In the Q1 2020 issue of our International Restructuring Newswire, we reported on the Canadian Companies' Creditors Arrangement Act (CCAA) proceedings of Stornoway Diamond Corporation (where our Montreal office acted as counsel to the debtors) and its innovative use of the CCAA sale process and reverse vesting orders (RVO) as an alternative to plans of arrangement (a Plan).

Following the Stornoway case, the RVO structure was contested for the first time in the restructuring proceedings of Nemaska Lithium Inc. Ultimately, both the Quebec Court of Appeal and the Supreme Court of Canada refused to grant objecting parties leave to appeal the RVO.

An RVO was also the subject of two more contested hearings in the CCAA proceedings of Quest University Canada in front of the British Columbia Supreme Court and the British Columbia Court of Appeal. The British Columbia courts similarly granted the RVO and refused to grant objecting parties leave to appeal the RVO.

Following their formal recognition in Quebec and British Columbia, RVOs are poised to become extremely valuable tools in insolvency and restructuring proceedings in Canada.

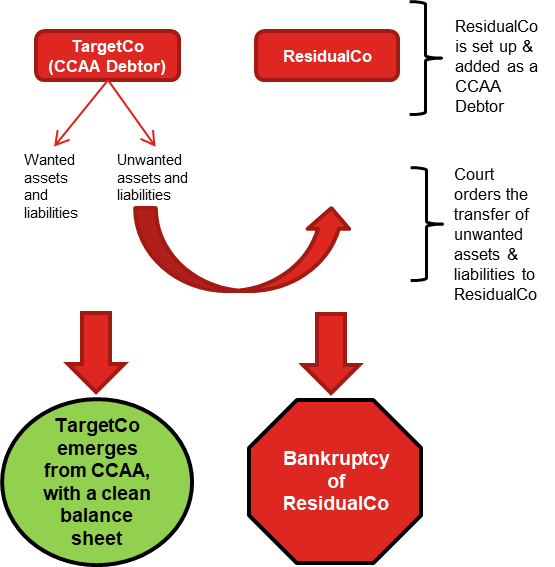

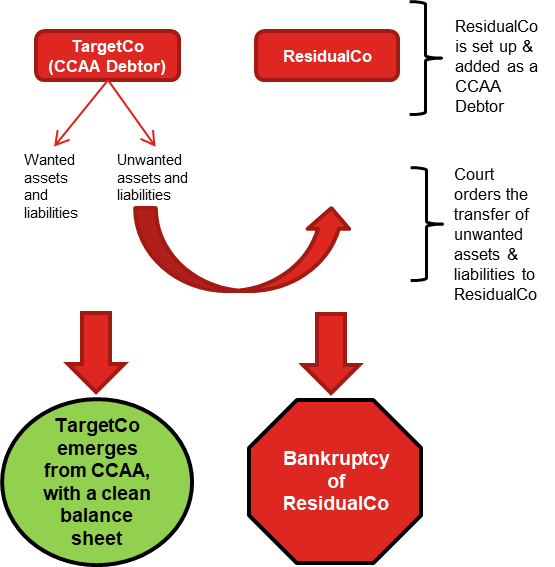

Essentially, an RVO allows for the transfer of liabilities/unwanted assets out of the debtor companies into newly created "ResidualCos", rather than transferring purchased assets out of the insolvent debtor into a newly formed entity. The end result of an RVO is to expunge the existing corporate structure of the debtor companies of anything the purchaser does not want, and see the debtor companies successfully emerge from their CCAA process cleansed of those unwanted liabilities and assets. The unwanted liabilities and assets reside in ResidualCos, who will then be liquidated or placed into bankruptcy. In most cases where RVOs have been used, the main objectives are to preserve the permitting/licensing and preserve the tax attributes that cannot be transferred out of the debtor company's existing corporate structure. RVOs have also been used, for example in the Quest University case, to sidestep the voting requirements that would arise under if the restructuring proceeded under a Plan where certain opposing creditors may hold a veto on the restructuring process to the detriment of the majority of stakeholders.

The structure of an RVO

RVOs offer an efficient and effective alternative to Plans and traditional approval and vesting orders (AVO), particularly in a highly regulated environment where the parties intend to maintain the going concern operations of the debtor company. While initially the use of RVOs was limited to circumstances where there was no value remaining for any creditors beyond the realization of secured debt, in more recent CCAA proceedings (such as in Quest University), the RVO has been used where the realization of assets has led to distributions to unsecured creditors as well.

The rise of the RVO

Stornoway and Nemaska were not the first cases of an RVO being granted. Indeed, the first was granted in 2000 as part of retailer T. Eaton Co's restructuring. In 2015, the RVO was used again in the insolvency proceedings of Plasco Energy Group, a waste-to-energy company.

Stornoway, however, brought the RVO into the mainstream. Since then, RVOs have been featured in nine insolvencies in 2020 alone: Wayland Group Corp., Tidal Health Solutions Ltd., Beleave Inc. and Green Relief Inc. (all in the highly regulated cannabis sector), fashion retailer Cormark Holdings Inc., Quest University Canada, Cirque du Soleil and Nemaska.

The CCAA proceedings of Nemaska

To recap, the Nemaska entities were involved in developing a lithium mining project in Quebec. Due to the declining price of lithium, they sought CCAA protection in December 2019 and in January 2020, the Superior Court approved a sale or investment solicitation process (SISP), which led to the acceptance of a bid from a consortium of Nemaska's largest secured creditors: IQ, Orion Mine Finance, and The Pallinghurst Group. This bid required that the sale transaction be effected via an RVO.

Two shareholders (one of whom was also an alleged creditor) filed motions opposing the issuance of an RVO on multiple grounds, notably that the court does not have the authority to grant a vesting order for anything other than a sale or disposition of assets, that the RVO is impermissible under the CCAA because it permits Nemaska to emerge from CCAA protection outside the confines of a Plan (and without a creditor vote), that the corporate reorganization contemplated by the RVO was not allowed under securities laws, and that the release in favour of Nemaska's directors and officers pursuant to the proposed transaction should not be authorized.

Justice Gouin, J.S.C., approved the RVO on October 15, 2020, after having reviewed the SISP process that led to the offer by IQ and the other participants in the bid, the absence of credible alternative transactions, and the potentially catastrophic consequences to Nemaska's stakeholders, including its employees, creditors, suppliers, the Cree community and the affected local economies. The alternative would have been to put the restructuring process on hold in order to re-initiate a SISP in an uncertain market that had already been thoroughly canvassed or, alternatively, to put the Nemaska entities into bankruptcy. In coming to this conclusion, the court noted that:

- When approving a vesting order pursuant to section 36 of the CCAA, the court must first assess (i) whether sufficient efforts to get the best price have been made and whether the parties acted providently; (ii) the efficacy and integrity of the process followed; (iii) the interests of the parties; and (iv) whether any unfairness resulted from the process;

- It is not for the court to dictate the terms of the offer, the legality of which should be analyzed against the backdrop of the uncontested SISP order. A purchaser is entitled to request releases in favour of the debtors' directors and officers via an RVO, particularly when the release is modulated so as to protect the rights of shareholders and creditors who may have a valid claim based on wrongful or oppressive conduct of the directors and officers;

- Canada's insolvency statutes pursue an array of overarching remedial objectives, which include: providing for timely, efficient and impartial resolution of a debtor's insolvency; preserving and maximizing the value of a debtor's assets; ensuring fair and equitable treatment of the claims against a debtor; protecting the public interest; and, in a commercial insolvency, balancing the costs and benefits of restructuring or liquidating the company;

- The CCAA generally prioritizes "avoiding the social and economic losses resulting from the liquidation of an insolvent company" by facilitating the reorganization and survival of the pre-filing debtor company in an operational state—that is, as a going concern;

- To further the objectives sought by the law, a CCAA supervising judge enjoys wide discretion pursuant to section 11 of the CCAA. This authority must be exercised in furtherance of the remedial objectives of the CCAA and the court must keep in mind three "baseline considerations," which the applicant bears the burden of demonstrating: (1) that the order sought is appropriate in the circumstances, and (2) that the applicant has been acting in good faith and (3) that the applicant has been acting with due diligence.

On seeking leave to appeal, the shareholders reiterated the CCAA judge lacked the power to approve a transaction that was structured to allow the debtor companies to emerge from CCAA protection free and clear of their pre-filing obligations outside the confines of a Plan and without the benefit of an approval by a vote of the required majority of creditors. They also argued the CCAA judge focused exclusively on the outcome of the proposed transaction, which he qualified to be the "best and only alternative available in the circumstances," while failing to give any meaningful consideration to creditor rights.

The Court of Appeal, while recognizing the novelty of the RVO transaction, questioned the appellants' good faith. The court noted that the contesting shareholders, representing a mere 4% of the total value of unsecured creditors' claims, have been using the arguments advanced on appeal as a "bargaining tool" during their negotiations with the debtors.

The Court of Appeal therefore rejected the leave to appeal, as the appellants failed to convince the court that their appeal would not hinder the progress of the proceedings and that it was not purely strategic or theoretical.

The contesting shareholders made a second attempt by seeking leave to appeal this matter to the Supreme Court of Canada, which applications were ultimately dismissed on April 29, 2021.

The CCAA proceedings of Quest University

Quest University is a not-for-profit post-secondary education institution located in Squamish, British Columbia. Quest initially sought to restructure its debt by way of a traditional AVO, which was conditional upon the approval of a Plan. When it became apparent that any Plan would fail because of the objections of a major creditor, the transaction took the form of an RVO instead. The contesting creditors opposed the granting of the RVO on similar grounds as the contesting creditors in Nemaska.

Madam Justice Fitzpatrick, however, granted the RVO by relying on the CCAA Court's discretion to "grant relief that represents an innovative solution to any challenges in a proceeding". She observed that the proposed RVO transaction was the only transaction that could save Quest. Justice Fitzpatrick commented that the contesting creditors potentially held "the sword of Damocles over the head of the significant broad stakeholder group" who stood to benefit from the transaction, and that they had nothing to lose in "this dangerous game of chicken".

Justice Fitzpatrick was, however, cognizant of the fact that an RVO structure should not be used "to simply rid a debtor of a recalcitrant creditor who may seek to exert leverage through its vote on a plan." Rather, the RVO in Quest was justified based on the unique circumstances of the case, and in light of the fact that granting such relief was appropriate in the circumstances in order to preserve the value created by an educational institution.

The British Columbia Court of Appeal rejected the contesting creditors leave to appeal. The Court, referencing Nemaska, noted that granting leave would likely be catastrophic for the transaction and to the detriment of Quest's stakeholders.

The CCAA proceedings of Quest University exemplify how RVOs can be used where there is value for unsecured creditors, and yet a creditor holding a veto is unreasonably exercising their vote to the detriment of the mass of stakeholders.

Takeaways

Today, RVOs are the most efficient manner to facilitate a going concern transfer of the operations of the debtors while preserving key attributes attached to the existing corporate structure. Additionally, an RVO allows for an effective change of control with broad releases in favour of third parties, notably the directors and officers of the debtors who played a key role in the reorganization.

The remedial nature of the CCAA is designed to enable insolvent companies to restructure, particularly where such transactions are to permit an internal reorganization that is fair to the interests of affected stakeholders and there is no prejudice to the applicants' major creditors.

RVOs are at the forefront of the flexibility that CCAA proceedings offer for distressed M&A transactions, and may become the predominant transactional path to effectuate and implement a restructuring in a distressed context.