Publication

Generative AI: A global guide to key IP considerations

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Global | Publication | June 2017

This month’s editors: Pearl Yeung, Sophie Chen, Jeremiah Chew and Lydia Fung.

Below is an excerpt from our monthly Competition Report. More detailed commentary on these issues and other recent competition law developments in the Asian region are to be found in this month’s edition of our report available on a free subscription basis (see further below).

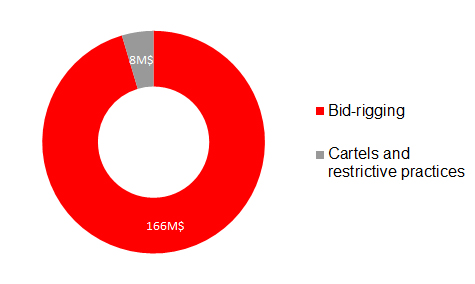

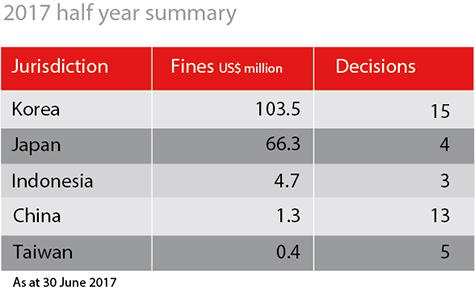

Enforcement data for the first half of the year shows a marked reduction in the total amount of fines imposed by competition authorities in the region. At $176 million, this amount is a quarter of the figure recorded during the same period last year. The number of decisions in which fines are imposed is also smaller, at 40 against 54 for the same period last year.

It is too early to tell whether the year will end with a lesser level of enforcement overall, although it is worthy to note that the jurisdictions with the most active competition law enforcers as measured by fines remain the same (Korea, Japan, Indonesia, China and Taiwan).

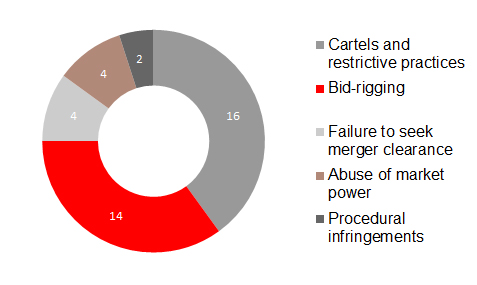

The affected industrial sectors are also largely the same, with capital-intensive industries such as construction, transport and telecommunications accounting for the most decisions. The types of infringements leading to an imposition of fines are also largely similar to those from previous years: bid-rigging and cartels account for the majority of cases, while procedural infringements (failures to seek merger clearance and obstruction of investigations) continue to be a focus of enforcement, particularly in China and Korea. Meanwhile, decisions sanctioning abuses of market power continue to be few.

As at June 30, 2017 by fine amounts

As compared to last year, the main difference relates to the amount of fines imposed in each decision. In previous years, the enforcers’ caseload comprised a higher proportion of infringements affecting a more significant value of sales, leading to comparatively higher fines.

As at June 30, 2017 in number of decisions

It may well be that enforcement activities in the second half of the year will lead to the adoption of more significant fines, perhaps in respect of bid-rigging of higher value contracts, or of a long-lasting cartel involving a significant volume of sales. However, a continued dearth of high-value cases could indicate a growing reluctance for parties to volunteer evidence to competition enforcers under leniency procedures, choosing instead to vigorously defend themselves in a context where decisions imposing administrative fines increasingly lead to follow-on private litigation or to criminal investigations against executives.

On 25 May, the Supreme Administrative Court dismissed an appeal against a 2010 decision of the Taiwan Fair Trade Commission (TFTC) in which three local paper suppliers (Cheng Loong, Long Chen Paper and Yuen Foong Yu Paper) were sanctioned for price coordination.

In the original decision, the suppliers were fined NT$10 million ($300,000) for exchanging information, which led to synchronised increases in the price of industrial paper between November 2009 and March 2010 in violation of Article 14(1) of the Fair Trade Act. Furthermore, two suppliers (Cheng Loong and Long Chen Paper) were also found to have engaged in restrictive practices in the supply of corrugated paper cartons (a mid-stream product for the production of paper products) between January 2010 and March 2010.

In making their appeal, the parties submitted that their pricing strategies were made independently and it was due to the oligopolistic nature of the market which caused the pricing adjustments to occur in simultaneous succession. Specifically, the parties pointed to escalating international paper prices which pushed up their cost base in the sourcing of waste paper (a core constituent of industrial paper).

However, the Court rejected these submissions, allowing the TFTC to rely on parallel price increases as indirect evidence of illegal collusion in a context where markets were oligopolistic in nature and where parties had artificially increased market transparency via the exchange of information at social gatherings or at trade association meetings. This judgment appears more favourable than previous holdings of the same court, which in 2014 had overturned a TFTC decision that had relied purely on indirect or circumstantial evidence to sanction parallel price increases by coffee chains.

Subsequent to the decision that was under review in the present case, the Fair Trade Act was amended in January 2015 to allow the TFTC to rely on circumstantial evidence including market conditions, characteristics of the relevant products or services, cost and profit considerations, and the economic rationale for the parties’ conduct to establish existence of concerted practices.

|

China Property management assessment and supervision association and members sanctioned for price fixing |

Japan JFTC reports on the compliance of destination clauses in LNG supply agreements with the Antimonopoly Act |

Read the full report - Please register if you are interested in subscribing to our monthly East Asia competition reports (free subscription).

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023