Publication

International arbitration report

In this edition, we focused on the Shanghai International Economic and Trade Arbitration Commission’s (SHIAC) new arbitration rules, which take effect January 1, 2024.

United States | Publication | février 2023

On February 10, 2023, the Federal Trade Commission (FTC) and Department of Justice Antitrust Division (Division or DOJ) issued the Annual Hart-Scott-Rodino Annual Report for Fiscal Year 2021 (covering October 2020 – September 2021). In addition to summarizing FTC and DOJ enforcement actions against proposed mergers during this time period, the report also provides statistical data about the agencies' merger programs.

FY2021 was a record-setting year for reportable merger activity in the United States, with more than 3,500 reportable transactions. But, despite agency leadership claims of reinvigorated antitrust enforcement, merger enforcement was actually down across the board:

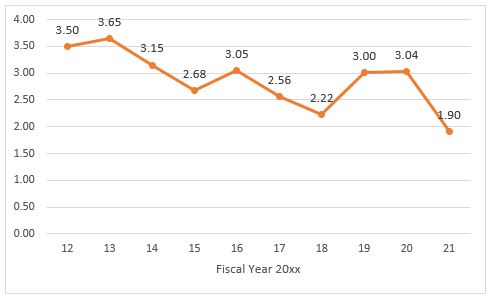

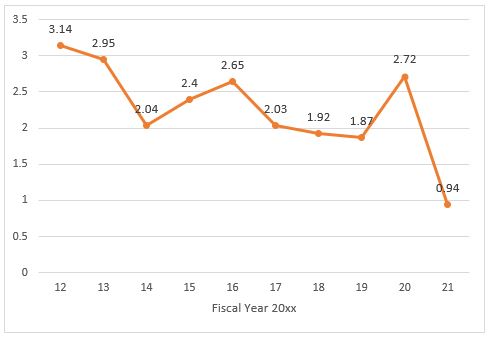

The agencies issued a record 65 Second Requests but on a percentage level, this was actually below historic norms: In the nine fiscal years prior to FY2021, the average rate at which Second Requests were issued was approximately 3 percent of reported transactions, but in FY2021 that number was less than 2 percent.1

The Second Request statistics also demonstrate that:

FY2021 merger enforcement was at its lowest levels over the past decade when considering both the percentage of reported transactions that were challenged and the percentage of Second Request investigations that resulted in a challenge.

The data also provide insights into two areas of recent FTC and DOJ attention: private equity and healthcare.

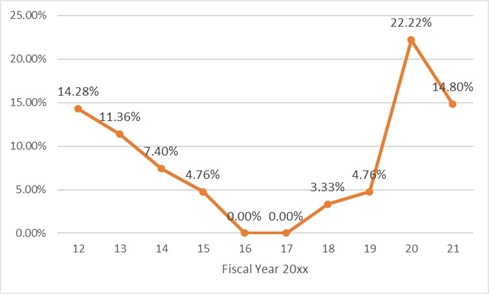

The data suggest the agencies' recent concerns regarding private equity firms may be related to an uptick in HSR filings, potentially involving such firms, as nearly one in every five transactions (19.1 percent) involved an acquiring entity with no reported historic revenue, which is a common feature of deals involving private equity firms.8

As for healthcare, which has historically received more scrutiny from antitrust enforcers than many other industries, the numbers are again down versus FY2020.9 In FY2021, the number of Second Requests in hospital transactions was down as compared to FY2020’s historically high levels.

The release of this data also provided an opportunity to hear from the FTC Commissioners regarding their view of the state of merger enforcement. Concurrently with the report, Commissioner Rebecca Slaughter issued a statement noting the “unprecedented challenges the FTC faces in conducting effective merger review in the modern economy.” She called on Congress to increase the HSR waiting periods from the current 30 days and applauded the new changes to the HSR filing fee structure. The other two Democratic Commissioners, Chair Lina Khan and Commissioner Alvaro Bedoya, joined this statement. By contrast, Republican Commissioner Christine Wilson issued a statement blaming FTC leadership for the current state of the merger program, including the decreased levels of enforcement and poor prioritization of agency resources.

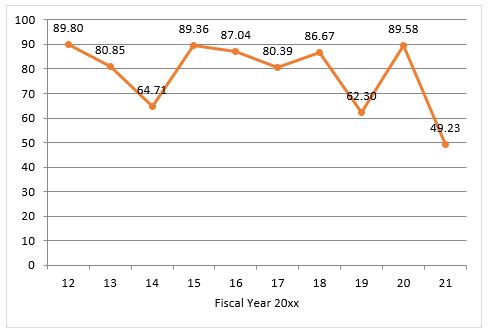

As these statements and the data they accompanied reveals, antitrust enforcement is not so straightforward. The numbers confirm our experience that federal antitrust enforcement may not be as vigorous as the public rhetoric may suggest. The bottom line, as the data shows, is that deals are being reviewed by the FTC and DOJ on antitrust grounds, but many deals—in fact, over 99 percent of all reported transactions in FY2021—cleared HSR review without challenge.

Norton Rose Fulbright’s antitrust team regularly helps parties navigate the ever-changing merger control environment.

1 HSR Annual Report FY2021, Appendix A. The Report data do not disclose historic percentages of transactions for which the agencies conducted a substantive investigation.

2 Source: Amanda Wait calculations based on HSR statistics data. All calculations are proprietary and may not be used without express permission from the author.

3 HSR Annual Report FY2021, Exhibit A, Table III.

4 HSR Annual Report FY2021, Exhibit A, Table IV.

5 Id.

6 Source: Amanda Wait calculations based on HSR statistics data. All calculations are proprietary and may not be used without express permission from the author.

7 Source: Amanda Wait calculations based on HSR statistics data. All calculations are proprietary and may not be used without express permission from the author.

8 HSR Annual Report FY2021, Exhibit A, Table X.

9 The FTC and DOJ report transactions by certain industry descriptions, including hospital transactions (three-digit NAICS code 622).

10 Source: Amanda Wait calculations based on HSR statistics data. All calculations are proprietary and may not be used without express permission from the author.

Publication

In this edition, we focused on the Shanghai International Economic and Trade Arbitration Commission’s (SHIAC) new arbitration rules, which take effect January 1, 2024.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023