Continuation fund transactions, commonly referred to as General Partner (GP)-led secondaries, have grown in popularity in recent years. With the appropriate structure, a continuation fund transaction can serve as an effective fund management tool for a general partner/fund manager (GP) looking to extend the maturity or capital available for its portfolio investments and provide limited partners/investors (LP) with liquidity options.

In this article, we discuss the nature and characteristics of a typical continuation fund transaction, and some of the key considerations for GPs and LPs in light of recent guidance published by the Institutional Limited Partners Association (ILPA).

What is a continuation fund?

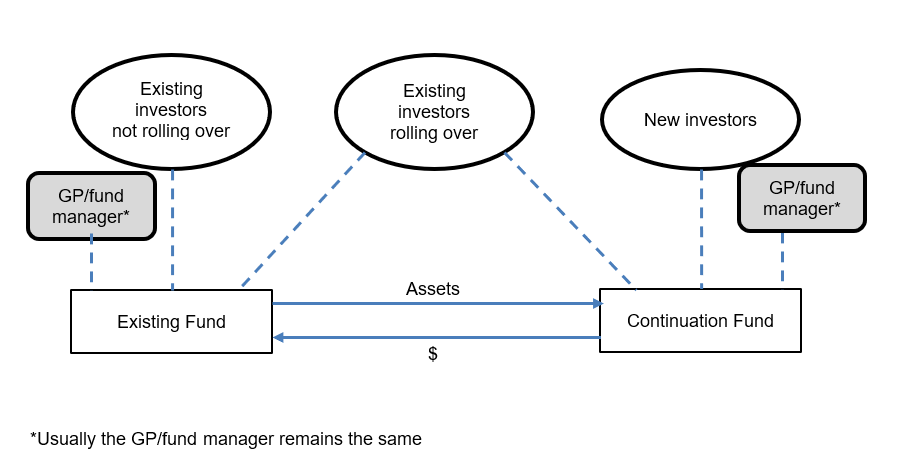

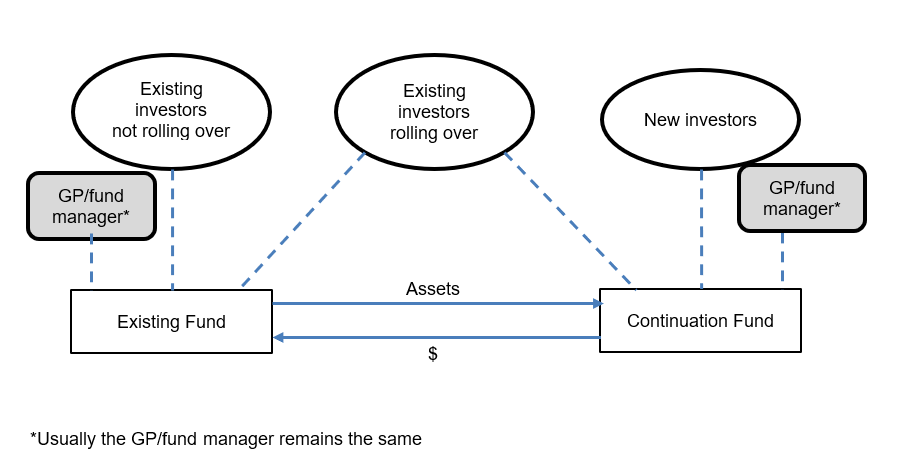

A continuation fund is a new vehicle set up by a sponsor to purchase all or part of the portfolio of an existing fund that is reaching the end of its term (Existing Fund).

The sponsor is the GP of the Existing Fund. The Existing Fund enters into a sale and purchase transaction with the new fund (Continuation Fund) whereby the Existing Fund sells all (or some) of the assets in the Existing Fund to the Continuation Fund. (Alternative procedures such as a cram-down of the existing assets into a subsidiary continuation vehicle followed by a distribution of interests in such subsidiary continuation vehicle to the Limited Partners may also be considered.)

Typically, both funds are managed by the same GP.

Typical Continuation Fund structure

Why use a Continuation Fund?

Some of the benefits of setting up a continuation fund are as follows:

- The GP has more flexibility to retain its holdings in certain investments for longer, and not be beholden to the maturity of the Existing Fund. This has the potential to provide the GP with more control on the timing of the sale of the investment.

This, in turn, can provide benefits in two ways – first, for distressed assets that may be difficult to sell within the maturity period of the Existing Fund, and second, for a GP choosing to retain well-performing assets to capitalise on potentially larger returns under better market conditions in the foreseeable future.

Existing LPs are usually given an opportunity to cash out at the maturity of the Existing Fund, or alternatively, stay invested and roll over their interest in the underlying asset into the Continuation Fund (or a combination of both).

- New third-party LPs to the Continuation Fund, in some cases, may see their returns crystallise as the transferred investments from the Existing Fund have been held for a longer period than any new acquisitions/investments.

What are some of the key considerations when dealing with a continuation fund transaction?

Although continuation fund transactions have the potential to provide significant benefits, including increased flexibility and options for creating liquidity as described above, they also pose unique challenges. A primary issue to be considered is how conflicts of interest are to be managed. This is because the GP will typically be both the seller and the buyer in a continuation fund transaction.

There is also the issue of appropriate pricing with respect to the selection of assets for the Continuation Fund. The challenge for a GP is to show that the valuation process has been conducted in a fair and transparent manner.

In addition, continuation fund transactions come with complex tax and structuring considerations for LPs, particularly rolling LPs, which need to be considered on a case-by-case basis. These transactions in Australia have very different tax outcomes to continuation fund transactions conducted overseas, such as the USA, and any tax rollovers that are available have very specific requirements that would need to be met. Any such transaction should, therefore, be considered very carefully with a trusted tax adviser.

The ILPA has published guidance on continuation funds that sets out best practice guidance on how to manage these key issues from the perspective of both GPs and LPs.

Industry-led best practice guidance on continuation fund transactions

In May 2023, the ILPA released guidance on Continuation Funds (Considerations for Limited Partners and General Partners)(ILPA Continuation Funds Guidance).

This guidance outlines best practice principles to address certain risks identified by LPs in their involvement with continuation fund transactions.

We set out a summary of the highlights below:

Managing conflicts of interest:

- Obtain waivers: The GP should engage the Limited Partner Advisory Committee (LPAC) or its equivalent early on to vote to waive any conflicts of interest associated with the transaction. This is irrespective of whether those conflicts are pre-cleared under the terms of the fund documents, such as a limited partnership agreement (LPA).

- Provide adequate disclosures: Key information to be disclosed to the LPAC includes all necessary information about the selected assets (for LPs to carry out their due diligence), alternative options explored for the selected assets, rationale for the transaction, process for soliciting bids, and details of any bids (i.e. number, range and content of bids considered) for the assets.

- Transparency: Other areas of transparency include more favourable economics for any incoming investors relative to rolling LPs, any factors that would have excluded certain acquirers, and other meaningful changes in terms to the existing LPA.

- Timing: Best practice is to provide the LPAC with at least 10 business days to review the transaction, including a live or in-camera session prior to the vote.

- Independent adviser: Best practice is for the LPAC to have the right to an experienced independent legal and specialist adviser (in addition to the GP-selected adviser), particularly in highly complex transactions and in transactions involving higher conflicts of interest risks.

- Conduct a competitive valuation: The GP should conduct a competitive valuation process, which includes third-party price validation, to ensure that a fair and market price is obtained for the selected assets.

- Maintain value: All carried interest accruing to the GP relating to selling LPs’ interests should be rolled into the new continuation vehicle to ensure an alignment of interests, and to avoid a situation where the GP could be selling certain assets to meet performance thresholds and crystallise the carried interest. Where the limited partners are reluctant to bear the delay in the investment return as a result of the longer continuation period, the GP might consider incentivising such continuation through a rebate in the continuation management fee and\or a sharing of the carried interest. Regulatory requirements as to statutory offering and marketing provisions of the new continuation vehicle versus a distribution of the portfolio investments under the existing fund vehicle (and the concomitant tax implications for the fund and for the investors will need to be considered). For the existing LPs, there should be no change to the economic terms that apply to the continuation fund, vis-a-vis the existing fund, and therefore the carried interest should be rolled over, and on the same rate. The tax indemnities and other liabilities under the existing fund documents will have to be carefully and selectively preserved if appropriate. Where the GP does not do so, the GP should provide their reasons along with any alignment incentives for the new vehicle. For example, where the new continuation vehicle is more appropriately regarded as an extension of the existing fund in its run-off phase, on the basis that the management required is largely to maintain the asset (rather than adding new portfolio investments), the management fee may be lowered to reflect the nature of the services required.

- Any other conflicts relating to economic incentives accruing to the GP that do not also accrue to the LPs should also be identified, mitigated and approved by the LPAC.

Managing the process:

In addition to conforming to the relevant provisions of the existing LPA and any side letters with rolling LPs, those promoting a continuation fund transaction process are encouraged to comply with the following principles:

- Timing: LPs should be given at least 30 calendar days / 20 business days to thoroughly evaluate the GP proposal and make their election - i.e. to roll their interests on a pro-rata basis into the new entity, sell their interests to the acquirer, or roll their LP interests into a continuation vehicle and purchase additional interests, or a combination of the three.

- Default position: Where LPs fail to make an election in a timely fashion, the default position should be that LPs should be treated as liquidating their interests, as they should never be forced to roll their interests into the new vehicle in the absence of a positive confirmation.

- Access to third party adviser: Experienced advisors should be engaged to facilitate the transaction to structure the process, initiate bid solicitation and guide the asset transfer. Best practice is to make transaction advisors accessible to LPs at the appropriate time.

- Consistency in key provisions: Any side letter agreements with rolling LPs should continue to apply (where relevant) to the continuation fund, including, at minimum, all relevant risk and governance terms.

Managing the proposal:

- Allocation of fees and expenses: The allocation methodology for transaction fees and expenses should be disclosed, and this allocation should be determined by the corresponding benefit. For example, where the GP benefits from additional fee revenue or through a stapled commitment, the GP should also share in the transaction costs.

- Changed fund terms: Rolling LPs could be provided with the option to participate in the new structure with no change to the management fee basis/percentage, carried interest rate / preferred return, or crystallisation of carried interest, such that the status quo is maintained. No minimum threshold roll participation should be imposed to offer this option. Where there are differences in terms between existing and rolling LPs, full disclosures around those terms and the reasons for the differences should be made.

Best practice recommendations for LPs:

In addition to the above best practice guidelines for GPs, recommendations for LPs include:

- Internal protocols: establish internal protocols specific to continuation fund transaction processes, including the approval and underwriting processes, as well as understanding obligations under relevant laws and regulations. Some LPs have institutional and legal requirements to consider which require additional layers of review, while others are legally/contractually required to consider each continuation fund transaction as a new investment, including necessary due diligence and review obligations that come with it;

- Timing: setting timing expectations with GPs around the process of reviews, negotiations and approvals; and

- Request for information: requesting from GPs all information (e.g. documentation, models and materials) to ensure that it is fully informed as though it was a prospective new buyer. Selling LPs should request an independent value assessment for the underlying assets from the fund, as well as a formal financial opinion on the fairness of the cash price.

As funds reach their maturities, continuation fund transactions will remain an important and increasingly utilised strategy as part of GP-led restructuring transactions. When structured appropriately, continuation fund transactions can serve as a useful tool for GPs to manage the timing of exiting certain assets from the fund, and also providing LPs an option to ‘cash out’ or continue to invest in these investments. It is important with these transactions that the GP’s duties to the fund and to the LPs, and interests of the LPs are managed appropriately. The ILPA’s guidance provides a useful guidance as to how these interests should be managed and how these issues should be navigated, setting a benchmark for these transactions going forward.

Please reach out to us below for any assistance on these matters.