The specificities of the energy market in France

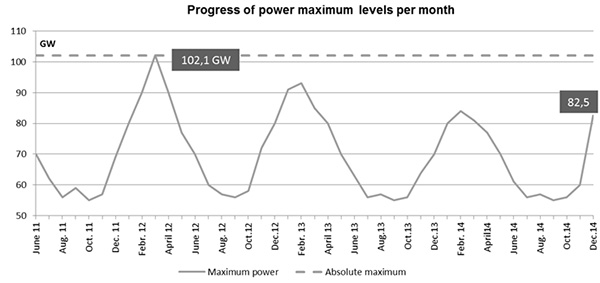

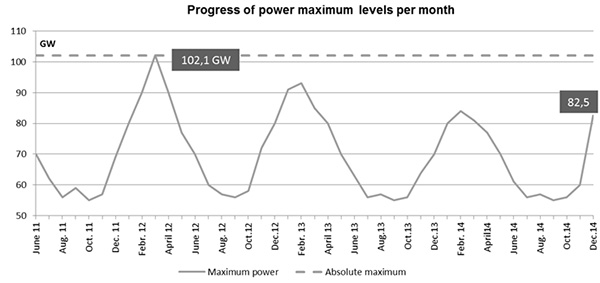

Source : RTE – the grid of power intelligence

On the other hand, the energy market offer poorly remunerates investments in capacities of energy production and in capacities of energy consumption curtailment. A report submitted in April 2010 by representatives Poignant and Sido in relation to the control of energy peak outlined the difficulties of the present energy market to attract investments in high-technology plants, even though such plants are necessary to guarantee a sufficient level of available energy during peak periods.

However, energy cannot be stored and must be constantly produced in accordance with the consumers’ demand. The consequence of these two specificities of the French energy market is the inadequate balance between the level of the available energy and the quantity of energy requested during peak periods.

According to a published RTE assessment, such inadequacy will increase in the coming years and will constitute a genuine threat for the safety of French energy supply by year 2016. Thermal production means (fuel, coal) will slowly be abandoned. As from 2013, GDF Suez (renamed Engie) mothballed5 its combined cycle power plant located in Cycofos (Bouches-du-Rhône) and cut off the electric grid of a 490 MW capacity. The very same year, the group cut back its activities, each with a 435 MW capacity, in Montoir-de-Bretagne (Spem) and in Fos-sur-Mer (Combigolfe)6. Coal plants and oil-fired plants have also been shut down since the specificities of the plants did not comply with European environmental norms that will be in force from early 2016.

The assessment also states that in case of severe winter conditions, the lack of energy could be up to 900 MW during winter 2015-2016 and up to 2,000 MW during winter 2016-2017. According to Dominique Maillard, President of RTE, the global cost of one unprovided kilowatthour was estimated to be 200 times higher than the production cost of the same kilowatthour. Two factors must be noted: a massive power curtailment involves loss for companies and individuals, and energy must be imported at high prices.

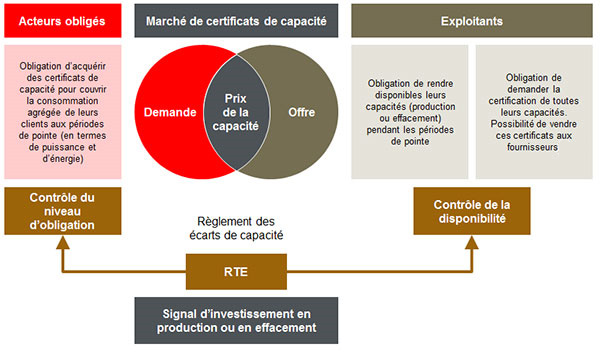

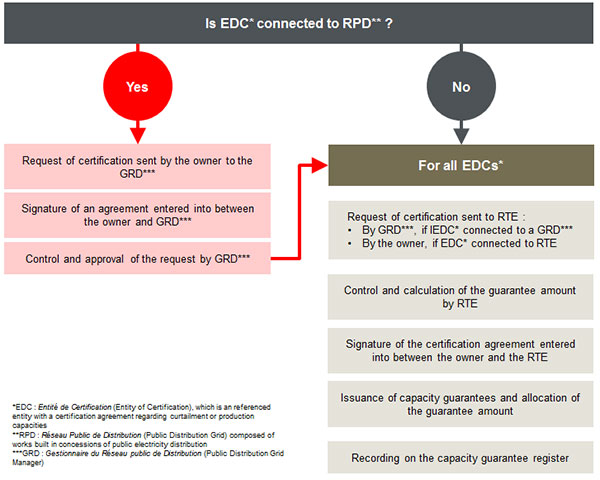

Therefore, as a strong sign of France’s commitment in the energy transition, the capacity market is bound to prevent any failure risk in the French energy system by helping to ease the transition to consumption peaks. It will be instituted by year 2016.

The multiplication of national capacity markets in Europe

Many European countries have already set domestic capacity schemes to ensure the safety of energy supply (United-Kingdom, Ireland, Sweden, Finland, Belgium, Poland, Hungary, Portugal, Spain, Italy, Greece). Capacity schemes are generally divided in three instruments, the last one being the most complex:

- capacity payment : providers receive a fixed compensation;

- strategic storage : grid managers must create an energy storage to cover risks of shortage;

- capacity market: a new market is created on which energy capacity is traded in the form of certificates.

Within the European Union, the United-Kingdom is the sole country to be already endowed with a capacity market. It is expected that each year, the British energy grid manager organizes centralized reverse auctions from which a capacity level is obtained. Such capacity level is required in order to guarantee a production level in adequacy with the energy demand. The first auctions occurred at the beginning of 2015 and set the energy capacity price that would be in force during peak periods of winter 2018-2019. A 49.3 GW capacity will be traded for an equivalent price of £19.40/KW-year.

In addition to France, Italy and Hungary are currently instituting a capacity market.