Introduction

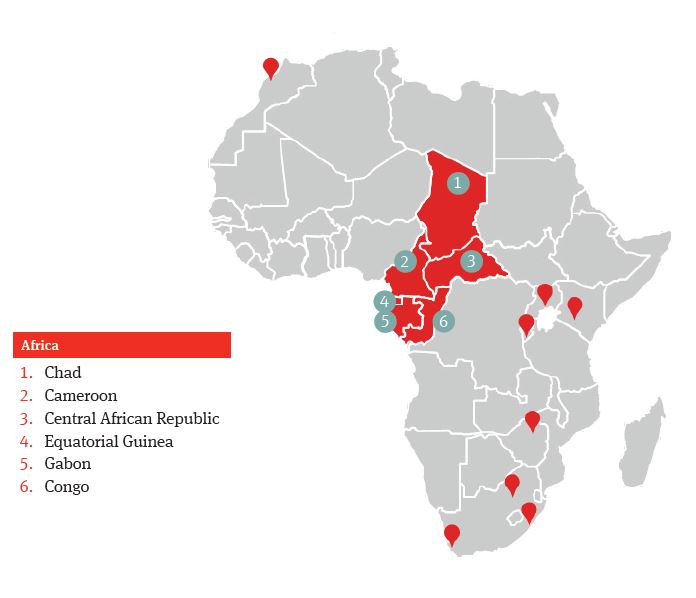

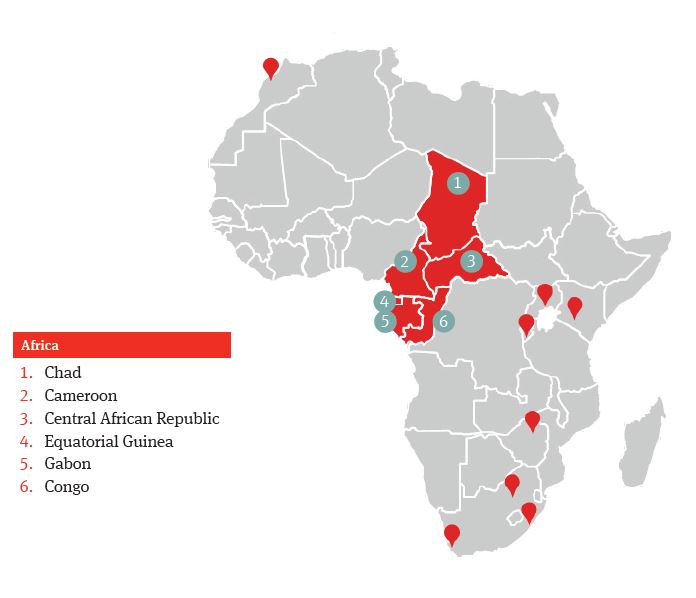

The new Currency Exchange Regulation nº02/18/CEMAC/UMAC/CM of

the Central African Economic and Monetary Community (CEMAC) (the New

CEMAC Currency Exchange Regulation) finally entered into force on

March 1, 2019 after several years of debate. It cancels and fully replaces

the former regulation nº02/00/CEMAC/UMAC/CM dated April 29, 2000

(the Former CEMAC Currency Exchange Regulation).

Following the sudden drop in oil prices during the second semester of

2014, a new regulation strengthening the currency exchange policy of

CEMAC region was called for among the CEMAC States and was debated

at governmental level since the 2016 Malabo and Youandé presidential

meetings. Built on the lines of the declarations made on June 27, 2018

by the Governor of the Bank of Central African States (BCAS) during the

10th Annual Concertation Meeting with the CEMAC Banking and Financial

Institutions regarding the alarming state of currency reserves in the CEMAC

zone, the New CEMAC Currency Exchange Regulation was finally adopted on

December 21, 2018.

In this context, the development and financing of any energy or infrastructure

projects in CEMAC member States (i.e. Cameroun, Central African Republic,

Republic of Congo, Gabon, Equatorial Guinea and Chad) will need to

take into account the provisions of the New CEMAC Currency Exchange

Regulation and more particularly the following matters.

The transfer, payment and settlement of routine business transactions are now subject to more stringent administrative control

(Article 6 of the New CEMAC Currency Exchange Regulation)

Any transaction for an amount above 1 million CFA Francs (i.e. approximately

1,500 Euros) per month and per entity remains free subject to evidencing the

origin of the funds to be transferred and the delivery of the documents requested

by the certified commercial banks (intermédiaires agréés) in order to prevent and

sanction money laundering and the financing of terrorism.

The opening of a current account in foreign currencies outside the CEMAC member States is now subject to an authorisation of the BCAS

(Article 41 of the New CEMAC Currency Exchange Regulation)

We note that the Former CEMAC Currency Exchange Regulation did not provide for any

provision in this respect.

Project financing is generally conducted on a non-recourse basis, meaning that the project

revenues generated locally in CFA Francs are the only source of repayment for the lenders.

Lenders are therefore very keen to secure such revenues and isolate them from a variety of

risks, including onshore bank credit risk, enforcement risk (in the case of project company

default), exchange rate risk, convertibility risk and transferability risk.

To minimize such risks, lenders usually require accounts to be opened offshore (for example

in Paris or in London) and operated in a way permitting monthly conversion of project

revenues into hard currency and transfer to such offshore accounts of the revenues not

required to pay local currency costs.

The new provision requiring BCAS authorization for the opening of such offshore accounts

means that the BCAS’s policies regarding the granting of such authorizations will be decisive

as to the bankability of international energy and infrastructure projects to be developed in

the CEMAC region.

The terms and conditions of the authorisation for the opening of a current account in

foreign currencies outside CEMAC member States are not clearly defined by the New CEMAC

Currency Exchange Regulation and this will need to be clarified as the payment of several

exportations (including Oil and Gas exportations) are usually subject to payments in US

Dollars and the opening of bank accounts outside CEMAC member States is often used in

energy or infrastructure projects.

The opening of a current account in foreign currencies inside CEMAC member States is now also subject to an authorisation of the BCAS

(Article 43 of the New CEMAC Currency Exchange Regulation)

Under the Former CEMAC Currency Exchange Regulation, this prerogative was granted to the

Ministry in charge of finance of each individual CEMAC member States. The new regulation,

requiring such authorisation to be granted centrally by the BCAS, demonstrates the more

stringent control that the BCAS intends to apply within CEMAC member States.

The terms and conditions of such authorisation are not clearly defined by the New CEMAC

Currency Exchange Regulation and this will need to be clarified. We particularly do not know

if entities already benefitting from an authorisation granted by the Ministry in charge of

finance in their own CEMAC member state pursuant to the Former CEMAC Currency Exchange

Regulation will need to request a new authorisation from the BCAS in accordance with the

New CEMAC Currency Exchange Regulation or whether they may continue to rely on the

existing “local” authorisation.

The obligation to repatriate exportation proceeds is maintained and no exception is provided

(Article 53 and seq. of the New CEMAC Currency Exchange Regulation)

The New CEMAC Currency Exchange Regulation provides (in line with the Former

CEMAC Currency Exchange Regulation) that exportation proceeds above 5 million CFAF

(i.e. approximately 7,622 Euros) must be repatriated within 150 days1 as from the exportation

date (you may recall that under the Former CEMAC Currency Exchange Regulation, operators had

30 days to comply with this obligation) into a certified commercial bank (intermédiaire agréé).

This is in practice burdensome and many foreign investors will probably consider as

unfortunate the fact that the promulgation of the New CEMAC Currency Exchange Regulation

did not afford the opportunity of introducing an exception (as the case may be subject to an

authorisation of the BCAS) to this mechanism.

We emphasise that each entity operating within the CEMAC region will have to comply with

the provisions of the New CEMAC Currency Exchange Regulation within six months as from

its entry into force. The exact consequences of the enforcement of the New CEMAC Currency

Exchange Regulation still need to be clarified (as this will depend on the manner in which the

New CEMAC Currency Exchange Regulation will be interpreted and implemented in practice)

but the clock began ticking on March 1, 2019.