Global offshore wind: Germany

Global | Publication | juillet 2023

Information correct as of 31 July 2023.

Content

- Germany: Market overview

- Germany: Offshore wind projects

- Germany: Regulatory overview

- Germany: Tender and development process

- Germany: Process for centrally pre-investigated sites

- Germany: Process for sites without central pre-investigation

- Germany: Support regimes and offtake

- Germany: The role of TSOs

- Germany: Obstacles and challenges

- Germany: Hot topics

- Germany: Investment outlook

Germany: Market overview

By the end of 2022, more than 1,500 offshore wind turbines (with a total capacity of about 8 GW) were connected to the grid in Germany. In 2022 the total installed capacity increased by more than 300 MW. According to the Site Development Plan (Flächenentwicklungsplan) published by the German Federal Maritime and Hydrographic Agency (BSH) in January 2023, a capacity of 24.7 GW is due for commissioning by 2030. This may increase the installed capacity to up to 36,5 GW until 2030, taking into account that the projects tendered in 2021 and 2022 which are to be commissioned by 2026 and 2027.

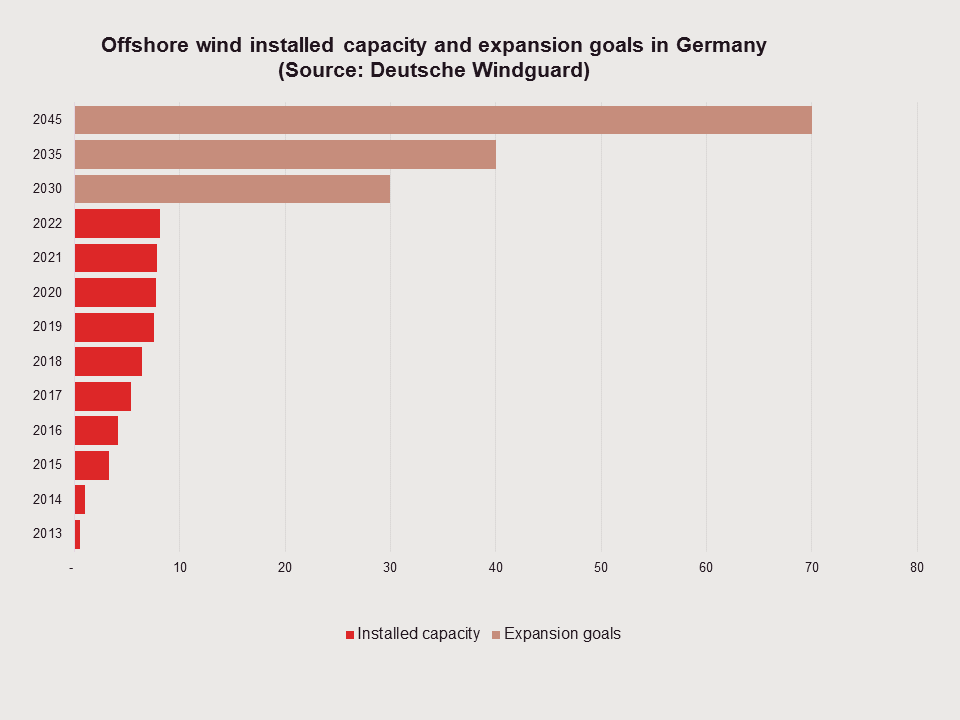

Accelerating the expansion of offshore wind is due to Germany’s commitment to the 1.5°c Paris Agreement target, to which the European Union has committed. The importance of this has been emphasized by the ongoing conflict between Russia and Ukraine and the resultant energy crisis in 2022. It is evident that an increasing electrification in all sectors (e.g. mobility and heating) based on renewable energies is inevitable in the medium and long term. The current statutory targets in Germany are for offshore wind to reach a cumulative installed capacity of 30 GW in 2030, 40 GW in 2035 and 70 GW in 2045 as per the reformed Wind Energy at Sea Act 2022.

Most of Germany’s offshore wind turbines are located in the North Sea, with an installed capacity of 6.7 GW comparative to its installed capacity of 1.1 GW in the Baltic Sea. This trend will likely continue when looking at the tenders under the Site Development Plan (Flächenentwicklungsplan), which shows that 14 out of the 17 sites are in the North Sea.

On the technical side, individual turbine capacity has been growing. The average capacity of existing turbines is rated at about 5.3 MW, whereas new projects will have capacities ranging from 9.5 to 15 MW (with an average of about 11 MW) for projects to be commissioned by 2025.

Offshore wind projects in Germany undergo a tender process. Tenders took place once per year in 2021 and 2022 and projects have historically been awarded to the lowest market premium offers. The system has changed, as tenderers can now bid for a concession for centrally pre-investigated sites. In addition to the concession payment by the operator, other award criteria are now factored into the evaluation such as decarbonization efforts of the bidder. Projects at sites which are not centrally pre-investigated are still awarded in an auction process based on the lowest market premium offered. If there are several €0.00 cent offers, in a further round, the highest payment offered by the bidders is selected, replacing the lottery process used in the past.

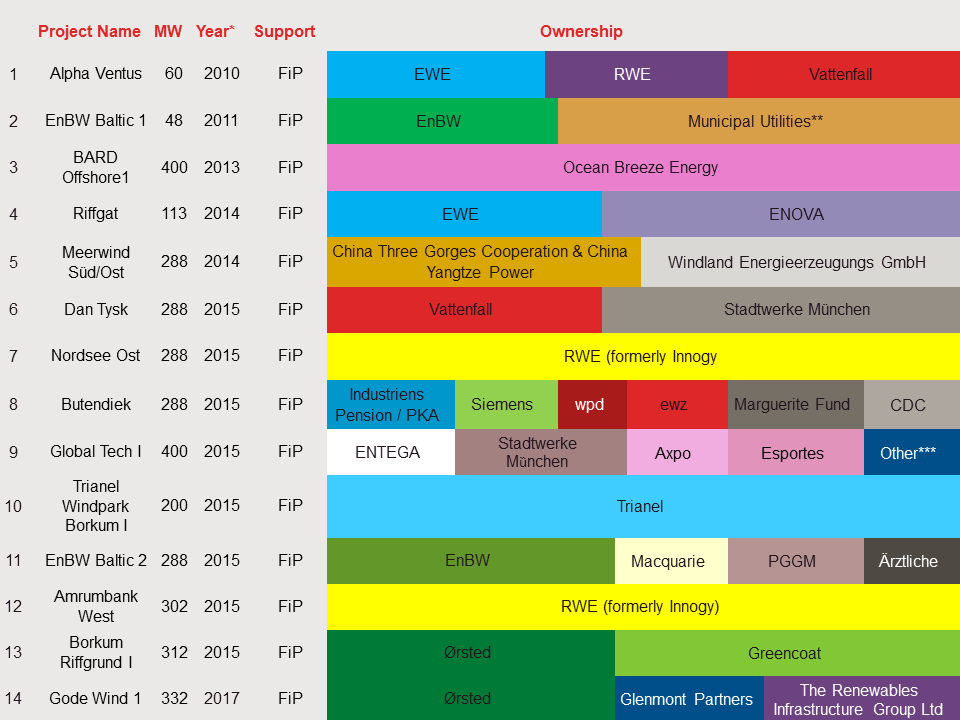

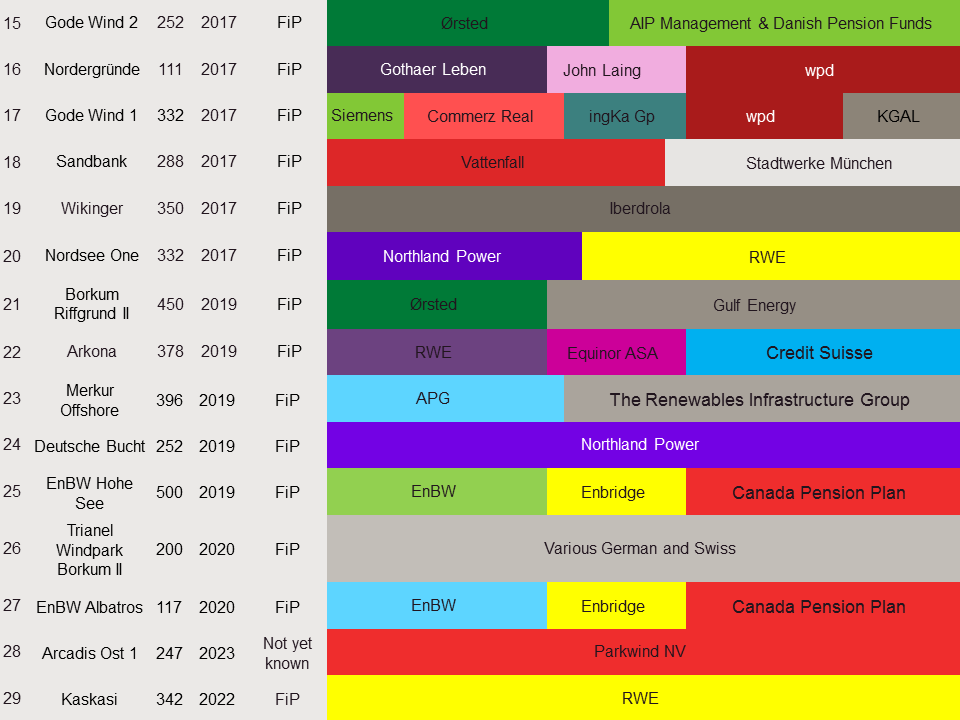

Germany: Offshore wind projects

Germany: Regulatory overview

The main legal framework for offshore wind in Germany is set out in the Renewable Energies Sources Act (EEG), the Wind Energy at Sea Act (WindSeeG), the German Energy Industry Act (EnWG) and in other ancillary regulations and ordinances. The EEG allows for a statutory claim of the wind farm operator against the connecting grid operator for grid connection and the off-take of electricity generated.

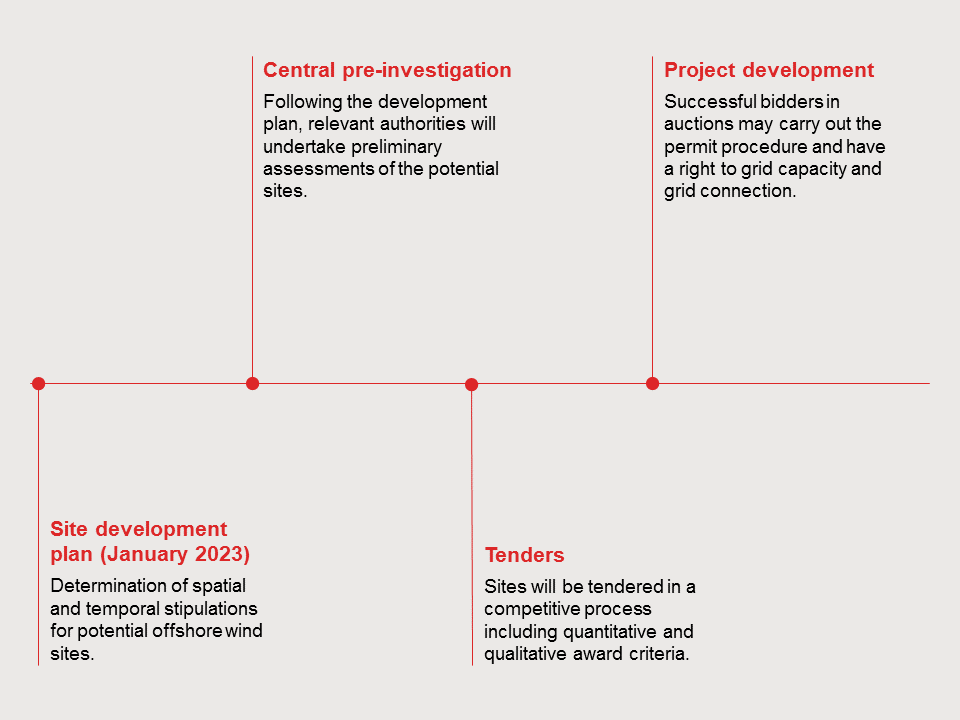

In the past, individual developers had to investigate the sites for their projects. To streamline the process and reduce costs by avoiding duplications of investigations and surveys, the WindSeeG contains rules for a centralized planning process for wind farms undertaken by the BSH. The WindSeeG also sets out details of the auctions held by the Federal Grid Agency (BNetzA) and provisions regarding the licensing of construction and operation of wind farms in the German Exclusive Economic Zone (EEZ).

The EnWG sets out the transmission system operator (TSO)’s obligations to build the necessary grid connections and to pay damages in the event of delay or interruption to the grid connection. Several ancillary ordinances (including those issued by BNetzA and BSH) and regulations provide further details regarding the planning, licensing, construction and operation of offshore wind farms.

To ensure energy security and to meet climate targets, the aim is for German electricity supply to be based almost entirely on renewable energies by 2035. In order to achieve this goal, the German Bundestag passed far-reaching amendments in July 2022, which relate to – among others – the EEG and the WindSeeG. The expansion of offshore wind energy is to be accelerated by adapting the conditions for installation and by consistently implementing support measures. It is envisaged that the installed capacity of offshore wind turbines will be at least 30 GW by 2030, at least 40 GW by 2035, and at least 70 GW by 2045.

To achieve these goals, bureaucratic obstacles to the planning of new offshore wind power plants have been reduced and approval procedures are becoming shorter and more digitized. In the future, tendering for offshore wind energy will be fundamentally reorganized.

Section 2 of the EEG provides for a significant simplification in the approval of new offshore wind projects. This will see the construction and operation of renewable energy plants and associated ancillary facilities deemed to be in the overriding public interest and to serve public safety until such time as Germany's power generation is carbon neutral. Section 1 (3) of the WindSeeG explicitly emphasizes this for offshore wind from January 1, 2023. Accordingly, an application to install a wind turbine at sea can only be rejected in exceptional cases.

Germany: Tender and development process

Starting in 2023: The dual auction model

In order to meet the increased expansion goals, auction volumes must increase and project development must accelerate. Previous auctions have also shown that bidders deem offshore wind projects profitable without the need for feed-in-tariffs and/or market premiums. Against this backdrop, the WindSeeG was reformed. This means in practice that bidders will likely have to fund the development of offshore wind projects rather than relying on a minimum remuneration in the form of a market premium.

In addition, the original capacity of centrally pre-investigated sites is not sufficient for the new goals, making it also necessary to auction new sites which have not been pre-investigated centrally so far by the BSH. Both site types will be auctioned in separate processes.

Auctions for centrally pre-investigated sites

Most significantly, bidders in auctions benefitting from centralized pre-investigation will not receive any market premiums and €0.00 cent bids are likely to be unsuccessful as developers save time and costs for pre-investigations. Instead, successful bidders are expected to offer a concession payment per KWh produced which makes up 60 percent of the award criteria. The other 40 percent are made up by qualitative criteria which are:

- Decarbonization efforts in the context of offshore wind development,

- Percentage of electricity sold via B2B PPAs,

- Technology used for the foundations with respect to noise levels and sealing of seabed,

- Efforts to combat skilled worker shortages in the offshore wind industry.

The degree of fulfilment of these criteria is graded by the BNetzA and then combined with the quantitative payment criterion.

If there is a tie between two bidders in the total ranking, the award will be made to the bidder with the highest payment.

In order to participate in the auctions, a bond of €200,000/MW of installed capacity is required to be provided. This bond secures compliance by the successful bidder with various development milestones set out in the WindSeeG and ultimately the timely commissioning of the offshore wind farm. If the successful bidder fails to comply with these milestones, different penalties apply and if the bidder does not pay these penalties, the authority may enforce the bond. The bidder is not obliged to pay penalties if it can prove that the project is delayed due to circumstances outside of its control.

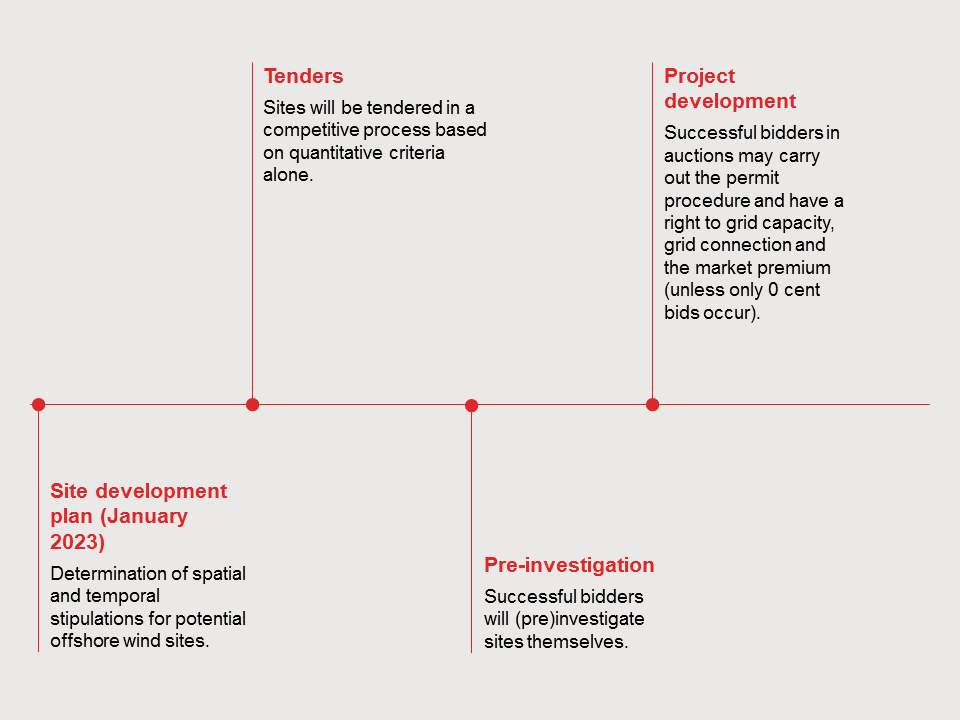

Auctions for sites not centrally pre-investigated

Auctions for sites which have not been pre-investigated centrally are based on the existing market premium design. The auctions will still accept bids with market premiums but if several bidders submit €0.00 cent bids, the winner is no longer awarded via lottery drawing. Instead, all €0.00 cent bidders are then invited to bid for a payment per MW of tendered volume, with the highest bid (after several bidding rounds) being awarded with the project.

The bond for not centrally pre-investigated sites lies at €100,000/MW.

Rights and duties of successful bidders

Successful bidders from both auction models have an exclusive right to carry out the permit procedure for the wind project at the relevant site. If a site has not been centrally pre-investigated, winning bidders will need to carry out a site investigation before commencing development of their project.

A successful award decision is also a necessary pre-condition for the right to obtain grid capacity and grid connection from the grid operator. Grid operators are required to extend the grid out to sea based on the Site Development Plan set up by BSH. In the past, the grid connection date only became final for operators of offshore wind projects when they followed a separate procedure based on a construction plan to be agreed between the TSO and the wind farm operator. Now that the Site Development Plan contains quarterly provisions on the installation of the internal grid of the wind farm to the converter station, the planning of the grid connection and the wind farm is to be synchronized.

Germany: Process for centrally pre-investigated sites

Germany: Process for sites without central pre-investigation

Germany: Support regimes and offtake

The first support regime: Feed-in tariff

Offshore wind turbines that were commissioned by December 31, 2020 still benefit from the attractive feed-in tariff (FiT) under the EEG 2014. This FiT regime allowed the operator to opt for the so-called compression model that provides for an increased tariff in the first eight years following commissioning and has proved to be a very attractive option from a financing perspective. The actual tariff period is longer (at least 12 years) and may be extended depending on water depth and distance from shore. During this extended period, a lower tariff is applicable. As a prerequisite for the entitlement to the FiT, the wind farm operator has to conclude a so-called direct marketing agreement with a third party. This agreement is a specific type of a bilateral PPA, normally concluded with large utilities or specialized service providers.

The second phase: (Centralised) Tariff auctions until 2022

The support scheme for offshore wind was changed in 2017 when the EEG 2017 and the WindSeeG came into force, introducing tariff auctions. From 2021, annual tariff auctions for projects which have been pre-investigated under a centralized system by BSH and BNetzA took place. A tender announcement set out details of the areas, including the anticipated date for the start of tariff payments, the available capacity at the sites and the year of completion of the grid connection.

Outcome of the 2021 and 2022 tenders

One tender process took place in each of 2021 and 2022. In accordance with previous auctions, the sites were awarded to bidders who offered €0.00 cent market premiums. Successful bidders were RWE (two sites, 225 MW and 300 MW) and EDF (one site, 433 MW) in 2021. The 2022 auction only awarded one site with 980 MW to RWE. However, Vattenfall used its step-in right (Eintrittsrecht) and will now develop site N-7.2 instead of RWE.

Jochen Homann (President of the Bundesnetzagentur) commented on the 2022 result: “The 0.00 cent bid continues to confirm the attractiveness of investing in offshore wind power in Germany. It shows that companies believe they can market wind power profitably.”

Germany: The role of TSOs

Operators of offshore wind farms have a statutory claim for a grid connection against the responsible TSO, which is TenneT and Amprion for the North Sea and 50 Hertz for the Baltic Sea. The mandatory grid connection date is to be set individually for each wind farm site.

Subject to further statutory requirements, wind farm operators are entitled to financial compensation for any loss arising due to a delay / interruption of the grid connection that is beyond the control of the wind farm operator. Certain thresholds and exceptions apply (for example, for planned maintenance of the grid connection facilities).

The German Energiewende led to a rapid increase in generation capacity which has, however, not been matched by low voltage grid connections or high voltage transmission development. As a consequence, more and more generation facilities are subject to curtailment measures undertaken by the TSOs and DSOs in order to manage grid congestion. Costs for curtailment are substantial and are increasing. This discrepancy in development has been identified as one of the key challenges for the transition of the German electricity market to a market dominated by renewable energy sources.

One of the key elements under the current regulatory regime is that the proposed installation of new generation capacity must be coordinated with the availability of the grid capacity to be provided by the responsible TSO. In order to synchronize delivery of new generation capacity with grid capacity, planning for new offshore wind farms has been centralized under the WindSeeG. BNetzA and BSH are now responsible for the pre-development and planning of wind farm sites, including the selection of sites and the order of their development, taking into account the expected grid connection capacity available for the individual sites as specified by the BSH in the Site Development Plan.

The Site Development Plan for the tender period until 2027 was published on January 20, 2023. This central planning instrument defines the areas in which additional (generation and grid connection) capacities are to be installed, as well as a timetable for their installation.

Germany: Obstacles and challenges

Regulatory

The main challenges are to be expected in the regulatory environment. In the tenders for centrally pre-investigated areas, the new qualitative criteria have not been specified in detail, leaving room for interpretation. If the uncertainties remain in the earlier auctions, this could lead to delays.

The price cap on electricity in connection with the collection of windfall profits stemming from soaring energy prices should not hinder the willingness of investors to engage in the German energy sector, as certain profits above the market premium will remain unaffected and additional profits are only captured to 90 percent. The market regulation resulting from the price cap on electricity which has been in force since December 2022 is only temporary, as it is limited until June 2023, with an option to be extended until April 2024. It will need to be considered by investors into operating projects when they calculate their expected remuneration.

In addition, as in other markets, offshore wind turbines in Germany are expanding in size, with the standard turbine size increasing to 9 - 15 MW. Given that German offshore wind farms are often located within or close to protected nature conservation areas, there may be stricter regulatory requirements to be observed as construction and operation permits may include, inter alia, obligations in respect of noise mitigation. However, although the environmental impact of larger installations cannot be finally assessed, stricter environmental regulations seem unlikely at present, given that both the EU and the German government are fostering the expansion of offshore wind parks, with environmental aspects taking a lower priority in the assessment decision than the public interest in rapid expansion of offshore wind turbines.

Geographical

Due to the geographical features of the seabed, German offshore wind farms are characterized by their relatively long distance from shore. This poses particular challenges in construction, grid connection, and operation and maintenance due to distance to shore and adverse weather conditions. Technical improvements, project management and appropriate provision for these issues in project documents are making these challenges more manageable, and bankable. The long-term principal challenge of offshore wind energy will be the transport of the energy generated by offshore wind farms and the expansion of the grid.

Land rights

Most German offshore wind farms are located in the German EEZ. It is not possible to secure land rights for the construction and operation of offshore wind farms in this zone. No private law ownership titles exist with regard to the seabed in the EEZ.

In addition, a legal debate is ongoing as to the extent to which German Civil law applies in the EEZ, including in relation to the application of general principles of transfer of ownership. This is a key issue for banks seeking to take security over wind farm assets.

Typical solutions to circumvent this uncertainty and to ensure the bankability of wind farm assets include the transfer of ownership (for security purposes) of wind farm assets whilst onshore or on German vessels. In addition, wind farm assets tend to be held by a special purpose vehicle (SPV), as SPV shares are not subject to any special restrictions regarding their transfer or pledge.

Germany: Hot topics

Permits

Several German offshore projects that are currently under development have a long history and have permits which were issued years or even decades ago under previous regulatory regimes. In such cases, it is essential that all requirements for extension are followed with in order to avoid losing the permit. Normally, an extension requires compliance with specific milestones. The authorities only grant extensions if sufficient progress in project development can be proven. Planning approval decisions can also be revoked if a wind farm is not in operation for one year or more. In addition, the grid connection capacity allocated to a project can be revoked or reallocated if the project is not built or if substantial delays in construction occur.

Commissioning deadlines

The introduction of the new tender procedure obliges the successful bidder to commission its project within the timeframe set by the BSH, which is determined by the date of the award and the completion date of the grid connection. If the bidder fails to do so it can be subject to penalty payments or, in a worst case scenario, the tender awarded may be revoked.

Germany: Investment outlook

Short-term outlook

The key players in the German offshore wind energy market are well-known, namely Ørsted, EnBW, E.ON/Innogy, Vattenfall and RWE. Institutional investors such as Macquarie and German public utility companies (Stadtwerke) frequently cooperate in joint ventures. New entrants are also emerging in the market – foreign utilities such as Kansai Electric Power, Northland Power and Statkraft, as well as project developers, pension funds and insurance companies. Significant M&A opportunities for investors are anticipated.

Considering the increased electricity prices leading to outperformance of wind farms, shareholders in operating wind farms might consider an exit, providing opportunities for incoming investors, albeit at high prices.

Due to the massive expansion of the installed capacity goals, auction volume will increase significantly. In connection with the new tendering process, the market will undoubtedly become more competitive. With respect to those sites which have not been centrally pre-investigated, it is likely that bidders will have to pay for the award and cannot expect to receive a market premium.

Technical improvements at all levels, in particular regarding foundations and wind turbines, as well as better and faster grid connections mean that larger, and therefore more profitable, projects can be achieved. However, investors are facing increasing costs to develop projects. Nevertheless, due to the location at the center of Europe and a strong domestic wind industry, supply chain risks for wind turbines and other important equipment can be mitigated.

The number of suppliers has been increasing, thereby offering project developers a wider choice of partners (for items such as cables). This contrasts with the situation regarding turbine suppliers where we have seen a consolidation (including the insolvency of Senvion). However, due to COVID-19 and the conflict between Russia and Ukraine, there are on-going supply chain risks.

There is also a growing interest from Asia, as seen with a Chinese company entering the German offshore supply market with a takeover of the insolvent tower and foundation manufacturer Ambau GmbH in 2020.

Another opportunity for the German offshore wind sector is the development of the green hydrogen market. Hydrogen projects are planned offshore as well as onshore at landing points of the offshore grid connection. This provides options for times of over-capacity in the market and grid congestion by reducing curtailment times.

Long-term outlook

The outlook for the German offshore market is predominantly positive. Germany now has a clear picture of its support scheme over the next years. This policy certainty and a stable project flow will provide a strong pipeline of investment opportunities in the coming years.

On a long-term basis, offshore wind will play a key role in the transformation of the German energy market. Other forms of renewable energy, such as onshore wind, solar and hydropower, will reach their operational limits in the long-term due to the scarcity of suitable and economically viable sites, leaving limited alternatives to offshore wind energy.

Subscribe and stay up to date with the latest legal news, information and events . . .