Blog

Squaring the circle: fiduciary duties v economic growth

This is the first in a series of blogs about the Government’s Mansion House reforms, and its goal to get pension schemes doing more for the UK economy.

Global | Publication | February 2017

The Chilean renewables market has been the focus of much interest in recent years, as the industry reacts to the potential for growth and the offer of economic and political stability. As of December 2013, installed renewable capacity represented 6.3 per cent of the energy mix in Chile. By June 2016, this amount doubled, reaching 12.65 per cent of total electrical capacity (20,151 MW). The renewable energy market in Chile is ready to make the leap towards greater development. This was evident in 2015, when the country attracted more than 50 per cent of total investment in the renewable market for Latin America and the Caribbean.

Figures released in July 2016 by the Centre for Innovation and Development of Sustainable Energy in Chile have exceeded all expectations, with an encouraging pipeline of 47 renewable energy projects declared under construction. By August 2018, these projects are expected to inject a total of 2,336 MW to the grid. Moreover, 91 renewable energy projects were under environmental evaluation as of June 2016. Once operating, these projects will inject more than 8,815 MW to the matrix, which will represent US$25,677 million investment to the Chilean energy matrix.

The attractiveness of the renewable market has made the energy sector the economic sector with the highest investment rate in Chile for the last two years.

The progressive annual renewable quota first introduced by Law 20,257 in 2008 was increased in 2013 by Law 20,701, which mandated a 20 per cent market share by 2025. The quota has been spectacularly fulfilled. Between June 2015 and June 2016, generation through renewable energy grew by 7.9 per cent, almost doubling the obligatory renewable amount. In December 2015, the government released the 2050 Energy Agenda establishing the pillars of a more sustainable energy market, and a new target quota of 70 per cent by 2050. Therefore, renewables are expected to take a more prominent role in the energy mix profile in Chile.

Its political and economic stability have made Chile one of the fastest growing economies in Latin America over the past decade. Moreover, a growth rate of 2.1 per cent is forecast for 2017. As the country’s economy expands, Chile’s energy requirement for 2015-2030 is forecast to grow in parallel at a rate of 72.98 per cent in the Central Interconnected System (SIC) and by 93.76 per cent in the Northern Interconnected System (SING) system.

According to the Energy Finance Climascope 2015 prepared jointly by Bloomberg New Energy Finance and the Inter- American Development Bank, Chile ranks third in the renewable energy investment attractiveness. Additionally, according to the World Bank’s Doing Business Report 2017, Chile continuous to be a top performer in Latin America and the Caribbean and ranks in fifty-seventh position.

In particular, the Atacama Desert potential for solar energy has been very attractive to local and foreign investors. In 2016, Chile became the largest producer of solar energy in Latin America with over 160 solar developers. Chile hosts of some of the largest solar plants under construction in the world. The 196 MW Romero Solar project of Acciona will be the largest PV project in Latin America, with a total investment of US$343 million. Additionally, SolarReserve is developing a 743 MW project which will be one of the largest CSP projects worldwide, with an investment close to US$2 billion. Other international players already active in the renewable market are Actis, BP (Pan American Energy), ENEL, GDF Suez, Pacific Hydro, Pattern, RP Global, SunEdison and Mainstream Renewable Power.

The increasing participation of foreign companies in the Chilean renewable market would not have been possible without the stability of the legal framework and the support provided by the State of Chile. Although Chile has a privatised energy market, when projects are to be built on State -owned lands, the Ministry of Public Goods will intervene to grant a concession. In 2015 renewables benefited not only from the openness of the market and almost non-existent currency controls, but also from 57 concessions granted over State -owned lands for the development of renewable energy projects. It is worth noting that over 40 per cent of Chilean solar and wind projects are located in lands owned by the State.

Additionally, during 2016 the government assigned over US$9 million of public budget to promoting the development of non-conventional renewable energy projects. It should be noted that the amount of public resources allocated to the Ministry of Energy in 2016 was 9.6 per cent higher than the previous year.

Chile was one of the first countries in the world to privatise its energy industry. Consequently, it has a tradition of a lightly regulated energy market where the government performs a role of regulation and supervision. Investors have guaranteed access to the Formal Exchange Market as well as freedom to repatriate capital and remit their profits.

Although rich in other natural resources, Chile is poorly endowed with conventional energy sources. Its supply of gas, oil and coal heavily relies on imports; a situation that has traditionally threatened the country’s energy security. As a result, the Chilean energy sector has traditionally been exposed to the volatility of external markets, which has implied high electricity prices in comparison to many other countries in the region. In July 2016, the average price of power traded on the spot market of the SING system was US$85.3/MWh, while the average price for the SIC system was US$102.9/MWh. Both systems registered higher prices than the previous year.

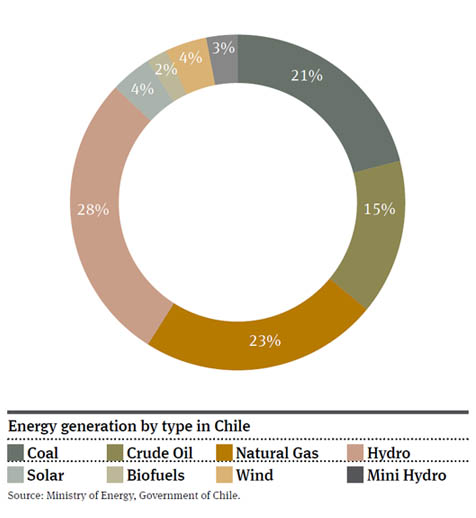

Law 20,018 of 2005 mandated distribution companies to run tender processes for securing energy supply to their regulated customers (those with an energy demand of up to 2 MW). These tender processes are public, non-discriminatory, and transparent. In addition, they allow the participation of every investor interested in exploring the market even if they are not incorporated in Chile. In 2015 by Law 20,805 the tender process was amended by the introduction of different sized hourly blocks of energy supply (day, peak, night, 24 hrs), and a longer supply period of 20-years. These amendments were meant to spur competition and their success was seen in the last tender process awarded in August 2016. Eighty-four investors of different technologies submitted offers, and renewable developers were awarded more than the half of energy bid. The graph below shows the composition of the energy Chile will have in 2021 once the awardees start their operations.

The average price of energy awarded was of US$47.6/MWh, 63 per cent lower than the average price offered in the tender process run by distribution companies in 2013. Renewables are expected to lower the energy prices between 20 per cent to 25 per cent, which would represent a US$ 1,863 billion saving for final consumers. Moreover, solar energy is now the cheapest energy in Chile as Solarpack Corp. was awarded with a 20 year PPA to sell at US$29.10MWh, which is also amongst the cheapest ever registered prices for solar energy around the world. Renewables are expected not only to lower the energy bill but also to provide more secure and sustainable energy for the country.

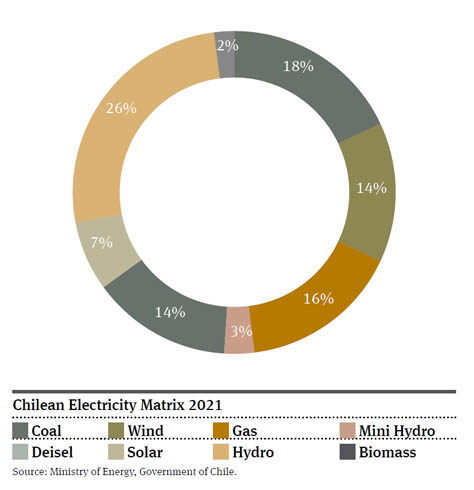

Chile is on its way towards a more sustainable and independent energy mix. In September 2014, Chile enacted a carbon tax which imposes a levy of US$5 on each metric ton of carbon dioxide emitted by thermal power plants with a generation capacity of at least 50MW (except biomass). This measure reflects the commitment to Chile’s target of cutting greenhouse gas emissions by 20 per cent from 2007 levels by 2020. Moreover, the 2016 distribution companies tender process showed that coal is less competitive than renewables, as the cheapest price offered for this technology was US$57/MWh, higher than solar (US$29) and wind energy (US$31).

Therefore, the authority has forecasted the displacement of coal from the matrix as a stronger participation of renewables is expected and desired. This was clearly reflected in the preliminary report for the expected short term node price prepared by the National Energy Commission. This report is prepared every six months and covers a ten-year period. According to the report, of the 2,915 MW planned to start operations between January 2019 and January 2027, 65 per cent corresponds to solar energy, followed by 980 MW from wind farms, and 40 MW from mini hydro.

Hydroelectricity is of particular importance in the Chilean electricity mix. Thanks to Chile’s geography, hydroelectricity is the most used renewable resource accounting for more than 6,000 MW of installed capacity. In 2014, the government began promoting sustainable hydroelectricity projects. To this end, the Chilean government has worked on identifying water basins and determining their potential for electricity production. Ensuring that the development of hydro-electricity projects take into account environmental, social and cultural heritage factors has become a cornerstone for the government.

As of June 2016, there were almost 1,975 MW of hydroelectric projects under construction. However, small hydro -projects have been the preference of investors because of their lower impact on the environment and less opposition from the local communities. Although small hydro projects allow storage of water for shorter periods than hydro -dams do, they provide sufficient backup for the intermittency of other renewables such as solar and wind. Consequently, marginal costs experience greater stability, which boosts the confidence of investors.

The North of Chile is where most of the mining industry and the world’s largest copper reserves are located. The mining industry is one of the largest energy off -takers in the market accounting for 33 per cent of the total energy consumption. Even though the mining industry has suffered from lower prices, the energy requirement from the mining sector is expected to increase by 53 per cent during the next years. Its operations require a continuous power supply, yet there is limited power in the North. Grid access and reliability of power supply are also problematic.

The North of Chile also hosts the Atacama Desert, which has one of the highest rates of solar radiation in the world. The potential for the development of solar technologies in the North is vast and represent a sensible alternative to overcome the barriers the mining industry face.

As a consequence, solar projects are being developed in close proximity to the mining sites, allowing easy grid access and overcoming grid capacity constraints. Finally, solar power can be produced at a competitive price in a country where power prices have been traditionally high, particularly by eliminating the risk and costs associated with bringing fuel supplies to remote mining sites. Some of the largest mining actors, like the Canadian Mandalay Resources and the Belgian Nyrstar, have signed PPAs with solar project companies and are already reaping the associated economic benefits.

Chile is located in the Pacific ring of fire and its estimated geothermal potential is at least 3,350 MW and the legal and institutional framework has been in place since 2000. The regime sets up the social, environmental, technical and the economic requirements for geothermal projects. Despite the great untapped potential for geothermal development in the rest of the region, Chile is jumping ahead and will host the first project of this kind in Latin America. Enel Green Power is developing the 48 MW Cerro Pabellon project, operations are expected to start in 2017 and an expansion is already being discuss to take the project to 100 MW.

However, the costs involved in geothermal energy production are still discouraging for larger investments. With the support of the World Bank and the Inter-American Development Bank, Chile is studying the alternatives to lower geothermal development prices and encourage further competition in the sector. In the 2016 tender process the cheapest registered energy price for Geothermal projects was US$66/MWh.

A renewable resource not prepared to be thrown into the shade by solar is ocean energy. With its long coastline of over 4,000 Km, powerful waves and tidal currents, Chile has 164 MW of potential capacity available through marine energy resources, according to the Chilean government’s assessment. According to a study by the British Embassy in Chile, Chile has the greatest potential in the world for the development of wave energy and will have a competitive marine energy market in coming years. As a consequence, the Chilean government created the national Marine Energy Centre, which was the first to be established in Latin America.

Even though the general rule is that renewable projects are financed on a contract basis, Chile already hosts renewable projects financed on a merchant basis. One of these projects is the SunEdison’s 73 MW Maria Elena located in Antofagasta. The financing for the project of US$155 million was provided by the Inter-American Development Bank (IDB), the Overseas Private Investment Corporation, Corpbanca (Chile), and Clean Technology Fund (CTF) of the IDB. This project is one of the largest merchant solar power plants not only in Latin America, but worldwide. Another completed merchant project is the Total-SunPower 70MW PV Salvador Solar Plant, which is expected to produce approximately 200GWh of solar electricity per year, enough to supply electricity to approximately 70,000 households in the country.

Such projects represent a welcome solution for developers who sometimes struggle to negotiate long-term PPAs. For these projects, the merchant risk is arguably limited, because plants in Chile are dispatched in order of their cost of generation to ensure that electricity is supplied at the lowest available cost. This system favours renewables with no fuel costs, such as wind and solar, which means that developers and financiers face reduced risk.

According to Transparency International’s 2015 Corruption Perceptions Index, Chile, ranks at 23rd place and its corruption level is competitively low in Latin America. Chile has for a long time also been one of the most attractive countries for doing business in Latin America and is wellknown for its openness to trade, capital flows, exchange of technology and ideas, labour movements and cultural integration. The county has been an OECD member since 2010 and ranks 57th in the World Bank Doing Business Report 2016.

Chile is well integrated into the global market, with 15 FTA, 26 double taxation avoidance agreements, and more than 40 treaties for the promotion and protection of investments. Thanks to all these characteristics, Chile accounted for US$23 billion of FDI in 2015. Its favourable reputation has led Chile to be ranked before any other Latin American country in the EY Globalisation Index (2012).

According to the International Renewable Energy Agency Report on renewables energy in Latin America 2015, apart from the renewable quota of 20 per cent by 2025, Chile is the only country in the region with a pure renewable energy certificate system. Under the current support regime, parties who are subject to the renewables obligation can comply by collecting green certificates, either issued to them or purchased from the market.

In addition, generation companies that do not comply with the renewable quota will be sanctioned with a fine of approximately US$27 for each deficient renewable MWh. This fine is increased by US$41, approximately, for each deficient MWh if the company persists in breaching the quota.

Through the Renewable Energies and Energetic Efficiency Program, the government of Chile supports the further integration of renewables. The program is backed by the German government and not only includes knowledge sharing, but also financing cooperation provided by the KFW bank.

Finally, Chile’s legal framework also incentivises the development of small distributed generation facilities (PMGD), by exempting them from toll payments; granting the possibility to opt between selling energy at spot market price, or at a stabilised price; and by allowing the self-dispatch of their production.

In Chile, the ownership of land is different from the ownership of their minerals. Consequently, a conflictive scenario may arise between electric and mining concessionaires. However, by Law 20,701 of 2013 and Law 20,897 of 2016, electric concessionaires and non-conventional renewable energy developers are entitled to avoid delays to the development of their projects by paying a bail in court, in order to guarantee the results of conflict.

There are concerns that the grid in Chile is ill-equipped to accommodate intermittent renewables generation. Furthermore, the two main transmission systems (SING and SIC) are disconnected and have limited capacity, causing sudden higher prices and congestion problems. Further investment in the transmission system is still required if Chile is to meet the growing energy demand.

As a part of the program to cope with this situation, the French Engie and the Spanish Red Electrica Internacional are already building the transmission line that will interconnect the SING and the SIC. Its operation is expected by the second half of 2017. The project will have a total cost US$860 million and will cross 600km of desert which currently divides these grids. The transmission line will operate under non-discriminatory technical and economic conditions as to further competition in the energy generation sector. Moreover, the interconnection will allow the country to take advantage of the diversity of its natural resources allowing cheaper energy prices to reach the majority of the Chilean population.

As to ensure adequate investments in the transmission sector, the National Coordinator annually offers in a public, non-discriminatory and economic based tender process the execution and exploitation of the transmission works. Investors regardless their nationality or place of incorporation, are allowed to participate.

The Chilean energy sector is lightly regulated and allows developers to freely set the regime to sell the electricity they produce. Energy developers are allowed to combine regimes and to sell ‘blocks’ of power to the spot and others under the contract model of their preference. The execution of PPAs reduces the exposure to the marginal costs of energy; however, it does not eliminate that risk. Consequently, the industry has adopted an alternative hedge mechanism with contracts for difference (CfD).

In a CfD, the parties agree on a strike price which is covered by the seller or the buyer benefited by the marginal cost of electricity. If the marginal cost of electricity is higher than the strike price the seller will reimburse the difference to the buyer. At the inverse, if the marginal cost of electricity is lower than the strike price, the buyer will pay the difference until the completion of the strike price. Since the Chilean marginal costs system is based on variable costs, renewables do not exert much influence on its determination. Therefore, renewables are ideal CfD candidates.

A bill was passed by the Chilean Congress in September 2014 with effect from 1st January 2017. Among other measures, the bill provides two new tax regimes: the attribution regime and the partially integrated regime. The amendment to the tax law increases corporate income tax from 20 per cent to 25 or 27 per cent by 2017 or 2018, depending on the regime adopted by the taxpayer.

The increasing demand for power from the industry and the country’s unparalleled natural renewable resources have made of the Chilean renewable market an attractive destination for international investors.

The increasing participation of renewables in the energy mix is a game changer. The country is succeeding in adding value to its primary energy sources and it is expected that Chile will become an exporter of electricity in the near future. Indeed, in February 2016, the country materialised its first transmission of electricity to Argentina. Additionally, by 2021 Chile expects to interconnect its National Transmission System with the Peru, Ecuador and Colombia. International interconnections will further promote competition by enabling transmission capacity for the participation of new actors in the energy sector.

Blog

This is the first in a series of blogs about the Government’s Mansion House reforms, and its goal to get pension schemes doing more for the UK economy.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025