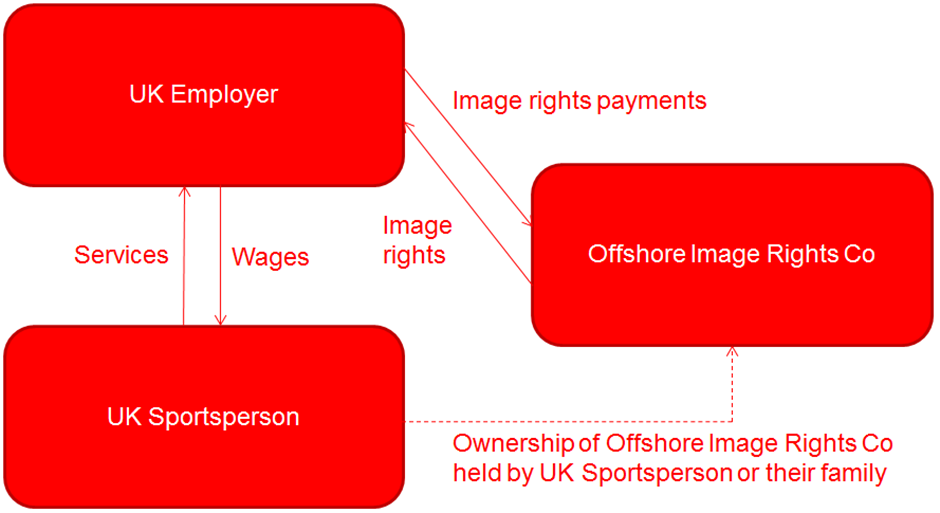

The leading case in this area is Sports Club plc and others v Inspector of Taxes [2000] STC 443 (the Sports Club Case). The Sports Club Case (which was anonymised) concerned payments to image rights companies. The Special Commissioners found that payments to the companies by the sports club, which held the image rights of two high profile football players, were, in principle, permissible. However this approach has been put in doubt by the Rangers Case, and subsequent guidance released by HMRC in August 2017.

Development 1: the Rangers Case

The Rangers Case makes it clear that employment income paid by an employer to a third party (irrespective of the location or type of third party used) remains taxable in the UK as income. It also made it clear that the courts could adopt a “realistic” approach when determining whether payments to a third party were in fact employment payments. Consequently, UK sportspersons, or sportspersons domiciled overseas, who are remunerated by a UK tax resident employer, may be taxed in respect of the entirety of their employment income, even where all or a proportion of that income is paid to a third party in respect of image rights (or indeed any other right or in respect of any other services provided by the sportsperson). For payments to image rights companies to be considered separate from the employment of the sportsperson, they must be just that – payments with clear commercial purpose which are definitively separate from that person’s role as an employee.

The Rangers Case concerned arrangements by which players were remunerated both via normal wages, and by certain payments made to a trust which would then loan those monies back to the players (directly or indirectly) at their instruction. Although the exploitation of image rights was not directly applicable or referenced in the case, the court took, and in future cases will take, a purposive approach in interpreting the relevant tax legislation. The effect of this approach, in practice, is that where payments are made which would otherwise be employment income, but fail to be so by virtue of the inclusion of certain steps which serve no clear commercial purpose, they are likely to be caught.

HMRC have subsequently released specific guidance on the taxation of image rights, and updated the HMRC Employment Income Manual. The guidance defines image rights, in the sports context, as likely to consist of various rights allowing for the exploitation of an individual’s name, likeness, trademarks etc. as well as public appearances. Depending on what constitutes the ‘image rights’ in each case, this revised guidance is likely to have a bearing on how HMRC look at the tax treatment of any payments made for their exploitation. The guidance also expressly states that HMRC considers the Sports Club Case as informative rather than having any precedent value because it was handed down by the Special Commissioners and did not proceed to the higher courts. In considering whether payments should properly be considered employment income, HMRC are therefore likely to consider each case on its merits, and refer to the Rangers Case where relevant.

Development 2: proposed new legislation

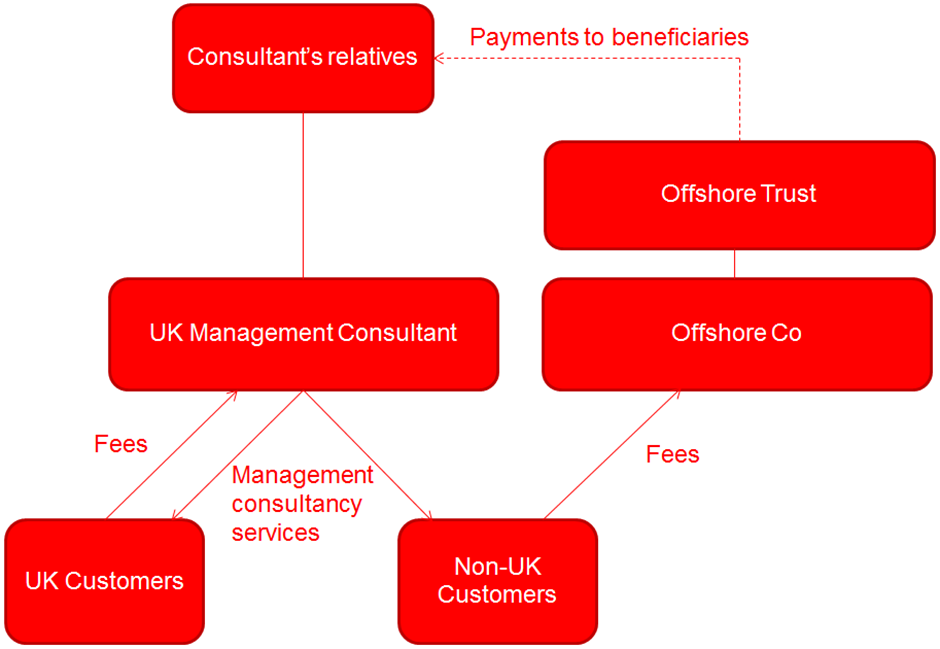

The consultation document published on 10 April 2018 details how the Government are seeking to target profits which are split, and at present are taxable in the hands of two separate persons, but which in substance derive from a single activity. The consultation provides examples of the kinds of arrangements it expects to catch under the proposed legislation, the most relevant being as follows:

Although the consultation does not reference the sports industry (the other example provided (in addition to the structure above) relates to architectural services provided by a sole trader), or image rights payments specifically, the proposed changes may catch these kinds of arrangements. The proposed legislation contains three conditions:

- profits arise which are attributable to the professional or trading skills of an individual resident in the UK (even if they are an employee);

- some or all of those profits end up in an entity which results in significantly less tax (approximately 20% less than under the applicable UK rate) being paid on them than would have been had they arisen to the individual only; and

- the individual, or a connected person, or someone acting together with the individual or the connected person, is able to enjoy economic benefits (whether directly or indirectly) from the alienated profits.

If each of these three conditions is satisfied, the legislation will only bite if a final condition is met: it must be reasonable to conclude that some or all of the profits of the entity which receives the alienated profits is excessive in relation to the profit-making functions it performs. This ‘excessive profits’ condition requires an examination of all the facts and surrounding circumstances of the arrangements. Where the UK individual does not report UK profits/losses, the profits are assessed as those of a free-standing trade.

The Government is also proposing a separate notification requirement and, where the legislation applies to the arrangements, this will result in an upfront payment of tax, removing any cash flow advantage otherwise available. The obligation to notify is set wider than the conditions of the offence itself so that HMRC can examine borderline cases. The current proposal is that the obligation to notify arises on satisfaction of conditions 1-3 above, with no requirement to meet the final condition.

It is possible that this proposed legislation could catch a situation where an employee has negotiated an amount in respect of remuneration with a club, and this is then split between direct earnings and payments to an offshore trust or corporate vehicle which (in practice) deals with amounts received at the employee’s wishes (either directly or indirectly). Whether HMRC intend to also use these proposed rules specifically in relation to image rights payments is not clear. Certainly, where such payments are in effect remuneration for the employee in respect of their services as a sportsperson, they may be caught. Where, however, it is clear that the payments are not derived from a single underlying activity, and the image rights company carries out a genuine commercial trade in its jurisdiction (as noted in the consultation itself), such arrangements should not come within the tax avoidance provision.