Publication

Generative AI: A global guide to key IP considerations

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Global | Publication | November 2016

While the world absorbed the outcome of the US presidential election on November 9, 2016, the UK Government finally published plans for the second allocation round (AR2) for Contracts for Difference (CfD) which is now planned to start in April 2017.

Consistent with announcements made in the Budget in March 20161, the Government has allocated £290m2 of funding for projects using “less established” technologies (so-called “Pot 2” technologies) commissioning in the 2021/22 and 2022/23 delivery years. Successful projects will be awarded a 15 year CfD.

To be eligible to participate in AR2, all projects must have a target commissioning date falling between April 1, 2021 and March 31, 2023. For offshore wind projects building in phases, they will be permitted to commission up to two years later. Further details relating to eligibility and the auction round mechanics will be published in the Allocation Framework document in due course.

It is important to recall that CfDs will be allocated to the cheapest projects first, regardless of their start date, provided that they fit within the budget profile. Also the strike price awarded to projects in an auction will be the highest strike price bid accepted for each delivery year (regardless of technology type), capped at the applicable technology specific administrative strike price.

As always, there will be winners and losers. This briefing examines what the announcements mean for different technologies.

Offshore wind will almost certainly be the main beneficiary of AR2. Its costs are significantly lower than wave and tidal stream and competition from fuelled renewable technologies will be limited by a cumulative cap, restricting how much budget these projects can capture in AR2.

Offshore wind has been allocated the lowest Administrative Strike Price (ASP) of all the Pot 2 technologies – effectively a cap on the strike price per MWh which an applicant project may bid in the auction. This ASP is consistent with the UK Government’s planned cost reduction trajectory for offshore wind, previously outlined in the Budget 2016, which targets offshore wind competing at £85/MWh by 2026. The ASPs for AR2 are set out in the table below.

| Technology | ASP for 2021/22 delivery year (£/MWh, 2012 prices) | ASP for 2022/23 delivery year (£/MWh, 2012 prices) |

|---|---|---|

| Offshore wind | 105 | 100 |

| Advanced Conversion Technologies (with or without CHP) | 125 | 115 |

| Anaerobic Digestion (with or without CHP) (>5MW) | 140 | 135 |

| Dedicated Biomass with CHP | 115 | 115 |

| Wave | 310 | 300 |

| Tidal Stream | 300 | 300 |

| Geothermal | Unspecified – subject to a call for evidence | Unspecified – subject to a call for evidence |

Given the tumbling prices which have been seen in other European offshore wind auctions recently, the UK Government is no doubt seeking to encourage a “race to the bottom” between the contender projects. In the Netherlands, DONG Energy recently won the tender for the Borssele I and II projects with prices of EUR 71.1591/MWh and EUR 73.807/MWh respectively, while on the same day as the UK Government announced their CfD plans, Vattenfall won the contract to build the Danish Kriegers Flak offshore wind farm with a record low bid of EUR 49.9/MWh (58 per cent lower than the original auction price cap). Whilst these prices do not include grid costs, nor are the developers carrying significant sunk development costs relating to consenting processes, they nevertheless reflect dramatic reductions in the cost of offshore wind. These price reductions are in large part due to wind turbines increasing in size (exponentially increasing the output per unit), due to efficiency savings in logistics and supply chains, to reducing cost of capital and greater use of debt finance. AR2 prices for offshore wind will necessarily reflect the specifics of the UK development environment and so prices will almost certainly not be as low as recently seen in parts of continental Europe.

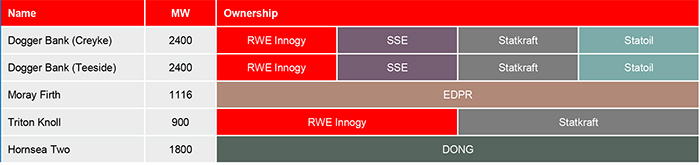

It is not currently possible to determine how many projects can be accommodated within the AR2 budget, because electricity market reference price assumptions have not yet been published. There are a number of planned (and consented) offshore wind projects that are potential bidders in AR2. The table below sets out UK projects that are consented but are currently without a support mechanism.

These projects face some tough choices. The likely bidders comprise a small number of large projects. Individual developers have sunk significant development costs into these projects to date and of course will need to be successful in AR2 or future auction rounds to recoup such costs. Furthermore, in contrast with some of the continental auction rounds where bidders have all been competing for the same development site, the UK system pitches different projects against each other (each with different site conditions, distances to shore etc.). The UK round must also be seen in the context of the wider international picture since many developers have pipelines of projects in the rest of Europe, the Far East and North America. All of these factors must be reconciled in a developer’s bidding strategy.

Wave and tidal stream will find it hard to compete in AR2. At £320/MWh and £328/MWh respectively, their levelised costs are over 200 per cent higher than those of offshore wind3. In a competitive auction, it will be hard for these projects to compete with lower cost technologies. Wave and tidal stream technologies were allocated a 100MW maximum across the Renewables Obligation (RO) and CfD policies in the first delivery plan period ending 2018/19, effectively ring-fencing budget for them, reflecting the fact that these are less developed technologies4. Under the CfD, a 10MW minimum was allocated until 2018/19 but the UK Government declined to extend it to AR2, explaining that to do so “does not represent good value for money for consumers”5.

In AR2, a cumulative maximum (of 150MW or a budget maximum of £70m in 2012 prices) will be applied to ‘fuelled’ renewable technologies: those that burn renewable fuel to generate power. Technologies included in this combined maximum are Dedicated Biomass with CHP, Advanced Conversion Technologies and Anaerobic Digestion.

The Government has also published a Call for Evidence alongside the AR2 announcement and is considering the role of these technologies, together with biomass conversion, in future allocation rounds.

Of particular focus, will be the interaction between support for heat and electricity, where the Government is looking for input in relation to which technologies have the potential to make a contribution to decarbonising heat in the UK, and appears to be seeking industry commitments to cost reductions, similar to those made by the offshore wind industry.

The Government is also seeking views on the interaction between the Renewable Heat Incentive (RHI) and the CfD mechanism. The RHI was set at the last Spending Review for a 5 year period to 2020/21, whereas AR2 covers a different period (2021-23). This effectively means that bidders need to make assumptions regarding the level of support for heat post 2020/21. In addition, respondents are asked to consider whether the contractual consequences under the CfD of plants losing their heat offtaker renders these projects unbankable. Under the CfD terms, the loss of a valid CHPQA Guidance Note 44 Certificate for more than 5 years risks reducing difference payments to zero.

Consistent with the Budget 2016 and more recent statements from the Department of Business, Energy and Industrial Strategy, it comes as little surprise that no budget has been announced in AR2 for the “Pot 1” established technologies. With no foreseeable support regime available after the closure of the Renewables Obligation, these more established technologies (onshore wind, solar PV, hydro, Energy from Waste with CHP, landfill gas and sewage gas) will be expected to fend for themselves in a subsidy free world. Strikingly, Government declined the opportunity to provide a ‘market stabilisation’ mechanism for these technologies, whereby the strike price might be set at a level sufficiently low as not to constitute a top up to the market price.

A combination of corporate PPAs, behind the meter and private wire solutions, technology advances (and corresponding cost reductions), supply chain efficiencies and energy storage may all play a part in the continued development of projects among these Pot 1 technologies and project developers are continuing to progress pipeline opportunities. However, the slowdown in project development across the UK is noticeable, matched by a trend in the project development community refocussing their skills on other jurisdictions globally. These technologies clearly have a role to play in the transition to a sustainable UK economy, particularly as cities are re-developed, but the focus will likely shift to distributed generation and local solutions, rather than utility scale, centralised generation.

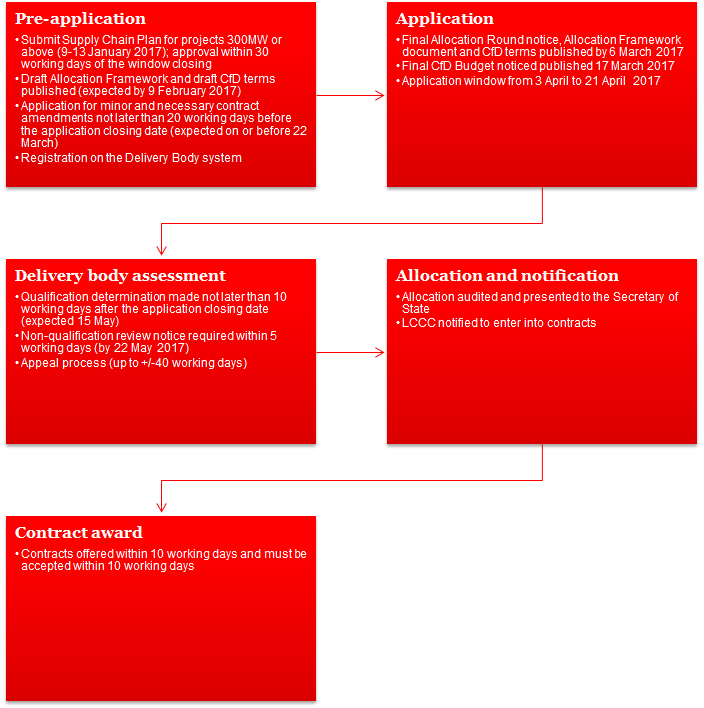

The AR2 process will be a long one. Starting with the submission of Supply Chain Plans in January 2017, contract award is not likely to take place until the summer. Depending on whether any disputes arise and how quickly they are resolved, timelines published by the Low Carbon Contracts Company suggest 6 July 2017 would be the earliest that CfDs are likely to be offered, the latest being 25 September. In the first allocation round, the appeals process delayed contract award by over 2 months which had operational implications for participants in the auction. We have set out below the different stages of the AR2 process, together our best estimate of key dates given the information currently available6.

This figure is in 2011/12 prices. £295m after adjustment for inflation.

Figures for projects commissioning in 2025. Offshore wind Round 3 levelised costs estimated as £100/MWh. All levelised cost estimates taken from BEIS’s 2016 Generation Costs Report published here.

See the Explanatory Note to the Budget Notice for the first CfD allocation round, BEIS, October 2014.

Accompanying Note to the Draft Budget Notice for the Second CFD Allocation Round, BEIS, 2016.

All dates are based on the CfD Implementation Plan: Round 2 document (version 2) published by the Low Carbon Contracts Company.

Publication

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Publication

We are delighted to announce that Al Hounsell, Director of Strategic Innovation & Legal Design based in our Toronto office, has been named 'Innovative Leader of the Year' at the International Legal Technology Association (ILTA) Awards.

Publication

After a lacklustre finish to 2022 when compared to the vintage year for M&A that was 2021, dealmakers expected 2023 to see the market continue to cool in most sectors, in response to the economic headwinds of rising inflation (with its corresponding impact on financing costs), declining market valuations, tightening regulatory scrutiny and increasing geopolitical tensions.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023