Publication

Generative AI: A global guide to key IP considerations

Artificial intelligence (AI) raises many intellectual property (IP) issues.

Author:

Global | Publication | October 19, 2017

On 6 November 2017 two laws to substantially amend the Competition and Consumer Act 2010 (Act) became effective:

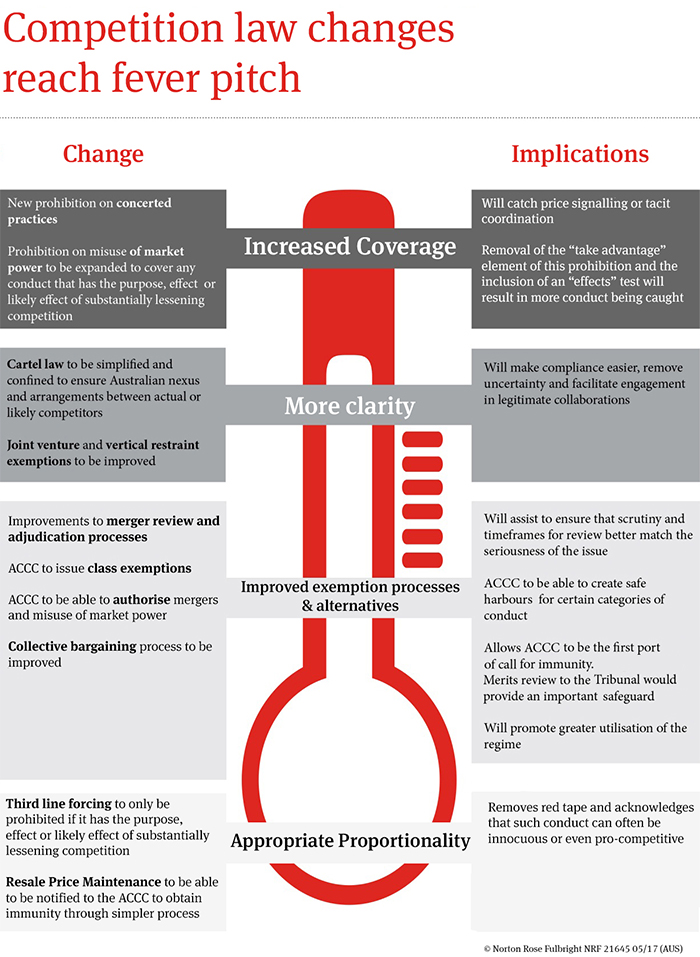

The changes respond to the recommendations of the Competition Policy Review, chaired by Professor Ian Harper in 2015. Whilst they increase coverage of the Act in some respects, they provide more clarity in the application of the Act, improve several exemption processes and achieve more appropriate proportionality across various types of anti-competitive conduct.

In the following article, we caution about the additional risk areas but also identify opportunities posed by these changes. These are also captured in our graphic below.

In the most controversial of changes, the Act now prohibits businesses with a substantial degree of market power from engaging in conduct that has the purpose, effect or likely effect of substantially lessening competition. Unilateral conduct that once was permissible because it did not constitute a “taking advantage” of market power and/or did not have an anti-competitive purpose, could now be caught.

To read more about the specific changes relating to market power, click through to our article here.

Australian law will now have a “concerted practices” prohibition, echoing the concept used in jurisdictions such as the European Union. A concerted practice is any form of cooperation between two or more firms (or people) or conduct that would be likely to establish such cooperation, where this conduct substitutes, or would be likely to substitute, cooperation in place of the uncertainty of competition.

The change is not intended to capture innocent parallel conduct or conduct which would enhance competition, such as public disclosure of pricing information. However it will likely capture a broader array of coordinated conduct, than the current law.

Given the concerted practices prohibition, the express prohibitions against price signalling that apply only to the banking sector, have been removed. This is a welcomes outcome because those provisions are widely viewed as not being fit for purpose and the ACCC has not taken a case under them.

We now have an appropriate confinement of the application of the cartel conduct prohibitions to those affecting competition in Australian markets. Simplification and clarification of the joint venture exception to the cartel laws will allow parties to navigate legitimate collaborations with competitors more readily.

Removing gaps and ambiguity, the joint venture exception to the cartel provisions, now definitely applies to:

However, the exception will only apply to:

The joint venture also cannot have the effect or likely effect of substantially lessening competition, otherwise it will fall foul of other provisions of the Act.

Duplicative and unused sections of the Act have been repealed and sections contained within Division 1 of Part IV have been renumbered to make the Act more workable.

The framework for authorising and notifying conduct under the Act has been improved and the ACCC will be now empowered to make class exemptions and merger assessments, having regard to public benefits, not just competitive impacts.

Previously the ACCC conducted merger clearance assessment, employing the test of whether or not the transaction would have the effect, or likely effect, of substantially lessening competition. Only the Australian Competition Tribunal could review proposed mergers by considering the public benefit of the transaction.

Now, the ACCC will be permitted to make a decision in the first instance by reference to a net public benefit test, not just likely competition impacts. As the ACCC puts it (in its media release of 18 October 2017):

The reforms also bring changes to the options available to merger parties to have their transactions cleared on either competition or net public benefit grounds. The merger authorisation and formal clearance processes will now be combined and streamlined, with the ACCC as the first-instance decision maker.

Such a change leaves the ACCC better-equipped to consider the nuanced issues often arising in mergers that involve material market consolidations. This also benefits merger proponents.

The ACCC will now have a class-exemption power. It can pre-judge certain types of arrangements and deem them to be immune from the Act. They can create a safe harbour for certain categories of conduct unlikely to raise competition concerns or likely to generate a net public benefit.

We will now have an alternative simplified process for seeking immunity for a potential breach of the prohibition against resale price maintenance. It is an acknowledgement that sometimes a supplier seeking to maintain resale prices or prevent discounting is not automatically anti-competitive and the strategy can deliver benefits. Notification to the ACCC will often be simpler, quicker and less resource-intensive than going through the in-depth authorisation process. Although, authorisation remains available.

Certain prohibitions in the Act that prevented conduct that is innocuous or even pro-competitive have either been removed or answered with improved exemption processes, as noted above. On the other side of the coin, it had been expected that secondary boycotts would have their maximum penalty raised, acknowledging their seriousness. However, this was reversed in a last minute Senate amendment to the Competition Policy Review Bill.

Third line forcing is no longer prohibited outright. Third line forcing is now only illegal if a supply is conditional on a customer making an acquisitions from a third party and it has the purpose, or would have or be likely to have the effect, of substantially lessening competition.

As such, there will only be a need to notify third line forcing conduct if there is a concern that there might be a material competition impact. This will assist greatly for many general customer-facing promotion strategies. More novel arrangements, however, may need further analysis to determine whether or not there is a competition law impact that necessitates ACCC notification.

There have also been substantial revisions and clarifications to the criteria and processes for declaring access to significant infrastructure in Part IIIA of the Act. However, this is a discrete topic, which we will deal with in the future.

Whilst businesses may now have greater confidence that there will be a solution for legitimate collaboration and other initiatives, there is also an imperative to revisit existing practices and arrangements, given the new and expanded prohibitions outlined in this article. In particular, your business may benefit from a Market Power Health Check. Norton Rose Fulbright competition law experts have put together affordable, fit-for-purpose packages to assist. Click here to find out more.

Stay tuned for more updates on specific matters arising from the changes to the Act.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023