This article was co-authored with Isobelle Martin.

The third tranche of the Federal Government’s industrial relations reforms was introduced to Parliament on 4 September 2023 to make good on a number of reforms foreshadowed in the most recent Federal election and at the 2022 Jobs and Skills Summit.

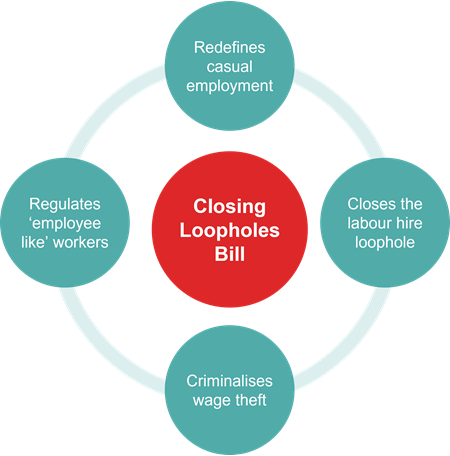

After a year of significant development in the employment and industrial relations space, the Fair Work Legislation Amendment (Closing Loopholes) Bill 2023 (Bill) further builds upon the Government’s robust agenda for change.

This article contains a snapshot of the key changes proposed to be introduced by the Bill.

1. Casual employment

As widely expected, the Bill proposes to introduce a new definition of “casual employee” into the Fair Work Act 2009 (Cth) (FW Act), which harks back to the common law approach to identifying casual employment. This effectively moves away from the position set out in section 15A of the FW Act, which was added following the High Court of Australia’s decision in WorkPac Pty Ltd v Rossato [2021] HCA 23.

Key aspects of these proposed changes include:

- an employee will be a casual employee where the employment relationship is characterised by an absence of a firm advance commitment to continuing and indefinite work;

- there will be a focus on the “real substance, practical reality and true nature of the employment relationship”, rather than solely the terms of the contract; and

- a firm advance commitment may be in the form of the contract of employment or in the form of a mutual understanding or expectation (that does not rise to the level of a contractual term).

The Bill also builds upon the existing casual conversion provisions in the FW Act, by providing an avenue for eligible casual employees to notify their employer that they consider they are eligible for permanent employment. Employers must respond within 21 days of a notification being made, and must consult the notifying employee before responding. Whilst there are various grounds on which the notification can be refused, a notification cannot be refused simply on “reasonable business grounds”.

Definition of employer and employee

Consistent with the proposed change to the definition of “casual employee”, the Bill also proposes that the ordinary meaning of “employee” and “employer” will be determined by looking at the “real substance, practical reality and true nature” of the relationship. This returns the approach to a more global consideration which looks at both the contract and other relevant factors regarding how the contract is performed in practice. This is consistent with how the issue was considered before the 2022 High Court decisions in CFMMEU v Personnel Contracting Pty Ltd [2022] HCA 1 and ZG Operations Australia Pty Ltd v Jamsek [2022] HCA 2.

2. Closing the labour hire loophole – “Same job, same pay”

In a nutshell, this proposed amendment targets situations where an employer has committed to wages for its employees through an enterprise agreement (or certain other, prescribed instruments), but uses labour hire employees to perform work at lower rates of pay.

The key facts are as follows:

- Regulated labour hire arrangement order - these orders will seek to ensure that labour hire employees (referred to as ‘regulated employees’ in the Bill) are not paid less than the ‘protected rate of pay’ for performing the same work. The protected rate of pay will be the full rate of pay that would be payable to the regulated employee if the host employment instrument applied to them.

- Eligibility - regulated employees, an employee of the regulated host, a union or the regulated host may apply in the Fair Work Commission (FWC) for a regulated labour hire arrangement order.

- Granting an order - there are two requirements for the FWC to make an order (to employers other than small business employers):

- an employer supplies, or will supply, either directly or indirectly, employees to a regulated host to perform work for the regulated host; and

- a covered employment instrument that applies to the regulated host would apply to the employees if the regulated host were to employ the employees to perform work of that kind.

- Refusing to grant an order – the FWC must not make an order if satisfied that it is not fair and reasonable in all the circumstances to do so, having regard to matters including the following

- existing pay arrangements;

- whether the performance of the work is or will be wholly or principally for the provision of a service, rather than the supply of labour to the regulated host; and

- the history of industrial arrangements applying to the regulated host and the employer.

- Related bodies corporate exception – there is no exception for related bodies corporate. Arrangements between related bodies corporate can be the subject of a regulated labour hire arrangement order.

- Other exceptions - Short-term increases in demand for services or deadlines which require employers to use short-term, non-ongoing labour hire (which are generally expected to be no longer than 3 months) will be exempt.

- Anti-avoidance – the Bill contains broad anti-avoidance provisions that seek to prevent employers from circumventing these new provisions.

3. Wage theft

The Government also proposes to deliver on its pre-election promise to criminalise wage theft. The new criminal offence will apply where an employer intentionally underpays an employee.

Victoria and Queensland have already criminalised wage theft. However, in Victoria the offence requires an employer to deliberately and dishonestly underpay an employee. Comparatively, the Queensland wage theft provisions in the Criminal Code 1899 (Qld) do not require intention to be established.

The headline points are as follows:

- Intention must be established. This means that underpayments that are accidental, inadvertent, or based on a genuine mistake will not be captured for the purpose of criminal liability (although will still be treated as breaches of the FW Act);

- Non-payments of superannuation contributions, amounts referable to long service leave, paid leave as a result of being a victim of crime, paid jury duty or emergency service leave are not captured by this offence;

- Prosecutors will be required to prove beyond a reasonable doubt that:

- the defendant intentionally engaged in the relevant conduct; and

- the defendant intended that their conduct would result in an underpayment (either because they intentionally underpaid the employee or were aware that the underpayment would occur in the ordinary course of events).

- Small business employers who, in the event of an underpayment, comply with the Voluntary Small Business Wage Compliance Code (yet to be released) will not be referred for criminal prosecution.

- The Bill proposes to create a new framework for cooperation agreements with the Fair Work Ombudsman and employers who self-report underpayments.

Increased civil penalties

The Bill also proposes to significantly increase the civil pecuniary penalties for wage exploitation-related provisions and failure to comply with a compliance notice. It proposes further changes to the calculation of penalties for underpayment offences where the maximum penalty may be determined by reference to 3 times the value of the underpayment in certain circumstances.

4. Regulated workers – ‘Employee like’ workers

The Bill proposes to introduce a raft of amendments to ensure that certain independent contractors are entitled to greater workplace protections.

These provisions will primarily relate to independent contractors who are either:

- Employee-like workers performing digital platform work – this is defined broadly in the Bill to include a range of contractual arrangements where the person, who is not an employee, performs all or a significant majority of the work (being digital platform work) under a services contract and at least one of the following applies:

- the employee-like worker has low bargaining power in negotiations;

- the employee-like worker receives remuneration at or below the rate of an employee performing comparable work;

- the employee-like worker has a low degree of authority over the performance of the work; or

- the employee-like worker has other prescribed characteristics.

- Road transport contractors engaged in the road transport industry – this is also defined broadly in the Bill to include a range of contractual arrangements where the person (who is not an employee) performs all or a significant majority of the work (being work in the road transport industry) under a services contract.

The FWC will be provided with a new jurisdiction to make minimum standards orders and non-binding minimum standards guidelines, for these independent contractors. Similar to the FWC’s unfair dismissal jurisdiction, the Bill will also introduce the concept of “unfair deactivation” from a digital labour platform for employee-like workers undertaking digital platform work, and “unfair termination” for regulated road transport contractors.

The regulated workers will also be permitted to make consent-based collective agreements and dispute unfair contract terms if earning below the contractor high income threshold, in the FWC.

5. Other proposed changes

The Bill also proposes numerous other changes in the employment and industrial relations space, including:

- Anti-discrimination - the expansion of current anti-discrimination provisions in the FW Act to include employees and prospective employees who have been or continue to be subjected to family and domestic violence.

- Industrial manslaughter – introduction of the offence of industrial manslaughter in the Work Health and Safety Act 2011 (Cth) in addition to increasing maximum penalties. Further changes to work health and safety laws are intended to increase the focus on silica related diseases and enable first responders suffering PTSD to access workers compensation more easily.

- Sham arrangements – amendment to the employer defence which currently applies where an employer establishes that they did not know, and were not reckless at whether the contract was a contract of employment rather than a contract for services. This defence will be amended so it only applies where the employer proves that it reasonably believed the contract was a contract for services.

6. Where to from here?

Unlike the earlier tranches of amendments, this Bill will take some months before it could become legislation. It has been referred to the Education and Employment Legislation Committee for inquiry and report by 1 February 2024.

This means we are unlikely to see any real progress until early in 2024. However, the Bill provides plenty of food for thought for employers in the lead up to the likely introduction of these proposed amendments. If you would like to discuss the proposed changes in more detail, including what they may mean for your organisation, please don't hesitate to contact us.

![]()