Climate change and sustainability disputes: Transport sector perspectives

Global | Publication | July 2021

Overview

According to the UN Environment Program, the transport sector contributes approximately one quarter of all energy related greenhouse gas emissions. However, the contributions from different transport types vary greatly, with road travel accounting for three-quarters of transport emissions, mostly from passenger vehicles, with around 30% coming from trucks carrying freight. Aviation, although high profile in any discussions on the topic, accounts for a similar proportion of emissions to global shipping, at around 10% each. Rail (including both passengers and freight) emits only 1% of all transport emissions.

In many developed economies there have been steep emissions reductions in areas such as the energy-supply sector, historically the worst offender. Emissions from the transport sector remain high and rising. As the global population increases and incomes rise, this drives demand for goods which need transporting and allows more people to travel by car, train and aircrafts. How quickly each transport type can transition from the current dependence on the combustion of fossil fuels will vary greatly, with hydrogen-technologies and electrification enabling some of these industries to decarbonise much quicker than others.

As governments come under pressure to reduce emissions under international commitments, and industry players scramble to meet regulatory requirements and innovate for the future of their own accord, the scope for disputes will increase.

Shipping

Shipping has long been the target of criticism from climate change lobbyists, national governments and regional groupings in failing to address the issue of climate change. Before considering whether such criticism continues to be justified, a number of issues have to be considered:

- Over 90% of all goods in international trade, by weight, are moved by ship. This is not a “nice to have” method of transportation – this is crucial for world trade and keeping the lights on.

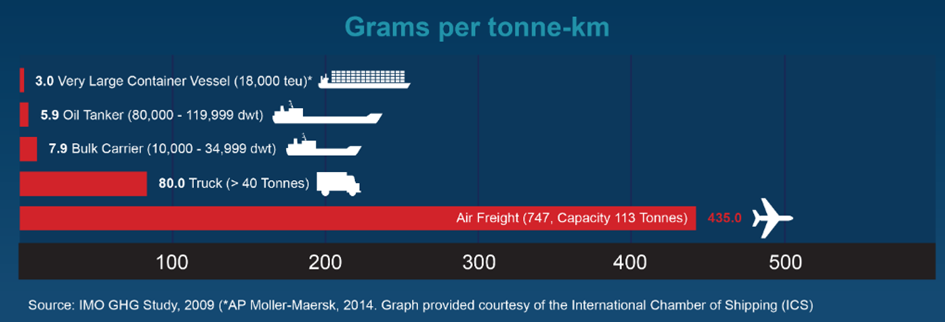

- Shipping goods by ship is the most energy efficient means of transport by far. Your new TV was transported to Europe from the Far East using 3.0 grams per tonne-km in comparison with your air-freighted asparagus from South America which used 435 grams per tonne-km.

- The sea is a hostile environment and safety and protection of life and the environment is paramount. Reliable propulsion and power generation is essential for this. There is currently little alternative to using internal combustion engine powered tankers to carry 2 million barrels of oil in a VLCC across the Atlantic.

- Ships are built with a +20 year life span – it was considered that making ships more efficient could only be achieved gradually by making new ships more efficient. It was assumed that ships already at sea could make only minor alterations to their energy efficiency without the risk of widespread disruption of trade. This view changed when, after the 2008 economic crises, slow steaming was used to mitigate the effect of massive oversupply of shipping, reduced demand and increased bunker prices. A by-product of this slow steaming was an increase in energy efficiency.

- The country of registry of a majority of cargo vessels at sea lies not with the industrialised nations who were early backers of the UNFCCC but with nations that were less enthusiastic; Panama, Liberia, and the Marshall Islands, as well as India, China and the US. There was no majority of states at the International Maritime Organisation (IMO) for radical change.

- The issues were regarded as being so technical and involved that the shipping industry was left to work this out for itself, mainly outside the formal structures of the UNFCCC. The lack of general agreement of the member states at the IMO made this a challenging task.

Shipping and the UNFCCC targets

As shipping (as well as aviation) was left under the UNFCCC convention to work out for itself how to take measures to combat climate change through the auspices of the IMO, progress. Since the nineties was slow, largely due to a lack of international agreement and the guiding principles of common but differentiated responsibility, together with the issues considered above. The IMO was criticised for failing to put substantive measures in place to control the growth and ultimately reduce the carbon footprint of shipping. Currently, shipping has a footprint about the size of Germany – about 2% of world emissions.

The IMO took some steps towards such measures, where it could find agreement to do so, by implementing a mandatory design index, the Energy Efficiency Design Index (EEDI) to improve the energy efficiency of new ships, as well as encouraging voluntary operational measures. However, these were regarded as insufficient by the climate change lobby and the EU as, in comparison with other sectors, the path to carbon reduction was just too slow. The EU, frustrated with the pace of change at the IMO, considered unilateral measures on global shipping calling at EU ports.

Spurred by this criticism, together with the increasing climate emergency which meant that many member states became less hostile to the idea of effective measures, the IMO is taking positive steps to develop initiatives which will reduce the carbon footprint of shipping. As mentioned, these already include the EEDI, requiring a minimum energy efficiency level for all new ships depending on the ship type and size, and the level is to be tightened every 5 years, thereby reducing emissions from new ships by at least 50% by 2050 (compared with 2008 levels). This initiative involved technical and operational measures such as the Ship Energy Efficiency Management Plan (SEEMP) and Energy Efficiency Operational Indicator (EEOI) which allow operators to monitor and improve the performance of their ships as well as measuring the fuel efficiency of their ships.1 However, these largely voluntary measures were not regarded as effective for existing ships and so in 2021 the IMO is likely to introduce more stringent regulations for these ships. This is in order to achieve the Initial IMO GHG Strategy, which aims to reduce carbon intensity of international shipping by 40% by 2030, compared to 2008.

The IMO Marine Environment Protection Committee (MEPC) 75, which met virtually in November 2020, approved draft measures to cut the carbon intensity of existing cargo and cruise ships that are above a certain size. These measures, if adopted as expected at MEPC 76 in June 2021, will enter into force by 1 January 2023 by way of amendment to MARPOL Annex VI.

The proposed amendments include a technical design requirement in the Energy Efficiency Existing Ship Index (EEXI) for ships with GT of 400 and above, and an operational one in the new Carbon Intensity Indicator (CII) for ships with GT of 5,000 and above. The latter will be coupled with a performance based rating scheme, with lower emissions getting an “A” rating, and plans to achieve the imposed CII targets will form part of the Ship Energy Efficiency Management Plan (SEEMP).

The EEXI is premised on the EEDI that has applied since 2013 to new-build ships and requires a minimum energy efficiency level per capacity mile for different ship type and size segments. EEDI-certified ships may, but will not necessarily, conform to the EEXI requirements.

In addition, MEPC 75 adopted a resolution on National Action Plans (NAP). This resolution encourages Member States to develop a voluntary NAP to help in reducing GHG emissions from international shipping. The resolution suggested that member states should consider national initiatives to reduce the GHG footprint of the whole global shipping chain, rather than just the ships themselves.

NAPs could include such steps as improving domestic institutional and legislative arrangements for the effective implementation of existing IMO instruments; developing activities to further enhance the energy efficiency of ships; initiating research and advancing the uptake of alternative low-carbon and zero-carbon fuels; accelerating port emission reduction activities, consistent with resolution MEPC.323(74); fostering capacity-building, awareness-raising and regional cooperation and facilitating the development of infrastructure for green shipping. These initiatives must also be seen against a long running policy of making shipping more green, sustainable and less polluting to the environment. For instance, since January 2020, ships have been banned from using high sulphur fuel oil: the maximum quantity of sulphur in marine fuel is now 0.5% and in certain areas, only fuel with 0.1% sulphur content can be used. This will have significant positive effects on air pollution from ships particularly in ports and coastal waters. Ballast water regulations now are in force to prevent invasive species being carried from one part of the world to another in ballast tanks. Regulations are being developed to reduce the radiated noise from shipping. Tougher regulation is in place to ensure more environmentally sound and safer recycling of ships. Shipping financiers have developed the ‘Poseidon Principles’, along the lines of the Equator Principles, to incentivise decarbonisation of fleets.

Finally, the European Union is proceeding with plans to bring shipping into its emissions trading system, a mandatory ‘cap and trade’ system which already applies to aviation and power plants, with parties initially required to participate in the monitoring, reporting and verification of CO2 emissions from large ships using EU ports and details on further participation being finalised.

The future challenge

Bearing in mind the facts mentioned above, making shipping green is a major challenge. Ships have a life of 20-30 years so ships being built now may still be afloat in 2050. The EEXI is a major step forward in reducing the carbon footprint of the existing fleet, as well as those designed for the future.

There is currently no realistic alternative to the internal combustion engine to power deep sea shipping. The global fleet will become green through incremental steps including the use of less polluting fuel such as LNG, and increasingly, methanol, hydrogen and other biofuels which, if they can be produced using green energy, will be a step change for shipping fuel and emissions. Other measures include: better hull design, the use of paint which reduces hull friction, the bleeding of air under the hull to reduce friction, the use of wind in the shape of kite sails and Flettner-type rotors to assist with propulsion and the use of solar power and batteries on board. The imposition of the EEXI will see engine power limiters installed to enforce slow steaming and bring existing ships within the carbon efficiency envelope required by the design index. These steps will be combined with the increasing use of AI and smart systems to maximise energy efficiency, reduce crew and produce truly green ships, at first in coastal trades but increasingly in the global fleet. Many ships are already more efficient than required under the 2025 target – containerships and general cargo ships are up to 58% more efficient. There is much to be positive about. In addition, the development of national initiatives will assist the greening of ports, the provision of green fuel options and the improvement in sustainability of the logistics chains serving them. But every step forward brings its own new set of problems – LNG fuel suffers methane slip (leakage) to the atmosphere and LNG is a more potent greenhouse gas than CO² by a factor of 30. Methanol and hydrogen may be low carbon fuels at sea but the energy required to make such fuel is immense and unless the fuel is made using renewable sources of energy it is not a green solution from a global perspective. The space for bunker tanks for alternative fuels will need to be larger; according to a 2019 DNV report on the Comparison of Alternative Marine Fuels,2

LNG has around 40% lower volumetric energy density than diesel. When accounting for the storage system, LNG has roughly 1/3 the volumetric energy density as diesel. Liquid hydrogen, ammonia and methanol have even lower volumetric energy density – around 40-50 % of LNG. Biodiesel is the only fuel which is close to matching the energy density of diesel, LNG has around 40 % lower volumetric energy density than diesel, roughly the same as LPG. When accounting for the storage system, LNG has roughly 1/3 the volumetric energy density as diesel. Liquid hydrogen, ammonia and methanol have even lower volumetric energy density – around 40-50 % of LNG. Biodiesel is the only fuel which is close to matching the energy density of diesel.

This will adversely affect the carrying capacity and endurance of ships powered by these alternate fuels.

Deep sea electric ships are some way off but electrically powered ships are being developed in the ferry and coastal/short sea shipping routes with some success. Much R&D funding is being expended on finding sustainable solutions and many exciting projects are under development – but these will take considerable sums of money to bring the successful projects to fruition and then roll them out into the global fleet in order to make a meaningful difference to the global carbon footprint .

Resulting litigation risk trends

The shipping industry will have to change fundamentally in the next 5-20 years if it is to make significant steps towards decarbonisation. The following may happen separately or in combination and could give rise to a variety of disputes:

- Potential disputes about the effect of the EEXI on ships where the engine power limiters reduce the ships speed and breach charterparty speed and performance warranties;

- There will be more consolidation in the industry as the technological challenges and environmental regulation burden become too great for SMEs;

- Disruptors will enter the industry if they perceive that it is too slow to change or they can bring an advantage in their logistics chains. For example, big retail players may develop control of entire supply chains rather than it being owned by different players: shippers, ship operators, terminals, rail and road will consolidate to ensure the whole chain is decarbonised;

- A two tier industry may develop with those greener ships trading between ports in states with more strict emissions requirements, and a less green fleet operating between those states that are not so committed;

- Negotiation on who will bear the burden of the cost of market based measures, such as those under consideration by the EU;

- AI and technology will need to be funded, financed and deployed;

- Progressive shipping companies will buy into technology to gain competitive advantage and better prepare for decarbonisation;

- There will be increasing regulatory action / litigation relating to environmental matters such as ship recycling, emissions, marine pollution, climate change litigation and ESG;

- Climate change will make conditions at sea more hostile leading to more incidents and claims, delay and disruption; and

- Climate change, increasing reliance on technology and increasing globalisation will bring more “black swan” events requiring advice, incident response and education.

Aviation

The global aviation industry produces between 2 and 3% of all human-induced CO2 emissions according to IATA, the airline trade association, meaning that if it were a country, it would rank in the top 10 emitters. Notwithstanding reduced passenger levels due to the COVID-19 Pandemic, demand for aviation is expected to continue growing strongly in the longer term, and different players within the aviation industry are already exploring ways to address their environmental impact.

Airlines have long been conscious of the imperative for carbon reduction, with improvements in the fuel efficiency of their fleets helping to mitigate their exposure to often volatile fuel prices. These financial incentives were strengthened by the inclusion of aviation within the European Union’s Emissions Trading Scheme (EU ETS) in 2008, followed by emissions trading schemes in other jurisdictions and the introduction of ICAO’s global carbon offsetting scheme, CORSIA, in 2019. Further regulatory developments have been promised by governments ahead of the next UN Climate Change Conference.

The drivers for further improvements in the carbon footprint of airlines’ operations are also increasingly coming from a different direction - financial institutions and asset managers are becoming subject to regulatory and public scrutiny regarding the environmental, social and governance (ESG) profiles of their portfolios.

A raft of measures aimed at improving transparency seek to harmonise the classification, standards and financial reporting of ESG projects and investments, including the EU’s Taxonomy Regulation, ESG Regulation and ESG Benchmarks Regulation. Combined with voluntary measures such as the recommendations of the G20’s Task Force on Climate-related Financial Disclosures, the pressure on financial institutions to consider ESG issues in their investments is rising. Some of the state aid offered to airlines due to the COVID-19 Pandemic have been conditional on carbon reduction measures being taken. Increasing public awareness of environmental and climate-related issues as well as regulatory changes have led to the development of a variety of green and sustainable lending products.

Industry players in different regions have responded with different levels of urgency. In February 2021 a group of European airports, airlines, aerospace manufacturers and air navigation service providers unveiled its sustainability initiative, Destination 2050, with the aim that all flights within and departing the EU, UK and EFTA realise net zero CO2 emissions by 2050. This and other initiatives aim to realise carbon reduction in the aviation industry by a combination of improvements in existing aircraft and engine technology, the development of hydrogen-powered and (hybrid-)electric aircraft and associated airport infrastructure, improvements in air traffic management and the scaling up of sustainable aviation fuels (SAF) production to commercially viable levels.

Resulting litigation risk trends

Both as a result of a changing regulatory environment and as a result of climate change itself, and how it will impact the industry at an operational level, increased numbers and types of disputes can be anticipated. For example:

- Competition issues may arise where governments or regulators take regulatory measures to promote decarbonisation which distort markets for particular players.

- The use of new financing products could lead to disputes between airlines and financiers as to whether sustainable criteria and targets have been met.

- The pressures for new technologies to meet regulatory requirements may lead to disputes about delayed orders for new types of aircraft and delays in SAF production upscaling quickly enough to meet demand.

- The interaction of emissions trading schemes and differences in the implementation of ICAO’s carbon offsetting scheme, CORSIA, at a domestic level may lead to disputes.

- Shifting wind patterns are leading to changes to optimal flight paths with increased fuel consumption, unpredictability of schedules and higher costs for airlines. These may lead to disputes between airlines and airports. Increasing incidences of clear air turbulence may lead to a rise in passenger claims.

- Rising sea levels and storm surges may increasingly lead to flooding of coastal and low-lying airports, leading to disputes with airlines that use them, the invoking of force majeure clauses and increased passenger claims.

- Increased warranty claims and manufacturer disputes may arise from aircraft manufactured today being unable to withstand the greater structural forces acting on them as a result of the atmospheric conditions resulting from climate change.

- Warmer air temperatures (providing less lift) may lead to restrictions on the take-off weight of aircraft, resulting in contract disputes with higher altitude airports and airports with shorter runways.

Rail

Rail transportation is the most environmentally-friendly efficient mode of transport for freight and passengers, as compared to road and air. Precise emission levels vary significantly, however, especially when drawing comparisons on a per passenger or per unit basis, depending on a multitude of factors including fuel source and overall distance, speed and weight.

In terms of fuel source, the rail industry relies predominantly on electric and diesel.

- Passenger - a significant part of passenger travel in particular takes place on electrified networks and trains (for example, high speed, long distance and urban/metro services). According to the International Energy Agency, around three quarters of passenger trains globally are electric, with regions such as Europe, Japan and Russia leading the pack. However, a material volume of services in most countries still remains dependent on diesel, with certain regions (e.g. North and South America) still heavily reliant on diesel.

- Freight - this sector is primarily fueled by diesel, mostly driven by the heavy weight “load” dependencies and the consequent need for a power “dense” fuel source - characteristics most easily/economically met by diesel. This sector is arguably the most “vexed” by (and therefore resistant to) the potential requirement to step away from diesel - the perfect storm arising from the combination of:

- the “physical” characteristics mentioned above;

- a largely privately owned sector, not benefitting from state support; and

- intense competition from low cost road hauliers, who do not have equivalent levels of infrastructure access charges.

- Other fuel sources - notwithstanding the above and the fact that further electrification is likely to provide the majority solution to the “greenification” of global rail networks, other competing fuel source technologies are being developed and (in a few instances) commencing operations, namely battery cells and hydrogen.

- Battery cells are further along the development/operational curve, but will need strategic (i.e. governmental) assistance as to the development of charging infrastructure, as in particular “diesel” charged cell technology becomes defunct.

- Hydrogen is generally at an even earlier stage, whether being developed as part of hydrogen charged cell technology or as a direct traction source. Although this technology will have application in some cases, its widespread commercial application is again linked to the development of hydrogen production and storage infrastructure - again requiring a national strategy.

In this regard, trains and locomotives powered by diesel with refined crude as their fuel source are more carbon-intensive than their electric counterparts. And, as with any mode of transport that draws from the grid, an electric train’s overall carbon footprint is determined in part by the source of electricity, be it coal, gas or renewables - a similar issue also for the burgeoning hydrogen rail technology, as it attempts to transition its production from brown/grey to blue/green sources.

Further, the wider rail industry supply chain includes energy-intensive raw materials (for example concrete), infrastructure development and construction, manufacturing and maintenance, and end-of-life disposition and recycling, all of which have significant impacts.

Railways worldwide are subject to emissions regulations. For example, European and Chinese emissions regulations for non-road engines apply to locomotives and include specified diesel emissions limits, and in some cases, metering tools and standards. Canadian and American regulations for federal railways also include diesel emissions limits for new locomotives and provide for emissions testing, idling reduction and reporting requirements.

The rail industry’s contribution to global emissions is also the subject of specific industry group action, such as Railsponsible, which focuses on sustainable procurement and provides guidance for the rail industry to set and act on targets related to the Paris Agreement.

Significant challenges for rail infrastructure are expected to result from the physical effects of climate change in coming years, including greater extremes in temperature variations and severe weather events such as flooding that, like other major infrastructure, can be expected to have a significant effect on railway systems and particularly in those jurisdictions most vulnerable to such events.

Subscribe and stay up to date with the latest legal news, information and events . . .