In early October the members of the International Air Transport Association (IATA) committed to reaching net zero carbon emissions by 2050.

With the political imperative for air transport to start on the path to net zero before propulsion technologies such as hydrogen and electric are widely available, focus is firmly on measures to increase the supply and use of sustainable aviation fuel (SAF).

SAF is a ‘drop in’ fuel, i.e. it can be safely blended with traditional jet fuel because the chemical characteristics of the two are very similar, and, as such, aircraft and supply infrastructure shouldn’t require extensive adaptation, unlike for hydrogen and electric technologies.

Manufacturers have taken note - all Airbus aircraft are currently certified to fly using 50% SAF mixed with kerosene, and an Airbus-led project in collaboration with Rolls-Royce is testing the emissions performance of 100% SAF use. Boeing has committed that its commercial airplanes will be certified to fly on 100% SAF by 2030.

The Biden administration has set a goal of replacing all of today’s kerosene-based jet fuel with SAF by 2050, and the United Kingdom has proposed a SAF Mandate on fuel producers. In July 2021 the EU published updates to its ‘Green Deal’, with proposals including mandated minimum levels of SAF for all flights out of the EU, and making the use of traditional jet fuel more expensive by introducing minimum tax rates when these fuels are used on intra-EU flights.

This article looks at some of these developments and what they will mean for airlines and lessors.

Background

The increase in the use of SAF has been slow but steady – in 2008 Virgin Atlantic performed the first test flight with biojet fuel; in March 2016 United Airlines became the first airline to introduce SAF into normal business operations; and by December 2019 more than 215,000 commercial flights using SAF had been performed, there were 40 airlines using SAF and 6 billion litres in forward purchase agreements had been executed1.

The expansion of SAF is widely included as a key component of major industry initiatives to reduce aviation emissions. IATA’s roadmap relies on 65% of emissions reductions resulting from SAF use by 2050. Waypoint 2050, a blueprint for aviation’s sustainable future co-ordinated by the cross-industry Air Transport Action Group (ATAG), relies on SAF to drive 50% to 75% of emissions reductions. The UN’s agency for aviation, ICAO, endorsed the 2050 ICAO Vision for Sustainable Aviation Fuels which calls for a significant proportion of aviation fuels to be substituted with SAF by 2050, and SAF is a key element of the ICAO basket of measures to reduce aviation emissions. The EU aviation sector’s 2021 roadmap “Destination 2050 — A route to net zero European aviation” also sees expansion of SAF production as crucial to reaching net zero CO2 emissions by 2050.

However the take-up of SAF has so far been limited by a lack of production capacity and its cost premium – the production costs of SAF are currently estimated to be around 3-6 times the market rate for traditional aviation fuel2 . According to IATA, SAF currently comprises less than 1% of all jet fuel used globally.

Governments are taking note. At the supranational level, ICAO includes SAF as an eligible option for aircraft operators to meet their obligations under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). However industry players agree that a significant increase in production capacity will be needed, as well as robust government support to offset the higher cost of SAF.

Key steps have been taken in jurisdictions such as the EU, the USA and the UK, who are all at different stages and with different approaches.

EU Proposals for minimum SAF levels

The EU has published its RefuelEU Aviation proposal, a draft Regulation which would apply EU-wide harmonised rules for SAF binding in full on all member states.

The proposed Regulation targets airlines, fuel suppliers and airports. Its requirements apply to all flights leaving EU airports:

- Fuel suppliers are required to include SAF in aviation fuel supplied at EU airports;

- Aircraft operators are required to uplift SAF-blended aviation fuel when departing from EU airports; and

- Airports are required to provide the necessary infrastructure for storage and blending of SAF to allow fuel suppliers and aircraft operators to meet their obligations.

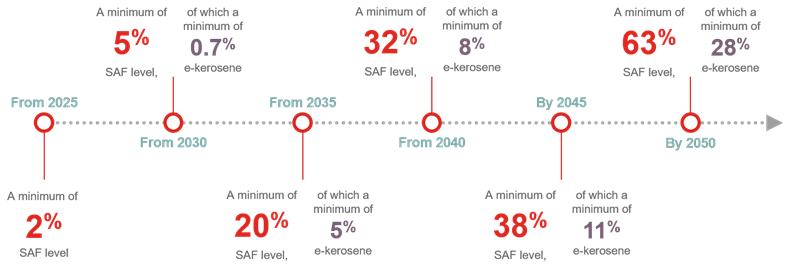

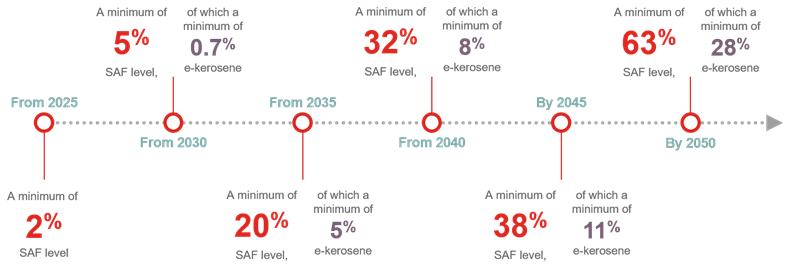

The central pillar of the rules requires fuel suppliers to include increasing proportions of SAF into jet fuel with a separate minimum for e-kerosene (the aviation category of e-fuels) from 2030:

The proposal promotes advanced biofuels and synthetic fuels produced from green electricity and in line with the sustainability requirements under the revised Renewable Energy Directive (RED) .

For sustainability reasons and as a result of their limited scaleability, crop-based biofuels are not included in the RefuelEU initiative. Hydrogen and electricity are also not included - although considered promising in the longer term, they are expected to be available only for short-haul flights, and not until after 2035.

The Regulation interacts with EU ETS in that airlines are not required to surrender allowances when reporting the use of SAF.

Article 5 of the draft Regulation places a “refuelling requirement” on aircraft operators, under which the yearly quantity of aviation fuel uplifted by a given aircraft operator at a given EU airport must be at least 90% of the yearly aviation fuel required.

This requirement is aimed at addressing concerns that airlines may use fuel tankering to save costs, i.e. uploading more fuel than necessary at non-EU airports where fuel may be cheaper, thereby increasing fuel consumption and emissions.

To ensure compliance, airlines will be required to report to EASA by 31 March each year in respect of their fuel uplift in each calendar year – this includes their fuel uplift and annual fuel required at each EU airport, their annual non-tanked fuel amount and the total amount of SAF purchased for flights from EU airports.

Similarly fuel suppliers will be required to provide an annual report on the total volume of aviation fuel as well as the volume of SAF supplied at each EU airport, and various details about the SAF (lifecycle emissions, conversion process, etc.)

The requirements for minimum SAF levels are expressed to start on 1 January 2025, while the reporting requirements apply earlier - from 1 April 2024 for the reporting year 2023.

Proposed EU tax on traditional aviation fuels

The revised Energy Taxation Directive is perhaps the most controversial proposal in the EU’s raft of measures for aviation – removing the rule under the existing Directive that fuel supplied for use in aviation is fully exempted from taxation.

The proposed Directive introduces minimum tax rates applicable to aviation fuels used on intra-EU flights. The aim is to price in the environmental cost of fossil fuels, thereby encouraging the use of SAF and more efficient, less polluting aircraft.

The proposed tax rates on aviation fuel will increase gradually over a ten year period to reach a minimum rate of €10.75/GJ EU-wide (the same rate as for petrol used in road transport), while sustainable and alternative aviation fuels will benefit from a minimum rate of zero to foster their uptake.

Although the revised Energy Taxation Directive proposes to remove the mandatory fuel tax exemption for fuel used on intra-EU flights, it contains an exemption for the cargo-only market with the aim of “preserv[ing] the level playing field between EU and third country cargo-only carriers”3 . This is because a high market share of cargo-only flights on intra-EU routes are operated by certain third country carriers which cannot be taxed due to international agreements.

UK initiatives to stimulate supply

The UK launched its Transport Decarbonisation Plan in July 2021, in which it outlined its approach to reaching net-zero aviation emissions by 2050 and UK domestic aviation reaching net zero emissions by 2040. A core aim was to “kick-start commercialisation of UK SAF”, a process already underway when, in July 2021, 8 industry-led projects were shortlisted to receive funding under the Green Fuels, Green Skies (GFGS) competition for the development of first of a kind commercial scale SAF production plants in the UK. The selected projects were required to demonstrate they will deliver SAF capable of reducing emissions by more than 70% on a lifecycle basis when used in place of conventional jet fuel. Shortlisted projects include Velocys’ waste-to-jet-fuel plant supported by British Airways.

Proposed UK SAF mandate

Alongside efforts to increase SAF supply in the UK, the UK Government is looking at the demand side. The UK Department for Transport (DfT) ran a consultation during Summer 2021 to solicit industry views on a mandate for the supply of SAF for flights departing from the UK (SAF Mandate) in response to what it describes as “industry engagement [which] has made it clear that a more comprehensive policy framework is needed in order to accelerate SAF deployment”. It invited responses on the need for a SAF Mandate, the eligibility criteria for SAF, monitoring and reporting systems, and how the SAF Mandate should interact with other domestic and international policies.

Significantly the proposed SAF Mandate falls on jet fuel producers rather than airlines. It would require them to ensure that at least 10% of their annual production is SAF by 2030, rising to a requirement of up to 75% by 2050. The Consultation proposes that eligible SAF meets several criteria, including that:

- it must meet the Ministry of Defence (MOD) Defence Standard (DEF STAN) 91-091 jet fuel specifications;

- it must deliver a reduction of at least 60% in lifecycle greenhouse gas emissions using a fossil fuel comparator;

- only waste-derived biofuels (also known as hydrotreated esters and fatty acids, or HEFA), renewable fuels of non-biological origin (RFNBOs), SAF from nuclear energy and recycled carbon fuels (RCFs) will be allowed, and, where hydrogen is used as a process input, the hydrogen must be low carbon. Biofuel crops are therefore excluded, as is grey (i.e. produced using fossil-fuel) hydrogen.

The Consultation also proposes that HEFA SAF be capped in order "to drive commercialisation of less developed SAF production pathways and to prioritise biofuels use on roads in the short term."

Once the SAF Mandate is in place, possibly from 2025, aviation fuel will be removed from the existing Renewable Transport Fuel Obligation (RTFO) which currently applies to fuel suppliers, in order to avoid double-counting and double-claiming within different schemes. This means that the SAF Mandate would become the only scheme under which fuel suppliers will be able to claim SAF use and receive a reward, in the form of a credit.

For aircraft operators, SAF use in the UK can be recognised through the UK Emissions Trading Scheme (ETS) and CORSIA, ICAO’s offsetting scheme. Under CORSIA, operators are able to reduce the number of CORSIA Emissions Units required to be cancelled at the end of the three year compliance cycle through the use of “CORSIA eligible fuel” (CEF). For SAF to qualify as a CEF, it must meet certain criteria as certified by an independent approved Sustainability Certification Scheme (SCS) and reported to its CORSIA administering state.

Therefore the ways in which the SAF Mandate differs from CORSIA may also affect airlines. It is proposed that the SAF Mandate uses the same fixed fossil fuel comparator as CORSIA (to better represent jet fuel, unlike the baseline comparator for the RTFO, which is based on road transport fuel). The Consultation also proposes that the greenhouse gas emissions methodology prescribed by the SAF Mandate could use or expand on existing methodologies under either CORSIA or the RTFO, in order to reduce administrative burden for fuel suppliers operating under more than one scheme. However it is open as to which should be used.

Although the UK SAF mandate would not change the certification process for CEF, the adoption of RTFO instead of CORSIA methodology could increase administrative burden. The Government recently consulted on how CORSIA should be implemented in the UK, with a further consultation planned later in 2021 on detailed proposals for implementing CORSIA, so the methodology under the SAF Mandate and CORSIA could both evolve.

In terms of the minimum greenhouse gas saving threshold required of eligible SAF, the Consultation proposes a threshold of at least 60% for SAF to be eligible under the SAF Mandate – this compares to a 10% requirement under CORSIA.

CORSIA also includes a requirement that an operator cannot claim emissions reductions in multiple schemes, meaning that emissions reductions from SAF cannot be claimed in both UK ETS and CORSIA, for example. It is unclear how the SAF Mandate and CORSIA will interact, although it is proposed that any emissions reductions claimed under a SAF mandate cannot also be claimed under another GHG scheme to ensure that they are only claimed once, and views are invited as to how the UK ETS, CORSIA and proposed SAF Mandate should interact.

The Consultation also invites submissions as to the what provisions the SAF Mandate might include to discourage the increased tankering (i.e. taking on additional fuel on inbound trips to the UK to cover the outbound trip) which could be expected if refuelling at a UK airport becomes more expensive.

According to a 2021 study by the ICCT, a UK and an EU-wide mandate implemented at similar timescales will reduce the risk of tankering that could result from unilateral use of SAF in the EU. Notwithstanding this, the Consultation proposes only a voluntary agreement from airlines to avoid tankering where there is no practical reason to carry additional fuel (the proposal is also covered by a separate Jet Zero Consultation).

The UK DfT anticipates publishing its response to the Consultation in 2022, with the next steps entailing a potential follow-up consultation, should a SAF Mandate be confirmed, possibly from 2025.

US initiatives to encourage SAF uptake

Biodiesel production is widespread in the United States. Production occurs in 33 states, with Iowa, Texas and Missouri currently leading the nation in production volumes. Increasing levels of production are anticipated. California hosts the first plant to produce SAF continuously, in contrast to Europe, where available biofuel refineries produce SAF in batches, and plans to host another 50,000 barrel per day plant in 2024. Airlines For Europe in their position paper on SAF cite this as being down to (a) the fact that commitments and off-take agreements were in place before modification of the plant and (b) stable policy incentives which ensure an acceptable return on investment (ROI) period and provide guarantees that certain feedstock can be used over a longer period.

In California, the landmark Low Carbon Fuel Standard (LCFS) prices in greenhouse gas emissions to the aviation fuel used, making SAF economical compared to traditional aviation fuel. Oregon has a similar albeit smaller scheme.

To incentivise the production of SAF, the Commercial Aviation Alternative Fuels Initiative (CAAFI) has worked with San Francisco International Airport, a number of airlines and SAF producers, to facilitate large SAF offtake agreements between airlines and SAF producers, in order to guarantee demand for SAF ahead of modifications to fuel plants to produce SAF.

However, even in these states, a large-scale increase in production is needed to meet future demand.

At the federal level some measures are starting to be introduced. On September 9, 2021, the Biden administration has announced a goal of replacing all conventional jet fuel with SAF by 2050 (projected at 35 billion gallons per year), with a plan to boost SAF production to 3 billion gallons annually by 2030 in co-ordination with Airlines for America, a trade group for major US carriers.

As part of the initiative, the U.S. Environmental Protection Agency, the Departments of Energy, Transportation and Agriculture, and the National Aeronautics and Space Administration will co-ordinate efforts to expand production and use of SAF that achieves a minimum of a 50% reduction in life cycle greenhouse gases compared to conventional fuel, by carrying out research, developing the fuels and related infrastructure and encouraging the production of raw materials. In addition, the General Services Administration plans to develop information concerning procurement decisions the U.S. government can take to reduce the sustainability impacts of federal employee travel.

Criticism has been levelled by certain interests at the voluntary nature of the targets, while industry players have called for a programme of grants and loans to support investments in production facilities. In May, a coalition of airline trade organisations and unions wrote to congressional leaders, asking them to enact a tax credit of US$1.50 per gallon for SAF which reduces emissions by half, rising to US$2 for those that reduce emissions further. This SAF tax credit has been endorsed by the Biden administration and forms part of a US$3.5 trillion spending bill being pushed in Congress by Democrats, although its outcome remains uncertain.

Conclusion

It is clear that SAF will form an important part of the means to achieve aviation industry’s net zero ambitions, but that government efforts will be needed both to make the use of SAF economically viable for airlines and to facilitate the increase in commercial capacity needed to meet future demand.