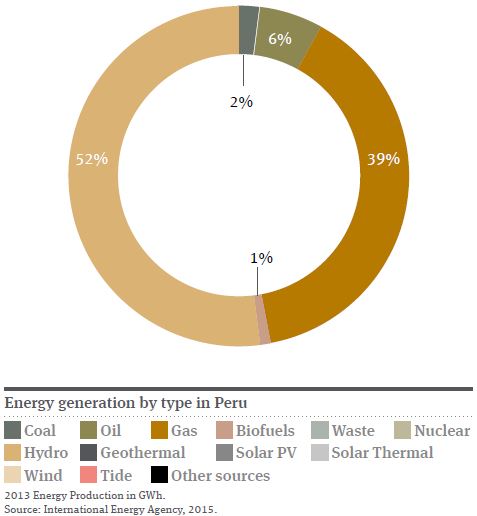

Peru is considered to have a ‘high’ potential for wind, solar, hydro and geothermal, a ‘high-medium’ potential for biomass, and an ‘unknown’ potential for ocean-based RETs. There is a significant gap between this potential and its realisation, and the 2014 statistics shown below illustrate that the country can do a lot more to harness alternative energy sources.

| Recourse |

Total power potential (MW) |

Installed capacity (MW) |

| Hydroelectric |

70,000 |

3,118 |

| Wind |

22,000 |

142 |

| Solar |

|

80 |

| Biomass |

450 |

27,4 |

| Geothermal |

3,000 |

0 |

In the near future, it is likely that the solar industry will provide the largest opportunity for energy export growth and rural-electrification, particularly for communities in the Amazon region. Consequently, several off-grid project tenders have also been floated.

In the wind sector, future investment depends on the success of several projects presently under construction. In April 2014, the first wind farm park in Peru, Marcona, became operational. It was developed by the Spanish concern Cobra Energía. The Talara and Cupisnique sites (110MW) are also scheduled to become operational this year, and their performance will have a positive impact on future support for such projects.

Decree No. 020-2013-EM, enacted in June 2013 under the umbrella of the LRER, deals specifically with the off-grid supply of electricity. Under this Decree, the government carried out an auction at the end of 2014, which resulted in the energy developer Ergon Power being awarded a contract for the construction of PV systems to supply 500,000 users in off-grid regions of the country.

The systems will be installed in the northern, central and southern regions of Peru and electricity services will be provided to homes, schools and health centres for a period of 15 years.