Global offshore wind: Australia

Global | Publication | janeiro 2024

Information correct as of 10 January 2024.

Content

Focus on: Australia

Market overview

Technical studies have shown that Australia has some of the best wind resources in the world, with the ability to support 2,000 GW of power.

While Australia’s offshore wind energy sector is still in its infancy, offshore wind appears set to join onshore wind and solar as a key component of the country’s renewable energy transition.

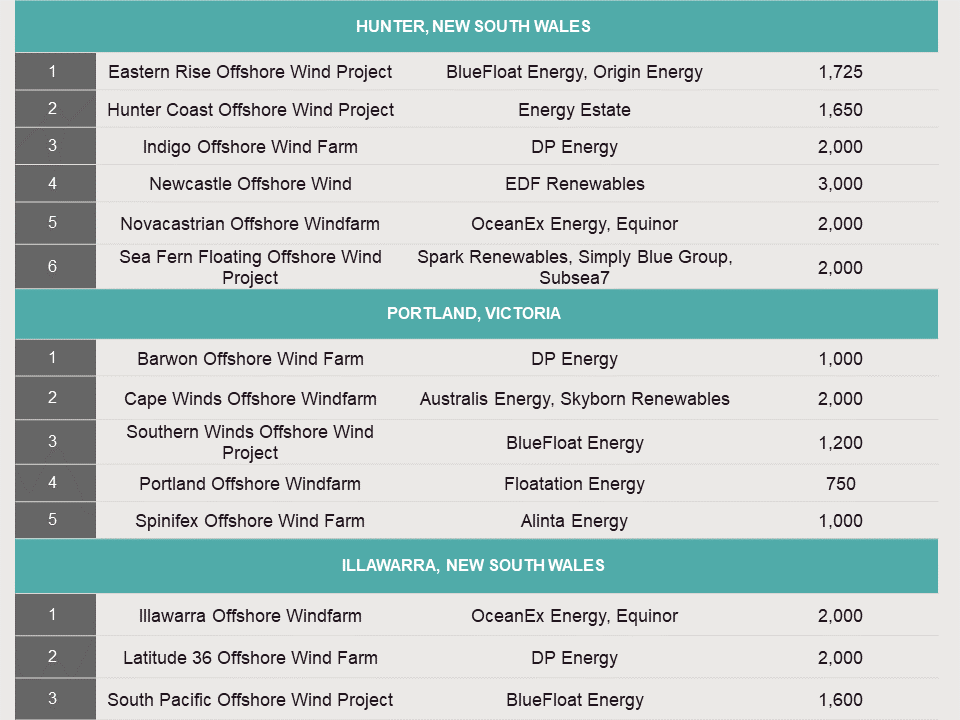

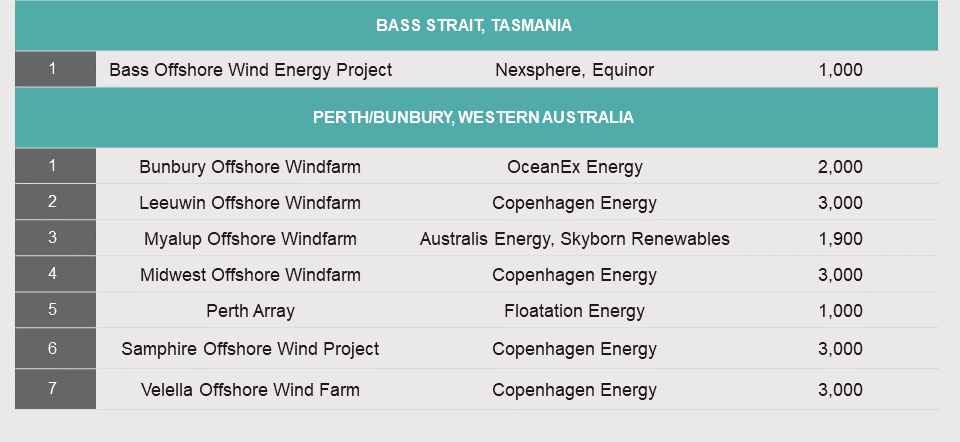

6 regions have been proposed for offshore wind development, with the Gippsland and Hunter zones having received formal declaration.

Victoria currently leads in offshore wind policy having released three implementation statements which address the commercial and regulatory issues facing proponents. The latest implementation statement provided important details on the State’s proposed revenue support incentive scheme, provided updates on transmission and ports planning, set out the Government’s expectations for industry development and traditional owner involvement as well as detailed the State’s plan to achieve regulatory harmonsation. Victoria is also targeting 2 GW of offshore wind capacity by 2032, 4 GW by 2035 and 9 GW by 2040.

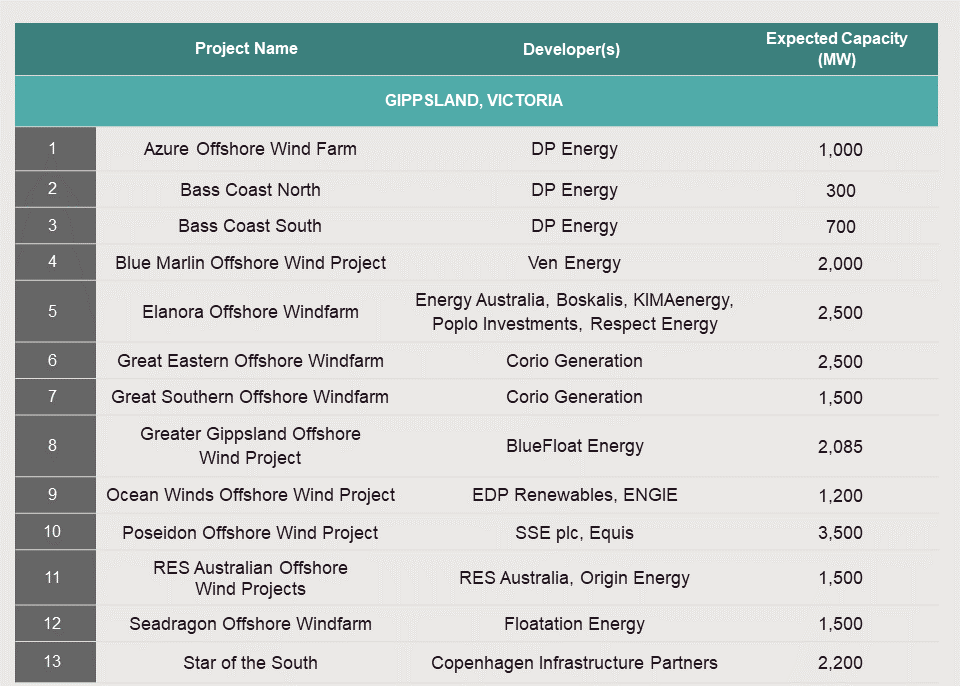

A number of major Australian and International project developers and funders have entered the Australian offshore wind market with the announcement of various project proposals, including CIP, DP Energy, EDF Renewables, Equinor, Iberdrola, Flotation Energy and BlueFloat Energy (among others).

There are a number of offshore wind of projects in early planning phases of development, but it is important to note that none of these projects yet hold licenses to undertake substantive feasibility and development activities. It is expected that feasibility licences will be awarded for projects within the Gippsland declared area very soon.

Australia: Offshore wind projects

The Regulatory Framework and Declarations

Source : Ecogeneration: Australian offshore wind farms get green light in landmark announcement

Declared Area

- Bass Strait off Gippsland, Victoria

- Pacific Ocean off the Hunter, NSW

Proposed Area

- Southern Ocean region off Portland, Victoria

- Pacific Ocean region off the Illawarra, NSW

- Bass Strait region off Northern Tasmania

Priority Assessment Areas

- Indian Ocean region off Perth/Bunbury, WA

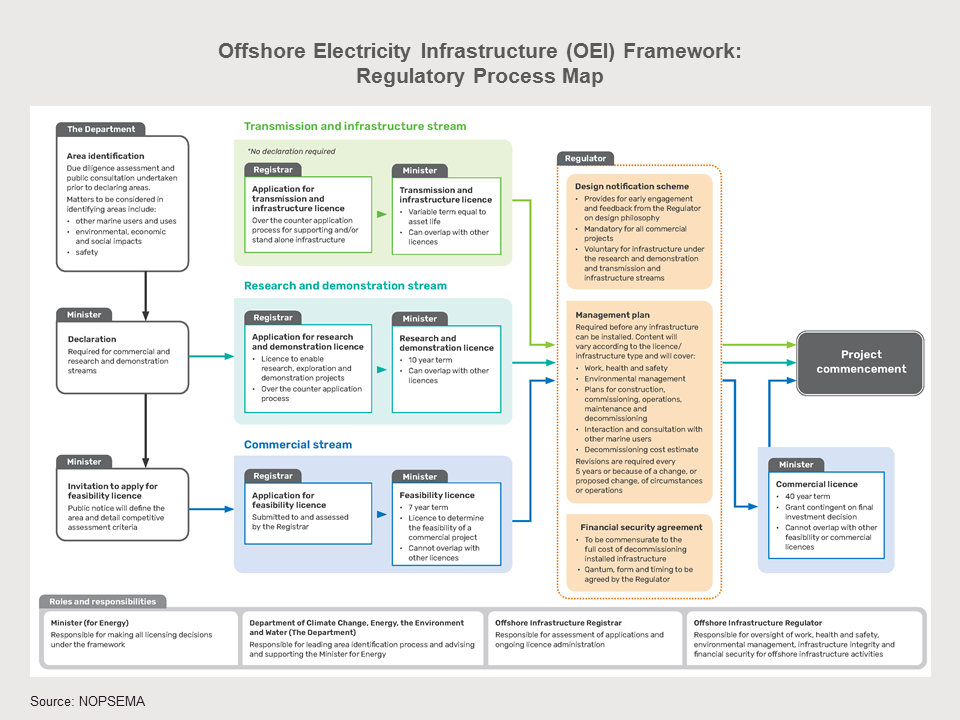

Regulatory Framework

Australia: Obstacles and challenges

Regulatory challenges

The Federal Government’s Offshore Electricity Infrastructure (OEI) Regulatory Framework took effect in June 2022. However, the OEI Regulatory Framework only applies to waters which the Federal Government has jurisdiction, being from 3 nautical miles from the coastline to 200 nautical miles from the coastline. Proponents will need to navigate State/Territory laws for their offshore transmission activities from 3 nautical miles offshore to the coastline. The interface between the OEI Regulatory Framework and these State/Territory laws remains uncertain with Victoria being the only state to take steps towards harmonisation.

The OEI Regulatory Framework is also currently incomplete. Existing laws allow proponents to apply for, and the government to grant, feasibility licences, however, until future regulations are released relating to financial security and management plans, substantive feasibility, construction, operation and decommissioning activities cannot occur.

The process for awarding feasibility licences is highly discretionary and potentially complex. Initially it involves a merits assessment which is comprised of numerous factors and considerations. Following this initial assessment, proponents may be invited to revise their applications to remove overlap with other applications and make financial offers to secure a licence. Proponents and regulators alike are only now beginning to grapple with this process and its nuances.

In addition to securing an OEI feasibility licence and state-based approvals, proponents will be seeking environmental approval under the Environment Protection and Biodiversity Conservation Act 1999 (Cth), an act which currently subject to review and is likely to be reformed in the next 12 months.

Market challenges

Supply chain infrastructure, lack of capacity or expertise and shortages in key materials and relevant machinery all present significant challenges and prospects of high competition for resources.

The scale of offshore wind development also likely exceed demand in the centers where connections are proposed (for example, Hunter, Illawarra, Gippsland), so their feasibility is linked to expanding industry, manufacturing and unlocking hydrogen and eFuels markets in the future for offtake.

Financing issues

The Victorian and Federal Governments have indicated that revenue support will be made available for the first tranche of offshore wind projects in Gippsland, and whilst the latest Victorian Offshore Wind Implementation Statement and the Federal Government’s launch of the Capacity Investment Scheme has provided some detail, much of the commercially significant points are yet to be announced such as contract terms, application criteria and bidding rules.

In addition, the complexities of staged development, shared infrastructure and split contracting packages will require financiers to grapple with risk issues that have not been addressed in the renewables context historically (though banks with experience in resources and oil and gas supply chains will be more familiar with these issues).

Environmental challenges

The impact of these projects on Australia’s seabed and marine environment is unique and somewhat uncertain. This will pose new challenges when it comes to securing environmental approvals. There are also concerns as to the cumulative impact of numerous projects being located in close proximity.

Many residents neighbouring the proposed offshore wind development zones have opposed the declaration of these areas with accusations of improper consultation being made. This raises the possibility of legal action in the future.

Geographical challenges

Australia has an abundance of suitable onshore sites for wind (and solar) developments at a lower cost of production.

Ocean water depth increases rapidly around most of the Australian coastline and several of the proposed offshore wind development zones require the development of floating offshore wind turbines. Floating turbine technology is largely unproven, particularly at the scale proposed by the Australian Government.

Subscribe and stay up to date with the latest legal news, information and events . . .