Publication

Navigating international trade and tariffs

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Global | Publication | June 2017

Climate finance is vital to transforming the global economy to meet the challenge of climate change. It has been one of the key factors in ‘unlocking’ the climate negotiations for many years. This looks set to continue at 2017 COP23 negotiations in Bonn, Germany. Over 130 Nationally Determined Contributions (which can be seen as country-driven ‘climate investment plans’) are conditional on receipt of climate finance. During the negotiation of the Paris Agreement at COP21 in 2015, which countries are now working to implement, a previous commitment made at climate change talks in Copenhagen and Cancun to raise US$100 billion per annum by 2020 was built upon to become a recognised ‘floor’ for climate finance commitments. Finance will then be escalated for successive Nationally Determined Contributions beyond 2020, and a new climate finance goal established by 2025.

At its broadest, climate finance refers to the financing of activities that reduce greenhouse gas emissions or help society adapt to the impact of climate change. This is often couched in terms of a flow of funds from developed nations to less developed nations, but climate finance mechanisms can be deployed in developed nations as well.

Article nine of the Paris Agreement recognises that, ‘developed country parties shall provide financial resources to assist developing country parties with respect to both mitigation and adaptation in continuation of their existing obligations under the Convention’ and that ‘as part of a global effort, developed country parties should continue to take the lead in mobilizing climate finance from a wide variety of sources, instruments and channels, noting the significant role of public funds, through a variety of actions […]’. It goes on to encourage developing countries to step up their own efforts recognising that all countries have a part to play.

Most climate finance efforts to date have been focused on mitigation finance but there is an increasing recognition of the need to mobilise more adaptation finance to help achieve the target set in the Paris Agreement of limiting global warming to a 2°C average global temperature rise.

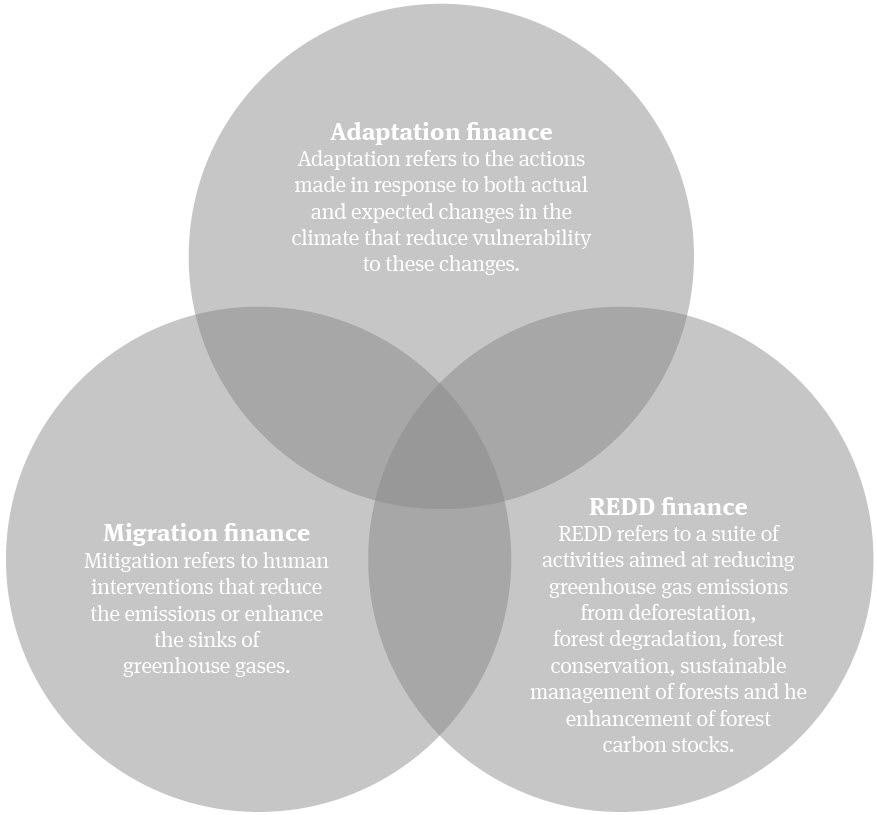

Climate finance is primarily targeted at one or more of the following overlapping areas:1

The Paris Agreement is not prescriptive as to the sources or the instruments of climate finance. To date, we have seen a raft of instruments deployed for climate purposes. The list below provides examples of the instruments used in the sector.

| Instrument | Example of climate finance initiative |

|

Loans |

The International Development Association (World Bank) and the Development Bank of Ethiopia provided working capital loans totalling US$ 20 million to finance household solar providers in Ethiopia. This forms part of the Electricity Network Reinforcement & Expansion Project (ENREP), a US$ 200 million project funded by the World Bank to improve Ethiopia’s electricity network. |

|

Green ‘Use of Proceeds’ Bonds |

The green bond market is growing exponentially. According to the Climate Bonds Initiative, 2016 saw 92% growth on 2015, with over US$80 billion bonds issued. The majority of these are ‘use of proceeds’ bonds where the proceeds finance green projects but are backed by the Iissuer’s whole balance sheet. Some examples include

|

|

Green ‘Project’ Bonds |

Green project bonds are issued for single or multiple specific projects, where the investor takes the risk on the projects rather than the issuer. Some examples

|

|

Subsidy/ policy support |

The Renewable Energy Independent Power Producers Procurement Programme (REIPPPP) is a South African government scheme to attract private investment into renewable energy in South Africa. Funding for the programme is provided through foreign and local private equity, and large commercial and development banks. In September 2014, Egypt’s feed-in tariff programme was established, with 9 power purchase agreements being entered into from Phase-one of the programme. Phase two was launched in October 2016 which has captured US$3 billion worth of investments in solar and wind projects with 60-70 per cent from foreign financing. |

|

Grants |

The AfDB offers grants for certain low income countries. In December 2015 it approved a combined grant of US$53.24 million to fund a water project in Zimbabwe and a financial reform programme in Chad. In October 2016, the Green Climate Fund approved a proposal by the Ecuador Ministry of Environment to finance the implementation of Ecuador’s REDD+ action plan. The GCF will provide a grant of US$41.2 million. |

|

Guarantees |

The African Guarantee Fund (a development finance initiative backed by Denmark, Spain and AfDB) provides the Green Guarantee Facility to assist finance institutions to minimise the risk of investing in small and mediumsized enterprises in Africa. The UK-headquartered Guarantco (which is backed by governments and aid agencies) offers to act as guarantor for debt financing infrastructure and development projects in emerging markets – transferring the risks on investments. In December 2014, they provided a US$ 28.2 million guarantee on the Lower Solu run-of-the-river hydro project in Nepal. |

|

Equity |

Equity investments may be by way of investments in funds or direct investments. As at end of July 2016, the European Investment Bank had invested in 37 active private equity funds investing in the Africa, Caribbean and Pacific regions, with total commitments of €574 million (US$ 614 million). The total size of these funds is approximately €4.57 billion.2 Climate Investor One is an FMO-backed infrastructure fund set up to facilitate private sector investment in developing countries. One of its projects is involved in a four-way all-equity partnership with eleQtra Limited, Mr Katai Kachasa and the Africa Finance Corporation to finance a 75 MW hydropower facility and 20MW solar PV facility in Zambia. The US$250 million is to be funded solely by equity and re-financed after commercial operation. |

|

Credit lines |

Through its Sustainable Energy Financing Facilities, the European Bank of Reconstruction and Development extends credit to local financial institutions with the aim to create self-sustaining markets in the areas of energy efficiency and small scale renewable energy. |

|

Insurance |

The Energy Savings Insurance Program, a global initiative based in London – seeks to overcome barriers to investment in financing energy efficiency projects through the implementation of risk mitigation instruments. It provides an insurance product that covers projected energy savings for energy efficiency measures and compensates insureds in the event that expected financial flows associated with energy efficiency savings are not realised, helping to unlock finance from local financial institutions. |

To date, multilateral and development finance institutions have taken a significant role in catalysing climate finance. Aggregate finance levels reached US$62 billion in 2014, an increase from US$52 billion in 20133. This estimate used the definition of public finance and private finance directly associated with public finance interventions and therefore did not account for private finance indirectly mobilised by capacity building, policy-related interventions and the role of broader enabling environments.

Whilst it is expected that a significant proportion of the US$100 billion target associated with the Paris Agreement will be met by public finance, it is critical that private finance is also mobilised to meet the scale of investment required to achieve climate change goals. Public finance alone, often constrained by budgetary restrictions, will not be sufficient.

In the first week of 2016 Marrakech climate negotiations, 38 developed nations and the European Commission published a roadmap to build confidence and increase transparency and predictability about how the US$100 billion target will be achieved. The roadmap provided projections on where developed countries planned to be by 2020, including US$67 billion a year of public finance and US$24 billion from private finance.

The issue of climate finance is gaining momentum during 2017. The Prime Minister of Fiji announced that adaptation finance would be a key issue for their incoming Presidency of COP 23, which will take place in Bonn in November 2017. Germany, which holds the Presidency of the G20 for 2017, has announced that its priorities include green financing and climate and energy policies. . The delegates of the recent Bonn Climate Change Conference also reaffirmed the importance of climate finance.

One example of an active mobilisation of funds so far this year is the investment in April 2017 by the Green Climate Fund of USD$250 million in equity to the European Investment Bank for GEEREF NeXt – a ‘fund of funds’. The fund aims to attract additional private sector investment of USD$500 million over the next 15 years. It is intended that the funds will be used to finance over 200 renewable energy and energy efficiency projects in eligible developing countries across the Middle East, Africa, Latin America, Eastern Europe and the Pacific. The programme aims to support the commercial environment for renewable and efficiency projects in the beneficiary states by absorbing risk in an anchor investor role or via equity commitments designed to stimulate additional capital for projects. GEEREF NeXt will either directly invest into beneficiary projects or operate indirectly through specialised funds.

The issue of how private sector finance is accounted for against public sector commitments has been the subject of debate. Developing nations are keen to ensure that funds which they were instrumental in mobilising are not counted towards the US$100 billion target. In recognition of this, in advance of COP 21, ministers and senior officials from 18 developed countries and the EU agreed that they would account for private finance, only to the extent that it has been mobilised by public finance, or by a public policy intervention. They also agreed to report only on their share of private finance mobilised, excluding the share of private finance that developing countries’ private finance has mobilised.4

Key issues for policy makers to address in order to mobilise climate finance include

Climate finance is available, however, funders complain that they are not presented with viable and sufficiently mature project pipelines. This may be a result of poor government planning, or poor communication of the projects available.

The multiplicity of sources of climate finance means that the architecture of climate finance is complex. Funds can be channelled via multilaterals (both within or outside UNFCCC financing mechanisms), or may be bilateral. This can make the process of securing funds more complex.

Low carbon technology costs are falling, however, transaction costs remain high. Initiatives such as the Terrawatt Initiative aim to reduce the cost of capital for solar projects by reducing transaction costs and developing better market practices for making these investments.

A key issue in climate finance is how to mobilise finance for smaller scale initiatives; for example investment in residential solar power and storage, enabling communities to move away from reliance on diesel generation or biomass.

To tackle the barriers discussed above, and encourage private sector investment, several new climate finance investment and corporate structures are under development which should attract and facilitate private sector investment and hopefully encourage the private sector to bring projects forward. Here are some examples

Financial flows that are directed at climate mitigation and adaption are increasing, but are nowhere near levels that are consistent with the investment needed to meet the Paris Agreement commitments in respect of global temperature increases. Leveraging private sector finance is seen as crucial to narrowing this funding gap. However, ‘traditional’ solutions appropriate in developed countries will not achieve this goal. More innovative solutions are needed. When they are found, a significant market for private sector finance is expected to open up.

Climate Funds Update, http://www.climatefundsupdate.org/themes

As estimated in OECD 2015 “Climate Finance in 2013-14 and the $100bn goal” http://www.oecd.org/environment/cc/OECD-CPI-Climate-Finance-Report.pdf

Joint Statement on Tracking Progress Towards the $100 billion Goal, made in Paris, France September 2015 http://www.news.admin.ch/NSBSubscriber/message/attachments/40866.pdf?bcsi_scan_1fe59ba8c561fa18=z3OjpezVJ08ZjJbgK/bVxh8SMfwSAAAAysjZJQ==:1&bcsi_scan_96404f7f6439614d=0&bcsi_scan_filename=40866.pdf

Publication

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025