Publication

Generative AI: A global guide to key IP considerations

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Australia | Publication | 十一月 2022

This article was co-authored with Jack Brown.

On 2 November 2022, the Commonwealth Government expanded Australia’s offshore wind regulatory framework with the release of the Offshore Electricity Infrastructure Regulations 2022 (Cth) (‘Regulations’) and the Offshore Electricity Infrastructure (Regulatory Levies) Regulations 2022 (Cth) (‘Regulatory Levies Regulations’).1

These regulations provide key details on the framework’s licensing scheme. This is particularly important for prospective offshore wind proponents who now have regulatory certainty as to the requirements for feasibility licence applications. In the following update, Norton Rose Fulbright provides an overview of the newly enacted laws and what they mean for Australian offshore wind proponents.

In December 2021, the Commonwealth Government introduced both the Offshore Electricity Infrastructure Act 2021 (Cth) (‘OEI Act’) and the Offshore Electricity Infrastructure (Regulatory Levies) Act 2021 (Cth) (‘Regulatory Levies Act’).2 These laws, which entered into force in June this year, form the foundation of the Commonwealth’s offshore wind regulatory framework. Amongst other things, the OEI Act:

In March 2022, the Government released exposure drafts of this licensing scheme for stakeholder consultation,3 and last week, the Government released the finalised scheme.4 This release complements the Minister for Climate Change and Energy’s 5 August announcement of the Commonwealth’s intention to declare the Gippsland area as being open for offshore wind development, subject to a public consultation process which concluded on 7 October 2022.5 In the same announcement, the Minister identified another five areas which will likely follow the Gippsland area. These are:

Additionally, the Commonwealth has recently released the Offshore Electricity Infrastructure Legislation Amendment Bill 2022 into Federal Parliament.6 If passed, this bill will amend the customs requirements applying to offshore infrastructure and make modifications to ensure effective administration of the regulatory framework. Consultation on this bill closes on 17 November 2022.

At the state level, the Victorian Government has been the most active in this space releasing an Offshore Wind Policy Directions Paper which outlines that State’s vision for offshore wind.7 It sets targets of 2 GW of offshore wind capacity by 2032, 4 GW by 2035 and 9 GW by 2040. This was followed by the publication of the Victorian Government’s 1st Offshore Wind Implementation Statement which outlined the government’s plans for the establishment of an offshore wind industry.8 It included updates and announcements on transmission, ports, government resourcing, local industry and regulatory alignment with Commonwealth laws.

The Regulations and the Regulatory Levy Regulations, which sit beneath the OEI Act and Regulatory Levies Act respectively, are the latest development in the offshore wind regulatory landscape.

The Regulations provide a distinct licence application process for each licence type (being, feasibility, commercial, research and demonstration, and transmission and infrastructure). Feasibility licence applications can only be made following the release of, and in response to, a public invitation made by the Minister. In this regard, the Regulations set out various feasibility application requirements including that the licence application area must not exceed 700 km2.

The Regulations set out the procedure which the Minister must follow if, after issuing an application, the Minister receives multiple applications over the same area or multiple applications which overlap. The first step in this procedure is determining whether the applications forms an overlapping application group. This determination is informed by the nature of the overlap of the applications and whether the applications are of equal merit. In considering the merit of each applicant the Minister is provided with a list of considerations which include:

Each of these considerations are informed by further matters detailed in the Regulations in section 26.

If the Minister does consider that the applicants constitute an overlapping licence group, the Minister may invite the applicants to revise and resubmit their applications to remove the overlap. However, if an overlap persists or applicants do not elect to revise their applications, licences will be offered on the basis of financial offers. To this end, the Regulations detail a procedure for making and dealing with financial offers.

The new laws also detail the process for applying for each other licence, the procedure the Commonwealth will follow when considering applications and the procedure for offering and granting licences.

As with feasibility licences, commercial licence applications licence areas must not exceed 700 km2. A commercial applicant must also hold a feasibility licence.

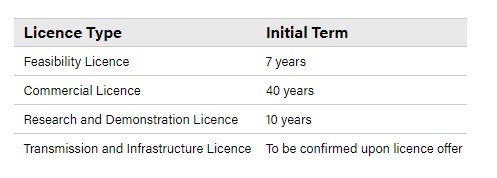

The licensing scheme within the Regulations allows for licences which have been granted to be extended and/or varied. The initial term each licence, which are set out in the OEI Act, are listed in the table below.

Once licence holders begin conducting activities under their licence they are obliged to provide the registrar with annual reports and should they apply to surrender their licence, prepare a final report.

Licence holders may apply to transfer their licences and apply for approval for changes in control of the licence holder. Each of these applications have an associated fee attached to them, as do the applications for each licence, licence extensions, licence variations and licence surrender.

Additionally, the Regulatory Levies Regulations sets out the levy amounts for each licence type. Every licence is subject to an annual licence levy, annual compliance levy and annual Commonwealth levy. The Commonwealth levy for each licence is a fixed amount ($295,186), however, the other levies vary based on the licence type and the size of the licence area. Levies and application fees have been set on a complete cost recovery basis.

The Regulations also set the datum provisions to be applied to offshore infrastructure as well as how pre-existing infrastructure will be dealt with.

Whilst further guidance on the licensing scheme and regulatory requirements is expected to be made available on the Department of Climate Change, Energy the Environment and Water (DCCEEW) website in the coming weeks, the Regulations and Regulatory Levies Regulations provide much needed regulatory certainty to Australia’s offshore wind industry.

Prospective proponents can begin to prepare the content of their feasibility licence applications with an understanding of what must be included and what requirements must be met.

The regulations also provide certainty as to the regulatory levies licence holders can expect to pay. This detail will be welcomed by prospective proponents’ financiers who will also be eagerly awaiting the next set of regulations which will contain arrangements for financial security and other key aspects of the Regulatory Framework.

Our energy practice has a good understanding of the developing offshore wind market in Australia, and we are currently advising a number of potential proponents in the sector.

Globally and within Australia, we have been involved with offshore wind right from the start. We have advised on all aspects of the development, financing, operation, sale and purchase of more than forty five offshore wind projects across the UK, Europe, Americas and Asia as well as advising on the creation of regulatory frameworks for offshore wind in the UK.

This unique offering has enabled us to garner a reputation for understanding the complex issues that are specific to offshore wind, allowing us to draw on this experience and knowledge to help our clients succeed in new markets.

Ibid.

Publication

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Publication

We are delighted to announce that Al Hounsell, Director of Strategic Innovation & Legal Design based in our Toronto office, has been named 'Innovative Leader of the Year' at the International Legal Technology Association (ILTA) Awards.

Publication

After a lacklustre finish to 2022 when compared to the vintage year for M&A that was 2021, dealmakers expected 2023 to see the market continue to cool in most sectors, in response to the economic headwinds of rising inflation (with its corresponding impact on financing costs), declining market valuations, tightening regulatory scrutiny and increasing geopolitical tensions.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023