Publication

ESG and internal investigations: New compliance challenges

As ESG concerns have come to the forefront in different jurisdictions, the scope of these inquiries is expanding in kind.

Global | Publication | August 2015

By way of Administrative Ruling N° SNAT/2015/0049, published in the Official Gazette of the Bolivarian Republic of Venezuela Nº 40,720, dated August 10, 2015, the National Tax Administration (“SENIAT”) appoints taxpayers qualified as special taxpayers as Value Added Tax (“VAT”) withholding agents (the “Ruling”).

Below are the most notable changes introduced by the Ruling.

The Ruling establishes three new cases in which appointed agents shall not withhold VAT:

Additionally, the exclusion applicable to vendors registered with the National Exporters Registry is modified to include the condition that vendors must have filed export VAT refund requests within the last 6 months.

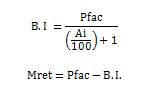

The Ruling introduces the following formula for the calculation of the tax withholding in cases where the VAT is not stated in the invoice:

Explanation:

B.I.: Taxable base;

Mret: Amount subject to withholding;

Pfac: Price of the goods and services on the invoice;

Ai: Tax rate

Two cases in which the withholding agent previously had to withhold 100% of the VAT have been repealed:

In addition, the Ruling establishes that withholding agents must verify the vendor’s information in the SENIAT web page and perform a 100% withholding when instructed therein.

A provision that allowed taxpayers to offset the withheld tax in subsequent periods when it was not deducted in the corresponding period has been repealed.

The taxpayer must indicate the amount of accumulated withholdings that have not been offset in the electronic statement “Declaration and payment of the VAT 99030” (previously they had to be stated in “VAT Form 30”).

In cases where the withholding agent delivers the withholding certificate after the return for the period has been filed, the taxpayer may offset the withheld tax from the VAT liability assessed for the period in which the withholding certificate was delivered only if the limitations period has not expired.

The provision that allowed withholding agents to file an informative statement of purchases and withholdings on a digital medium in exceptional cases in which it was not possible to file such a statement through the SENIAT website within the prescribed period of time has been repealed.

Withholding agents must deliver the withholding certificate to the vendors at the latest within the first two business days of the period that follows the withholding (previously such period was three calendar days).

A new provision requires that withholding certificates must state the full amount of the invoice or similar document, the taxable base and the VAT.

The provision that established that vendors must identify transactions made with withholding agents in their Purchase Book has been repealed.

The ruling will come into force on the first day of the month that follows its publication in Official Gazette (namely, September 1, 2015) and will be applicable to taxable events that occur after its coming into force.

Publication

As ESG concerns have come to the forefront in different jurisdictions, the scope of these inquiries is expanding in kind.

Publication

In compliance with the constitutional reforms published in the Federal Official Gazette, new secondary legislation regulating the energy sector, specifically in terms of power and hydrocarbons, was published on March 18, 2025.

Publication

In compliance with the constitutional reforms published in the Federal Official Gazette, new secondary legislation regulating the energy sector, specifically in terms of power and hydrocarbons, was published on March 18, 2025.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025