created under the Canada Shipping Act and SOLAS.

It is noted that Bill C-48, An Act respecting the regulation of vessels that transport crude oil or persistent oil to or from ports or marine installations located along British Columbia’s north coast,130 received royal assent on 21 June 2019, but is unlikely to significantly affect the operation of LNG carriers. The Oil Tanker Moratorium Act prohibits oil tankers carrying more than 12,500 tonnes of crude oil or persistent oil products as cargo from stopping, loading, or unloading in the moratorium area of British Columbia’s north coast. However, it does not apply to vessels carrying LNG as cargo and, except for oil tankers that are otherwise subject to the moratorium, does not prevent other vessels loading LNG as bunker fuel.131

K. Cargo declarations and immigration

All Canadian exports, including in-transit movements, must be reported to the Canada Border Services Agency (CBSA) by submitting the appropriate export documentation to a designated export office within legislated time frames. At least two copies of the crew list must be filed with the CBSA upon the vessel’s arrival so that it may be endorsed by it. The crew list must be kept up to date during the vessel’s stay. Until the crew list is endorsed by a CBSA officer, none of the crew may disembark into Canada.

L. Port operations

The port operations regime that applies at any LNG terminal will vary depending on the particular port and whether it is a public port and falls within the responsibility of a port authority. Kitimat, British Columbia, for example, which is the site of a number of planned LNG terminals, is currently a private port with no established federal port authority governing its operations, no existing traffic separation schemes, and no harbour dues. However, the Government of Canada has advised that it will designate Kitimat as a public port in the future.132

Public ports in Canada are operated under the Canada Marine Act,133 the Public Ports and Public Port Facilities Regulations,134 and the Practices and Procedures for Public Ports,135 which govern activities such as:

- monitoring ships about to enter or within the waters of the port;

- establishing traffic control practices and procedures to be followed by ships;

- requiring ships to have the capacity to use specified radio frequencies; and

- requiring information to be given by ships about to enter the port or within the port

for the purpose of obtaining a traffic clearance.

Each public port also has its own bylaws and tariffs and their use may be subject to berthage fees, harbour dues, storage charges, utility and other service charges, and wharfage and transfer charges.

M. Pollution response

Under the Canada Shipping Act,136 vessels loading LNG must have an arrangement (such as a contract) with a qualified spill response organization, such as the Western Canada Marine Response Corporation on Canada’s west coast or the Eastern Canada Response Corporation Ltd. on Canada’s east coast.

In the context of LNG carriers, the risk of pollution due to spillage is relatively limited due to the fact that LNG when spilt will generally vaporize and dissipate. Nevertheless, to the extent LNG, bunker fuel, or any other substances released from an LNG carrier cause pollution, this may give rise to both civil and criminal liability. While a detailed discussion of these topics falls outside the scope of this article, brief overviews are set out in the following paragraphs.

Civil liabilities will be governed by the Marine Liability Act,137 which implements the Bunkers Convention,138 which will apply in respect of any pollution caused by bunker oil (to the extent carried by any LNG carrier). Once it comes into force, the International Convention on Liability and Compensation for Damage in Connection with the Carriage of Hazardous and Noxious Substances by Sea, 1996139 will apply in respect of any pollution caused by hazardous and noxious substances (which include LNG) released by vessels. In the meantime, civil liability of shipowners for releases of LNG will be governed by Part 6, Division 2 of the Marine Liability Act, subject to the limits set out in Part 3 thereof (please see below).140 These civil liability regimes generally impose strict liability on shipowners (subject to certain defences) for pollution caused by substances discharged or originating from their ships, based on the “polluter pays” principle.

Criminal liability for pollution from ships can arise based on pollution-related offences under a variety of statutes, including the Canada Shipping Act,141 Canadian Environmental Protection Act, 1999,142 Fisheries Act,143 and Migratory Birds Convention Act, 1994.144 Conviction of these offences can, in some cases, result in fines of up to CDN$12 million for corporations and, for individuals, fines of up to CDN$1 million and imprisonment for up to 3 years.

N. Claims against a vessel and arrest

One area of the legal landscape with which shipowners may wish to be familiar before visiting any jurisdiction, including Canada, is the applicable regime for bringing claims against vessels and arresting them as security for such claims. This will be the case particularly if the shipowner is aware of any debts or alleged claims against the relevant vessel or against any other vessels that it may own.

The threat of arrest may also be a concern for cargo owners who could be exposed to the risk of having a cargo of LNG detained in the event of the arrest of the ship on which it is carried. While the arrest of a ship will not generally extend to the property of third parties onboard such as cargo, having to arrange for a cargo of LNG to be discharged or transshipped and stored or carried to the destination port on another vessel may involve a significant amount of time and cost. This includes the cost of the cargo volume reducing during any period of delay due to boil-off, which may not be recoverable if the shipowner is insolvent. Cargo owners, therefore, have a significant interest in knowing the risks associated with any particular shipowner (for example, based on due diligence in respect of its financial position and the existence of any creditors) and the legal regimes of any particular jurisdictions visited by any ships carrying their cargoes.