Global offshore wind: US

Mondial | Publication | July 2024

Information correct as of July 2024.

Content

Focus on: Eastern US

Market overview

The Block Island Wind Farm, the first operating offshore wind project in the US, started commercial operations in 2016. This US$360 million, 30 MW project is located in Rhode Island state waters within three nautical miles offshore. The power purchase agreement (PPA) price starts at $244/MWh and escalates at 3.5 per cent annually. Originally developed by US developer Deepwater Wind, its construction was project financed. Norton Rose Fulbright lawyers acted for the lenders. In October 2018, Ørsted acquired Deepwater Wind for US$510 million. Norton Rose Fulbright lawyers represented Ørsted on its acquisition of Deepwater Wind.

The second offshore wind farm in the US, Coastal Virginia Offshore Wind, began operating in 2020. This 12 MW, two-turbine project is located about 27 miles off the coast of Virginia Beach. Norton Rose Fulbright lawyers represented Ørsted as the construction contractor on this project.

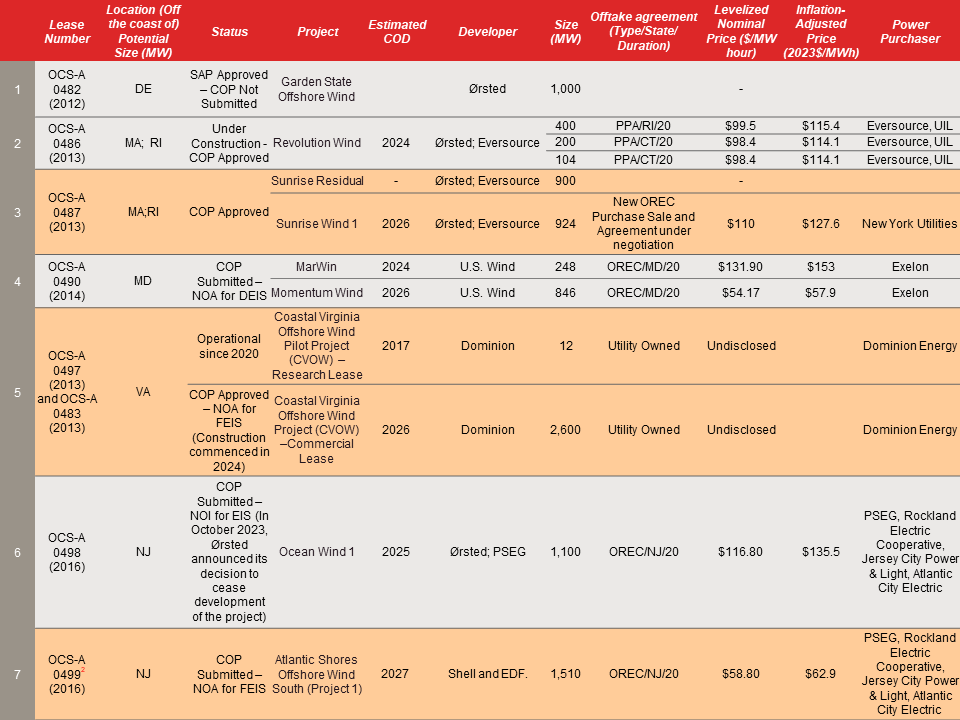

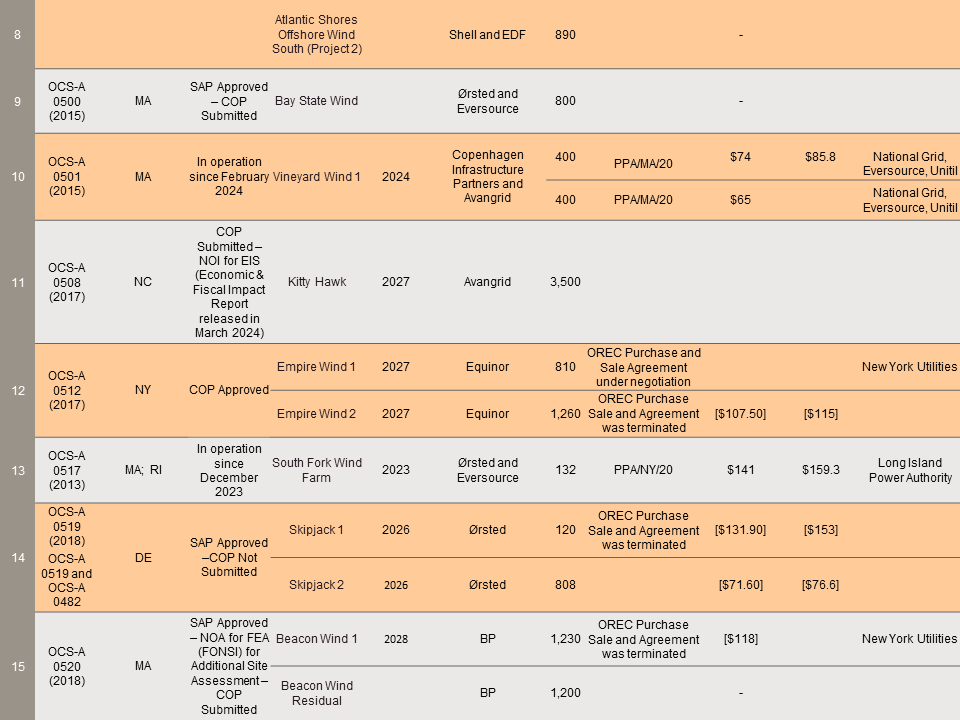

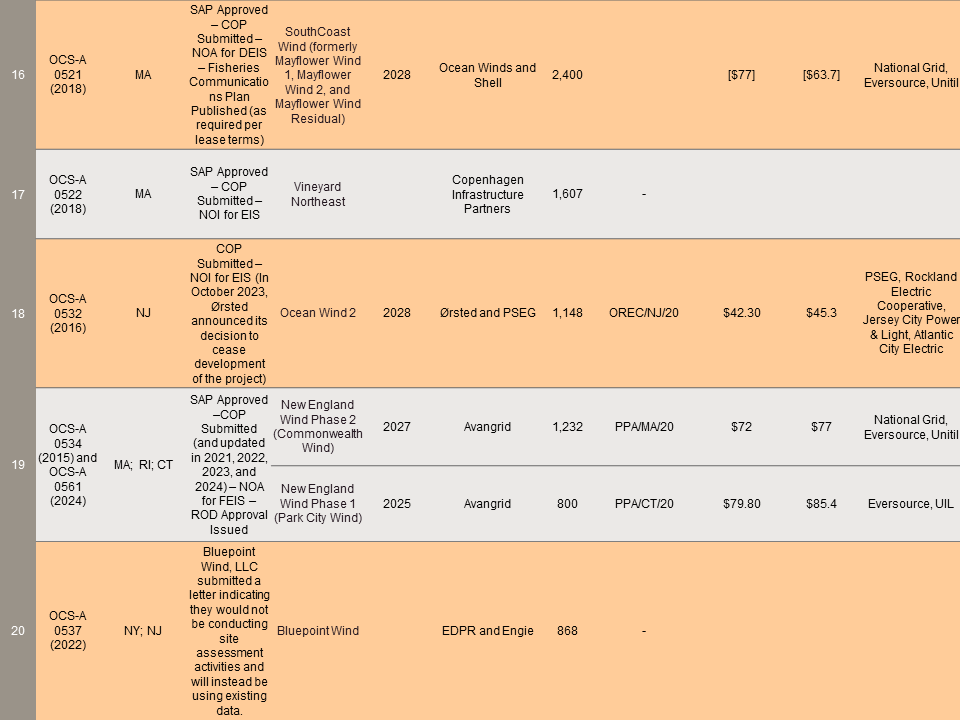

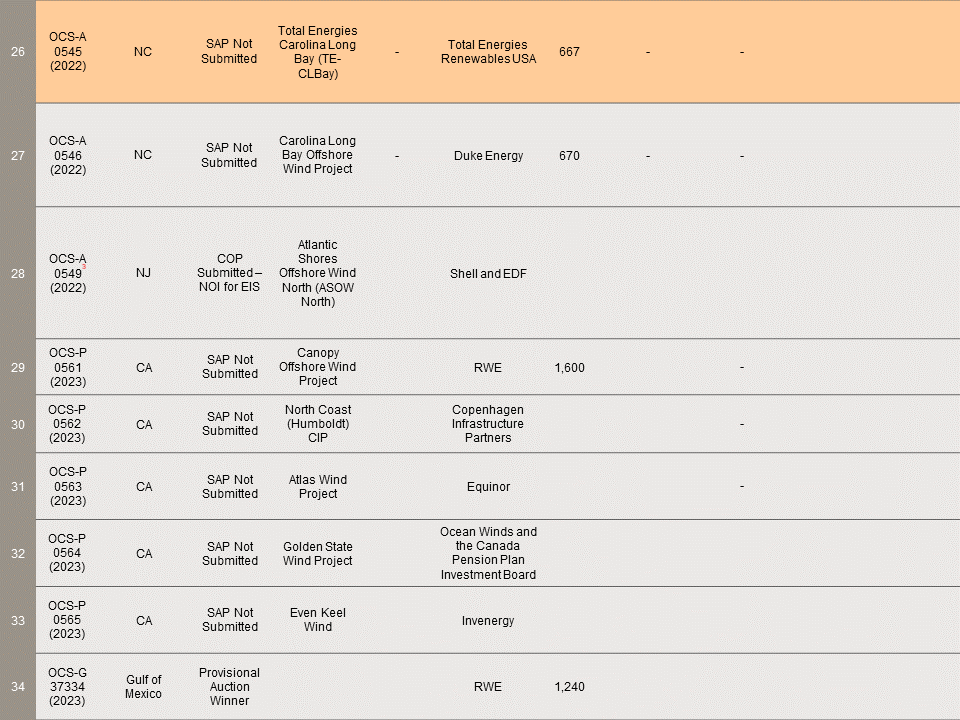

At least 27 federal leases of the outer continental shelf (farther than three nautical miles from shore) have been issued for projects, representing approximately 27 GW of potential installed capacity. Major European market players like Ørsted, Copenhagen Infrastructure Partners, Avangrid, EDP Renewables, Shell, BP, EDF Renewables and Equinor hold leases and are actively developing projects.

In November 2021, Avangrid and Copenhagen Infrastructure Partners initiated construction of Vineyard Wind 1, an 800-MW offshore wind project located 15 miles off the coast of Martha’s Vineyard. This project was the first large commercial-scale offshore wind farms in the US to achieve financial close and represents one of the largest investments in a single renewable energy project in the country. (Norton Rose Fulbright lawyers represented Vineyard Wind in this US$2.3 billion debt financing.) In February 2024, the project’s first five turbines became operational, and in June 2024 five more turbines came online, making it the largest operating offshore wind farm in the U.S.

In February 2022, Ørsted and Eversource began constructing the 132-MW South Fork Wind Farm in East Hampton, New York. This project is now the first fully operational commercial-scale offshore wind farm in the U.S. Earlier this year, Eversource announced it is selling its 50 percent ownership share in the 132 MW South Fork Wind and the 704 MW Revolution Wind to Global Infrastructure Partners.

Dominion Energy is advancing development of its 2.6-GW offshore wind farm, the Coastal Virginia Offshore Wind (CVOW) project, situated off the coast of Virginia Beach. As the largest project of its kind in the United States, CVOW aims to supply power to approximately 660,000 homes and represents a significant milestone for the U.S. offshore wind industry. The CVOW project is slated for completion on budget and on schedule by the end of 2026.

The Biden administration set a goal of deploying 30 GW of offshore wind by 2030 and 15 GW of floating wind projects by 2035, supported by legislation and executive actions. States continue to set more aggressive offshore wind procurement mandates, with eight states calling for the deployment of at least 39,322 MW of offshore wind capacity by 2040.

Despite the advances described above, offshore wind has also experienced setbacks and challenges. In early 2024, Eversource announced plans to sell its ownership interests in the Revolution Wind and South Fork Wind projects to Global Infrastructure Partners and its interests in the Sunrise Wind Project to Ørsted. In late 2023, Ørsted announced that it is no longer developing Ocean Wind 1, a 1,100-MW project, or Ocean Wind 2, a 1,148 MW project. Both were to be located off the coast of southern New Jersey. (Norton Rose Fulbright lawyers represented PSEG, later bought out by Ørsted, on Ocean Wind 1.) In addition to inflation and supply chain issues, projects continue to face legal challenges over socio-economic and environmental concerns, including the impact on the local fishing industry and the potential threats to the endangered North Atlantic right whale. To date, such challenges have not been successful, but projects like CVOW and Vineyard Wind have periodically been paused as a result.

Federal offshore wind leases1

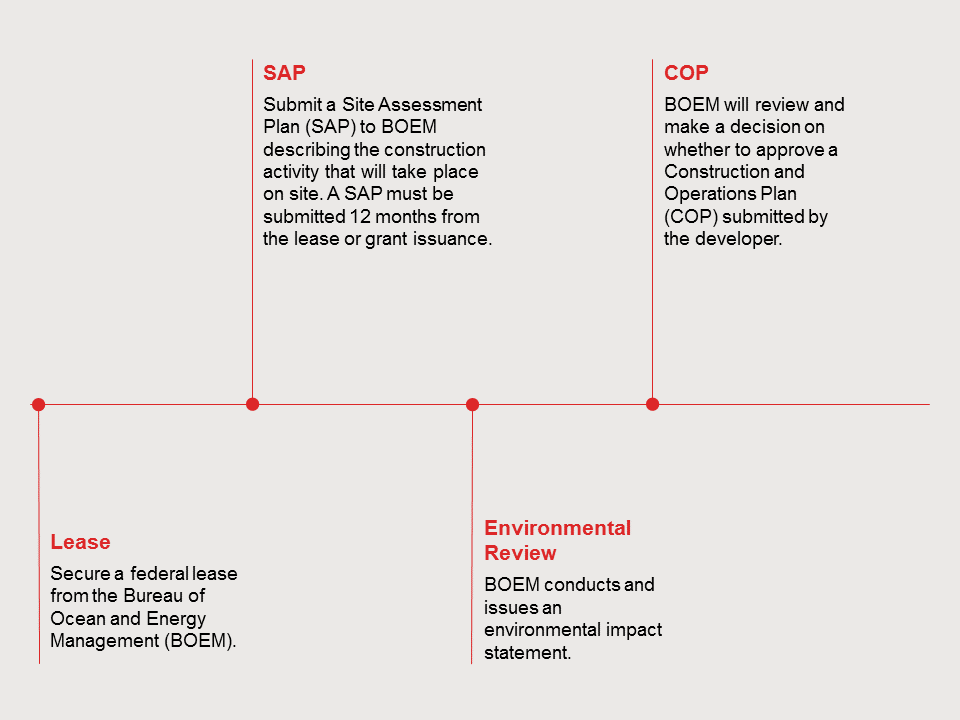

Development process in Federal waters

Note: State-led offtake contract tender processes are not reflected in the timeline but will also form part of the process.

US: Obstacles and challenges

Tax credit challenges

An important driver of onshore renewable energy development in the US has been the federal tax credits and accelerated depreciation. The tax savings from the two incentives are worth at least 44¢ per dollar of capital cost (higher if domestic content rules are met). The tax credits at full rates are available for offshore wind projects that are under construction for tax purposes within one year after greenhouse gas emissions from the US power sector fall by at least 75% from 2022 levels, after which they start phasing out. The phase out cannot start before 2034

Permitting and regulatory challenges

A mix of numerous federal and state approvals are required to construct and operate an offshore wind project in the US.

Most federal approvals will require projects to go through an environmental review process under the National Environmental Policy Act. Certain states such as Massachusetts and New York have comparable state-level environmental reviews.

Permitting processes are complex, fragmented and provide ample opportunities for project opponents to force delays. The Cape Wind project, an early project proposed off the coast of Massachusetts, faced 23 lawsuits challenging the project.

Inflation and supply-chain challenges

Despite the increased tax incentives under the Inflation Reduction Act of 2022, several projects in New England have struggled to obtain construction financing due to supply-chain disruptions, historic inflation, and increases in the costs of capital that have made their PPAs uneconomic. In some cases, developers are expected to re-bid their projects to achieve more favorable agreements after vacating agreed-upon PPAs and paying termination fees. See discussion below of the Southcoast Wind project, a joint venture by Shell and Ocean Winds North America, and the Commonwealth Wind project developed by Avangrid.

Jones Act challenges

The Jones Act requires US.-flagged vessels to transport merchandise or personnel between two points in waters controlled by the US.

Currently the lack of US- flagged turbine, cable and heavy lift platform installation vessels force developers to rely on more complex and costly installation strategies.

Transmission

Many solicitations to date have required developers to bid generation and transmission jointly. States are exploring European models, which keep generation and transmission bidding separate. As the volume of projects increases, there will be a desire to drive power prices down. One way to do this is to separate transmission bidding, which opens grid access to more than the first mover developers who own their transmission. In 2018, Massachusetts passed a law allowing the state to conduct separate transmission bidding.

US: Hot topics

Spotlight on State regulatory advancements and offtake awards

Offshore wind development in the U.S. began accelerating in 2020, driven primarily by the procurement requirements of states along the East Coast. Of the almost 17.6 GW of capacity under contract in May 2022, offtake agreements for 12.7 GW of that capacity have been signed since January 2020, over 2.5 times the capacity contracted in the prior decade.

Furthermore, the current amount of contracted capacity represents less than half of the collective procurement targets of Massachusetts, Maryland, New York, New Jersey, Connecticut, Virginia, and North Carolina - a total of 39,322 MW offshore wind capacity by 2040. These state procurement policies continue to drive offshore wind energy deployment in the U.S., where 18 projects are currently in the process of securing power offtake contracts after having achieved site control. Nevertheless, development of several projects has stalled due to rising construction costs and unsuccessful attempts to renegotiate PPA prices.

Although states on the West Coast and along the Gulf of Mexico that rely on pre-commercial floating technology have not set offshore wind procurement requirements, several states have adopted policies that continue to promote interest in offshore wind development.

Massachusetts

In March 2021, the governor of Massachusetts signed “An Act creating a next generation roadmap for Massachusetts climate policy” authorizing procurement of an additional 2,400 MW of offshore wind power by 2027. In December 2021, the state concluded its third offshore wind RFP, awarding new offtake agreements for a total of 1,600 MW of capacity to Commonwealth Wind and SouthCoast Wind 2 (fka Mayflower Wind 2). In November 2021, Avangrid and Copenhagen Infrastructure Partners initiated construction on the Vineyard Wind 1 project (800 MW), the first commercial-scale offshore wind farm to be fully approved for construction in federal waters. Although the PPAs for Commonwealth Wind and SouthCoast Wind 2 have been terminated, Avangrid continues to move forward with Vinyard Wind 1.

Maryland

Maryland awarded two new offshore wind offtake agreements in December 2021. The 808 MW Skipjack 2 project and the 846 MW Momentum Wind project is expected to bring Maryland’s total procured capacity to 2,022 MW, its 2040 target. The offtake agreements include a commitment to locate component manufacturing facilities within Maryland as part of the state’s effort to make Maryland an offshore wind industry manufacturing hub. However in a recent setback, the developer of Skipjack 2, Ørsted, determined that its project was no longer commercially viable at prices agreed to under its then-existing purchase and sale agreement. The company cited today’s challenging market conditions, including inflation, high interest rates and supply chain constraints as reasons to withdraw from Maryland Public Service Commission (MPSC) orders approving the project.

However, in 2023 Maryland enacted the Promoting Offshore Wind Energy Resources Act (POWER Act), establishing one of the highest offshore wind capacity goals nation-wide—8.5GW by 2031. The POWER Act also instructs the MPSC to request that PJM conduct a study to assess the necessary transmission system upgrades and expansions necessary to accommodate Maryland’s goal.

New York & New Jersey

New York and New Jersey continue to have two of the nation’s leading offshore wind goals of 9,000 MW and 7,500 MW respectively, by 2035. In June 2021, New Jersey’s planned capacity neared the halfway point of its target when the New Jersey Board of Public Utilities approved the largest combined offshore wind award to EDF/Shell’s Atlantic Shores Offshore Wind (1,510 MW) and Ørsted’s Ocean Wind II (1,148 MW).

New Jersey has also demonstrated a commitment to developing offshore wind industry infrastructure, announcing in 2020 plans to construct an offshore wind energy port and securing commitments from Atlantic Shores Offshore Wind and Ocean Wind II to invest in manufacturing facilities in the State. Likewise, in early 2024, New Jersey and PJM entered into an agreement to assess New Jersey’s transmission needs—a requisite step before the state can make an award for a comprehensive offshore transmission network.

New York has the largest offshore wind pipeline in the country, with five projects in active development (totaling more than 4,300 MW). These policies likely contributed to the record setting offshore wind lease prices in the New York Bight auction. Despite this, inflation’s impact on rising construction costs has resulted in the cancelation of the Ocean Wind 1 and Ocean Wind 2 projects and the termination of the PPA for Empire Wind 2 in 2023. Nevertheless, bright spots remain, with South Fork Wind becoming operational in early 2024 and Empire Wind 1 receiving FERC’s approval in March 2024, the final state approval to move forward in May 2024, and is expecting to commence operations in 2026.

Ohio

In 2020, local municipalities in Ohio signed an offtake agreement for a portion of the output from a six-turbine demonstration project in Lake Eerie. The Icebreaker Wind project, which would be the first fresh water offshore wind project, stalled in May 2020 due to restrictive permit provisions issued by state regulators. Developers were working to restart the project after a legal win in the Ohio Supreme Court in August 2022 but have since halted development due to rising costs.

North Carolina

The Governor of North Carolina issued Executive Order 218 on June 9, 2021, which highlights the economic and environmental benefits of offshore wind and sets offshore wind development targets of 2.8 GW by 2030 and 8 GW by 2040. It also establishes the NC Taskforce for Offshore Wind Economic Resource Strategies to advise North Carolina’s offshore wind energy projects. The 8 GW target puts North Carolina second only to New York. Nevertheless, the relative newness of the policy and the bidders, along with the lack of supporting infrastructure and offshore wind procurement requirements in South Carolina may have contributed to significantly lower Carolina Long Bay auction prices as compared to the New York Bight auction.

California

In August 2022, the California Energy Commission (CEC) adopted a preliminary report establishing planning goals of 2,000-5,000 MW of offshore wind by 2045. In March 2022, the CEC approved a US$10.5 million grant for renovating the Port of Humboldt Bay to prepare for offshore wind activities in an area designated for development on the coast, after Humboldt Bay (1,607 MW) and Morro Bay (2,925 MW) were established as Wind Energy Areas (WEAs) in 2021. The five offshore wind energy lease areas off the coast of California were awarded through the Bureau of Ocean and Energy Management (BOEM)’s December 2022 auction to developers RWE (Canopy Offshore Wind), Copenhagen Infrastructure Partners (North Coast (Humboldt) CIP), Equinor (Atlas Wind), Ocean Winds (Golden State Wind) and Invenergy (Even Keel Wind).

Spotlight on recent and upcoming Federal lease auctions

BOEM recently finalized its designation of a WEA in Oregon and in the Gulf of Maine where it will conduct its next offshore wind lease auctions. BOEM’s latest auction for the offshore wind development rights in the Gulf of Mexico ended with a single US$5.6 million winning bid by German developer RWE for rights to 102,480 acres (41,472 hectares) off Louisiana. It is the lowest winning bid for a federal offshore wind lease at auction since the Obama administration. The other two lease areas on offer off Texas received no bids, according to results posted online by BOEM.

In December 2022, BOEM announced results from a US$757.1 million lease auction for five lease areas in Morro Bay and Humboldt County, California. This was the first major offshore lease sale in the Pacific and the only commercial lease sale in the U.S. requiring the use of floating wind technology.

In February 2022, six lease areas in the New York Bight (supporting at least 5,600 MW of new capacity) sold collectively for a record setting US$4.37 billion. This was the first auction held in the United States since 2018 and added new developers to the U.S. offshore wind market and at least 5,600 MW of new capacity to the pipeline. In May 2022, two new lease areas were auctioned in the Carolina Long Bay with a combined total sale price of US$315 and at least 1,337 MW of capacity.

BOEM plans to offer up to 12 more offshore wind leases through 2028. Its planned leasing schedule includes four offshore wind lease sales in 2024, one in each of the years 2025 and 2026, and four in 2028 in areas including California, the Gulf of Maine, and Hawaii.

Spotlight on BOEM auction rules

BOEM has traditionally relied on a single factor (monetary) ascending bid auction for offshored lease areas, evaluating only the revenue from the sale returned to the US. Department of the Treasury. In contrast to previous auctions, the Carolina Long Bay in May 2022 was the first to be assessed by BOEM using multifactor bidding criteria that allowed for the consideration of non-monetary benefits to states and local communities. For the Carolina Long Bay auction, BOEM published requirements to qualify for bidding credits related to programs designed to develop a larger or better trained domestic offshore wind workforce, a more robust domestic offshore wind supply chain, including manufacturing, assembly, and services. BOEM has subsequently employed similar types of bidding credits in lease auctions off the coast of California and in the Gulf of Mexico. In its 2024 Renewable Energy Modernization Rule, BOEM further entrenched its use of bidding credits to implement its multifactor auction procedure, explicitly permitting BOEM to award bidding credits for a bidder’s commitment to undertake some future action, such as commitments to advance the domestic supply chain.

Spotlight on shared transmission developments

Recent efforts have emerged aiming to advance shared offshore transmission infrastructure to enhance the offshore wind industry. In June 2023, Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont, New York, and New Jersey collectively urged the U.S. Department of Energy (DOE) to back their proposed “Northeast States Collaborative on Interregional Transmission” to study the region’s offshore wind transmission needs and potential solutions. Since then, Maryland and Delaware have also joined the Collaborative. Under their proposed model, DOE would coordinate and plan regional interconnectivity, aiming to reduce costs and increase reliability and generation from clean sources. DOE is now working with the Collaborative to help facilitate the achievement of their offshore wind transmission goals. In March 2024, DOE published its Atlantic Offshore Wind Transmission Study which found that the benefits of developing shared transmission systems to serve offshore wind farms outweigh the costs by a ratio of 2-to-1 or greater and are anticipated to produce between US$330 million and US$2.47 billion in net annual value, as compared to the current radial model.

Some East Coast states have begun taking initial steps to implement this concept. For instance, states such as New Jersey and Maryland, through the POWER Act, have been exploring the “State Agreement Approach” to meet their offshore wind goals. This approach permits states to voluntarily fund transmission solutions that support their state-specific energy goals, independently of the required regional transmission planning process. Likewise, New York issued an RFP in April 2024 seeking a developer to build a transmission system capable of transmitting electricity from multiple offshore wind farms into New York City. These developments indicate that shared offshore transmission may soon become a reality in the U.S., leading the offshore wind industry into uncharted territory.

Spotlight on the West Coast

On the West Coast of the US (including off the coast of Hawaii) the bulk of the available offshore wind resource is located in areas with waters deeper than 60 m. These areas are not suitable for existing fixed bottom foundation technologies and require the deployment of floating turbine technologies.

Floating technology remains at the pre-commercial stage of development. By the end of 2021, a total of 10 pilot projects with capacities greater than 1 MW were operating in Europe and Asia, supporting commercial interest.

BOEM Has received several unsolicited lease applications for floating turbine projects (including Hawaii, California, and Washington). In April 2018, the Redwood Coast Energy Authority selected a consortium of companies, including Principle Power Inc. and EDPR Offshore North America, LLC, to enter into a public-private partnership to pursue a 100 to 150 MW floating offshore wind development off the Northern California coast and Humboldt County. In 2021, BOEM identified two WEAs, Morro Bay and Humboldt, off the central and northern coasts of California, which resulted in the sale of two Homboldt WEA lease areas and three Morro Bay lease areas in December 2022.

Oregon set a planning goal for the development of up to 3 GW of floating offshore wind energy by 2030 in connection with the addition of two new Call Areas off its coast developed by BOEM’s Intergovernmental Task Force.

For further information, please refer to the section on floating offshore wind.

Spotlight on the Gulf of Mexico

The Gulf of Mexico is attracting limited interest in offshore wind development. In 2021, BOEM published a Call for Information and Nominations to assess commercial interest in the established Gulf of Mexico Call Area. In 2022, BOEM announced that it is preparing a draft environmental assessment to consider offshore wind leasing in the area, and Louisiana released a climate action plan recommending (but not requiring) a goal of 5,000 MW of offshore wind energy procurement by 2035. The first lease auction for the Gulf of Mexico, held in August 2023, resulted in only one winning bid. Nonetheless, BOEM is planning to hold up to three more lease auctions in the Gulf of Mexico between 2024 and 2027.

Notes

Abonnez-vous et restez à l’affût des nouvelles juridiques, informations et événements les plus récents...