Overview

On October 24, 2023, the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation (FDIC) (hereinafter the agencies) released a final rule to implement changes to the Community Reinvestment Act (CRA).

The CRA was enacted in 1977 to ensure that banks would lend into communities from which they received a substantial portion of their deposits. Many of the key changes in the final rule are intended to account for the gradual move that has transpired from the late 1970s, where bank activities were tied to branch locations, to today's environment, where both lending and deposit taking is primarily conducted online. As explained in more detail below, the final rule updates how banking activities will qualify for CRA consideration, particularly where lending may be concentrated in areas where banks have few, if any, branch locations. Importantly, although commenters requested that the final rule apply to nonbank lenders and credit unions, the agencies did not agree to apply CRA obligations to credit unions or to entities that do not hold FDIC-insured deposits.

Key objectives of the final rule

The key objectives of the final rule are as follows:

- To strengthen the achievement of the core purpose of the statute;

- To adapt to changes in the banking industry, including the expanded role of mobile and online banking;

- To provide greater clarity and consistency in the application of the CRA;

- To tailor performance standards to account for differences in bank size, business models and local conditions;

- To tailor data collection and reporting requirements and use existing data whenever possible;

- To promote transparency and public engagement;

- To confirm that CRA and fair lending responsibilities are mutually reinforcing; and

- To promote a consistent regulatory approach that applies to banks regulated by all three agencies.

Key changes in the final rule from current regulation

CRA Framework

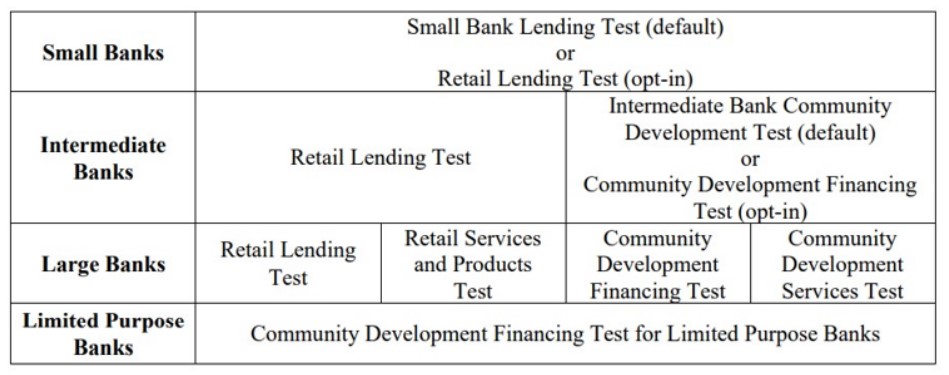

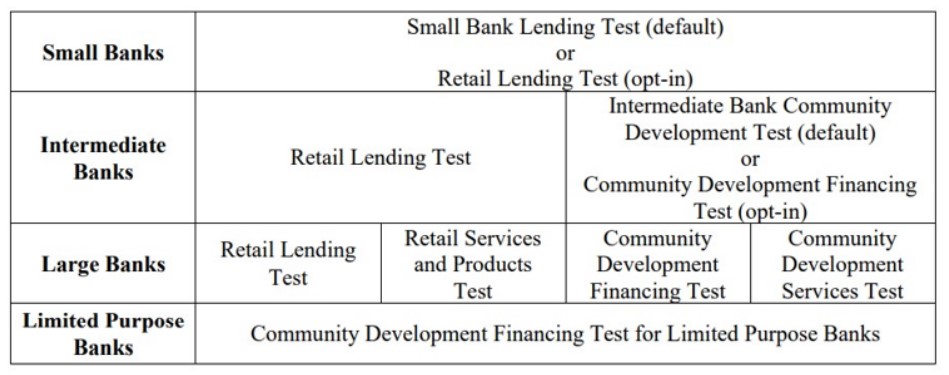

The final rule significantly builds on metrics and criteria to provide a more consistent and transparent approach to the tiered CRA evaluation framework. The tiered framework now includes the following:

- For banks with less than US$600m in total assets (small banks):

- The existing CRA evaluation is unchanged but also provides an evaluation option under the Retail Lending Test.

- For banks with between US$600m and US$2b in total assets (intermediate banks):

- The existing community development evaluation is unchanged, but a new retail lending evaluation has been implemented. Intermediate banks have the option of evaluation under a new test for community development financing.

- For banks with over US$2b in total assets (large banks):

- The final rule implements separate evaluations for retail lending, retail services and products, community development financing and community development services.

- For banks with over US$10b in total assets:

- The final rule implements additional data collection, recordkeeping and reporting requirements. In addition, for these financial institutions, the evaluation of retail services and products includes digital delivery systems.

As noted above, the final rule adopts a new US$2bn threshold for a bank to be considered a "large bank" for purposes of the CRA, and essentially applies the same evaluation for a US$2bn bank as it does for a US$2t bank. As a result, smaller community banks satisfying the over US$2bn threshold may find themselves compared to "peers" that are much larger and benefit from economies of scale in terms of lending and community investments. This new threshold may not sufficiently differentiate between smaller community banks and the largest banks, and indicates that, even though smaller community banks have different balance sheets and business models, CRA expectations may not be fully tailored to a bank's size, risk, service area and business model.

Additionally, approximately 600 banks currently categorized as intermediate small banks will be recategorized as "small banks." Approximately 130 banks that are currently categorized as large banks will be recategorized as "intermediate banks." The size of banks to be categorized will be adjusted annually for inflation.

Data and reporting

While placing a greater emphasis on data driven comparisons, the final rule does not change data collection and reporting requirements for small and intermediate banks. As referenced above, large banks will be subject to updated and expanded data collection, maintenance and reporting requirements to support the implementation of metrics and benchmarks for retail lending, community development financing and retail services and products. Certain new data requirements are limited to large banks.

Community development

The final rule defines eleven investment categories that can result in credit for community development: affordable housing; economic development activities; community supportive services; six place-based activities[1]; activities with Minority Depository Institutions (MDIs), Community Development Financial Institutions (CDFIs), women's depository institutions and low-income credit unions; and financial literacy. The agencies are required to maintain a publicly available list of example products that qualify for community development consideration.

Geographic areas in which a bank's activities are considered

The final rule utilizes a system of metric based, data driven peer comparative performance tests to evaluate a bank's performance in meeting the credit needs of its community. The following four tests are a new, required performance evaluation for large banks.

Retail lending test

Large Banks with 80 percent or less of lending in areas that are adjacent to their deposit-taking facilities, known as "facility-based assessment areas," will have an alternate evaluation. Instead of evaluating retail lending in just the facility-based assessment areas, the agencies will consider "retail lending assessment areas." Retail lending assessment areas are the areas in which banks originated more than 150 closed-end home mortgage loans or 400 small business loans in the prior two years. Lending outside the retail lending area will also be considered if the majority of lending is done outside of the bank's facility-based assessment areas.

Community development financing test

The Community Development Financing Test has been amended to consider how banks meet community development financing needs in each facility-based assessment area, State, or multistate metropolitan statistical areas (MSA) rather than specific areas. As part of this test, the primary metric considered for large banks is deposits. For limited purpose banks, including wholesale banks, however, the primary metric considered as part of the Community Development Financing Test is assets. Limited purpose banks are only evaluated under the Community Development Financing Test, but these banks may extend to retail customers those loan types evaluated under the Retail Lending Test on an incidental and an accommodation basis without losing their limited purpose bank designation.

Community development services test

The Community Development Services Test has been amended to consider the importance of community development services in fostering partnerships, building capacity and credit conditions for effective community development. These factors will be evaluated in rural areas, facility-based assessment areas, States, multistate MSAs and even nationwide.

Retail services and products test

The final rule amends the Retail Services and Products Test to evaluate the availability of a bank's retail banking services and retail banking products as well as the products' responsiveness to the credit needs of the bank's entire community. Retail banking products can only serve as a positive factor in terms of a bank's evaluation under the Retail Services and Products Test.

The following chart summarizes which tests apply to each bank category:

Effect of CRA performance on applications

The final rule includes no substantive changes to the regulatory provisions concerning the effect of CRA performance on bank applications, including those for mergers, acquisitions or consolidation of assets, deposit insurance requests and the establishment of domestic branches. While nearly every bank merger is subject to CRA objections, large banks contemplating mergers, in particular, should expect that objectors will have broader bases on which to oppose proposed combinations because the final rule expands the criteria on which banks will be assessed, including updated and expanded data collection, recordkeeping and reporting requirements.

Effective date

Generally, the final rule is effective April 1, 2024, but the compliance date for the majority of the rule's provisions is January 1, 2026, with certain other requirements becoming applicable on January 1, 2027.Some amendments are only effective April 1, 2024 through January 1, 2031, while others are delayed indefinitely. The agency will continue to publish effective dates as they are decided, and will update the Federal Register. Until then, banks should consider their size and respective categorization, and consider what tests will be used to evaluate their performance. Given the complexity and length of the final rule (together with explanatory text, the final rule is nearly 1,500 pages long), it is likely that implementation will require significant overhauls of banks' policies, procedures and systems. Accordingly, banks should begin compliance planning immediately.

Implementation

The agencies plan to engage with banks in comprehensive implementation efforts to improve understanding of and help banks transition to the revised CRA framework in the final rule. The agencies expect to issue supervisory guidance, including examination procedures and will conduct outreach and training to facilitate implementation of the final rule. Additionally, the agencies intend to develop: data reporting guides and technical assistance materials to assist banks in understanding supervisory expectations with respect to the final rule's data reporting requirements; and templates, such as for the submission of digital and other delivery systems data as well as for responsive deposit products data. Finally, the agencies intend to develop data tools for banks and the public that would increase familiarity with the operation of the performance tests and allow for monitoring of performance relative to benchmarks based on historical data.

Practical considerations/compliance challenges

Best evaluation practices

Because the final rule provides more clear guidelines for banks of different sizes, banks should assess which particular evaluation guidelines apply to them and prepare accordingly. Small banks, intermediate banks, large banks and limited purpose banks all have different reporting requirements as well as evaluation standards. Banks must pay close attention to this refined guidance to ensure compliance with the relevant requirements.

Diversity and inclusion

The final rule provides incentives for banks to consider community development and investments. Activities such as supporting low-income communities and women, considering affordable housing opportunities and ensuring customers are financially literate are all community development factors that positively reflect on a bank.

Banks should continue to consider whether or not they have sufficient products that target, and are accessible to, LMI individuals. Moreover, banks should develop programs targeting low-income and minority communities. Beyond specific products, activities like financial literacy courses can help bolster strong community involvement.

Online banking

The final rule significantly modernizes the agencies' approach to evaluating banks that operate online. One way the rule does this is by evaluating retail lending outside of facility-based assessment areas. Although physical branches are still an important consideration, the final rule recognizes that not all banks have physical branches.

In addition to considering physical branches, the final rule evaluates certain large banks' digital delivery systems, which are the channels through which customers can use retail banking services electronically.

All banks that have an online presence should ensure the program is accessible to a broad range of individuals; not just those customers that are computer literate or of particularly higher income.

Clean energy investments

The final rule does not specifically outline which energy-related activities qualify as community development. That being said, the final rule is broad enough to incentivize banks to consider financing at the community level for solar, and other clean energy initiatives , which can be considered a community benefit in alignment with the CRA. Banks can receive CRA credit for clean energy investments.

Special thanks to Law Clerk Ian Slingsby (Washington, DC) for his assistance in the preparation of this content.

[1] The six place-based activities are revitalization or stabilization activities; essential community facilities; essential community infrastructure; recovery activities in a designated disaster area; disaster preparedness and weather resiliency activities; and certain activities in Native Land Areas.