Global offshore wind: Japan

Global | Publication | July 2023

Content

Focus on: Japan

In collaboration with:

Market overview

The renewable energy sector in Japan has been rapidly growing since the Government introduced the feed-in tariff (FIT) program in July 2012. In 2021, the Government announced its strategic goal of having 36-38 percent of domestic power generation come from renewable energy sources by 2030 (increased from the previous target figure of 22-24 percent), together with its commitment to achieve “carbon neutrality” by 2050.

Among other things, offshore wind power is considered to be particularly essential for further growth of renewable energy in Japan. This is because although three quarters of Japan’s land is mountainous and the remaining flatlands are densely populated, Japan has approximately 29,751 km of coastline.

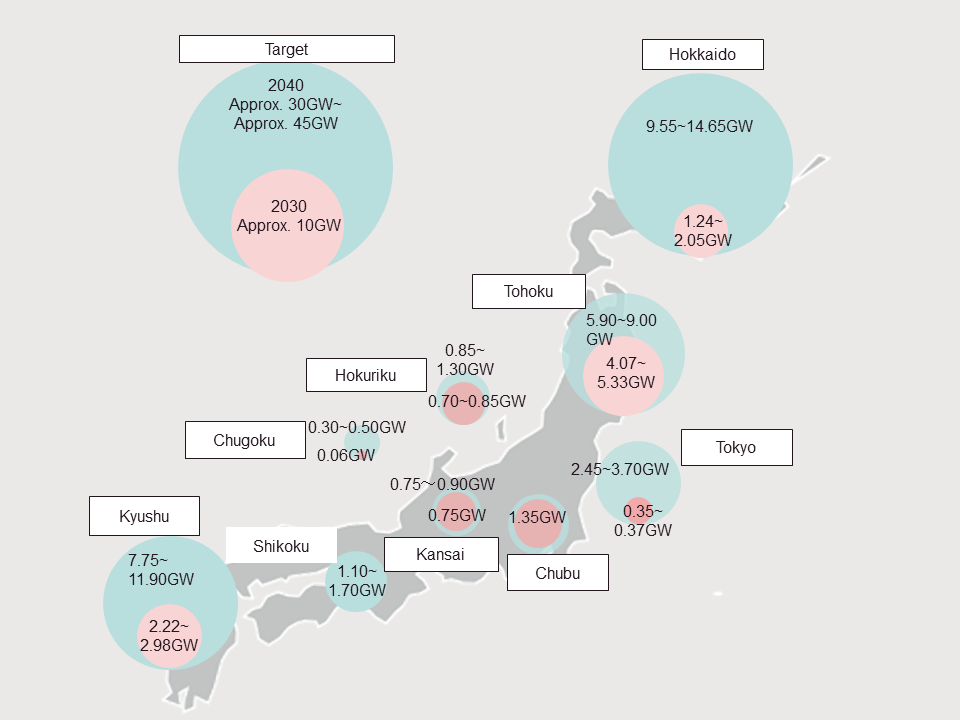

The Government now aims to introduce 10 GW of offshore wind power projects by 2030 and 30-40 GW by 2040. In order to achieve this, it has been promoting offshore wind power by introducing various policy measures, including legislation to establish an auction system for the occupancy of “general marine areas”(*).

Under the newly adopted auction system enacted under the General Marine Act, the first round auctions for offshore wind projects were held in 2020-2021 with respect to four general marine areas, including Goto, Noshiro-Mitane-Oga, Yurihonjo, and Choshi. Of these four areas, the same consortium led by Mitsubishi Corporation and Chubu Electric Power has been awarded occupancy permits for all but one area (Goto). The winning tariff range was from JPY 11,990/MWh to JPY 16,490/MWh, which was drastically lower than the upper price limit set in each auction (JPY 29,000/MWh).

(*) Marine areas within the territorial waters and internal waters excluding port areas.

Support regime and offtake

As previously stated, Japan adopted a feed-in tariff (FIT) program for renewable energy in July 2012. In April 2021, it also introduced a feed-in premium (FIP) program. Under these regimes, a power producer is entitled to sell generated electricity: (i) to the relevant grid operator at a fixed price (tariff) where the FIT program applies or (ii) to the power market at a market price plus a fixed premium where the FIP program applies.

With regard to offshore wind power, the relevant authorities specify the support regime (FIT or FIP) in the document corresponding to the RFP, and the applicable tariff/premium is determined through a bidding process under the auction system either in port areas or general marine areas. Once the tariff/premium is determined for a particular project, in principle, it will not be changed for a period of 20 years from the COD.

The recently amended Port Act 2016 created a legal framework to allow renewable energy projects to use port areas (kouwan kuiki – regulated offshore areas around certain designated ports). Also, the General Marine Act enacted in November 2018 established a legal framework to ensure the long-term occupancy of offshore general marine areas.

Grid operators are generally required to accept grid connection applications from renewable power generation facilities. Some limited exceptions exist; including failure to meet certain technical or safety requirements, or lack of infrastructure either at a connection point or in the grid generally.

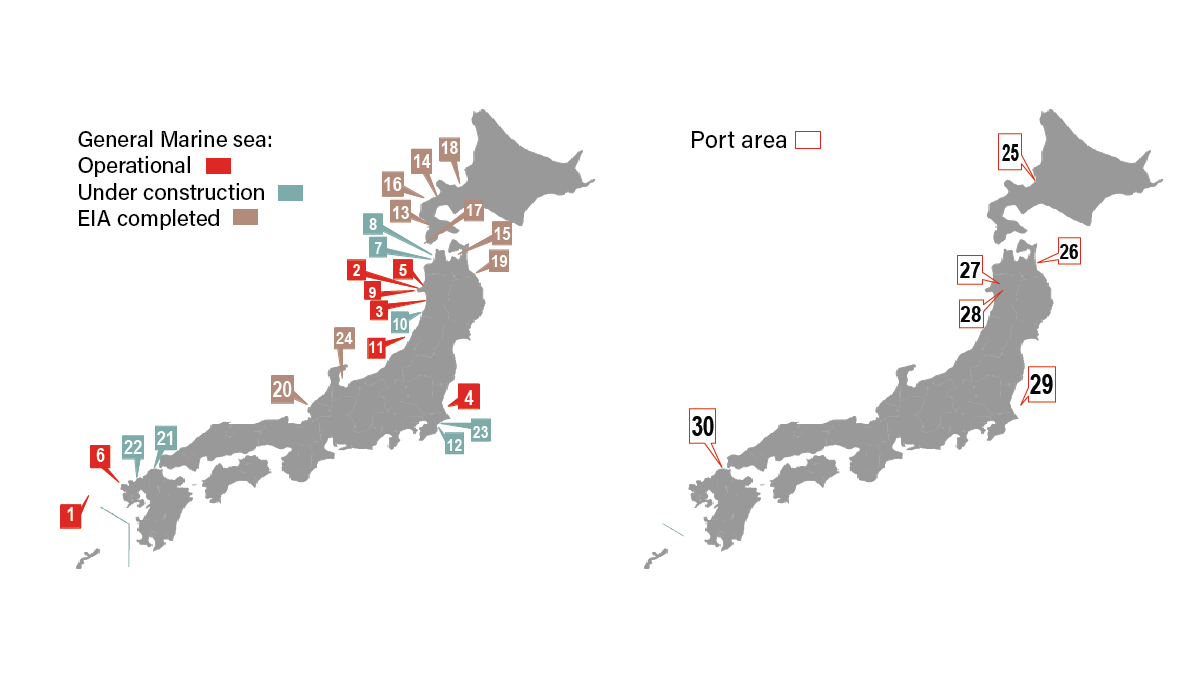

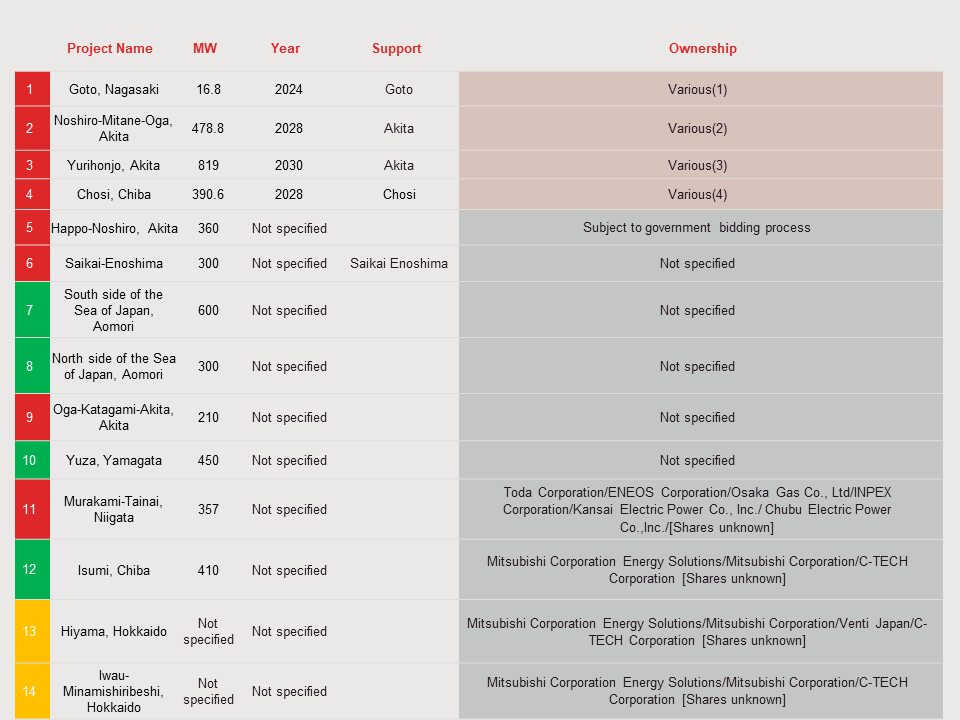

Japan: Offshore wind projects

Japan: Shareholdings in offshore wind projects

(1) Shares unknown: Toda Corporation, ENEOS Corporation, Osaka Gas Co., Ltd, INPEX Corporation, Kansai Electric Power Co., Inc., Chubu Electric Power Co.,Inc.

(2) Shares unknown: Mitsubishi Corporation Energy Solutions, Mitsubishi Corporation, C-TECH Corporation

(3) Shares unknown: Mitsubishi Corporation Energy Solutions, Mitsubishi Corporation, Venti Japan, C-TECH Corporation

(4) Shares unknown: Mitsubishi Corporation Energy Solutions, Mitsubishi Corporation, C-TECH Corporation

(1) Shares unknown: Kitanihon Kaiji Kogyo Co; Ministry of Economy, Trade & Industry, Japan; Mutsu-Ogawara Port Offshore Wind Development Co., Ltd

(2) Shares confidential: Marubeni Corporation,Obayashi Corporation, Tohoku Sustainable & Renewable Energy Co., Inc., Cosmo Eco Power Co., Ltd., The Kansai Electric Power Co., Inc., Chubu Electric Power Co., Inc., and other seven local companies

(3) Shares confidential: Marubeni Corporation, Obayashi Corporation, Tohoku Sustainable & Renewable Energy Co., Inc., Cosmo Eco Power Co., Ltd., The Kansai Electric Power Co., Inc., Chubu Electric Power Co., Inc., and other seven local companies

(4) Shares unknown: Windpower Group, TOKYO GAS CO.,LTD., Japan Wind Energy Co.,LTD

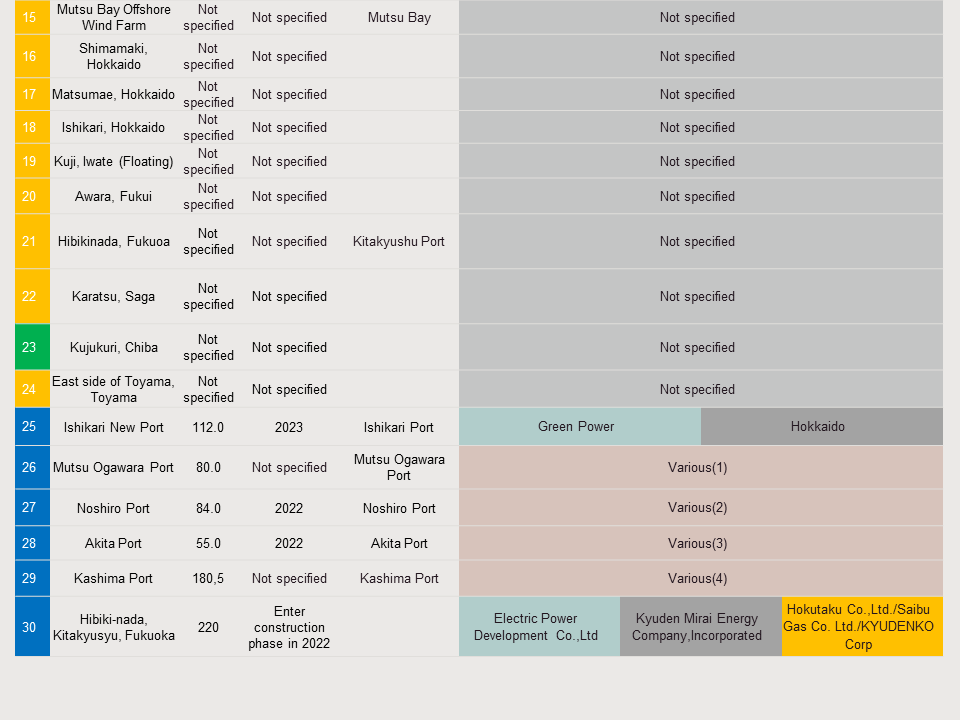

Japan: Development process

Japan: Obstacles and challenges

Negotiation with stakeholders

In Japan, the fishing industry is very active and fishing rights are heavily protected. Developers have to negotiate with local fishermen and fishermen cooperatives, and sometimes compensate them to gain approval for the construction of facilities in marine areas.

The new General Marine Act has established a legal framework to accommodate the interests of both developers and existing users of marine areas, including fishermen.

Ships and ports

Many local ports in Japan do not have the sufficient infrastructure, nor equipment to support the construction of offshore wind power plants.

At present, there are very few self-propelled, self-elevating support vessels and experienced crew available for the construction of offshore wind farms in Japan. Further, it is difficult to use foreign vessels and crew because of the maritime cabotage regulations which prohibit foreign ships from transporting cargo between ports in Japan. This point is further accentuated by the fact that the boarding of foreign crew on Japanese ships is stringently regulated.

Tariff and grid connection

Under the current regime, the tariff/premium for offshore wind power will be determined through auctions. The results of the first round auctions have proven that there is fierce competition to lower down the price of the tariff / premium.

In addition, since the grids in areas with relatively high wind speeds (Hokkaido, Tohoku and Kyushu) can accommodate little additional capacity, grid connections might be permitted under less favorable conditions, and may require developers to make substantial investments to upgrade transmission lines, or accept occasional output curtailment to balance demand and supply of power in the grids.

Japan: Hot topics

Legal framework for the use of offshore areas

The General Marine Act provides for:

- designation of “Promotion Zones” to allow long-term occupation for the construction/operation of offshore wind power plants;

- competitive bidding process to select the developer and set the tariff/premium;

- framework to accommodate the interests of local stakeholders.

As of 5 February 2023, there are eight Promotion Zones. Out of the eight areas, four have already completed the auction process. The outstanding four areas (Happo-Noshiro, Akita; Saikai Enoshima, Nagasaki; Oga-Katagami-Akita, Akita; and Murakami-Tainai, Niigata) are currently holding their respective auction processes. Bid submissions for these auctions closed on 30 June 2023.

Outcome of the first round auctions

The winning prices of the first round auctions released in December 2021 were much lower than anticipated and it was surprising to the market that the same consortium won all three auctions. In response to the reactions of the industry, the Government had been considering changes to the auction guidelines. After completion of the public consultation process, the government released revised guidelines on 27 October 2022, which introduced numerous changes to the regime including: (i) giving a higher score on the speediness of the development/construction of the project, (ii) restricting a single consortium from being awarded multiple projects (exceeding an upper limit on the power output) in the same round of auction, and (iii) treating equally all the bidders in terms of score to the extent they offer a price below a pre-set price.

Grid interconnection

In some regions, including those where offshore wind power is expected to be developed, grid operators insist that it would be difficult to integrate larger quantities of renewable energy into the existing electricity grids.

Tender process for grid connection

Regulators and utilities have been implementing a tender process for grid connection in order to construct or upgrade electric transmission facilities with the intent being that the power generation operator would bear the construction cost relating to the interconnection.

Japanese version of Connect and Manage

In addition, to improve the utilities’ capability to accommodate renewable power, regulators and utilities are discussing methods to use the existing grids more effectively. They are currently discussing a Japanese version of Connect and Manage, under which the grid operators would adopt transmission planning, utilise a part of the grid capacity reserved for emergencies, and offer non-firm (i.e., interruptible or as-available) interconnection.

Government-led Survey Initiative

With the aim of streamlining the development process of offshore wind projects, the Government is discussing the introduction of a more centralized scheme where the Government takes initiative to carry out environmental impact assessments, conduct sea condition surveys, engage local stakeholders, etc., each of which is currently handled by each individual developer separately.

Investor outlook in Japan

Projects are under way and regulations are being set. The Japanese offshore wind market is ready to emerge.

Although only a few offshore wind farms are currently operating in Japan, there are more offshore wind projects being planned. Some developers are proceeding with major commercial offshore wind projects, particularly in port areas where regulations on the use of marine areas were established relatively early on.

The Government and major developers have jointly formed a council to enhance the competitiveness of the offshore wind industry. The council published the Vision for Offshore Wind Power Industry (1st edition) in December 2020, which presents the introduction targets by area for 2030 and 2040 (see the chart below).

The Government recognized 11 potential marine areas where preparations for projects have proceeded to a certain extent (although they are not so mature as to be categorized as prospective marine areas). As of 5 February 2023, the Government has designated eight areas as Promotion Zones, and is currently preparing for the designation of five prospective marine areas (which are expected to be designated as Promotion Zones relatively soon; possibly later this year).

Experimental projects with floating wind turbines continue to be implemented. If they are successful, the sea area available for offshore wind farms is expected to significantly increase.

Although there are some hurdles for developing offshore wind farms in Japan, the Government is continuing its efforts to promote offshore wind power. Investors and banks have also expressed a positive stance towards offshore wind projects.

Source: Vision for Offshore Wind Industry (1st edition)

Subscribe and stay up to date with the latest legal news, information and events . . .