Global offshore wind: Canada

Global | Publication | 三月 2024

Information correct as of 22 March 2024.

Content

Focus on: Canada

Market overview

Canada has great potential for offshore wind development due to the quality resources on its coasts and offshore. While no offshore wind projects have been built in Canada to date, market conditions are improving as a result of the introduction of proposed legislative and regulatory changes, which are expected to pave the way to an offshore wind market on Canada’s Atlantic coast, and significant federal government financial commitments and incentives with respect to clean energy development. Canada is expected to see the completion of its first-ever offshore wind farm in Nova Scotia in 2030.

Onshore wind power accounts for 7.7 percent of Canada’s total electricity capacity. Along with solar photovoltaic, Canada also counts wind energy as one of its fastest growing renewable energy sources, likely due to its highly scalable nature. Canada’s onshore wind capacity has grown from eight wind farms in 1998 to 337 in 2023, with an installed capacity of over 15 gigawatts (“GW”). This is due in large part to the strong historic wind leadership demonstrated by Ontario, Alberta, and Quebec, as the nation’s leading wind markets.

Policy in relation to offshore wind continues to develop in Canada, particularly as it relates to Canada’s East Coast. As of August 28, 2019, the Canadian Energy Regulator Act (the “Act”) is now in effect governing the Canadian energy sector, including offshore wind. The Offshore Renewable Energy Regulations (“ORER”) initiative is supporting the implementation of this Act with respect to offshore renewable energy projects. The Act also effected a renascence of the National Energy Board as the Canada Energy Regulator (“CER”) with a new mandate that covers emerging energy developments such as regulation of offshore renewable energy.

The accelerating pace of change to the regulatory regime for offshore wind in Atlantic Canada is noteworthy. On May 30, 2023, the federal Minister of Energy and Natural Resources introduced Bill C-491, proposed legislation which would permit offshore wind development for the first time in the provinces of Nova Scotia and Newfoundland and Labrador. Bill C-49 proposes amendments to the existing frameworks governing joint federal-provincial management of offshore petroleum resources. The amendments under Bill C-49 would expand the regulatory authority under those frameworks to offshore wind power, generally modernize regulation of offshore energy resources in Nova Scotia and Newfoundland and Labrador, and provide added certainty and consistency with respect to the approvals process to potential developers, financiers and other stakeholders. In addition, in December 2023, the federal government and the government of Newfoundland and Labrador signed a memorandum of understanding (“MOU”) which aims to ensure that offshore renewable energy project approvals within designated provincial bays will be regulated by the Province alone, without involvement from the joint federal-provincial regulator as proposed by Bill C-49.

Canada: Offshore Wind Projects

East Coast

As of January 2024, the planned St. George’s Bay project in Newfoundland and Labrador, developed by Atlantic Canada Offshore Developments (“ACOD”) has been paused. The planned Sea-Breeze Tech Demonstration Project in Nova Scotia, to be developed by Brezo Energy, is in early stage development.

The Province of Nova Scotia has announced its intention to offer leases for five GW of offshore wind energy by 2030 in support of green hydrogen production. The leases will be granted through a competitive bidding process, jointly managed by the provincial and federal governments, with the first call for bids scheduled to be issued in 2025.

The Nova East Wind Project in Nova Scotia, with a projected generation capacity of 300 to 400 megawatts (“MW”), is expected to be the first offshore wind farm in Canada. The Project is currently undergoing survey work and the Province of Nova Scotia must complete a regional assessment and environmental reviews with engagement with local communities. The Nova East Wind Project would use existing undersea cables leftover from the abandoned offshore natural gas sector to bring clean electricity to shore.

West Coast

In 2020, it was announced that Oceanic Wind (formerly NaiKun Wind Energy Group) sold the development rights of their offshore wind project located in Hecate Strait between Haida Gwaii and Prince Rupert in British Columbia to Northland Power Inc. The project has the Environmental Assessment Certificates from the provincial and federal governments for the first phase of the project, 300 MW to 400 MW. Fully developed in phases over many years, the wind resource in Hecate Strait could provide in excess of two GW of power.

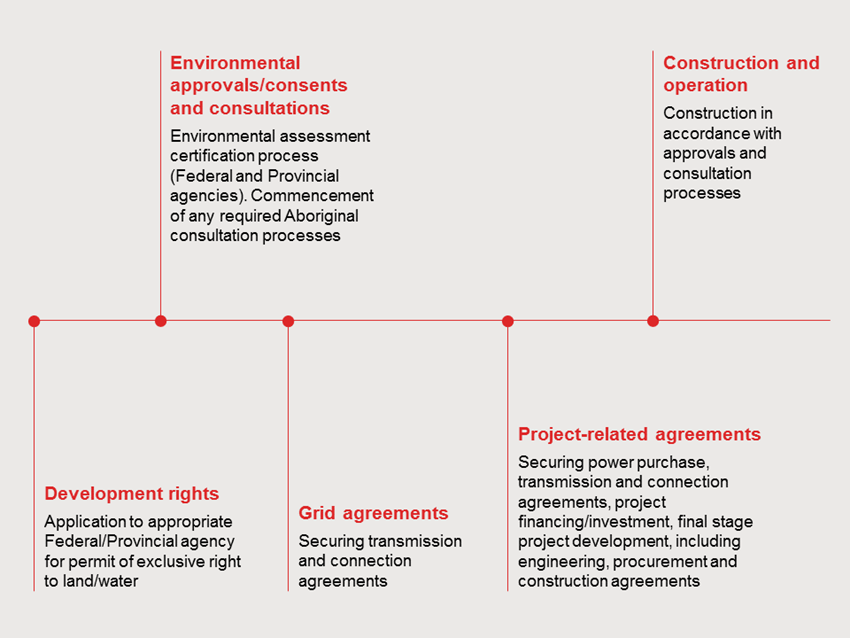

Canada: Development process

Notes:

- The adoption of Bill C-49 into law would streamline the regulatory regime and processes for offshore wind development in the provinces of Nova Scotia and Newfoundland and Labrador by leveraging the existing regulatory framework for single joint federal-provincial regulation of offshore petroleum resources.

- The MOU between the federal government and Newfoundland and Labrador confirms that the provincial government of Newfoundland and Labrador will have sole regulatory authority with respect to the approval and management of offshore wind projects in 16 designated inland bays in the province.

- The Canadian Energy Regulator Act has been in effect since August 28, 2019 and the National Energy Board became the CER. Together, these initiatives are part of the federal government’s legislative framework for a sustainable Canadian energy sector, which includes offshore wind.

- Ontario historically had a regime for offshore wind power development in the Great Lakes, but a moratorium was imposed on new projects in 2011.

Canada: Opportunities

Emerging renewable energy market

- Significant development opportunity along the coast of the Gulf of Saint Lawrence and on both the Atlantic and Pacific coastlines.

- Excellent environmental conditions – shallow water close to land and consistent, strong winds.

- Existing infrastructure and a strong industrial base – skilled workforce with transferable skills, suitable deep water ports (serving as supply and service hubs), and offshore experience (from oil and gas industry).

- Export opportunities to the United States and Europe.

- Green hydrogen production using renewable electricity sources such as onshore and offshore wind, a clean alternative to fossil fuels which does not produce greenhouse gas emissions.

- Accelerating commercial-scale hydrogen trade between Canada and Germany placing Canada pursuant to the Memorandum of Understanding signed on March 18, 2024 under the Canada–Germany Hydrogen Alliance, which aims to secure early access to the German market for Canadian hydrogen producers and make Canada a priority market for Germany to source clean hydrogen.

- Ideal storage locations and geographic advantage for international shipping of green hydrogen from the Atlantic coastline, allowing Canada to export green hydrogen abroad, including to Germany under the Canada–Germany Hydrogen Alliance.

Access to domestically sourced components

- The foundations and certain other components may be sourced domestically.

- While installation and interconnection would most likely be sourced internationally, a local workforce is available to attend to onshore and offshore support activities.

- A large part of substation design work, equipment and materials may be sourced locally.

- Maintenance and inspection services – oil and gas experience in offshore logistics can shape evolving strategies in offshore wind.

Commitment to green energy

The federal government has introduced policies aimed at promoting the use of renewable resources such as the Powering Canada Forward: Building a Clean, Affordable, and Reliable Electricity System for Every Region of Canada published in August 2023. In 2022, the federal budget allocated $250 million over four years to support pre-development activities of clean electricity projects on the national scale, as well as inter-provincial electricity transmission projects. The 2022 federal budget also committed $600 million over seven years to support renewable electricity and grid modernization projects. Offshore wind projects are considered eligible projects for this funding, subject to certain requirements and criteria. Newfoundland and Labrador has received federal funding for several renewable energy research projects, including a project using floating wind turbines to power oil and gas assets.

In 2023, the federal government committed significant financial resources in the form of monetary investments and investment tax credits (“ITC” or “ITCs”) to support the development of green energy in Canada, including offshore wind. The ITCs available include:

- Clean Technology ITC: Worth up to 30% of capital cost of investments in wind, solar photovoltaic, and energy-storage technologies;

- Clean Hydrogen ITC: Worth between 15% and 40% of capital cost of investments in green hydrogen production, assessed based on produced carbon intensity;

- Clean Manufacturing ITC: Worth up to 30% of capital cost of investments in clean technology manufacturing, including wind energy equipment; and

- Clean Electricity ITC: Worth up to 15% of capital costs of investment in non-emitting electricity generation systems, including wind.

In addition, eligible businesses will be able to benefit from the existing Atlantic ITC, worth up to 10% of the capital cost of investment in wind energy conversion systems. Specifically, the Canada Infrastructure Bank will be investing $20 billion to support the development of major clean electricity and clean growth infrastructure projects. The 2023 federal budget also includes a commitment $3 billion over 13 years to Natural Resources Canada to create new investments for Canada’s offshore wind potential.

In addition, at the provincial level, the Canadian Energy Strategy (“CES”) was created; an agreement between all Provinces and Territories that sets the plan for shaping Canada’s energy future.

Canada: Challenges

Permitting and regulatory challenges

With the anticipated exception of Atlantic Canada, which could benefit from added clarity and certainty as a result of the regulatory changes flowing from Bill C-49, a mixture of federal and provincial approvals will be required to construct and operate an offshore wind project in the rest of Canada, including Canada’s west coast. Both the federal and provincial approvals process will likely require projects to go through an environmental review process. While numerous federal statutes and regulations govern many activities in federal offshore areas, the Canadian Energy Regulator Act is the legislative framework for the administration of renewable projects, including offshore wind projects. Natural Resources Canada is implementing new regulations to develop modern safety and environmental protection for offshore renewable energy projects through the Offshore Renewable Energy Regulations Initiative. In addition, Natural Resources Canada is conducting a four-year (2019 to 2023) renewable resource assessment on wind energy, including an assessment of offshore wind potential in Canada.

The approval processes for offshore wind projects in Nova Scotia and Newfoundland and Labrador would be significantly improved through the expanded regulatory mandates proposed by Bill C-49, alleviating some of the challenges that arise from dual federal/provincial jurisdictional management by allowing developers to obtain all necessary approvals through a joint singular regulator, rather than dealing with provincial and federal authorities separately.

On December 6, 2023, the federal government and the government of Newfoundland and Labrador signed a MOU, signaling to investors and developers their commitment to advance the offshore wind market within a designated offshore renewable energy area, which encompasses 16 provincial bays. On the condition that Bill C-49 passes into law, the MOU will provide Newfoundland and Labrador with sole offshore wind regulatory authority within the designated area.

While there are significant opportunities for offshore wind growth in Pacific Canada, there are currently no publicly known plans to modify the existing regulatory regime in the same manner as is being undertaken in Atlantic Canada.

First Nation - Duty to Consult

Canada’s Constitution recognises and affirms existing Aboriginal and treaty rights and thus they benefit from special protection in law. The Crown has a constitutional duty to engage with Indigenous peoples in Canada in meaningful consultation and often accommodation where its actions (including the issuance of regulatory permits) may adversely affect established or credibly asserted Aboriginal and/or treaty rights. The Supreme Court of Canada has also confirmed that decisions related to permits or other approvals issued by a regulatory tribunal (including energy regulators) can trigger the duty to consult. In such cases (and subject to the legislation governing such regulator), the regulatory tribunal may consider that duty to consult through a regulatory hearing process.

Footnotes

Bill C-49: An Act to amend the Canada—Newfoundland and Labrador Atlantic Accord Implementation Act and the Canada-Nova Scotia Offshore Petroleum Resources Accord Implementation Act and to make consequential amendments to other Acts (“Bill C-49”).

Subscribe and stay up to date with the latest legal news, information and events . . .