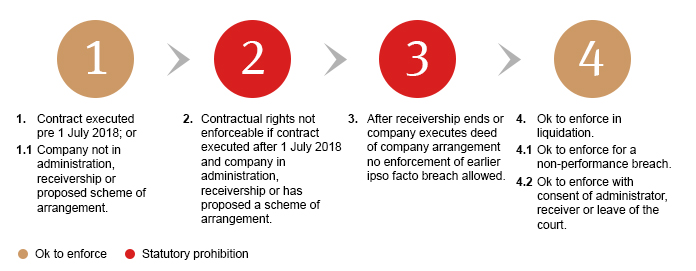

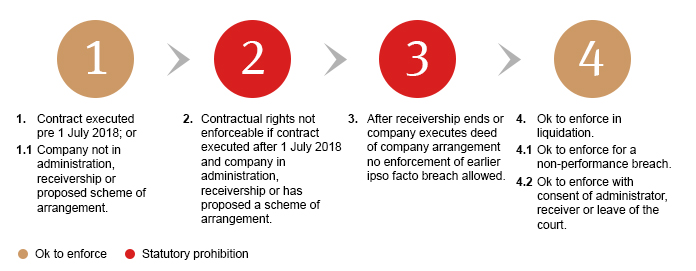

The Treasury Laws Amendment (2017 Enterprise Incentives No. 2) Act 2017 (Cth) amended the Corporations Act 2001 (Cth) to impose a prohibition on the enforcement of rights against a company including, relevantly, contractual termination rights arising on the occurrence of an Insolvency Event.

Specifically, the prohibition prevents the enforcement of contractual rights because the company is in voluntary administration, receivership or subject to a scheme of arrangement. The legislation also captures broader Insolvency Event clauses by also preventing enforcement of those contractual rights because of “the company’s financial position” at the time that they are under voluntary administration, receivership or subject to a scheme of arrangement.

The reforms emulate to some extent the ‘ipso facto’ moratorium under Chapter 11 of the United States Bankruptcy Code.

Section 365(e)(1) of the Bankruptcy Code provides that a contract may not be terminated solely because of a clause in the contract ‘conditioned on the insolvency or financial condition of the debtor’.

As a consequence, the contractual counterparties will be ‘locked-in’ and required to continue to perform contractual obligations.

‘Locking-in’ suppliers and other contractual counterparties during voluntary administration, receivership or a scheme of arrangement is intended to assist in maintaining ‘business as usual’ conditions for the company’s trading during these insolvency processes. This should help prevent the unnecessary destruction of valuable and viable businesses, and thereby create a better opportunity for a successful restructure.