Global offshore wind: Brazil

Publication | 1月 2024

Information correct as of 31 December 2023.

Content

Focus on: Brazil

Market overview

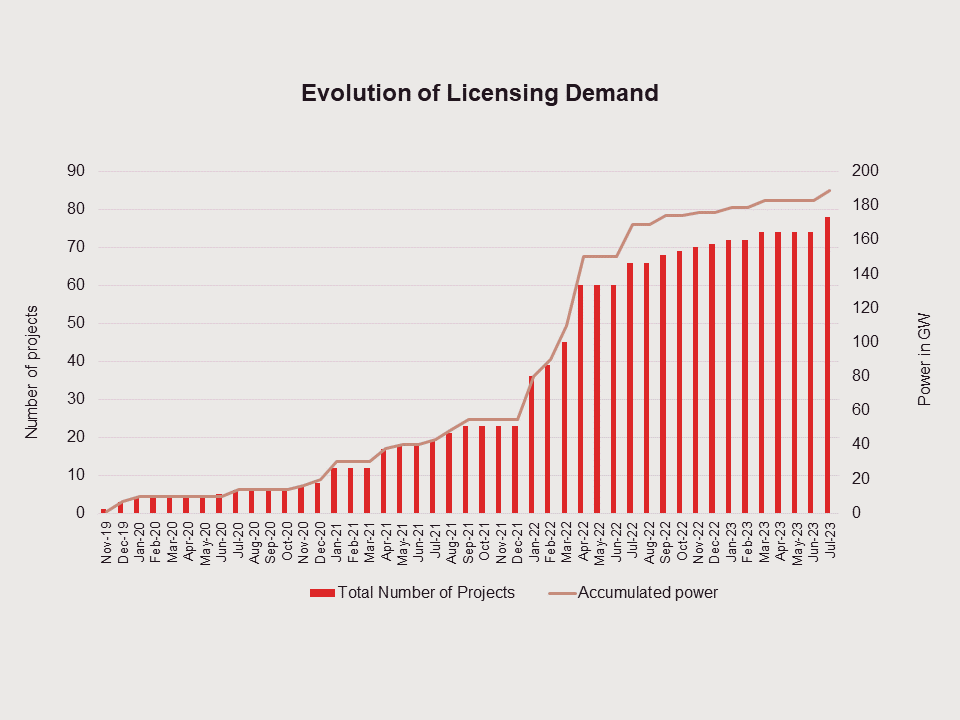

To date, there are no operational offshore wind projects in Brazil. However, according to Brazil’s 2050 National Energy Plan, published in April 2020 by Empresa de Pesquisa Energética, Brazil's federal energy research office, the potential installed capacity of offshore wind power generation should reach around 16GW by 2050. As of July 2023, Brazil had around 189GW of offshore wind projects being evaluated by the federal environmental licensing agency, Ibama (see figure below).

Brazil: Obstacles and challenges

Regulatory obstacles and challenges

The regulatory framework for offshore wind projects in Brazil is still being developed, with the necessary regulatory apparatus needed to progress these projects yet to be put in place. That said, Brazil has made some significant regulatory advancements over the past few years:

- December 2021 - Law No. 14,286/2021, which established the legal framework for the foreign exchange market and international capital. Law No. 14,286/2021 permits the purchase and sale of electricity in foreign currency and is predicted to pave the way for new international generators and financiers to enter the Brazilian energy sector. This is of particular interest in the context of prospective offshore windfarm projects given that a high portion of project capex is typically constituted by imported equipment. Dollarized PPAs are also predicted to reduce current currency exposure and encourage an increase in international project financing.

- January 2022 - Decree No. 10,946/2022 was published by Brazil’s federal government. The Decree sets forth the rules for allocating the use of 'physical spaces and natural resources' to generate energy from wind in inland waters, territorial sea, exclusive economic zone and continental shelf under Brazil's domain. The Decree, which came in to force in June 2022, represents a significant milestone in the regulatory development of Brazil's offshore wind sector.

- November 2023 - Bill PL 11247/18 was passed by the Brazilian Congress. The bill, which still needs the approval from the Senate, allows offshore areas to be granted through authorization or concession by the federal government.

Brazil had planned to hold its first auction to award four blocks for offshore wind projects in September/October 2022. However, it is now expected that any such auction will take place in 2024. Also, the Brazilian national electric energy agency (Aneel) is set to continue work on the regulatory framework for offshore wind energy power during the first half of 2024.

Whilst there are still significant regulatory, financial and technological challenges related to the feasibility of advancing offshore wind projects in Brazil, these legislative developments provide a framework for the much-needed legal security required in order to attract investments in the sector and to facilitate project bankability.

Transmission infrastructure obstacles and challenges

Despite a degree of regulatory uncertainty and a lack of transmission infrastructure needed to accommodate a new energy supply chain from offshore wind, several local and international players are already looking at opportunities across the country and remain optimistic about what Brazil has to offer. Below figure shows the number of environmental licensing projects by company for offshore windfarms submitted to Ibama as of July 2023.

Environmental licensing projects for offshore wind farms - Ibama, 2023

| Company | Number of Projects | Total Power (MW) |

|---|---|---|

| Shizen Energia do Brasil | 6 | 18000 |

| SPE Bravo Vento | 5 | 17475 |

| Shell Brasil Petróleo |

6 | 17080 |

| Ventos do Atlântico |

5 | 15227 |

| Bluefloat Energy do Brasil |

7 | 14960 |

| Equinor Brasil Energia |

6 | 14370 |

| Eólica Brasil |

4 | 10800 |

| Neoenergia Renováveis |

3 | 9000 |

| Totalenergies Petroleo & Gas Brasil |

3 | 9000 |

| Bosford Participações |

4 | 7305 |

| Acciona Energia Brasil Ltda |

4 | 6080 |

| Alpha Wind Morro Branco Projeto |

1 | 6000 |

| Kaanda R. M. Cunha |

2 | 5388 |

| Monex Geração de Energia SA |

2 | 4920 |

| CEMIG Geração e Transmissão SA |

2 | 4500 |

| Geradora Eólica Brigadeiro I |

1 | 3840 |

| H2 Green Power Ltda |

1 | 3000 |

| Internacional Energias |

1 | 2484 |

| Prumo Logística | 1 | 2160 |

| Geradora Eólica Brigadeiro IV |

1 | 1920 |

| Chiri Renovables Ltda. |

1 | 1920 |

| Geradora Eólica Brigadeiro III | 1 | 1680 |

| Votu Winds |

1 | 1440 |

| Qair Marine Brasil |

1 | 1216 |

| Camocim Eirelli |

1 | 1200 |

| Geradora Eólica Brigadeiro II |

1 | 1200 |

| Geradora Eólica Brigadeiro V | 1 | 1200 |

| Energia Itapipoca Ltda | 1 | 720 |

| Com. Energia Humberto de Campos |

1 | 720 |

| Pedra Grande |

1 | 624 |

| Bi Energia Ltda | 1 | 576 |

| SENAI/RN |

1 | 22 |

Subscribe and stay up to date with the latest legal news, information and events . . .