Corporate PPAs can be broadly broken down into two types: synthetic / virtual PPAs and sleeved or physical PPAs.

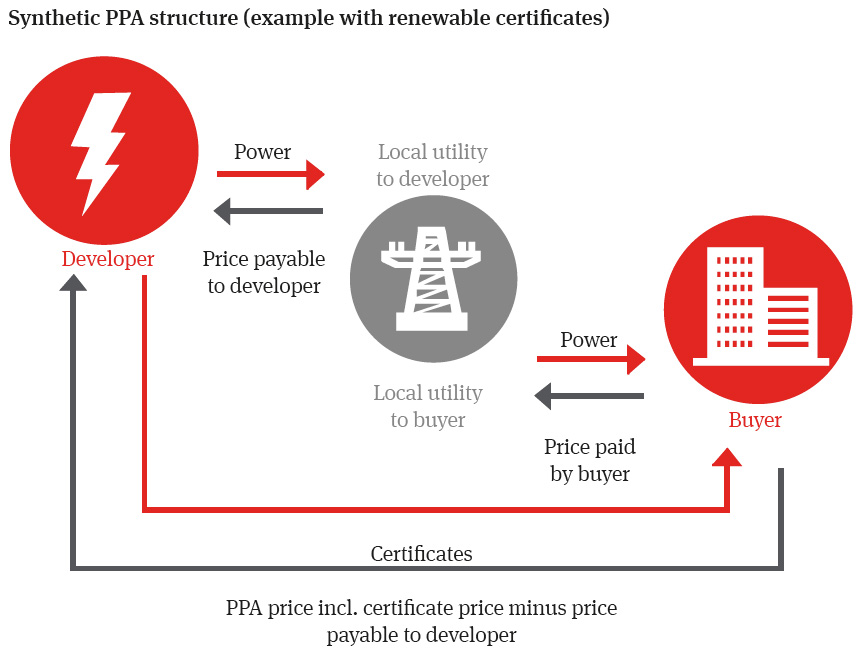

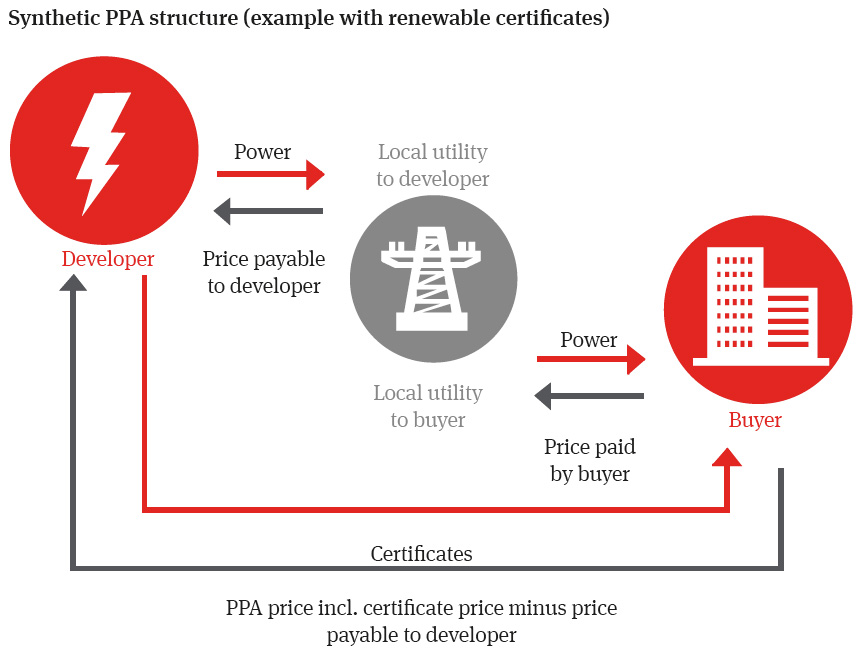

Synthetic or virtual PPAs

Source: ‘Corporate Renewable Power Purchase Agreements: Scaling up Globally’ A report produced by World Business Council for Sustainable Development (WBCSD), in conjunction with Norton Rose Fulbright and EY

The first type is referred to as “synthetic” or “virtual” PPAs. These are a financial derivative under which the parties agree a strike price, with payment flows being determined by comparing that strike price against a market reference price. They do not involve the physical delivery of output to the buyer or a utility agent of the buyer. There is a wide range of possibilities regarding how these can be structured. For example, they may be two way or one way. In the former, where the market reference price is higher than the strike price, the generator pays the difference to the buyer. Where the market reference price is lower, the buyer pays the difference to the generator. The volume contracted under the agreement can also be specified in a variety of ways and need not be tied completely to the actual generation of the project. This is known as a contract for difference.

There is usually one physical aspect in a synthetic PPA. The corporate buyer will usually need the green certificates awarded to the project for the purposes of demonstrating the renewable nature of the electricity to be delivered to the buyer. These will be used to record against their overall electricity usage and thereby demonstrate the performance of the corporate buyer against their commitments. Some transactions have taken different approaches to this. For example, the corporate buyer may separately purchase green certificates and allow the project to sell the green certificates issued to it.

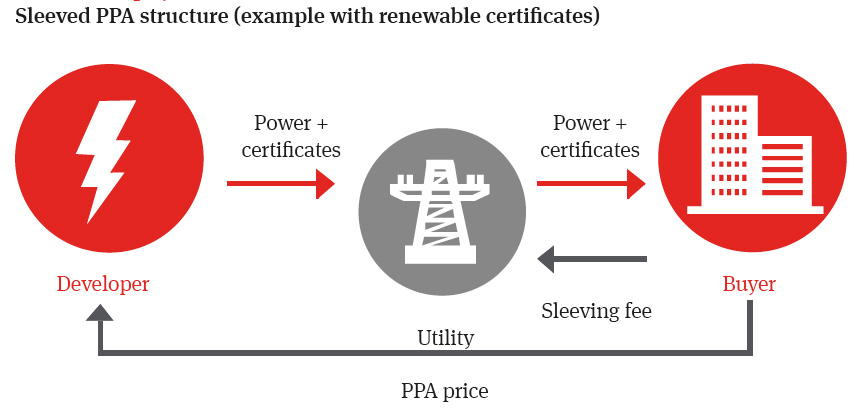

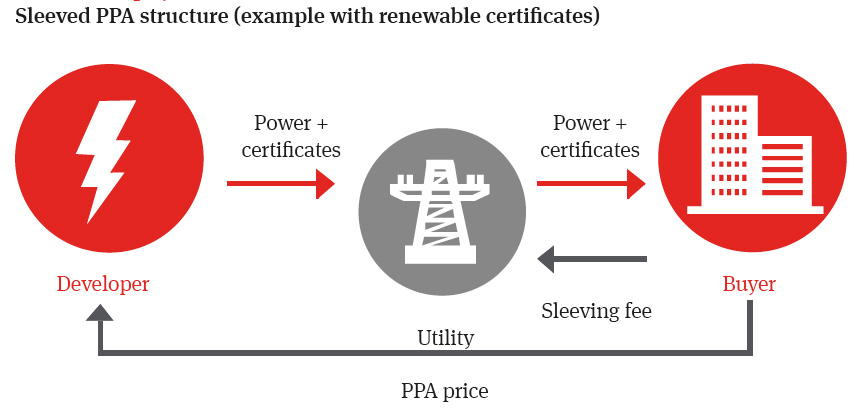

Sleeved or physical PPA

Source: ‘Corporate Renewable Power Purchase Agreements: Scaling up Globally’ A report produced by World Business Council for Sustainable Development (WBCSD), in conjunction with Norton Rose Fulbright and EY

The second type is referred to as “sleeved” or “physical” PPAs. These often (but not always) involve a direct PPA between the corporate buyer and the generator. The corporate buyer usually enters into associated arrangements (either managed by the corporate buyer itself or via a utility) to enable the output purchased to be used for the benefit of the corporate’s wider facility load.

This is the approach normally adopted in the United Kingdom (although the UK has seen synthetic PPAs). Under this approach, the corporate buyer enters into a PPA with the generator. The corporate buyer simultaneously enters into a PPA with its incumbent energy supplier. This second PPA requires the utility to act as the buyer’s agent in managing the offtake of power from the generation facility. Generally the design of the linked PPAs is intended to mitigate risk for the corporate buyer by passing through obligations and liabilities to the extent possible. Usually the corporate buyer will agree with the utility how the intermittent electricity output of the generation facility will be credited against the corporate’s electricity requirements. This will generally involve management fees associated with the intermittent nature of that generation output. Although this approach has been common to date, it is not the only approach possible. The author is currently developing alternative approaches which offer a far more standardised and stream- lined approach to overcome some common issues in the UK market, including the long negotiation period required to document sleeved transactions and the difficulties in making those work for multi-buyer structures. Multi -buyer structures involve using more than one corporate buyer to support a project, either by having a number of parallel PPAs with different corporate buyers or the establishment of a single buying vehicle that multiple corporate buyers then participate in.

An example of a simpler approach for physical PPAs is provided by the Netherlands. In the Netherlands, a number of corporations are already actively engaged in the wholesale electricity market to manage their electricity requirements. They either directly or via existing service providers. In this context, corporate PPA structures can involve a single PPA between the generator and the corporate buyer. That said, there are usually associated arrangements by which a agent manages the nomination process between the seller and the buyers for the purposes of the wholesale electricity market.