Publication

Faster USPTO patent grants after payment of issue fee

Effective May 13, 2025, the USPTO’s expected timeframe between issue notification and issue date will be approximately two weeks (instead of approximately three weeks)

Global | Publication | Q1 2022

The current global market has been exposed to various transformative developments and industry consolidation for some time. Depending on the industry, short-term, but far-reaching crises, such as supply chain disruptions, are negatively impacting firms. This comes on top of transformations such as digitalization and electrification (especially in the automotive sector) that are leading large corporations, in particular but also private equity companies, to look for ways to shed less profitable and crisis-prone assets.

Historically, non-core and less profitable entities or assets have usually been separated from the healthy core business of a group by means of a carve-out of the distressed assets or business units. The downside of the carve-out, however, is that the legacy debts commonly remain on the enterprise's balance sheet, and the financial situation of the group as a whole remains impaired. On the other hand, if completely separated, the shareholders may lose control over the carved-out assets or business unit, for example where it is sold to investor third-party.

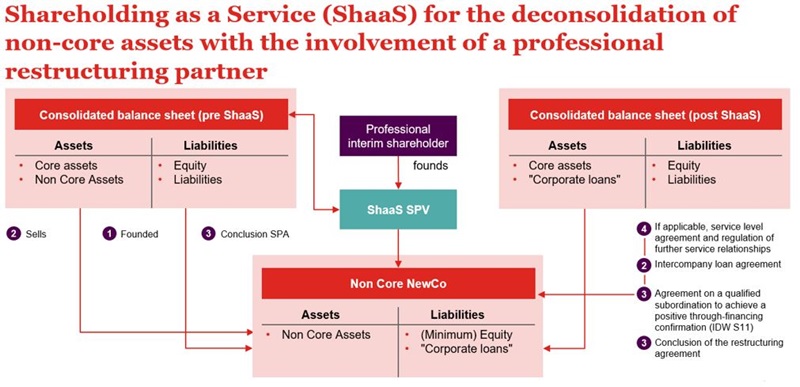

Against this background, a new restructuring model in Germany called "Shareholding as a Service" (ShaaS) offers a different path with continued opportunity for investor recovery. ShaaS focuses on separating the core business from the distressed non-core assets by transferring them—if possible at book value—to a "restructuring shareholder", which leads to a short-term deconsolidation and reduction of liability and risk. The special feature of ShaaS, however, is the ability to also retain full control over the non-core assets in accordance to the regulations of a corresponding restructuring agreement between the existing owners and the restructuring shareholder. The appointed restructuring shareholder acts on its own behalf (subject to the terms of the restructuring agreement) and the carve-out transaction can be communicated externally as the final sale of the non-core assets.

The main prerequisite for the successful implementation of the ShaaS model is precise due diligence and determination of the object, its products, sites, employees and other value-creating factors, as well as third-party liabilities and financing requirements. Previously used group services and service relationships of the object must be identified and a decision taken as to which of these will remain in place. Change of control clauses and the existence of collateral in the contractual relationships with customers and external financiers may be decisive in this respect. Furthermore, cash pools have to be dissolved and intragroup clearing accounts will be frozen. Based on the findings of the due diligence, a corporate structure must then be developed that enables the most advantageous implementation of ShaaS, also taking into account tax law aspects. Typically, the object will first be transferred within the group into a separate legal entity, e.g. a NewCo, via an intercompany asset deal at book values. In order to reduce risk, it is advisable to appoint a restructuring management team, in particular a CRO to support the group in implementing the steps outlined. As a further preparatory step, it is also necessary to prepare a business plan. Based on this plan, the financing needed can be derived and, if necessary, communicated to the external financiers. However, generally a shareholder loan will be granted to ensure that the process is adequately financed.

Starting from there, the restructuring shareholder takes over the—possibly over-indebted—NewCo via share deal for a symbolic purchase price. For this purpose, an SPV may be established that holds the shares of NewCo for the purpose of restructuring.

In order to ensure a successful process and thereby prevent the object from becoming insolvent, the transaction will be secured by appropriate measures. Quite commonly, the group will agree to a qualified subordination agreement for the shareholder loan. This will enable a positive financing confirmation for the entire process. In addition, the purchaser's concept can be confirmed by an expert opinion, in accordance with the IDW-standard 11, showing the non-existence of over-indebtedness or illiquidity and thereby ensuring that there is no legal obligation to file for insolvency according to German insolvency law. The granting of collateral by the group is another way to secure the object accordingly. After successful implementation of the ShaaS, the acquisition can be communicated externally as the final purchase of the non-core assets by the restructuring shareholder.

The main advantage of the ShaaS model is the continuing control over the NewCo. The control can be exercised, for example, by an appointed advisory board to monitor the restructuring on behalf of the former shareholder and to influence decisions of the restructuring management. The CRO, who assumes operational responsibility, will report regularly to the advisory board as part of the common reporting structures during the restructuring. The details of these structures can be customized individually to meet respective requirements and needs of the parties involved, whereby the repayment of the shareholder loan will usually be one of the main objectives. Whether the old business model can be developed into a sustainable future business model and NewCo subsequently sold at a profit, or whether it is more appropriate to continue with the old business model after undergoing a performance-related restructuring and subsequent sale, depends on the specific economic and legal situation. Alternatively, the winding-up and leveraging of synergies can also be a useful mean of generating economic success.

For private equity companies in particular, the ShaaS model provides new business opportunities. Depending on the scenario, the private equity company either can make use of the ShaaS-model by restructuring loss-making investments through involvement of a professional restructuring shareholder or, alternatively, invest into the company, which has undergone restructuring in accordance to ShaaS. While the group is relieved of liability and risk, it still retains control over the NewCo, the private equity companies contribute to increasing the value of the company by sharing their expertise, thereby increasing their own profit. Furthermore, if a buyback agreement is envisaged, there is also no need for the often-lengthy search for a buyer after a successful turnaround.

Outside of a ShaaS, the affected group consisted of both profitable assets on one hand and loss-makers on the other hand. Under the ShaaS procedure, a comprehensive separation of the economically unstable non-core asset from the core group can be achieved. The financial structure and debt leverage of the group will be adjusted to fit the future core business' capacity. The sale of the risky subsidiaries or assets and the granting of the shareholder loan will result in deconsolidation of the object. If the restructuring proves to be successful, the group will now be able to continue with an adjusted balance sheet in the long term. The credit rating of the group and its core business will improve.

Shareholders who granted shareholder loans to the NewCo have a significantly higher probability of repayment. Further, the shareholders benefit economically from an increased value of the non-core assets or business as a result of a successful restructuring. In addition to the economic opportunities, the medium to long-term reduction of risk, while retaining control, has a positive effect in every way. Liability and risk, which could previously arise from capital maintenance regulations, are significantly reduced or even excluded.

The structural advantage of ShaaS is the deconsolidation of non-core assets from a group`s balance sheet while retaining control for the group. Considering the balance sheet of the NewCo (see picture above), the assets are transferred onto the SPV (at book values) as well as liabilities resulting from the shareholder loan. With the consent of the contracting party, other legacy obligations and liabilities can also be severed and transferred to the NewCo. However, a possible over-indebtedness and therefore insolvency risks can be mitigated by the above-mentioned subordination agreement. The group will henceforth be the main creditor of the NewCo and the shareholder loan will be accounted for in the annual and consolidated financial statements.

Risk for existing shareholders, which may arise from capital maintenance regulations or other liability, cease to apply in a ShaaS model. This is also true for liability risk for the current management. Generally, management may be held civilly liable with their personal assets at risk, but also may be liable under criminal law, when the provisions of the German insolvency laws are not strictly followed. When applying the ShaaS model, however, liability risk for shareholders and management are transferred to the restructuring shareholder and the restructuring management. Any risk for the restructuring shareholder and restructuring management, can be mitigated by means of an experienced CRO with substantial expertise in the restructuring area.

The ShaaS model represents a target-oriented alternative for those who wish to separate a loss-making business unit or asset from the group through deconsolidation, but without losing control. ShaaS also represents a way of ensuring risk reduction for the existing shareholders and management. In addition, private equity companies can benefit in several scenarios from the reorganization, while the financing requirements are fully covered by the group, which might substantially pay out if the reorganization is successful. All in all, ShaaS therefore represents a serious alternative in the field of corporate restructuring that is worth considering for all parties involved.

Publication

Effective May 13, 2025, the USPTO’s expected timeframe between issue notification and issue date will be approximately two weeks (instead of approximately three weeks)

Publication

In For Women Scotland Ltd v The Scottish Ministers, the Supreme Court unanimously held that the definitions of “man”, “woman” and “sex” in the Equality Act 2010 refer to a person’s biological sex.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025