Although there are many similarities with ECA financing, there are also some key differences which apply to the AFIC structure. These include commercial or intercreditor considerations resulting from the use of multiple corporate insurers, differences between insurance law and guarantee law, the bank capital regulatory analysis which applies to an insurance policy, and the fact that the insurance market is highly regulated.

A key difference is that the insurers, although highly rated, are not sovereign entities. Therefore banks will analyse and account for a transaction not on the basis of sovereign risk, but on the basis of the corporate credit rating of the insurance companies.

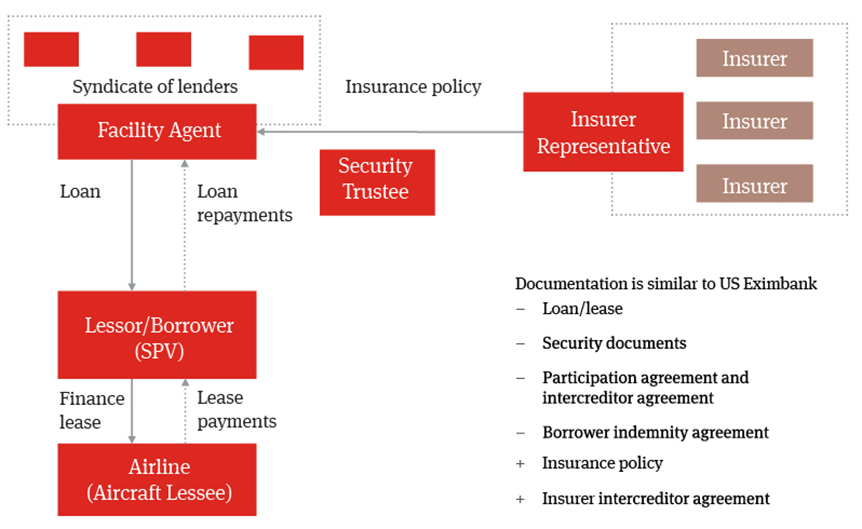

In addition, the insurance is provided not by one insurer, but by four insurers on a several basis. Each insurer is liable only for its own share of the liabilities, and there is no joint liability. Banks may therefore need to analyse and account for each portion of the debt on a different basis, taking into account the exposure to each insurer. This is also relevant to the insurer intercreditor agreement. In the event that one insurer fails to pay, the lenders will – in turn – want to be subrogated to the rights of that insurer in the insurer intercreditor agreement, to recover the relevant share of any security proceeds, or to exercise voting rights.

As the insurance is provided on a commercial basis, there are no OECD rules about any level of national content in the aircraft, nor about the invoice price applicable to an aircraft. Similarly, there is no “home country rule” preventing leasing to countries where large aircraft are manufactured.