Introduction

In the past few years, there has been a proliferation of countries and organisations pledging to achieve net-zero emissions.

While organisations should prioritise reducing greenhouse gas (GHG) emissions from their own operations and supply chain, the use of carbon offsets is necessary for emissions that are currently not technologically viable, or too costly, to eliminate.

Carbon offset units can be generated pursuant to many different standards and used for both compliance purposes (i.e. offsetting emissions to ensure compliance with an emissions trading scheme or carbon tax) and voluntary purposes (i.e. supporting the achievement of net-zero or carbon neutrality claims).

In this client alert, we focus on the generation of offsets that may be used for voluntary purposes.

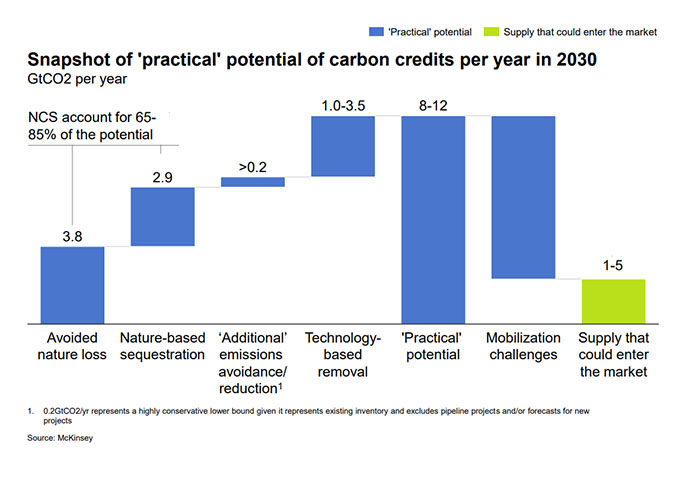

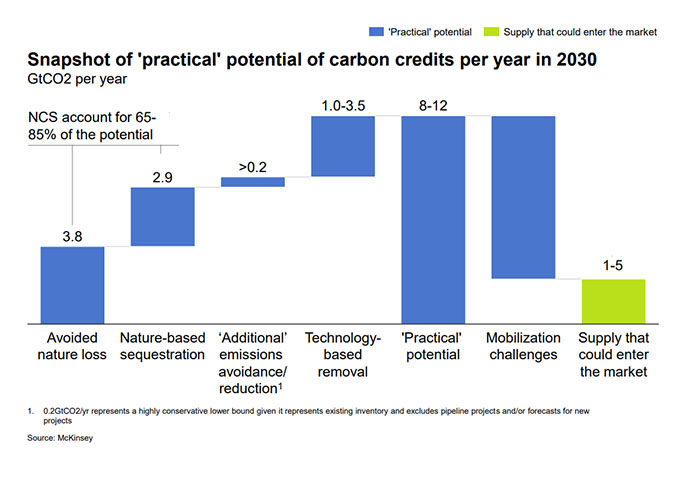

The size of the voluntary carbon market was valued at over USD 1 Billion in 2021. The Taskforce on Scaling Voluntary Carbon Markets (TSVCM) found that voluntary carbon markets need to grow by over 15 times by 2030 in order to make a meaningful contribution to limiting global temperature increase to 1.5°C. Figure 1 shows the findings of the Taskforce in relation to the significant practical potential to generate carbon offset units from different types of projects in 2030, and also how this supply may be limited due to challenges in mobilising this demand and scaling the market.

Figure 1: Practical potential of carbon offset units compared with supply that is likely to enter the market due to mobilisation challenges

In general terms, increasing demand for carbon offsets presents significant opportunities for organisations who are looking to develop or invest in carbon projects. However, a variety of risks also arise from the development of carbon projects and the purchase or sale of carbon credits that require careful consideration and should be addressed in applicable documentation.

In this client alert, we consider:

- In Part 1, the major international voluntary market standards under which carbon offset units may be generated;

- In Part 2, the different types of carbon projects that are capable of generating carbon offset units;

- In Part 3, the initial steps that must be undertaken by an organisation prior to registering a carbon project in accordance with one of the voluntary market standards; and

- In Part 4, the ongoing requirements that must be fulfilled by the proponents of registered carbon projects.

What are the major international voluntary market standards?

Voluntary market standards establish frameworks for the registration of carbon projects in accordance with approved methodologies, the verification of emissions reductions and the issuance of carbon credits. There are currently two leading international voluntary market standards.

The largest in terms of the transacted carbon offset volume is Verra’s Verified Carbon Standard (VCS). Verra is a non-profit corporation registered in the United States. Verra manages a number of other environmental market standards in addition to the VCS. The VCS enables carbon projects to be registered and generate verified carbon units (VCUs) across the energy, waste, construction, mining, transport, industrial and agriculture, forestry and other land use (AFOLU) sectors.

The primary rules applicable to the VCS are the VCS Program Guide and the VCS Standard, which are supplemented by policies, procedural documents and guidance documents. The VCS has rigorous requirements relating to the validation of proposed carbon projects and the independent verification of emissions reductions achieved.

Verra also administers the Verra Registry which became operational in 2020 and provides online public access to information on certified projects as well as the issuance and trading of VCUs.

The VCS is complemented by the Climate, Community and Biodiversity Standards (CCB Standards), which is also administered by Verra and can be applied to any land management project. The CCB Standards enable the independent auditing and certification of community and biodiversity attributes in addition to climate benefits. When VCUs are issued from projects that are registered under the VCS and certified under the CCB Standards, they will have a “CCB label”.

The Gold Standard for the Global Goals (Gold Standard) is another international voluntary carbon offset standard that enables carbon projects to be registered and generate verified emissions reductions (VERs). It aims to promote the Sustainable Development Goals (SDGs) alongside climate mitigation, and also certifies the achievement of SDG impacts. The Gold Standard has rigorous safeguards, stakeholder engagement and project design requirements to ensure high levels of environmental and social integrity. The Gold Standard also has methodologies for the generation and issuance of Averted Mortality and Disability Adjusted Life Years (ADALYs) and Water Benefit Certificates.

Both the VCS and Gold Standard require that all emissions reductions credited are real, additional and permanent. VCUs and VERs each represent one tonne of carbon dioxide equivalent of emissions reductions.

We also note the following standards, which we do not consider in detail for the purposes of this alert:

- Certified Emission Reduction Units (CERs) issued by the Kyoto Protocol’s Clean Development Mechanism (CDM) may be transacted for voluntary purposes;

- the Climate Action Reserve (CAR) and American Carbon Registry (ACR) enable the registration of projects that generate carbon offset units for voluntary purposes as well as for the purpose of compliance with California’s Cap-and-Trade program and the International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). The purpose of this alert is to consider standards that apply in a broad selection of international jurisdictions, and CAR is limited to the Unites States, Mexico and Canada, while the vast majority of ACR projects are in the United States;

- Architecture for REDD+ Transactions’ REDD+ Environmental Excellence Standard is an emerging standard under which countries and some subnational jurisdictions can generate credits from projects that reduce emissions from deforestation and forest degradation in developing countries (REDD+ projects);

- the Global Carbon Council is another emerging standard, with 91 projects currently pending approval (the majority of which are renewable energy projects) and 2 approved; and

- Plan Vivo, which is limited to land sector projects.

Types of carbon projects

There are two main categories of carbon projects:

- GHG avoidance and reduction projects; and

- GHG removal and sequestration projects.

GHG avoidance and reduction projects avoid activities that cause GHG emissions, or reduce emissions from current sources by replacing them with low-carbon alternatives.

Examples of currently approved avoidance and reduction methodologies on the voluntary market include reducing methane emissions from dairy cows, improved cookstoves, household energy efficiency measures, fuel switching, renewable energy in circumstances where it is additional and not a business-as-usual technology, nitrogen fertiliser rate reduction, avoided ecosystem conversion and deforestation, and efficient waste management.

GHG removal or sequestration projects remove and store GHGs from the atmosphere, for example through biological sequestration (e.g. reforestation), geological sequestration (e.g. carbon capture and storage) or other technology based removals (e.g. direct air capture).

Currently approved removal or sequestration methodologies on the voluntary market include, for example, soil organic carbon, afforestation and reforestation, GHG capture and utilisation in plastic materials and concrete production, coastal wetland creation, and tidal wetland and seagrass restoration. The CCS+ Initiative has begun developing a carbon capture and storage methodology for approval under the VCS.

The TSVCM highlighted that while avoidance and reduction projects are important in the short-term, a shift to removal or sequestration projects is required to limit global temperature increase to 1.5°C. They estimated that in order to reach the Paris Agreement’s long-term temperature goal of limiting global temperature increase to 1.5°C, 2Gt of GHGs will need to be sequestered or removed from the atmosphere by 2030. This requires a scale-up in excess of 15 times the carbon offsets generated under voluntary standards in 2019.

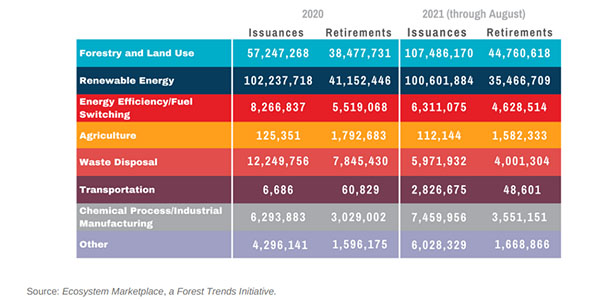

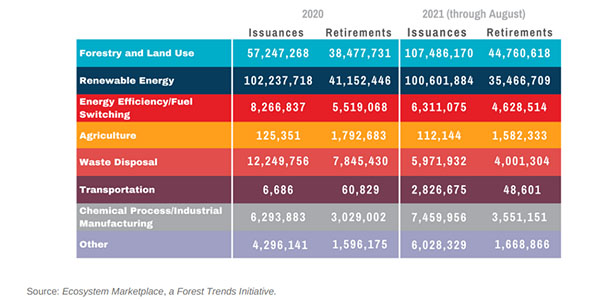

Ecosystem Marketplace found that voluntary carbon market transactions in 2021 were dominated by forestry and land use offset units as well as renewable energy offset units. Table 1 identifies the issuances and retirements by project category in 2020 and to 31 August 2021.

Table 1: Issuance and Retirement by Project Category on the Voluntary Carbon Market

Planning and registering a carbon project

In order to achieve registration under a voluntary market standard, carbon projects must meet the requirements set out under the standard’s rules and an approved methodology. In this Part, we address the key elements that carbon project developers (or investors) should have regard to when considering the development of (or investment in) a carbon project.

Selecting an applicable methodology

The first step when planning a carbon project is to determine whether there is an applicable methodology under a voluntary carbon standard. Methodologies apply to specified types of carbon projects, and enable the quantification of emissions reductions achieved by eligible projects. It is often important to engage technical consultants to match proposed activity design with the requirements of a specific methodology.

Methodologies set out eligibility requirements, which may limit the application of the methodology to particular activities or technologies, or require that the project site had a particular land-use prior to the implementation of the carbon project.

The major voluntary market standards have methodologies that apply to a wide range of sectors, for example energy, industry, transport, waste, mining, and AFOLU. New methodologies are added, and existing methodologies may be updated and/or retired over time to ensure that they continue to conform to scientific consensus and best practice, and respond to changes in technology. The VCS allows for organisations to develop and submit their own methodologies for approval by Verra, and also allows methodologies developed under the CDM and CAR to be applied by VCS projects, whereas Gold Standard has a regular approval procedure for methodologies as well as a fast track procedure for methodologies already approved under another standard.

In addition to the already approved methodologies, VCS and Gold Standard have a pathway for the development and approval of new methodologies where no existing methodology addresses the needs of a project. This requires internal assessment by the standard organisation followed by a third-party assessment prior to the methodology being approved.

Demonstrating additionality

A key requirement under all methodologies is that carbon emissions reductions and removals must be additional to what would have occurred under a business-as-usual scenario if the carbon project had not been carried out. To illustrate this concept, VCS have developed an additionality tool specifically for agriculture, forestry and other land use activities. Under this tool, project proponents must follow four steps to demonstrate additionality:

- Identification of alternative land use scenarios to the project, for example whether there are realistic and credible other uses of the land except for the project;

- Investment analysis to determine that the project is not the most economically or financially attractive land use;

- Barrier analysis to determine whether there are barriers to the proposed project that would prevent the project activities being undertaken without the revenue from the carbon credits; and

- Common practice analysis, to show the extent to which similar activities to the project have been implemented previously or are currently underway.

These questions provide a general indicator of the types of hypothetical scenarios that a project proponent should be considering in the early stages of project development. As there are multiple qualitative criteria, assessment of additionality can be difficult, and requires up-to-date analysis, particularly in relation to what is common practice.

Project Site

In general terms, neither the VCS nor the Gold Standard restrict the development of carbon projects to particular countries. Some methodologies, however, are limited to particular locations or environments.

Some of the key considerations when selecting a project site include:

- Whether the site meets all requirements under the applicable methodology, and is suitable for carrying out the planned project;

- Identifying all relevant landholders, community groups and other stakeholders, and determining their level of support for the project as well as which entity has the legal right to any emissions reductions generated on the project site;

- Whether any government approvals are required to carry out the project or to export carbon offset units generated by the project; and

- Whether any co-benefits may be associated with the development of a project on a particular site, for example biodiversity, water, social and cultural co-benefits. Carbon offset units generated by projects that are associated with co-benefits will often attract higher prices.

Demonstrating legal right to be issued with carbon offset units

Project proponents must establish that they have the legal right to the carbon offset units generated by a project. This can be demonstrated in a number of different ways depending on the type of project and jurisdiction.

For projects in the land sector, for example, it is first necessary to determine whether the landholder, the government or another entity has ownership of the carbon rights associated with the project site. In some jurisdictions carbon rights may be assigned from the holder of the carbon rights to a project proponent, and in other jurisdictions it is only the right to the emissions reductions achieved (and carbon offset units generated) that may be assigned. These rights are generally assigned via an agreement between the project proponent and the holder of carbon rights, which may rely on underlying title documents or agreements between the carbon rights holder and a relevant government body.

Both Gold Standard and VCS require that the project proponent have full and uncontested legal and equitable title and rights to all and any carbon credits generated by the project.

Obtaining relevant government approvals

Depending on the nature of a project and the host country, regulatory and environmental approvals may be required from a number of different government bodies. These may include, for example, environmental approvals, approvals relating to water access, approvals for forestry-related activities, and other regulatory or project-related approvals. It is also required that carbon projects do not violate any applicable laws.

We also note that, following agreement on the rules governing Article 6 of the Paris Agreement at COP 26 in Glasgow, voluntary market standards and/or host countries may require that the international transfer of carbon offset units generated under voluntary market standards be authorised by the host country in some or all circumstances. Host country governments may also apply a corresponding adjustment to ensure such units are not counted towards the host country’s Nationally Determined Contribution (NDC) under the Paris Agreement. Whether or not host country authorisation is obtained, and a corresponding adjustment is applied, may impact on the nature of the claims that can be made in relation to such offsets and potentially, the value of the offsets.

Engaging with relevant interest holders and respect for human rights

In addition to engaging with relevant government bodies and landholders for the purpose of demonstrating legal right and obtaining government approvals, it is often necessary to engage more broadly with relevant stakeholders. For example, many carbon projects in the land sector rely on cooperation from local communities and indigenous groups. Equally, it is important that projects respect human rights in addition to statutory and customary rights, and project proponents should ensure that free, prior and informed consent is obtained.

The Gold Standard requires information about any stakeholder inputs and legal disputes as part of the documentation needed to establish an entity’s right to be a project proponent. This includes any legal grievances which have been received in relation to the project, and reporting on any mitigation measures that were agreed to address stakeholder concerns. The Gold Standard is prescriptive about how this engagement takes place and provides that stakeholder consultation must comprise a minimum of two rounds of consultation.

The VCS also requires local stakeholder consultation to be conducted prior to validation, as well as mechanisms for ongoing communication with local stakeholders. The project proponent is required to take all inputs received into account, and either update the project design or justify why updates are not appropriate.

Applying for project registration

The forms and documentation required to apply for project registration differ between standards and project types. However, these forms generally require the following information:

- Identification of the proponent, and any other involved parties;

- Description of project, including how it satisfies the applicable rules and the applied methodology, the location of the project, demonstration of additionality and proposed crediting period of the project;

- Description of the monitoring system to be applied by the project;

- Estimations of carbon reductions to be generated; and

- Stakeholder inputs and legal disputes as referred to above.

In addition to using technical experts to prepare the documentation or data provided, some of the documentation required must be validated by third-party validation prior to submission. For example, Verra approve validation bodies that must assess applications for project registration. It is generally the responsibility of the project proponent to retain an independent auditor to prepare a validation report.

Operating a carbon project and issuance of carbon offset units

Once a project is approved, project proponents are required to comply with ongoing monitoring requirements and must report periodically to the relevant voluntary market standard. If a monitoring report documents that emissions reductions have been achieved in a monitoring period, these will be verified by an independent auditor to ensure adherence to the applicable standard rules and methodology, and project proponents may then submit a request to the standard body for the issuance of carbon offset units. If this request is approved, units are issued into a nominated registry account. Carbon offset units may continue to be generated and issued for the duration of a project’s crediting period.

In general terms, the crediting period and first monitoring period of a project will commence on the project “start date”. What triggers the start date depends on the methodology, for example for a land based project the start date might be from the date of planting or seeding.

Ongoing requirements also apply in relation to ensuring the permanence of emissions reductions (in particular for land sector and geological sequestration projects) and maintaining communication channels with stakeholders to ensure that any concerns can be raised and addressed. Project proponents are generally required to develop grievance procedures to address disputes that may arise with stakeholders.

Crediting Period

A project’s crediting period is the time during which GHG emissions reductions or removals generated are eligible for the issuance of credits. A finite crediting period allows for opportunities to reassess a project, and best efforts to be made to transition the project to financial viability in the absence of its ability to generate carbon credits.

The crediting period differs depending on the project type. For example, under the VCS, crediting periods for non-AFOLU projects are either 7 years (twice renewable, for a total maximum length of 21 years) or a single period of 10 years. AFOLU projects may have a crediting period of up to 100 years. Some crediting periods must be renewed after a specified period of years while others have a fixed single crediting period.

Reporting and verification

Project proponents must report to the relevant body at specified intervals for the verification of emissions reductions achieved by the project. Reporting is a mandatory part of the process, and also ensures oversight of the project by the standards body for risk mitigation.

Under the VCS, for example, the maximum time a project can go without reporting is five years.

Managing the risk of non-permanence

Emissions reductions or removals may be generated by projects that carry a risk of reversal, for example land sector and geological sequestration projects. This can occur through mismanagement of a project, deliberate or accidental reversals caused by third parties, or unforeseen events such as natural disasters. Project proponents must generally notify and report to the standard body any loss which takes place.

To maintain the integrity of voluntary carbon markets, project proponents are required to ensure that emissions reductions are not reversed after credits have been issued in relation to those emissions reductions. The voluntary market standards also have a number of tools to ensure that any reversals that do occur are addressed.

The VCS employs a non-permanence risk tool to assess AFOLU projects. Where the longevity of certain land and agricultural projects (the number of years that the project will be maintained) is less than 30 years, the project will fail the risk assessment and be ineligible for crediting. For projects that satisfy the risk assessment, a designated percentage of at least 10% of VCUs generated by the project are withheld in a pooled buffer account. The VCUs held in the pooled buffer account are cancelled to cover reversals, which means that VCUs already issued to projects do not have to be cancelled or “paid back”.

To ensure permanence, the Gold Standard requires a fixed 20% contribution for a pooled compliance buffer, which again covers risk of reversal and non-performance. If the buffer is insufficient, the Gold Standard may require further compensation/retirement of lost emissions reductions units.

Dispute resolution and fraudulent conduct

Finally, we note that project proponents may also be liable to the verification body for any fraudulent conduct, negligence or misrepresentation. This may include deliberate or negligent errors on verification documents that result in additional carbon offset units being issued to a project. In these circumstances, project proponents may be liable to compensate for the issuance of these credits.

|

Norton Rose Fulbright has been advising participants in carbon markets for over 15 years. Our carbon markets team has significant expertise in advising clients on undertaking carbon projects across a number of different standards and jurisdictions. In particular, we have deep experience of advising on nature based solutions projects, including afforestation, avoided deforestation, vegetation restoration, soil carbon, blue carbon and customary land management. This experience includes advice on scheme participation and compliance, commercial arrangements between different stakeholders (such as landowners, project proponents, government entities and traditional owners) and the project finance or other financial mechanisms which support project development.

Please reach out to a member of our carbon markets team for further advice on how you can undertake or finance a new carbon project.

|

| |