President Biden signed into law a historic US$1.2 trillion infrastructure bill on November 15, 2021. The bill, known as the Infrastructure Investment and Jobs Act, was passed on a bipartisan basis in the Senate on August 10, 2021, and in the House of Representatives on November 5, 2021, demonstrating broad support for core infrastructure investments.

The bill will accelerate infrastructure projects across the country. Many of the projects will replace or modernize aging or obsolete infrastructure, including road, rail and water projects. Some of these investments have been delayed for years, or even decades, waiting for funding. The bill will also build out and support new and improved broadband, electric vehicle, coastal protection, flood mitigation and other critical infrastructure systems and facilities.

While the bill provides an extraordinary amount of funds for these projects, the magnitude of infrastructure needs in the United States makes it likely that many projects funded by the bill will advance with a combination of federal, state and local funding, private capital, debt financing and public-private partnerships. Officials at all levels of government will be looking for opportunities to leverage the federal funding commitment to attract substantial public and private co-investment and deliver more projects in their capital plans.

I. Core infrastructure priorities

The Infrastructure Investment and Jobs Act is a once-in-a-generation investment in core infrastructure priorities, including roads and bridges, rail, transit, ports, airports, broadband, resiliency, the electric grid, electric vehicles, waterways and water systems.

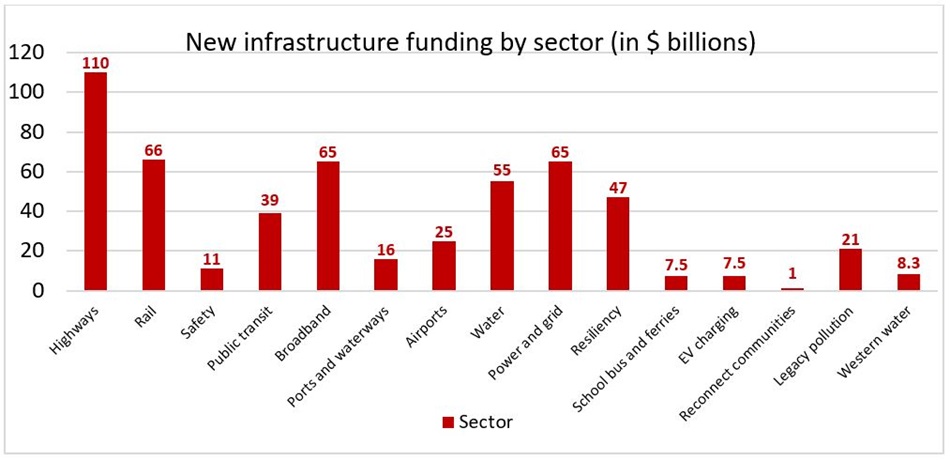

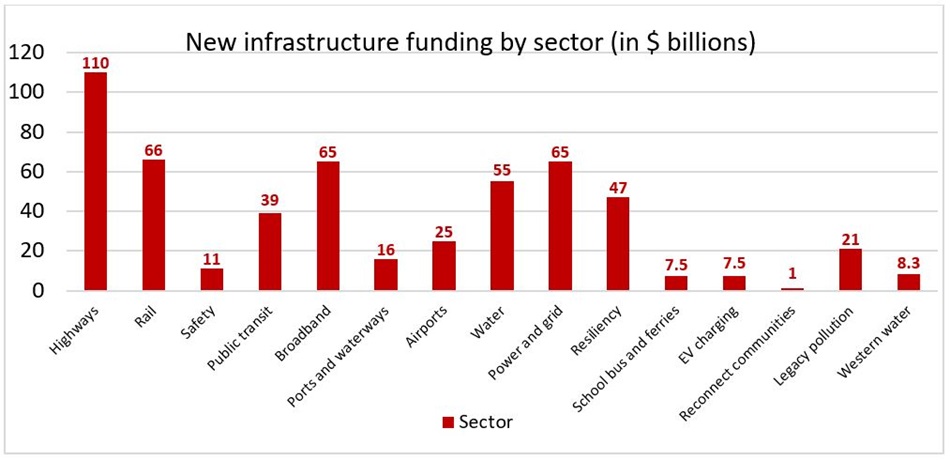

Approximately US$550 billion of the US$1.2 trillion bill will fund new or enhanced programs, with US$284 billion of the US$550 billion allocated to transportation, and the rest to water, broadband, energy, power and other sectors. The remaining US$650 billion will be used to fund existing transportation and water programs for the next five years, through 2026.

The following table provides a breakdown of new funding by sector. Section II below identifies certain new and enhanced programs funded by the bill in such sectors.

II. New and enhanced programs

New and enhanced programs under the Infrastructure Investment and Jobs Act include the following, among others:

- Highways: In addition to reauthorizing and providing supplemental funding for existing highway programs, the bill provides US$110 billion of new funding, including US$40 billion to repair and replace the national backlog of deficient and outdated bridges.

- Rail and Amtrak: The bill provides US$66 billion in new funding to help eliminate Amtrak's maintenance backlog, modernize and improve Amtrak's Northeast Corridor and invest in new rail corridors, including Amtrak priority corridors.

- Transit: The bill provides US$39 billion to help address an estimated need for more than 24,000 buses, 5,000 rail cars, 200 stations and thousands of miles of track, signals, and power systems and to advance major new transit corridor projects.

- Broadband: The bill provides US$65 billion in new funding for broadband deployment in currently under-served parts of the country, including rural areas and tribal lands and to make broadband access more affordable for low-income families.

- Airport: The bill provides US$20 billion in new funding for airports, including US$15 billion for the Airport Improvement Program which invests in runways, gates and taxiways and US$5 billion for a new program which aims to help advance airport terminal projects.

- Ports and waterways: The bill provides US$16.6 billion of new funding for coastal infrastructure projects, inland waterway improvements, port infrastructure, land ports of entry and US Army Corps of Engineers harbor and waterway construction priorities.

- Water: The bill includes US$23.4 billion for drinking water and wastewater programs and provides US$15 billion in new funding to replace lead pipes and US$10 billion in new funding to treat and remove dangerous chemical substances.

- Power and grid: The bill includes US$65 billion in funding for grid reliability and resiliency, critical minerals and supply chains for clean energy technology, transmission projects and other energy efficiency and critical energy projects.

- Resiliency: The bill provides US$47.2 billion in new funding for cybersecurity and other critical infrastructure needs such as waste management, flood and wildfire mitigation, drought, and coastal resiliency, ecosystem restoration, heat stress and weatherization.

- EV charging infrastructure: The bill provides US$7.5 billion to help develop a national network of electric vehicle charging infrastructure and encourage the use of alternative fuels and non-fossil fuel vehicles.

The bill also includes funding for safety programs, freight programs, Federal Aviation Administration air traffic control infrastructure, clean school buses and ferries, removal of legacy infrastructure to reconnect communities, addressing legacy pollution at brownfield and superfund sites, reclaiming abandoned mines and investments in western water infrastructure.

III. Federal funding mechanisms

A substantial percentage of the bill's funding will be allocated through formula grant programs, which means that states will receive a percentage of the funds available under a particular program in accordance with formulas established by Congress. The formulas aim to ensure an equitable and effective distribution of the funding.

Other programs in the bill, including a number of new programs, are discretionary grant programs. State and local governments will be competing for funding under these programs, although Congress may require that these programs also achieve an equitable geographic distribution. Applications for funding will be solicited by federal agencies (such as the US Department of Transportation) and will be evaluated based on criteria that are either identified by Congress in the bill or will be identified by the relevant federal agencies in program guidance that will be published in the coming months. The evaluation criteria will target national priorities.

A key benefit of formula funds is that they are allocated to state and local governments quickly to advance projects that are ready to go. Discretionary funds take longer to reach state and local governments because federal agencies need to solicit applications and evaluate projects prior to award. Discretionary funds, however, allow the federal government to target investments to projects that promise to provide the most benefit for the United States, including multi-state and other large and complex projects that need substantial amounts of funding.

The bill also continues to support a number of focused federal loan programs, including the Transportation Infrastructure Finance and Innovation Act (TIFIA) program, the Water Infrastructure Finance and Innovation Act (WIFIA) program and the Railroad Rehabilitation and Improvement Financing (RRIF) program. These programs provide loans for eligible transportation and water projects. The President's initial infrastructure proposal included a new multi-sector infrastructure investment fund, but this concept was dropped from the bill.

The bill also includes certain tax and regulatory provisions that may help accelerate major infrastructure projects. For example, the bill increases the national cap on Private Activity Bonds (PABs) for transportation projects from US$15 billion to US$30 billion. The initial US$15 billion cap is almost fully allocated to eligible projects. Doubling this cap will continue to allow public infrastructure projects developed and financed by the private sector to benefit from a federal tax exemption otherwise available only for publicly-financed projects. The bill also codifies a number of reforms to the permitting process to help speed project delivery.

IV. Leveraging private sector investment

The considerable amount of money that will be invested under the Infrastructure Investment and Jobs Act will help advance many of the largest and most significant infrastructure projects in the United States and many additional projects.

A number of provisions in the bill encourage state and local officials to leverage the federal investment to attract public and private co-investment. For various programs, the bill requires the use of non-federal funds alongside the federal funds for each project. Congress also included goals and evaluation criteria for certain discretionary grant programs which favor projects that have more non-federal funding. Federal agencies implementing discretionary grant programs may include similar evaluation criteria in program guidance they are preparing. As noted above, the bill also supports the use of PABs and low-cost TIFIA, WIFIA and RRIF financing for projects with dedicated sources of revenue to repay project financings.

The bill encourages public-private partnerships (P3s). The bill requires applicants for TIFIA and RRIF financing for projects expected to cost more than US$750 million to perform a value-for-money analysis to ensure that a P3 option has been properly considered for major projects. State and local governments will be eligible for grants to help public officials explore P3s. The bill also requires state and local governments to review the compliance of the private partner with the P3 agreement within three years after the opening of a P3 project, which should help make the case for more P3s if projects are performing well.

Since much of the infrastructure in the United States is owned and operated at the state and local level, the government officials tasked with financing and delivering infrastructure projects will likely be seeking additional sources of funds, including private investment, to make the substantial new federal investments go even further and to deliver more projects that would otherwise not be fully-funded. In some cases, projects have been in planning for years and the award of federal funds, alongside existing commitments of state and local funds and private investment, maybe the last piece of the puzzle needed to complete a project's financing plan. The desire to make federal funds go further and advance more projects will help facilitate a more robust pipeline of projects moving forward with private sector investment.

The funding provided by the bill will be made available over the next five years. Unlike federal stimulus funds, which are meant to be spent quickly on shovel-ready projects and to replace investments not being made by state and local governments because of an economic downturn, the five-year horizon of the bill's funding programs is expected to allow state and local governments to maximize the number of projects in their capital plans by matching the new federal funds with other anticipated sources of funding, including state, local and private investments.

For major projects, the financing plan often includes various sources of public funds and private investment, including a mix of some or all of the following:

- Public funds: Federal, state and local funds used to pay for portions of a project's costs during construction or as dedicated sources of revenue to repay financing.

- User fees: Tolls, fares, charges and other user fees which are collected and used as dedicated sources of revenue to pay for project costs or to repay financing.

- Private capital: Equity investments from infrastructure funds, pensions funds, developers and other sponsors, which are repaid with public funds or user fees.

- Debt: Debt financing provided by banks, capital markets and institutional lenders, which is repaid with public funds or user fees.

- Federal loans: Low-cost and flexible loans or loan guarantees provided by TIFIA, WIFIA, RRIF and other federal loan programs.

The bill provides a substantial new source of public funds which can be allocated towards project costs or to repay financings. The bill also recommits the federal government to providing low-cost, flexible loans for eligible infrastructure projects. These investments will likely make more projects financeable and facilitate a more robust pipeline of projects moving forward with private sector investment.