Publication

International Restructuring Newswire

Welcome to the Q2 2025 edition of the Norton Rose Fulbright International Restructuring Newswire.

Global | Publication | December 2018

More than four years after the enactment of the new competition laws of June 2014, the new Competition Council, institutional cornerstone of the new regime, is finally active since all its members were appointed on December 17, 2018. The long awaited new antitrust and merger control rules are now fully operational.

After a long transitional period, Morocco’s new competition regime has become a reality with the recent appointment of the new Competition Council’s (CC) members by Decree of December 17, 2018, exactly one month after the appointment of its new President, Mr. Driss Guerraoui.

Although a number of rules were already applicable in practice, this landmark event brings significant changes both in relation to (1) merger control, and (2) anticompetitive practices, as the new regime can now be fully implemented.

Since the implementing decrees were adopted two years ago, transactions were already subject to merger control if they met any of the thresholds and the concept of notifiable concentration provided by the new law. Nothing will change from this perspective.

Applicable thresholds

Transactions are subject to merger control if they meet any of the three following thresholds:

These turnover thresholds and the market share threshold are alternative. Therefore, only one of these thresholds must be met for the transaction to be subject to notification.

However, in accordance with article 1 of law n°104-12, the transaction must also be capable of having an effect on the market in Morocco. It is therefore arguable that transactions where parties have no presence or turnover in Morocco would not be subject to notification, even if they achieve the global threshold of 750 million dirhams.

On the other hand, the following should be subject to notification:

Definition of notifiable transactions

Henceforth based on the definition adopted in many jurisdictions, the concept of concentration covers mergers, acquisitions of control (sole or joint) and creation of “full function” joint ventures (i.e. those which perform on a lasting basis all the functions of an autonomous economic entity).

While no guidelines have yet been published by the CC, these concepts shall be read in the light of international standards.

File to the CC

The reform places the burden of filing on the acquirer of control (in case of an acquisition of sole control), or all of the parties concerned, jointly (in case of a merger or creation of a joint venture).

It must be noted that a penalty of 5 per cent of the parties’ turnover in Morocco (in the last fiscal year) may be imposed on undertakings in case of failure to notify, gun jumping (except upon express authorisation to implement the transaction before clearance), failure to comply with commitments or injunctions, or incomplete or inaccurate information in the notification.

All notifications now have to be filed to the CC instead of the head of government, except the transactions involving businesses active in the telecommunications sector, which fall within the jurisdiction of the ANRT (l'Agence Nationale de Réglementation des Télécommunications).

In the case of transactions involving financial institutions (or equivalent accredited bodies), the CC will have to refer to the Bank Al-Maghrib for its prior opinion before making any decision.

However, the head of government’s office will retain a “right of evocation”, permitting them to take jurisdiction over transactions on the grounds of public interest other than the preservation of competition (see below in Phase II). Although rarely used in certain countries in which this power exists (for example France, where it has been applied only once), this power should not be overlooked in the Moroccan regime, particularly in the case of sensitive transactions.

Follow the new form

The notification files must follow the form set out by decree n°2-14-652 of 1st December 2014, which is significantly more detailed than the previous form.

Although the new regime does not provide for a pre-notification procedure, informal contacts with the CC may be considered before notification to facilitate a smooth and timely treatment of the case.

Schedule the transaction so as to include the new procedural timeline

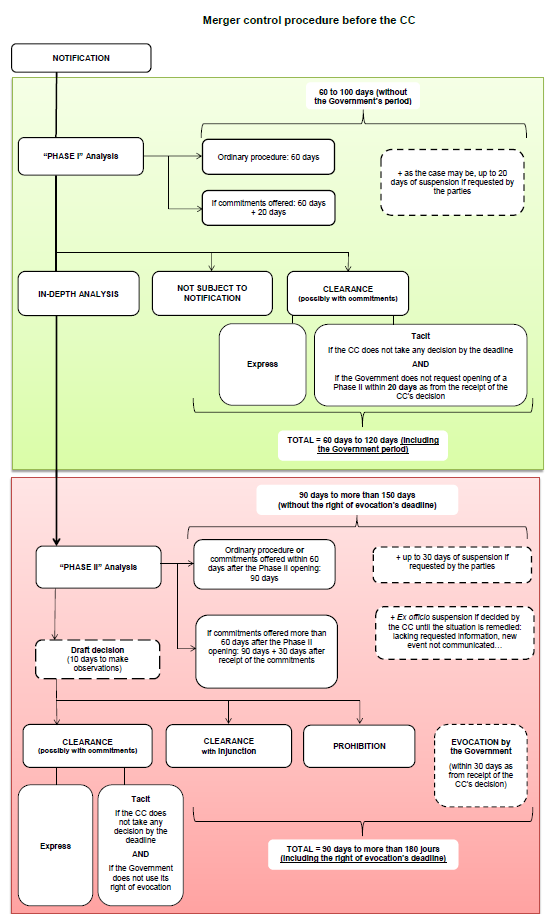

The reform provides for a five-month period, including a two-month Phase I (60 days from the receipt of a complete notification) and a three-month Phase II (90 days), but these terms may be extended or suspended in a number of cases (Phase I up to 120 days, and Phase II up to 180 days or more).

The details of these phases are as follows:

If commitments are offered, the 60-day examination will be extended by 20 days.

In addition, a new stop-the-clock procedure has been created. The parties may ask for a suspension of the examination period for a maximum of 20 days in case of ‘particular necessity’ (e.g. to finalise the commitments).

Within 20 days from the receipt of the CC’s decision, or if the CC does not take any decision until the end of the first 60-day period, the head of the government (or a delegate) will have the power to ask the CC to open a Phase II proceeding.

Therefore, Phase I could theoretically last between 60 and 100 days, plus 20 extra days for the head of the government’s reaction.

If commitments are offered less than 30 days before the end of the 90-day period, the 90 days will be extended by 30 days as of the receipt of the commitments by the CC.

In addition, there are two new possible stop-the-clock options:

Within 30 days from the receipt of the CC’s decision, the head of the government (or a delegate) has a “right of evocation” allowing him to take over the case (whatever the decision previously rendered by the CC) and make another decision on the transaction for reasons of general interest (other than competition reasons) such as: industrial development, the international competitiveness of the businesses in question, or the creation or maintenance of employment. This decision may be subject to commitments. No deadline is set for the head of the government’s decision.

Therefore, Phase II could theoretically last from 90 to 150 days (or more if a suspension is decided ex officio by the CC), plus at least 30 extra days for the head of the government’s reaction (or more since there is no deadline for him or her to issue such a decision).

The CC has extensive powers in terms of investigation, prosecution, and sanction of anticompetitive practices (agreements and abuses of dominant position) that it has jurisdiction to apply to all businesses, except:

In line with international standards, the CC can conduct in-depth investigations into businesses and seize documents (provided that it has been duly authorized by the King’s prosecutor having jurisdiction). In addition, these investigations can also be conducted by administrative agents under the government’s supervision.

If the CC decides to bring proceedings on the basis of these investigations, it will be able to sanction the businesses concerned, after carrying out a procedure which permits them to make observations.

The CC has particularly broad powers of sanction, including the imposition of:

The weight of the administrative fine in particular may encourage businesses to make use of the two cooperation procedures created by the new law:

Since the new law was enacted in 2014, the list of complaints and requests for opinion has grown on the desk of the CC, and concern many sectors of the Moroccan economy such as tobacco, education, telecom, health, temporary work, oils, milk, e-commerce, public tenders, etc.).

A few investigations were already conducted in certain sectors by the head of government’s office in application of the new law, as well as by the former members of the CC (although the latter did not have the power to do so).

These open matters will likely keep the new CC quite busy in the months to come.

It is particularly important for Moroccan businesses to prepare themselves for the application of these new rules, and in particular:

Publication

Welcome to the Q2 2025 edition of the Norton Rose Fulbright International Restructuring Newswire.

Publication

Another compliance deadline is approaching under the federal Pay Equity Act – federally regulated employers are required to file an annual statement with the Office of the Pay Equity Commissioner on or before June 30, 2025, if they posted a pay equity plan in the previous year.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025