This update delves into the latest corporate governance and disclosure trends and our recommendations for the upcoming proxy season. In 2025, directors will need to navigate a complex landscape marked by geopolitical and macroeconomic uncertainties. Striking the right balance between conflicting trends, stakeholder expectations, and regulatory requirements will be crucial.

How far will the ESG pendulum swing back?

Environmental Claims: Meeting Disclosure Expectations while Avoiding Potential Liability

On June 24, 2024, new greenwashing provisions under the Competition Act1 came into force with the passing of Bill C 59, confirming that potential greenwashing continues to be an enforcement priority. More precisely, such provisions prohibit:

- for product-specific environmental representations, any “representation to the public in the form of a statement, warranty or guarantee of a product’s benefits for protecting or restoring the environment or mitigating the environmental, social and ecological causes or effects of climate change that is not based on an adequate and proper test” (subparagraph 74.01(1)(b.1) of the Competition Act); and

- for business-wide environmental representations, any “representation to the public with respect to the benefits of a business or business activity for protecting or restoring the environment or mitigating the environmental and ecological causes or effects of climate change that is not based on adequate and proper substantiation in accordance with internationally recognized methodology” (subparagraph 74.01(1)(b.2) of the Competition Act).

There has been much uncertainty around such provisions, including the meaning and implication of the terms “adequate and proper test” and “internationally recognized methodology,” as they are not currently defined under the Competition Act. The Competition Bureau is currently conducting a public consultation on proposed guidelines related to these new provisions, with feedback due by February 28, 2025.2 The proposed guidelines do not prescribe when or how businesses can make environmental claims. Rather, they clarify key concepts and terms used in the new provisions and outline a set of six principles to help companies assess whether their environmental claims are in line with the Competition Act's requirements.

Importantly, the proposed guidelines clarify that the Competition Bureau will likely consider a methodology to be “internationally recognized” if it is recognized in two or more countries. It remains to be confirmed whether mandatory disclosure standards (which may be issued by the Canadian Securities Administrators (CSA) and adopted at the provincial and territorial levels) or voluntary ones issued by bodies such as the Canadian Sustainability Standards Board (CSSB) (discussed below), will be recognized as “internationally recognized methodologies” that companies can rely upon when making business-wide environmental claims.

Also importantly, the proposed guidelines state the Competition Bureau's focus is on marketing and promotional representations made to the public, rather than representations made exclusively for a different purpose, such as to investors and shareholders in the context of securities filings. It will be interesting to see whether this guidance will dampen the “greenhushing” phenomenon we are observing since the coming into force of the greenwashing provisions, as discussed in our recent legal update.

In all cases, as mentioned in the proposed guidelines, one should remember that such guidelines represent the Competition Bureau’s own views and are not binding on the Competition Tribunal or on private applicants who may bring a case to the Competition Tribunal.

Businesses found violating deceptive marketing provisions could face significant penalties. These may include orders to cease the conduct, corrective notices, and/or administrative fines that can represent up to 3% of a business’s worldwide revenues. Currently, the Competition Tribunal can order restitutionary damages, but this remedy only applies to the general false or misleading in a material respect provision (subparagraph 74.01(1)(a) of the Competition Act). However, it is likely that private applicants will bring claims under the new anti-greenwashing provisions and this general provision at the same time.

Climate-Related Reporting: What’s Next?

With voluntary climate-related reporting standards maturing and regulators aligning their approaches, the stage is set for major regulatory changes in 2025.

Canadian Reporting Issuers

In June 2023, the International Sustainability Standards Board (ISSB) issued its first two sustainability standards, IFRS S1 and IFRS S2, which deal with general requirements for sustainability disclosure and climate-related disclosure, respectively. While remaining entirely voluntary in Canada, IFRS S1 and S2 became effective for annual reporting periods beginning on January 1, 2024, with earlier application permitted. Throughout 2024, the ISSB held multiple meetings on the implementation of these standards and is now working on producing educational and capacity-building content3.

On December 18, 2024, the CSSB published the “Canadianized” version of the ISSB standards, the Canadian Sustainability Disclosure Standards (CSDS). The resulting CSDS S1 (general requirements) and S2 (climate-related disclosure) remain consistent with IFRS S1 and S2, except for the timing of disclosure obligations, as CSDS S1 and S2 include transitional reliefs for some of the more burdensome requirements4. As with IFRS S1 and S2, the CSDS are voluntary standards in Canada although they have now been incorporated into the CPA Handbook – Sustainability.

Now that the CSDS are finalized, the CSA anticipates a new round of public consultation on a revised version of a climate-related disclosure rule5. We should note the CSA also mentioned it is monitoring and assessing international developments, including the United States Securities and Exchange Commission’s (SEC) climate-related disclosures rules introduced on March 6, 2024, and currently stayed pending litigation6. The CSA has indicated that any CSA rule will be focused on climate disclosure and not broader sustainability disclosure. CSDS 2, which deals with climate-related disclosure, will need to be properly incorporated into a CSA rule that is adopted by the securities regulators before it becomes mandatory for Canadian public companies.

Several TSX 60 companies are preparing for the coming changes: 36.6% of major Canadian issuers mentioned they were tracking the evolution ISSB standards, or even taking active steps to begin complying with them, in their last sustainability (or similar) reports. In the meantime, the proportion of issuers that comply with other globally recognized voluntary disclosure frameworks maintained its steady growth over the past year:

|

Voluntary disclosure framework

|

Proportion of TSX 60 issuers that report in accordance with the voluntary framework

2022 2023 2024iii

|

|

Task Force on Climate-related Financial Disclosures (TCFD) or International Sustainability Standards Board S1/S2 (ISSB)

Sustainability Accounting Standards Board (SASB)

Global Reporting Initiative (GRI)

|

75.0%i

80.0%

75.0%

|

75.0%ii

88.3%

81.7%

|

78.6%

92.9%

83.9%

|

i Including four issuers in the process of adopting the TCFD framework.

ii Including one issuer in the process of adopting the TCFD framework.

iii Data for 2024 was compiled for 56 issuers, as four issuers opted not to publish sustainability (or similar) reports in response to recent changes to the Competition Act.

Financial Institutions

The Office of the Superintendent of Financial Institutions (OSFI), which is responsible for supervising federally regulated financial institutions and pension plans, published Guideline B-15 in March 2023. This instrument sets out OSFI’s expectations of federally regulated financial institutions in managing climate-related risks. Guideline B-15 includes requirements for climate-related disclosure that are aligned with the TCFD/IFRS disclosure model and focus on governance, strategy, risk management, and metrics and targets. Depending on the institutions, some requirements became effective for the fiscal year ending in 2024, while other requirements will come into force in relation to fiscal years 2025 and 2026.

As discussed in our recent legal update, provincial and territorial regulators can impose climate disclosure obligations on financial institutions subject to their jurisdiction. In Quebec, the Autorité des marchés financiers (AMF, Quebec’s financial sector regulator) published the final version of its “Climate Risk Management Guideline” on July 4, 2024. The guideline puts in place a timeline, which starts applying to financial institutions for their fiscal year 2024 or 2025, depending on how they were categorized by the AMF.

Federal Private Corporations

As discussed in our recent legal update, the Canadian federal government announced in October 2024 its intention to amend the Canada Business Corporations Act7 (CBCA) to introduce mandatory climate-related financial disclosure for large, federally incorporated private companies. This intention was confirmed in the recently published 2024 Fall Economic Statement. No information on timing, process, company size thresholds or substantive requirements has been released at this time.

Preparing for Year 2 of Modern Slavery Reporting

Canada’s Fighting Against Forced Labour and Child Labour in Supply Chains Act8 (commonly referred to as the Modern Slavery Act) came into force last year. For a detailed overview of the Modern Slavery Act and its related reporting requirements, you can access our earlier update.

In November 2024, following its review of the first reporting year during which more than 5,650 entities published a modern slavery report, Public Safety Canada amended its guidance in an attempt to clarify some key interpretative questions. As further discussed in our recent legal update, the amendments clarify which organizations are required to report under the Modern Slavery Act, as well as the scope of the reporting requirements. In preparing for year 2, organizations should consider whether they are required to report under the amended guidelines, as well as the steps they can take to reduce the risk that forced labour or child labour is used in their supply chains or operations. Reporting entities may also wish to consult the key findings from our review of reports submitted during year 1. Finally, organizations that fell short or were slightly above the relevant financial thresholds in 2024 should reevaluate the necessity to publish a modern slavery report, especially after a significant acquisition or disposition.

Navigating DEI Through the Anti-Woke Movement

In recent years, in the wake of George Floyd’s death and the subsequent Black Lives Matter protests against racial inequity in 2020, many companies worldwide increased their commitments to diversity, equity, and inclusion (DEI). This period also saw a surge in shareholder proposals related to DEI being submitted to companies.

In Canada, this social movement coincided with heightened disclosure obligations relating to diversity for distributing corporations governed by the CBCA. Since January 1, 2020, these corporations have been required to provide shareholders with information about the representation of four designated groups—women, Indigenous people (First Nations, Inuit, and Métis), members of visible minorities, and people with disabilities—on their boards of directors and among senior management.

Since then, there have been incremental increases in the representation of designated group members on both boards of directors and senior management teams as well as a growing trend among distributing corporations to adopt written policies addressing the identification and nomination of members of designated groups for director roles.9

More recently, however, according to Corporation Canada’s 2023 annual report on the diversity of boards of directors and senior management of corporations subject to such disclosure obligations, slight declines were identified as compared to 2022, including as they relate to the number of board seats held by members of visible minorities (from 6% to 5%), the number of distributing corporations that set targets for women (from 23% to 22%) and visible minorities (from 5% to 4%) and the number of distributing corporations that considered the level of representation of women on their boards (from 70% to 69%) and on their senior management teams (from 66% to 64%) when identifying candidates. Recent trends also indicate a decline in average shareholder support for DEI proposals in Canada.10

Such declines are occurring against the backdrop of a growing anti-woke movement south of the border, with some of the largest companies retreating from their DEI programs in the face of vocal critics who dismiss DEI as a “woke agenda.” DEI disclosure obligations in the United States are also facing mounting legal heat. Indeed, on December 11, 2024, the US Court of Appeals for the Fifth Circuit struck down the Nasdaq board diversity disclosure rules, holding that the SEC lacked the statutory authority under the Exchange Act to approve the rules. As such, Nasdaq-listed companies will no longer be required to comply with the rules. Nasdaq has indicated it will not appeal the decision. A copy of the decision can be found here.

While the full impact of the anti-woke movement on Canadian boardrooms and senior management remains to be seen, it is important to note that disclosure obligations are still on the CSA’s agenda, with potential changes to diversity-related disclosure requirements being explored in an effort to work towards an updated harmonized national framework.11 Proxy advisory firms also continue to have expectations regarding minimum levels of board diversity. Refer to our earlier update here.

Recommendation: Consider engaging with your company’s stakeholders to make an informed decision as to where the company should be for ESG objectives and disclosure. In doing so, keep in mind upcoming regulatory developments and potential liability under new rules regarding environmental-related claims.

Cybersecurity and AI: emerging trends and expectations around board oversight

Cybersecurity

Cybersecurity threats remain a top priority for companies as the frequency and costs of attacks continue to escalate, with the global average cost of a data breach soaring to USD $4.88 million in 2024.12 Against this backdrop, boards are increasingly expected to exercise broad oversight over cybersecurity risks and mitigation strategies, including by keeping informed of material cybersecurity risks and allocating appropriate resources to prevent them. Since 2023, Glass Lewis expects all companies to provide disclosure on the board’s role in overseeing issues related to cybersecurity and the steps taken to properly educate directors on the topic. In the same spirit, a new criterion was added to the Globe and Mail’s Board Games methodology in 2024 measuring how companies describe the consideration given by their boards to cybersecurity or technological risks, with top marks being given to companies that identify board committees for overseeing such risks, particularly if they regularly review strategy, risk management and operating performance.13

AI

While the development and deployment of artificial intelligence (AI) is progressing at TSX 60 companies, we are seeing emerging trends in board oversight over AI. About half of TSX 60 companies (32/60, 53%) refer to AI in their 2024 management proxy circulars. The most common disclosure relating to AI concerns the education of board members, with 24/60 (40%) of TSX 60 companies disclosing presentations or workshops having been given to directors on the topic.

However, many issuers have moved past mere education on the subject. About a third (19/60, 32%) of TSX 60 companies have incorporated board oversight over AI in their board mandates. A smaller number (6/60, 10%) has delegated the responsibility of AI oversight to a single board committee (whether the risk management committee, the audit committee or the corporate governance committee, for example), while one company disclosed it has multiple board committees overseeing AI.

Of note, Glass Lewis dedicated a new section of its 2025 benchmark policy guidelines to the topic of board oversight of AI, much as it did in its 2023 benchmark policy guidelines for cybersecurity.14 Glass Lewis believes issuers that use or develop AI technologies should adopt strong internal frameworks that include ethical considerations and ensure effective oversight of AI, and expects clear disclosure on how boards are overseeing AI and expanding their collective expertise and understanding in this area. If there is evidence that insufficient management of AI technology has resulted in “material harm” to shareholders, Glass Lewis may recommend that shareholders vote against the re-election of accountable directors.

We further note that AI is on the CSA's radar. On December 5, 2024, the CSA released its Staff Notice and Consultation 11-348 – Applicability of Canadian Securities Laws and the Use of Artificial Intelligence Systems in Capital Markets15. The notice provides guidance on the applicability of securities laws to the use of AI and the considerations that market participants (including issuers) should take into account when using AI. Although the notice does not create or modify current legal requirements for market participants, the CSA is seeking comments on whether securities laws should regulate the use of AI in capital markets. Interested stakeholders can submit responses and feedback until March 31, 2025. For more information on the notice, please see our recent article.

Recommendation: Consider developing internal procedures and policies on how the board of directors or its committees should oversee cybersecurity and AI and provide sufficient and appropriate disclosure in that respect.

Taking the pulse on executive compensation

Keep Paying Attention to Pay-for-Performance

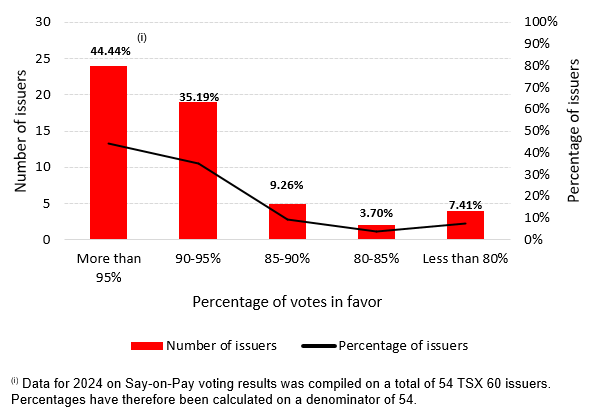

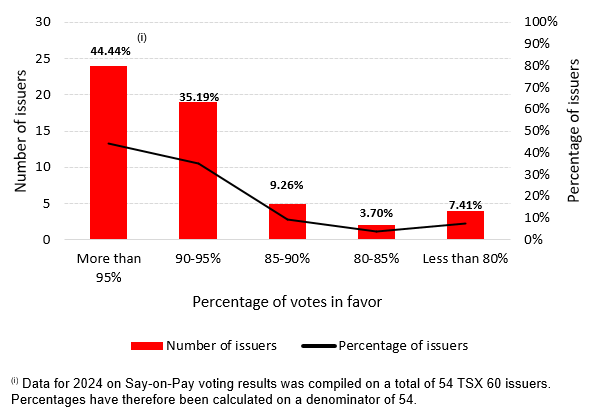

Say-on-pay resolutions garnered strong support in Canada in 2024, with approximately 93% of TSX 60 issuers surpassing the symbolic threshold of 80% approval, as illustrated in the graph below.

However, issuers should keep focusing on pay-for-performance, as this will remain a priority for leading proxy advisory firms. In that regard, ISS noted in its most recent benchmark policy guidelines that it will use, in exceptional circumstances, a non-CEO named executive officer’s compensation in its pay-for-performance evaluation, if doing so would provide a more appropriate basis for the alignment of pay-for-performance.

Similarly, Glass Lewis noted in its 2025 benchmark policy guidelines that, rather than utilizing a scorecard approach, it will review all factors related to named executive officer compensation, including the issuer’s stated rationale for particular pay decisions as well as the issuer’s ability to align executive pay with performance and shareholder experience. Glass Lewis has also augmented its list of problematic pay practices to include excessive perquisites and adjustments to performance results that lead to problematic pay outcomes.

ESG-Pay: Here to Stay?

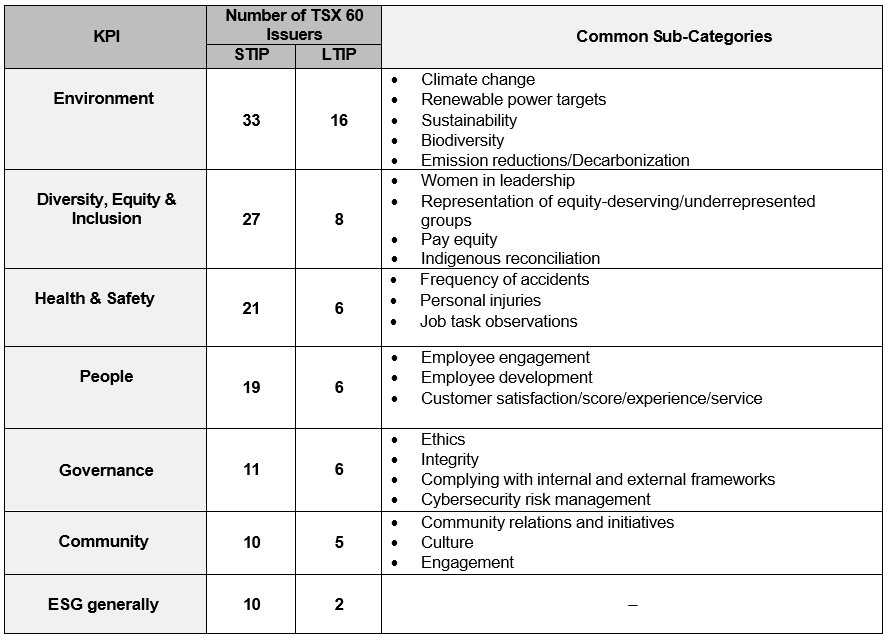

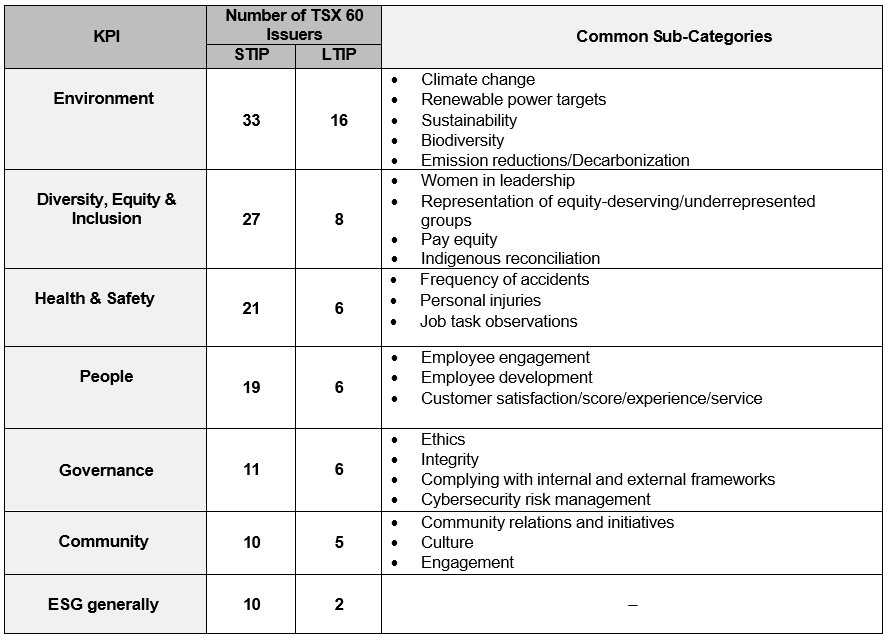

Despite the anti-ESG movement mentioned above, we expect ESG considerations in executive compensation will remain a focal point in 2025. Last year, the Board Games methodology was amended to include a marking criterion relating to the consideration of ESG and climate metrics in executive compensation16; top marks are attributed to issuers that disclose any measurable ESG metrics in either their short-term or long-term incentive plans (STIP, LTIP), with at least one of the metrics related to climate. There have also been multiple shareholder proposals filed advocating for including ESG metrics in the compensation of all employees.

Based on our review of the compensation discussion and analysis of TSX 60 issuers in 2024, 44 (73%) of them consider ESG measures in executive compensation to a certain extent, the same number of issuers as in 2023. Of such issuers, 41 (93%) consider it in their STIPs (39 in 2023) and 20 (45%) consider it in their LTIPs (16 in 2023). We further note that 17 issuers now consider ESG in both their STIPs and LTIPs, while there were 14 doing so in 2023.

ESG measures are included in executive compensation by virtue of key performance indicators (KPIs). As we pointed out in last year’s update, ESG-related KPIs can be considered on a “stand-alone” basis, as part of a scorecard, as a performance modifier or as a prerequisite to paying certain amounts.17 The most frequent KPIs related to ESG used for compensation purposes include the following:

Recommendation: Carefully select and analyze appropriate performance objectives. Ensure you sufficiently describe how executive compensation aligns with performance, including with respect to ESG factors.

Virtual vs. hybrid vs. in-person meetings: the debate continues

A continuing topic of debate is whether companies should hold their annual shareholder meetings virtually, in person or adopt a hybrid approach.

In 2024, a majority of TSX 60 issuers decided to adopt a virtual format for their annual shareholder meetings. If we consider hybrid formats, more than 84% of these issuers allowed attendees to participate online:

|

Meeting format

|

Proportion of TSX 60 Issuers who adopted the format

|

|

Virtual-only

|

53.44%

|

|

Hybrid

|

31.03%

|

|

In person

|

15.51%

|

Some issuers may consider moving away from virtual-only meetings in 2025, in the face of mounting pressures against such format. Indeed, in February 2024, the CSA highlighted that some stakeholders had concerns based on their experience participating in virtual-only shareholder meetings, while Glass Lewis stated in its 2025 benchmark policy guidelines that “virtual-only meetings [...] have the potential to curb the ability of a company’s shareholders to meaningfully communicate with the company’s management.” Both organizations stated that companies allowing solely online participation for shareholder meetings must ensure the level and quality of shareholder participation are comparable to what shareholders could reasonably expect if they were attending in person.

Glass Lewis has not yet set a benchmark policy voting recommendation based solely on meeting format and continues to expect clear disclosure as to how the issuer ensures shareholders’ ability to meaningfully participate in a virtual-only meeting format. It also expects issuers to actively engage with shareholders on this topic and to provide a rationale to shareholders if there is no in-person attendance option. For 2025, Glass Lewis has clarified in its benchmark policy guidelines that it may recommend shareholders vote against the chair of the governance committee in egregious cases where a board has failed to sufficiently respond to legitimate shareholder concerns regarding the meeting format.

In its 2025 benchmark policy guidelines, ISS clarified its position to vote against proposals to amend the company’s articles or bylaws to include a provision that grants discretion to directors to hold virtual-only meetings in the absence of compelling reasons. For further information, see our recent legal update on recent changes to ISS and Glass Lewis’ benchmark policy guidelines.

Throughout the year, many organizations representing shareholders have taken a stance against virtual-only meetings or expressed a clear preference for hybrid and in-person meetings. Similarly, the “Mouvement d’éducation et de défense des actionnaires” presented shareholder proposals in 2024 requesting companies to hold in-person annual meetings, with virtual meetings as a complement. Such proposal was voted on at the annual meetings of 13 companies and received majority support in seven cases. Finally, last year, the Board Games methodology was amended to include a new marking criterion whereby issuers can only obtain points if they hold annual meetings in a hybrid format.18

See our legal update from March 2024 for more details on annual meeting format recommendations.

Recommendation: Consider the pros and cons of various meeting formats in light of the evolving market sentiment and your stakeholders’ expectations.

The authors would like to thank Eden Bélanger, Lambert Girardin, Simon Létourneau and Véronique Parent, students, for their contribution to preparing this legal update.