Publication

Achieving a just transition: Human rights and renewables

The legislative landscape is developing quickly in response to the increased perception of modern slavery.

Global | Resource and tool | September 2022

Note: At its broadest, the term 'modern slavery' refers to any situations of exploitation where a person cannot refuse or leave work because of threats, violence, coercion, abuse of power or deception. The Australian regime defines modern slavery to incorporate conduct that would constitute an offence under existing human trafficking, slavery and slavery-like offence provisions set out in Divisions 270 and 271 of the Commonwealth Criminal Code. Modern slavery therefore encompasses slavery, servitude, the worst forms of child labour, forced labour, human trafficking, debt bondage, slavery like practices, forced marriage and deceptive recruiting for labour or services.

On 1 January 2019, the Modern Slavery Act 2018 (Cth) (Commonwealth Act) commenced, heralding a new statutory modern slavery reporting requirement for larger companies operating in Australia.1

The three-year statutory review of the Commonwealth Act led by Professor John McMillan AO was tabled in Parliament on 25 May 2023. The review provides 30 recommendations to be considered by government: these include introducing due diligence obligations, lowering the consolidated revenue threshold from $100 million to $50 million, and the introduction of civil penalties for non-compliance. A Commonwealth Anti-slavery Commissioner has also been recommended. A summary of the proposed changes can be found here.

While the recommendations made in the review are yet to become legally binding, it is a matter of ‘when’ not ‘if’ the Commonwealth Act will be amended.

Entities need to report under the Commonwealth Act if they are an Australian entity or carry on business in Australia with a minimum annual consolidated revenue of $100 million. The revenue threshold is one aspect of the Commonwealth Act which is under review.

The Modern Slavery Act 2018 (NSW) (NSW Act) passed the NSW parliament in June 2018 but it did not come into effect until 1 January 2022. By way of background, the NSW Act in its original form, introduced a reporting obligation on both government bodies and corporations operating in Australia with a consolidated revenue of $50 million. However, the NSW Act was subsequently harmonised with the Commonwealth Act, and ultimately came into effect in 2022, with a reporting obligation only for NSW government bodies, local councils and state owned corporations and an obligation to take reasonable steps to ensure that goods and services procured are not the product of modern slavery.

The NSW Act also empowers the NSW Anti-slavery Commissioner, the NSW Procurement Board and Auditor-General to oversee efforts to remove products of modern slavery from public procurement. Dr James Cockayne was appointed the NSW Anti-slavery Commissioner for a five-year term commencing in 2022. The Commissioner will have broad oversight over Government policies addressing modern slavery, develop and publish codes of practice to provide guidance and maintain a public register that identifies any government agency failing to comply with the directions of the NSW Procurement Board, any state owned corporations not reporting under the NSW Act and any other information that the Commissioner considers appropriate. More details on the Commissioner’s role can be found here.

Reporting obligations relate to the risk of modern slavery in the operations and supply chain of a reporting entity (and its owned and controlled entities), as well as the steps it has taken to respond to the risks identified.

The reporting criteria in Australia are mandatory. Reporting entities must have a reasonable basis for any opinions expressed in their modern slavery statement, so it is important that reporting entities take the time to assess their risk. The reporting criteria are

Businesses must describe the risk of modern slavery and the actions taken in the reporting year (not in previous years). Joint statements are permitted for corporate groups, but all reporting entities need to be consulted to prepare the statement.

NGOs, civil society groups and universities have commenced the process of analysing and benchmarking statements published on the register. Benchmarking reports have looked at statements by sector and also by ASX rankings. They each adopted different methodologies to assess the quality of the statements, with some looking beyond technical compliance with the Commonwealth Act and some opting to name and shame companies.

It is crucial that reporting entities meaningfully review their supply chains and operations on an ongoing basis and consider specific actions that can be taken to manage risks identified.

Even if there are no new actions to report in subsequent statement, you need to check that the description of your operations, supply chains and risks remain accurate.

It is important to be up front if your business has had limited progress in responding to modern slavery risk during a subsequent year. If there are reasons for the slow progress, they should be described. Entities should still address the mandatory reporting criteria and use the opportunity to commit to goals for the next period of reporting. Those goals will demonstrate commitment if the last year has proved challenging.

Statements are due within six months after the end of the reporting entity’s year end. This means that if your entity’s annual reporting period is 1 January – 31 December, the due date for your statement will be 30 June the next year (meaning six month after the close of the entity’s financial year).

Reporting entities must provide their approved modern slavery statement to the Attorney General’s Department for publication on an on-line public register (https://modernslaveryregister.gov.au).

In 2018, Norton Rose Fulbright and the British Institute of International and Comparative Law (https://www.biicl.org) released the results of our human rights due diligence (HRDD) in supply chains project and published a report entitled ‘Making sense of managing human rights issues in supply chains’ (Business and Human Rights Due Diligence in Supply Chains (biicl.org).

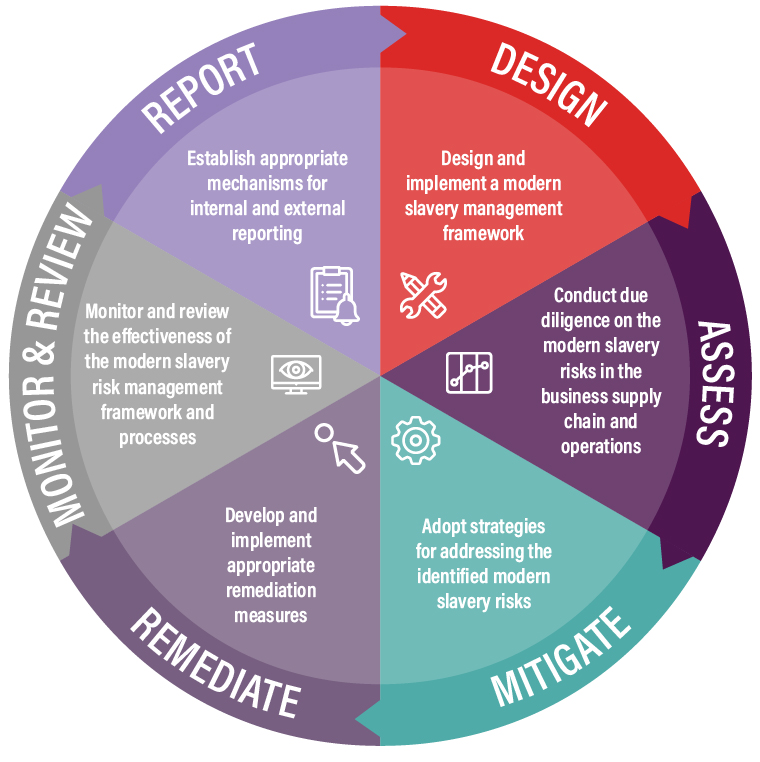

Supply chain HRDD is best understood as an ongoing, dynamic and context-specific process which is depicted in the diagram forming the central point of our report.

The report provides a comprehensive overview of the legal and regulatory framework relevant to the management of human rights issues in supply chains, discusses the components of human rights due diligence in supply chains and sets out observations of current practice and best practice recommendations. Access the report along with a summary of the findings here.

|

What are the statistics? Many Australian businesses may be unaware of the risk that they have slavery in their business or supply chains. Statistically, the incidence of modern slavery within Australia appears to be relatively low, but it is likely that the statistics reflect a low level of awareness of the issues, and the actual incidence may be much higher, both domestically and overseas. The 2022 Global Estimates of Modern Slavery revealed:2

|

Publication

The legislative landscape is developing quickly in response to the increased perception of modern slavery.

Publication

We have been receiving lots of questions in relation to the second year of reporting under the Australian Modern Slavery Act. Here’s our answers in a nutshell.

Publication

Businesses are increasingly being required to report upon, and manage, their potential human rights impacts. We have compiled an interactive guide to business human rights, summarising developments by jurisdiction.

Publication

Our top 6 New Year's resolutions for entities operating in Australia with a minimum consolidated revenue of AUD$100M or more.

Publication

On October 26, 2020, the European Commission (the Commission) launched a public consultation on sustainable corporate governance (the Consultation), soliciting responses from stakeholders on a possible EU sustainable corporate governance initiative with the aim of ensuring “that environmental and social interests are embedded in business strategies”.

Publication

Publication

On 16 January 2025, the USTR published a notice of determination that China’s targeting of the maritime, logistics and shipbuilding sectors for dominance is actionable under Section 301 of the US Trade Act of 1974. Section 301 grants the USTR the authority to investigate and remediate, including through the imposition of tariffs or other import restrictions, foreign trade practices that it determines (1) are unreasonable or discriminatory, and (2) burdens or restricts US commerce.

Publication

The OECD Pillar Two rules (also known as the Global Minimum Tax), where implemented by a national jurisdiction, require multinational enterprises (MNEs) with a consolidated group turnover of more than €750 million to calculate the effective tax rate in each jurisdiction in which it operates.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025