Introduction

On June 18, 2020, the Pensions Regulator published some new interim guidance for those setting up and running a DB superfund.

The guidance sets out the standards the Regulator expects to be met in the period before the legislative framework is in place.

Superfunds must clear a high bar before they can transact but, as the interim regulatory regime comes into force immediately,

superfunds will now be able to seek the Regulator’s approval and embark on their first transactions. As the superfunds market

is evolving, the Regulator envisages developing this guidance accordingly, and providing further detail in certain areas over the

coming months.

1. Why has the Regulator released this guidance now?

The development of DB consolidators in the market generated

considerable diversion of views, including between government

departments. These models have attracted some criticism

and contention over the last few years but one unforeseen

consequence of the COVID-19 pandemic appears to be its

ability to expedite long awaited guidance and legislation.

The DWP’s consultation on superfunds closed on February

1, 2019, and the Regulator published its response (and its

guidance) over a year later on June 18, 2020. The consultation

looked at the potential issues surrounding the consolidation of

DB schemes into superfunds, in order for them to benefit from

improved funding, better security for members, economies

of scale and better governance. DWP has not yet issued

a response to their consultation and it is not clear when a

legislative framework dealing with DB consolidators will be

introduced. The Pensions Bill 2019-2021 does not currently

deal with this topic and whilst the Regulator acknowledges

that the existing legislation does not specifically cater for

DB consolidators, it considers that superfund models can

exist within the current legislative framework. The Regulator

is supportive of the DWP’s intentions to ultimately legislate

for an authorisation and supervisory regime but in the short

to medium-term, the Regulator wants to clearly set out in

the guidance its own expectations for any consolidation

transactions intending to proceed in the interim period. During

this interim period, the Regulator wants a high degree of

certainty that a superfund will be able to pay 100 per cent of

member benefits so expects to be involved in any transactions

via its clearance procedure.

2. What is a superfund?

The guidance describes a superfund as a consolidation of DB

schemes, run on a commercial basis. They will be privatelyfunded

enterprises, and investors will expect to achieve a

return on funds they put at risk in the capital buffer. This

can be achieved by replacing the scheme employer with a

special purpose vehicle (usually to preserve the scheme’s PPF

eligibility) or it may involve replacing the scheme employer’s

liabilities with a new employer, backed up by the introduction

of investor capital (alongside a contribution or premium paid by

the employer of the scheme).

Consolidator schemes are typically formed by a bulk transfer

of the transferring scheme’s liabilities, members and assets to

the consolidator (usually from various unconnected transferring

employers). The consolidator will usually have its own

governance and administration processes and normally there is

one trustee board.

3. What type of schemes are likely to consider transferring to a superfund?

DWP’s consultation set out a “gateway” test requiring

that schemes which could afford a full buy-out within the

foreseeable future (i.e. three to five years) should not be

considering consolidation. The Regulator’s guidance is

consistent in that it suggests that schemes with the ability to

buy out within the relatively near future (“for example, in the

next five years”), should not be accepted by a superfund.

Considering a transfer to the superfund might be particularly

appropriate for schemes which are relatively well-funded (in

that they can afford to transfer into a superfund) but have

relatively weak employer covenants. The addition of upfront

contributions and investor capital could improve the funding

of these schemes and remove the risk of the employer

covenant deteriorating.

The current economic uncertainty resulting from COVID-19

might increase the number of schemes for which superfunds

might be viewed as an attractive option. For example,

employers facing a possible insolvency event where it can

afford to secure benefits that exceed PPF compensation but

cannot afford to buy out benefits in full.

A transfer to a superfund (and consolidation more broadly)

could also be beneficial for smaller schemes, which tend to be

less well-governed and could benefit from economies of scale

and access to a wider range of investment opportunities.

4. What requirements must be met by the superfund during the interim period (before any transactions will obtain clearance)?

To achieve a sufficient level of member protection, superfunds are expected to comply with a range of requirements:

| Capital requirements, based on: |

Extraction of value requirements, based on: |

Investment and governance, based on: |

- The scheme’s technical provisions.

- The amount of additional risk-based capital the superfund is required to hold in the capital buffer.

- The legally enforceable triggers a superfund should put in place

|

- Limiting the extraction of profit from the superfund (initially no surplus value should be extracted for three years).

- Monitoring and reporting on the fees and expenses of the superfund.

|

- The guidance sets out eight investment principles, including investing (on a comply or explain basis) the capital buffer in line with the principles underlying the pensions investment regulations, maximum allocations to the total issuance of a security and to single securities and issuers.

- Limits apply on the levels of illiquid assets that can be held.

- Assets transferring to the superfund scheme or capital buffer need a transition plan in place to meet these limits usually within a 12-month period.

- Governance requirements intended to provide assurance that those running the superfund are fit and proper, as well as ensuring adequate systems and processes are in place for the superfund to run effectively.

|

| |

|

|

5. What conditions must be satisfied for an individual transfer to obtain clearance?

Under the new regime, transferring employers will sever their

liabilities to the DB pension scheme. This severance will be

a new Type A event and employers proposing to transfer will

need to obtain clearance by showing that the arrangement is:

- Capable of being supervised by the trustees.

- Run by fit and proper persons with effective governance

arrangements in place.

- Financially sustainable and with adequate contingency

plans in place to manage funding level triggers as well as to

ensure an orderly exit from the market.

- Run effectively, with sufficient administrative systems and

processes in place.

As part of the clearance process, the Regulator will assess

whether any detriment to the scheme has been adequately

mitigated and consider whether the scheme could achieve

a better outcome through other means. A transfer will only

proceed where any top-up payment or other mitigation agreed

as part of the transfer into the superfund will mitigate this

detriment fully.

6. What is the capital buffer and why is it required?

The scheme employer is to be replaced by either an employer

which is a special purpose vehicle (preserving the scheme’s

PPF eligibility), or by an employer backed with a capital

injection to a capital buffer (generally created by investor

capital and contributions from the original employers).

The capital buffer replaces the transferring employer’s covenant

and, while it is not an asset of the pension scheme, it forms part

of the longer-term security of the scheme and can be called

upon by the trustees of the scheme in specified circumstances.

Trustees of some superfund models will only gain control of the

investment strategy of and/or the assets in the capital buffer

(or the share of the capital buffer appropriate to their section)

in the event that funding level falls below certain funding level

thresholds (see question 7 below).

The Regulator regards the superfund’s capital buffer as a proxy

for the employer covenant. One of its key aims for the interim

period is to ensure a high degree of certainty that members’

benefits will be paid, thus the overall level of funding and capital

required is fundamental.

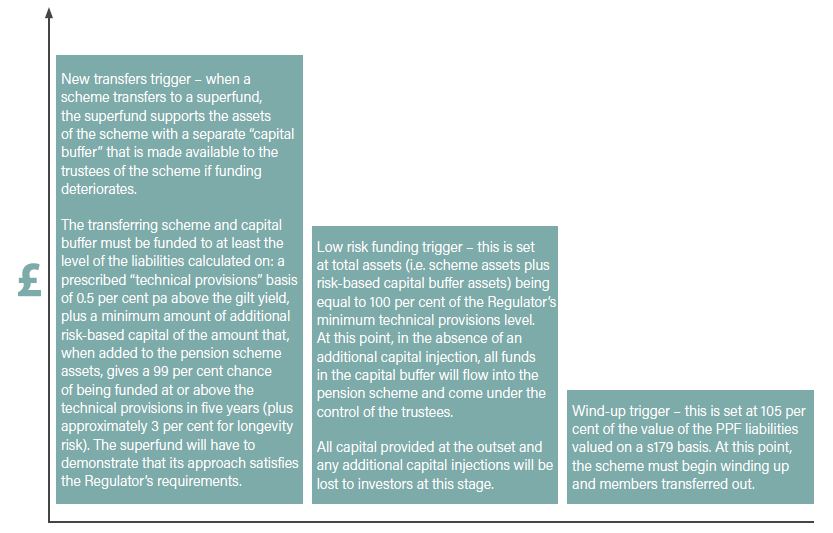

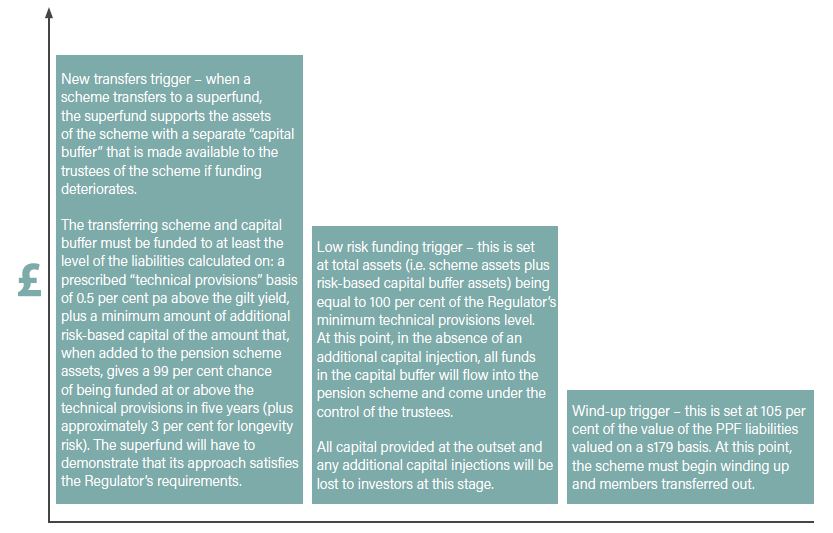

7. What are the capital adequacy triggers?

The superfund will include the following triggers if capital falls below certain levels.

Superfunds should also identify any other events that may trigger (a) the commencement of the wind-up of the pension scheme

superfund; or (b) it being left to run-on without the support of the corporate entity and/or capital buffer.

8. What are the rules in relation to value extraction during the interim period?

The Regulator recognises that the “management for profit”

motive is outside the normal DB scheme concept. During this

initial period, as different models and structures emerge, the

Regulator believes that superfunds should not extract funds

from the scheme or the capital buffer unless members’ benefits

are bought out in full.

This will help to ensure that the incentives for those running

superfunds are aligned with members and to limit the potential

for excessive risk-taking.

A review of this profit extraction position is to be conducted within

three years of this framework being published. The review will be

informed by both the experience to date of the operation of the

superfund regime and by any DWP policy developments.

Surplus value in the scheme or capital buffer should not be

used as capital to support new transfers into a superfund, and

all transfers should be able to meet the capital adequacy test

on a “standalone” basis.

In response to concerns that superfunds might try to extract

capital by the back door (for example, by charging higher than

standard fees), the Regulator has also included a requirement

for any fees, costs or charges to be justifiable. There are no

prescriptive limits on fees but the guidance sets out key principles

to follow (including that these charges should be no higher than

equivalent “market prices” and all success or transaction fees

should be disclosed to all parties prior to transfer).

Fees, costs and charges will need to be monitored on an

ongoing basis and the superfund trustees need to regularly

demonstrate to the Regulator that they are getting value for

money for the services they commission.

Robust provisions are also required to ensure the capital buffer

is not subject to value leakage and will be available to the

pension scheme if it is needed.

9. What information is required by the Regulator?

Companies considering a transfer to a superfund can expect the Regulator to request information about four key areas to ensure a

smooth transition:

| Supervision |

Governance |

Capital requirements |

Administration |

| Evidence will be required to show that the superfund is capable of being supervised. Funds themselves will need to be registered with HMRC and be able to explain why the fund is eligible for the PPF. Superfunds will be expected to provide prospective transferring employers and trustees with full and transparent details of their offering, their associated fees, their funding and investment objectives, and their methods for achieving their objectives. |

The superfund must be run by fit and proper persons and have effective governance arrangements in place. The Regulator expects those carrying out certain key functions to be able to demonstrate that they have the right level of knowledge, skills and experience to carry out their role as well as “an appropriate level of propriety”.

|

The superfund must be financially sustainable and have adequate contingency plans in place to manage funding-level triggers as well as to ensure an orderly exit from the market. It will be required to be funded on a prudent basis and have a capital buffer. |

The superfund must have sufficient administrative systems and processes in place to ensure that it is run effectively. |

| |

|

|

|

10. What areas are we expecting the Regulator to issue further guidance on?

Further guidance is expected on capital buffers, enforceability

provisions, administration, transfers out, reporting requirements

and data security issues. More detailed guidance is also

expected specifically for trustees and employers that may be

considering a transfer to a superfund.

11. How does the guidance differ from the proposal in DWP’s consultation?

The transferring scheme and capital buffer must be funded to

at least the level of the liabilities calculated on the prescribed

“technical provisions” basis described in question 7 above (new

transfers trigger). This has changed from the 2018 consultation

proposal which suggested that the scheme assets plus capital

buffer combined should at least be equal to an estimate of the

buy-out price (producing a 1-in-100 Value at Risk (VaR) over a

one-year period).

The Regulator’s response to the consultation outlines various

reasons for moving away from this basis, including:

- Concerns that the level of capital required may be set too

high for a superfund market to develop.

- That aligning the proposals to a buy-out figure (and setting

intervention triggers on that basis) could mean superfunds

would be investing in the same limited pool of assets as

insurance companies, affecting availability and price.

- It might be difficult to obtain an accurate assessment

of the buy-out price on an ongoing basis in practice

(as insurance companies have no obligation to disclose their

pricing bases).

A key safeguard introduced by the guidance is that no capital

will be permitted to be withdrawn during the interim period

unless the scheme benefits are bought out in full with an

insurer. This will be reviewed within three years. Various other

changes to the original consultation proposal have been made,

particularly in relation to the investment principles.

12. What has the reaction been from the industry in general?

The guidance has generally received a positive reaction

from the industry in that it aims to provide an opportunity for

a viable market in DB consolidators during a period when

many businesses are attempting to deal with the economic

consequences resulting from COVID-19. Superfunds are

widely seen as having the potential to strengthen the security

of millions of DB savers whose sponsoring employers face an

uncertain future. The pandemic may create a new category of

schemes for which a transfer to a superfund might be a prudent

option to consider.

The guidance appears to be seen as a real step forward for

superfunds and innovation in the sector. Indeed, Clara-Pensions

and The Pension Superfund have both welcomed the guidance.

However, the Regulator needs to tread carefully between

ensuring sufficient member protection whilst allowing enough

flexibility for a commercially viable superfund framework.

The guidance has received some criticism, particularly in

relation to the rule against profit extraction in the interim

period which has been branded as too cautious. In contrast,

the severing of the employer link without the security for

members of a regulated insurance company has been criticised

(particularly by some unions and insurers).

Whether the guidance will have the intended effect of giving

trustees and sponsors the confidence to embark on the

first superfund transactions remains to be seen, but it reemphasises

that the Regulator clearly sees a role for the

superfund model as part of pension scheme ‘endgame’

planning. In particular, it may be of interest to schemes who

find themselves stuck between their current position and a

seemingly unattainable insurance solution and it is anticipated

that the guidance may also lead to greater consideration of

other types of DB consolidation (for example through new

insurance products entering the market or other forms of

capital backed journey plans).

If you require any further information or assistance with any

of the above, your Norton Rose Fulbright pensions adviser is

always happy to help.