Publication

Navigating international trade and tariffs

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Global | Publication | December 2018

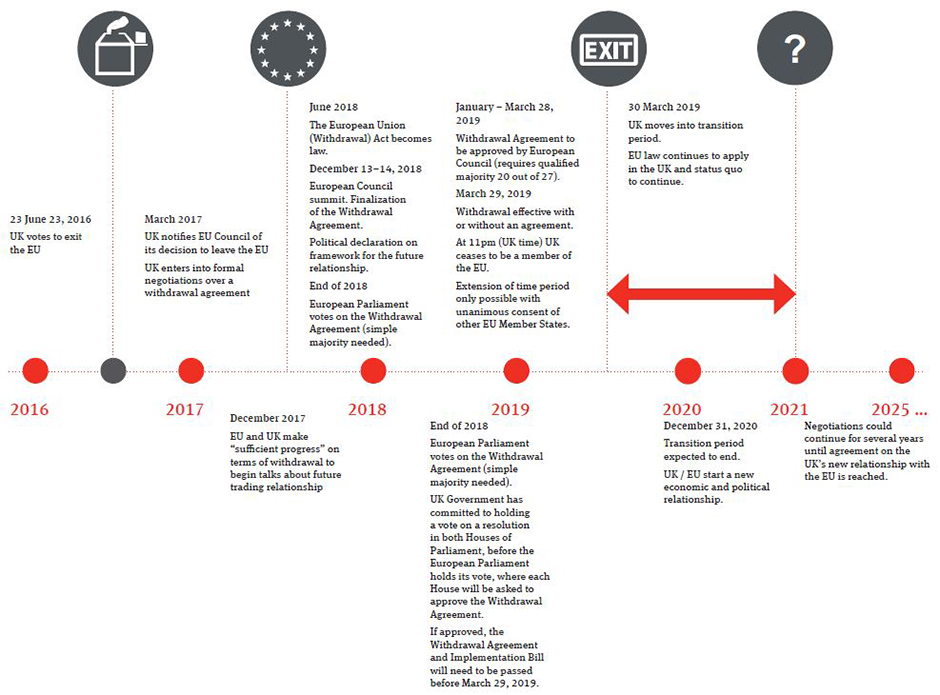

On March 29, 2017, the UK Government triggered Article 50 of the Treaty on European Union. In the 18 months since, we have seen red-lines, breakthroughs, bust-ups and backstops. As we near the climax of the negotiations on the terms of the UK’s exit from the European Union uncertainty remains acute for the European insurance industry, in which many groups conduct business on a cross-border basis. We set out below the “known knowns” and the “known unknowns” from an insurance regulatory perspective which contingency planners should take into account.

In the absence of unanimous agreement from all member states of the EU to an extension of the negotiating period, at 11pm on March 29, 2019, the UK will leave the EU (Exit Day).

The UK and the EU have negotiated the terms of exit (the Withdrawal Treaty). The Withdrawal Treaty includes the terms of an “implementation period” which would maintain the status quo until December 31, 2020 (the Implementation Period). Although the Withdrawal Treaty has political agreement there remains considerable doubt whether it will pass through Parliament. Accordingly, fears of a no-deal Brexit have mounted.

There is immense timetable pressure on these negotiations: the Withdrawal Treaty must be ratified by the European Parliament, a qualified majority of the EU member states at the European Council and the UK Parliament (which, under the European Union Withdrawal Act 2018, must also approve a framework on the future trading relationship between the UK and the EU). It has been widely considered that the Withdrawal Treaty must be agreed prior to the European Council summit on December 13–14, 2018 to ensure ratification prior to Exit Day.

Over £8 billion of premium is brought annually to the London market by brokers on behalf of European customers.1 Global insurance programs are frequently written out of the UK, covering UK, other EEA and non-EEA exposures. The biggest impact of Brexit on the European insurance industry is the likely loss of the passporting rights which enable such business to be concluded across the European Economic Area.

If the Withdrawal Treaty is not agreed prior to Exit Day, the United Kingdom will automatically become a “third country” under European law. As a result, UK (re)insurers will lose their existing authorizations to write or service (re)insurance business across the EEA or in respect of risks situated in the EEA on a freedom of services basis and/or freedom of establishment basis under the Solvency II Directive (2009/138/EC) and UK insurance intermediaries will also lose their similar rights granted under the Insurance Distribution Directive (2016/97/EC). European insurers and insurance intermediaries will likewise no longer be authorised to carry on regulated activities in the UK.

Regulated activities are not entirely consistent across the EEA due to variations in Member States’ implementation of EU law. However, broadly, they span the product cycle, from a broker arranging a policy on behalf of a policyholder and advising it on the terms of cover, to an insurer underwriting the cover, administering the policy by processing mid-term adjustments and ultimately settling and paying claims. In the United Kingdom, conducting regulated activities without authorization is a criminal offence, and this position is mirrored in many other European jurisdictions.

The European authorities and their UK counterparts are taking divergent approaches to the risks of a No-Deal Brexit.

The European Insurance and Occupational Pensions Authority (EIOPA) expects insurers to plan on the basis of a No-Deal Brexit, as set out in formal opinions dated December 21, 2017 and June 25, 2018.2 The position of EIOPA and the European Commission is that existing contracts will remain valid and 2 Opinion on service continuity in insurance in light of the withdrawal of the United Kingdom from the European Union, EIOPA-BoS-17/389, December 21, 2017;it is for businesses to take the necessary steps prior to Exit Day to prevent their insurance activities being undertaken without authorization and to ensure service continuity for existing contracts.

In response, many insurance groups, including the Lloyd’s market, which currently access the European (re)insurance market from the UK have or are in the process of establishing new European carriers prior to Exit Day, either to act as a new hub for European business or to act as a fronting insurer for their UK capacity (Brexit Vehicles).3

Many insurance intermediaries are also restructuring their operations to route EEA business through an existing or newly-established Brexit Vehicle within their group.

The extent to which these Brexit Vehicles can leverage existing UK capacity, expertise and governance structures varies from jurisdiction and is often subject to negotiation with the relevant local regulator. To pre-empt regulatory arbitrage amongst EEA jurisdictions competing for UK market business, EIOPA has published an opinion in July 2017 warning European regulators not to permit large-scale outsourcing of critical and important functions (such as underwriting and claims handling) where it would “deplete the corporate substance of the EU entities with repercussions on the adequacy of their management and on the effectiveness of supervision” by European regulators. EIOPA also indicate that there should be a minimum of ten per cent of the business written retained in the Brexit Vehicle. The implication is clear: letter-box entities will not be acceptable.

A number of insurers have also drafted “contract continuity” endorsements which would novate the policy to an EEA-licensed insurer in the event of a no-deal Brexit. However, there is a risk such clauses may on exercise trigger a requirement to undertake a court-sanctioned transfer of insurance business under Part VII of the Financial Services and Markets Act 2000, particularly where they novate exposures in existing contracts. Insurers, brokers and policyholders, should seek legal advice on such terms.

The current European approach to contract continuity has led many UK insurers to undertake a Part VII Transfer of existing policies relating to EEA-situated risks to a carrier licensed in an EEA jurisdiction. This process can take up to 12-18 months, and so there is a material risk that such transfers, unless commenced well in advance of a No-Deal Brexit, will not be completed prior to Exit Day.

The UK approach is conversely predicated on the assumption that “it will be difficult, ahead of March 2019, for firms on their own to mitigate fully the risks of disruption to financial services”.4 Accordingly, the UK Government has unilaterally committed to address the risks of a No-Deal Brexit for European insurers and insurance intermediaries operating in the UK through the implementation of a “Temporary Permissions Regime” (TPR). The UK Government has also agreed a commitment with the government of Gibraltar to agree measures for continued mutual market access for financial services. The FCA has announced that Gibraltar-based firms that passport into the UK will not need to use the TPR and will be able to continue to operate as they do now post-Brexit until 2020, when a bilateral framework will be put in place.

The TPR would allow European firms, subject to making a notification prior to Exit Day, to continue to write new business and service existing business in the UK for up to three years after Exit Day on the basis of their current passporting permissions. The PRA and FCA will allocate participating firms a three month period in which to submit an application for full UK authorization, known as “landing slots”.

Both the FCA and the PRA have published consultation papers on how they will regulate participating firms. Broadly, they intend to use temporary transitional powers to ensure that participating firms do not immediately need to fully comply with UK regulations applicable to third country firms (e.g., the localization of assets to meet branch solvency and minimum capital requirements).

The UK Government has also stated that it will make separate statutory provision for EEA firms which will not be establishing a UK branch to wind down their UK regulated activities, including any outstanding contractual obligations.

In light of the TPR, inbound EEA firms can plan with more certainty than UK insurers and insurance intermediaries. In the absence of political agreement with the EU on contract continuity, the choice faced by UK insurers upon a no-deal Brexit will be to “break the contract or break the law”. The Bank of England has suggested that up to 48 million European policyholders could be affected.5

The UK Government’s so-called “Chequers plan”, set out in the July 12, 2018 white paper, accepts that UK firms “can no longer operate under the EU’s ‘passporting’ regime”. The UK Government’s proposal for the Future Trading Relationship in financial services instead focuses on autonomous but aligned markets based on a principle of “expanded” equivalence. 6

As a first step, the UK Government has targeted recognition of existing equivalence under Solvency II. This concept of equivalence does not, however, primarily relate to market access. In addition, while the UK will be equivalent in practice on Exit Day, the formal adjudication process can be lengthy and highly political. In addition, while substantive changes to the UK regulatory regime appear unlikely, a future government could seek to create competitive advantage for the UK market by moving away from the Solvency II position.

The UK hopes that existing equivalence can be expanded to “the most mutually beneficial activities for the economy”. This is implied to include the London speciality insurance market. However, it is not clear what such equivalence would mean for market access given that the EU is unlikely to be receptive to any attempt to replicate the substance of passporting. The UK also wants any withdrawal of such access to be a structured process, with clear timelines and notice periods, and arrangements for contract continuity in the event that equivalence is withdrawn. However, the EU may be unwilling to offer additional rights to the UK on the equivalence process than it offers to currently equivalent jurisdictions, such as Bermuda and Japan. The UK’s request for formalized regulatory and supervisory cooperation, however, is unlikely to be controversial.

London Market Group "A Brexit Roadmap for the UK Specialty Commercial Insurance Sector" March 9, 2017.

Opinion on service continuity in insurance in light of the withdrawal of the United Kingdom from the European Union, EIOPA-BoS-17/389, December 21, 2017;

This is also an obligation upon (re)insurance undertakings in Article 41(4) and Article 46(2) of the Solvency II Directive.

Publication

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Publication

Norton Rose Fulbright South Africa is acting on behalf of the Helen Suzman Foundation (HSF) in its application to be admitted as an amicus curiae in the ongoing High Court litigation regarding the state’s failure to prosecute apartheid-era crimes.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025