Publication

European energy infrastructure opportunities: Small scale LNG

Global | Publication | May 2016

Content

Introduction

Despite low prices and market uncertainty, this is an exciting time for small scale LNG projects. With LNG becoming increasingly cost competitive, the drive for cleaner fuel gathering pace and the desire for energy companies to expand and diversify their LNG businesses, investors are becoming alive to the potential for small scale LNG projects.

Regulatory drivers

On January 1, 2015, stricter regulations came into force pursuant to the International Convention for the Prevention of Pollution from Ships (ICPPS) and sponsored by the International Maritime Organization requiring the sulphur content of maritime fuel to be reduced from 1 per cent to 0.1 per cent within defined Sulphur Emission Control Areas (SECAs) – broadly, in the Baltic Sea, North Sea, the US east and west coasts and the area defined under the regulations as the ‘US Caribbean SECA’, which covers waters under the jurisdiction of the United States surrounding Puerto Rico and the US Virgin Islands, extending approximately 50 nautical miles from the coast. Vessel owners and operators are increasingly turning to the use of LNG as a fuel as part of their strategy to reduce emissions.

In addition, although the Paris Agreement concluded at the international climate change negotiations (known as COP21) in Paris in December 2015 does not include specific emission reduction targets, it does contain a legally binding obligation on each signatory to the Paris Agreement to submit its ‘nationally determined contribution’ (NDC) every five years. These NDCs will set out each signatory’s proposed actions for reducing emissions at a national level, with the aim of contributing to achieving the overarching objective of the Paris Agreement – namely, to limit global warming to well below a 2°C increase above pre-industrial levels. The expectation is that NDC submissions will be enshrined in domestic law, steering a transition to a low carbon economy. In practice, this is likely to mean that companies traditionally reliant on heavily polluting fossil fuels will seek alternative, but cost-competitive, options, which could create new markets for LNG.

In the UK, the Secretary of State for Energy and Climate Change, Amber Rudd, announced in a speech given in November 2015 an intention to end reliance on coal-fired power stations, restricting their use from 2023 and closing them all by 2025. Given the cut in subsidies for renewables in the UK, and the extremely long lead time (not to mention controversial nature in the minds of the public) of new nuclear projects in the UK, the way seems clear for a new generation of gas-fired power stations. Indeed, Ms Rudd made it clear that ‘we’ll only proceed [with closing coal-fired power stations] if we’re confident that the shift to new gas can be achieved within these timescales’. Although gas-to-power projects are not necessarily small scale, in the event that this policy leads to an increase in LNG imports to the UK (of which there is more than sufficient terminal capacity to do so at present, given the under-utilisation of the three existing import terminals, not to mention the fourth under construction at Port Meridian, Barrow-in-Furness) there could be potential for add-ons such as break bulk facilities, bunkering facilities, truck refuelling stations, and perhaps even transport by rail, such as we are already witnessing at the Isle of Grain. We will examine each of these below.

Company focus: Grain LNG

Grain LNG in the UK is a good example of an existing LNG business diversifying its operations into small scale LNG in order to create multiple income streams. It was the first UK receiving terminal to offer LNG reloading services (in 2015) and subsequently launched a consultation to offer small scale ship reloading. In addition, a road tanker reloading facility is due to open this summer. This stateof- the-art truck loading facility will allow road tanker operators to load LNG in bulk and transport the fuel directly to LNG filling stations, as well as to industrial and commercial markets throughout the UK and mainland Europe. These two developments will further enhance the distribution of LNG as a fuel for the marine and road transport industries as well as off-grid applications.

Financial drivers

Fewer large scale LNG regasification terminals are reaching Final Investment Decision (FID) in Europe – at the last count, according to IHS Inc., only one in twenty of the proposed LNG import projects put forward secured financing. Notwithstanding this, according to Energy Aspects Ltd., 2016 will be the year that LNG supply capacity outstrips demand. This is partly due to newly contracted supplies of LNG coming to market e.g. from Australia and Papa New Guinea, partly due to new US shale supplies, and partly due to a lower than anticipated demand from Asia. It is also becoming increasingly difficult to persuade financial institutions of the bankability of large-scale LNG liquefaction projects given current low oil (and therefore LNG) prices, which are not set to rise any time soon.

Against this background, many companies are looking to widen their LNG strategy and diversify the markets for LNG that they target in the hope of either finding new demand sources for overflowing inventories (in the case of sellers) or taking advantage of lower priced LNG (in the case of buyers). Throughout this briefing we will consider the different strategies being implemented by a diverse mix of players to illustrate the scope and variety of opportunities on offer.

Company focus: The Port of Rotterdam Authority

The Port of Rotterdam Authority is involved in a project for the design and construction of a dedicated harbour basin for LNG break bulk operations, and has already introduced new regulations that allow LNG bunkering for inland barges and ship-to-ship bunkering of seagoing vessels. The Port Authority’s aim is to put Rotterdam firmly in place as the leading European hub for the complete LNG supply chain (indeed, the GATE LNG terminal was originally developed with LNG bunkering services as part of its long-term strategy) and the project represents an important step in achieving the goals of the ‘Green Deal Rhine and Wadden’ (a partnership between the Dutch government, business and knowledge institutes aimed at promoting green growth). By mid-2016, a full scope of supply services for LNG will be available in the port of Rotterdam.

Bunkering

LNG bunkering is growing in popularity as it has a far better emissions profile than traditional petroleum-based sources of marine fuel, which has been particularly important since the ICPPS (see above) came into force this time last year. In addition, although the Paris Agreement made no specific reference to shipping, there is a general movement towards a cleaner, greener future and a 20 per cent reduction in carbon dioxide from shipping emissions (achieved by switching from marine fuel to LNG) is seen as a key component of the strategy to meet this aim. According to a recent DNV-GL study, the number of non-LNG carrier vessels running on LNG will reach 1,000 by 2020. Whilst current low oil prices are expected to rise in the longer term it is likely that low priced LNG out of the US will be available to make the use of LNG as a bunker fuel competitive against heavy fuel oil, even factoring in the conversion costs. The ordering of LNG-fuelled ships is becoming a more common occurrence in Northern Europe – see for example the recent orders of LNG-fuelled ships from Tallink Grupp and Containerships.

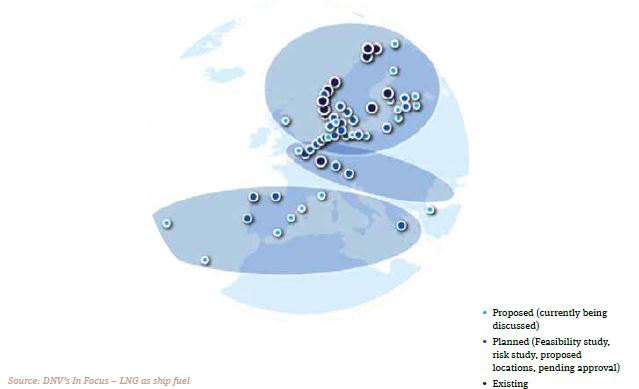

The infrastructure necessary for refuelling LNG-powered vessels is currently limited, but expanding as new LNG bunkering projects come on stream across Europe, with more proposals for bunkering facilities under consideration. So far Europe’s LNG bunkering activity has been focused in the north, notably Scandinavia and the Baltics. Pilot projects have been developed in northern Europe, boosted by strong government support, infrastructure already in place and the ICPPS. However, there are also a number of initiatives underway elsewhere in Europe, including the Poseiden Med II project (see below) and multiple studies focused on Greek waters.

The Port of Rotterdam was the first port in Europe to offer LNG bunkering in 2014. New facilities have been recently announced for the Port of Antwerp (expected 2019), and the owners of many other European import terminals are considering similar expansion. We are beginning to witness a new add-on to traditional project models for LNG terminals, whereby bunkering vessels are granted rights to load LNG at existing terminals and then deliver LNG to arriving vessels. Such bunker delivery will be either at a berth, from road tankers (truck to ship) or via ship-to-ship transfer. There could also be huge potential to expand the sector in the Mediterranean for use in container vessels, tugs and other support vessels operating close to shore, as well as cruise liners and passenger ferries. At a panel session on ‘LNG as a Marine Fuel’ held during London International Shipping Week in September 2015 (during which the issues and solutions surrounding LNG as a marine fuel were discussed) the panel were unanimous in their view that a major change is imminent, and a number of independent industry forecasts indicate that the use of LNG as a bunker fuel offers opportunities for early movers to secure a market-leading position ashore and afloat as global LNG fuelling becomes a mainstream option.

Poseidon Med II LNG Bunkering Project Formally commenced in February 2016 as a continuation of the previous Poseidon Med and Archipelago LNG projects , this European cross-border project, co-financed by the European Union through the Connecting Europe Facility, aims to take all necessary steps towards adoption of LNG as marine fuel in the east Mediterranean and Adriatic Seas, with the aim of making Greece an international marine bunkering and distribution hub for LNG in South Eastern Europe. It encompasses three EU member states (Greece, Cyprus and Italy) and its task is to prepare a detailed infrastructure development plan promoting the adoption of LNG as marine fuel for shipping operations. The final stage of the project (to be completed by 2020) is expected to include a detailed strategy plan for an LNG transport, distribution, and supply network, and define the framework for a well-functioning and sustainable market. The project is coordinated by the Public Gas Corporation of Greece (DEPA) and comprises 26 partners including DEFSA (the Greek gas system operator), Lloyd’s Register, Ocean Finance, all major short sea shipping companies operating in Aegean, Ionian and Adriatic seas, as well as several of the main seaports in the region such as the Port of Piraeus, the Port of Venice and the Port of Limassol.

Norton Rose Fulbright acts on Europe’s first LNG bunkering vessel

We recently acted for NYK, Engie SA, Mitsubishi Corporation and Fluxys SA in relation to the US $45 million debt financing of MV Engie Zeebrugge, a new-build LNG bunkering vessel with a capacity of 5,100m3. The vessel is currently under construction at Hanjin Heavy Industries shipyard, South Korea, with delivery expected towards the end of 2016. On delivery it will be used for bunkering in and around the Zeebrugge port, by loading LNG at the Zebrugge LNG terminal and supplying arriving vessels via ship to ship transfer. United European Car Carriers (a Norwegian automobile carrier) will be the primary user of the vessel under a longterm bunkering contract but the vessel is intended to be multi-user, which aligns with Fluxys’ strategy of supporting the development of the small-scale LNG market.

Distribution and consumption

As of September 2015, 70 LNG fuelled ships were in operation and 76 were on order (of which six were conversion projects). The number of ships in operation represents an increase of over 50 per cent compared to the figures just 18 months previously, and the rapid pace of fleet expansion is predicted to continue. It is estimated by DNV-GL that there will be over 1000 LNG-fuelled ships in operation by 2020. In addition, many vessels are being constructed to allow for dual fuel in order to be ready to run on LNG when the infrastructure is available.

As a fuel, LNG presents hazards when handling and storing that are not present with traditional oil bunkers. If LNG is spilled onto a hull the cold can shatter steel, for instance. The liquid is constantly boiling, and so the methane must be used relatively constantly to avoid methane being vented through pressure release mechanisms. Whilst there are not the same pollution risks associated with an LNG spill LNG handlers require specialised training and storage tanks, pipes and hoses are specialised and expensive.

Supply to off-grid demand

Increased use of trucks to transport LNG will enable suppliers to tap into industrial and domestic gas demand in places which are not connected to gas grids, such as Sardinia. Plans are underway for the construction of an LNG terminal and distribution facility, which will be located in the Port of Oristano, (on the west coast of Sardinia) with completion targeted for 2017. It will be the first coastal LNG service facility and bunkering station in the Mediterranean. The LNG will be delivered to the terminal via LNG tankers, and then distributed to customers by pipeline and trucks.

DEFSA, in its recently approved ten-year investment plan, included a number of initiatives for the development of special loading facilities at the country’s existing LNG import terminal in Revithoussa islet close to Athens. It is currently being upgraded and when operational will allow for the loading of small LNG vessels and trucks. The aims are to promote the use of LNG as marine fuel in smaller satellite ports around the country and to be able to supply consumers in areas currently detached from the existing gas grid. These initiatives also form part of the Project Poseidon Med II project mentioned above.

Company focus: Stolt-Nielson

Stolt-Nielson has taken an active interest in the Port of Oristano terminal (see above) as represented by a 10 per cent stake in the facility and plans to order between two and four 7,500m3 vessels to supply it. This forms part of its strategy for taking a share of the LNG market by focussing on stranded demand. Part of the deal also includes an option to acquire a further 80 per cent stake in the project, although a decision on exercising this has been postponed to end Q2 2016 as a direct result of the low commodity price environment in which they are currently operating. In June 2015, Stolt-Nielsen and Golar LNG announced plans to establish a 50/50 joint venture aimed at developing opportunities in small-scale LNG production and distribution.

Commercial structuring and financing

Most small scale receiving terminal projects currently under consideration have much more in common with downstream distribution businesses than with the larger scale LNG terminals that we have seen in the past. The capital investments for small scale LNG terminals are significant, but not on the same sale as other elements of the LNG chain, which will likely result in lenders having less influence in the structuring of the project. We anticipate that this may well be an area where we see new players coming into the industry with new commercial models. Some investments, particularly in the infrastructure, may be very attractive to pension funds and sovereign wealth funds looking for stable revenues. In relation to those assets we are likely to see tolling agreements used. The big issue, as with any new business model, is the question of who will take the risk while the concept is first tested. As in the case of other distribution businesses the siting of distribution hubs and development of new technologies will be important (and potentially disruptive).

Permitting

In many markets, particularly in Europe, a lot of work has already been done to establish appropriate regulation of the LNG distribution and LNG bunkering industries. Whilst arguably the risk of a catastrophic accident involving LNG is less likely than other petroleum products that are already distributed by land and sea (such as gasoline and LPG) with relatively little issue, regulators are still contemplating what is appropriate HSSE regulation for these new businesses. However, this ‘chicken and egg’ situation – where investors are unwilling to make investments in infrastructure if they don’t know what regulations they will need to comply with, and regulators are loath to introduce regulation until they understand what the industry is doing – appears to be edging closer to resolution.

Conclusion

Despite the low prices and market uncertainty, this is an exciting time for small scale LNG projects. As the drive for cleaner fuel gathers pace and energy companies seek to both expand and diversify their LNG businesses, investors are becoming alive to the possibility of growth in this area. LNG has become increasingly cost competitive and as the move towards a carbon-neutral economy gains momentum, the demand for small scale LNG and the related infrastructure required can only increase. What remains to be seen is whether any unity of pricing for LNG can be achieved across Europe, the US and Asia, and whether, or rather how, the crash in oil prices will further affect the financial decisions taken in this fledgling industry. As Donald Rumsfeld famously said, we are faced with a series of ‘known unknowns’ in this market, but what can be said for certain is that the traditional profile of LNG projects is changing and some interesting times lie ahead.

Recent publications

Subscribe and stay up to date with the latest legal news, information and events . . .