Introduction

As of 1 January 2024, the Income Inclusion Rule (IIR) of the OECD Pillar 2 proposal will impose an additional tax on the ultimate parent company of a group if a foreign subsidiary is effectively taxed below 15%. In this way, Pillar 2 introduces a global minimum tax system with a minimum effective tax rate (ETR) of 15% at the jurisdictional level.

Large multinational enterprises with a global turnover of at least €750 million will be within the scope of Pillar 2. For a more complete picture of the BEPS Pillar 2 global minimum tax, please see our previous publication.

In numerous domestic tax regimes, participation exemptions provide for a corporate income tax (or in some cases a withholding tax) exemption on dividends and capital gains on disposals of equity interests between group or related companies. Pillar 2 also provides for an exemption for excluded dividends when calculating the net qualifying income used to determine the ETR. The way that the Pillar 2 exemption works will not, however, always align with the domestic law participation exemption which can lead to a mismatch.

This means that where the domestic participation exemption applies but there is no exemption under the Pillar 2 rules, additional top-up tax may become due under Pillar 2.

This article discusses dividends and profit distributions that qualify for exemption under Pillar 2 alongside those that could incur additional levies and offers practical steps for effectively managing dividends and distributions in key jurisdictions such as the Netherlands, France, Germany and Luxembourg.

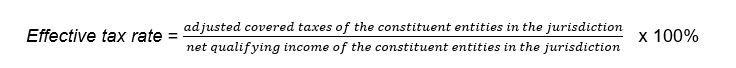

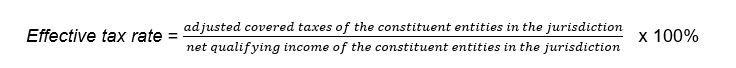

Calculation of the ETR

Under Pillar 2, if the ETR of a group entity in a specific jurisdiction is lower than 15%, additional tax obligations may arise. The ETR is calculated by dividing the adjusted covered taxes (essentially, the taxes on the income or profit of all group entities in a state) by the net qualifying income, also referred to as GloBE income (essentially, the adjusted net profit or loss of all group entities in a state):

Net qualifying income includes the qualifying income of all group entities established in a specific state, minus the qualifying losses incurred by group entities located within that state. Qualifying income or loss is ascertained from the net profit or loss of an entity based on financial reporting standards (this is calculated at the level of each group entity before the consolidation process and elimination of intra-group transactions).

Under Pillar 2, underlying profits are adjusted to exclude “excluded dividends” and equity gains or losses.

Excluded dividend

An “excluded dividend” is, broadly, any dividend or distribution other than those arising as a result of an interest that is a short-term portfolio holding.

Short -term portfolio interest

A portfolio interest exists if the multinational group holds an interest entitling it to less than 10% of the profit, capital, reserves or voting rights of an entity.1

That portfolio interest will be a short term interest if it has been held by the member for less than one year. The holding period is assessed on a member-by-member basis, so, where an interest is transferred between members of the group, a period of time for which a previous member held the interest, is ignored. Whether a portfolio interest is held by a group entity for a continuous period of at least one year is determined on the basis of beneficial ownership at the time of vesting of the dividend or distribution. Beneficial ownership exists when the group entity is entitled to all or substantially all of the benefits and burdens of ownership, including the right to the profits, capital or reserves associated with that interest.

| Dividends or other distributions obtained in or attributable to a reporting year from a(n): |

Portfolio interest

(MNE group holds less than 10% of profit rights, capital interests, reserves or voting rights) |

Non portfolio interest

(MNE group holds 10% or more of profit rights, capital interests, reserves or voting rights)

|

Interest held for less than one year at time of distribution by group entity

|

Included in qualifying income or loss

|

Excluded from qualifying income or loss

|

Interest held for more than one year at time of distribution by group entity

|

Excluded from qualifying income or loss

|

Excluded from qualifying income or loss

|

Mismatch with domestic participation exemptions

Participation exemptions within various domestic tax regimes provide for a corporate income tax (or in some cases a withholding tax) exemption on dividends and capital gains on disposals of equity interests between group or connected companies. However, this can give rise to a mismatch in situations where the Pillar 2 dividend exclusion does not align with the treatment of the same dividends under domestic tax laws.

If dividends or other distributions are exempt under domestic participation exemptions but do not meet the Pillar 2 criteria for excluded dividends, there will be a higher amount of net qualifying income but no corresponding tax in the respective jurisdiction. This may result in a group entity being classified as a low-tax group entity so that additional tax could be due under Pillar 2

Conversely, in jurisdictions like Germany and France with a 95 or 99 per cent exemption for corporate income tax purposes, dividends or other distributions may increase the ETR as dividends may be excluded from the Pillar 2 net qualifying income calculation, but corporate income tax is paid on the non-exempt portion of such dividend (i.e. 5 or 1 per cent).

The table below gives examples of various participation exemptions, each of which differs from the excluded dividend outlined in Pillar 2.

| Country |

Minimum shareholding percentage |

Mandatory holding period

|

Full or partial exemption |

Consistent with Pillar 2 |

| The Netherlands |

The recipient company needs to hold at least 5 per cent of the shares in the entity

|

No

|

A 100 per cent tax exemption will apply

|

No

|

| France |

The recipient company needs to hold at least 5 per cent of the share capital of the entity or, if this threshold is not reached, 2.5 per cent of the entity’s share capital and 5 per cent of the entity’s voting rights provided, in the latter case, that the recipient is controlled by one or more non-profit organizations

|

The recipient company needs to hold or undertake to do so its shareholding in the entity for at least two years when the shares represent at least 5 per cent of the entity’s share capital or five years when the shares represent 2.5 per cent of the entity’s share capital and 5 per cent of the voting rights

|

A 95 per cent tax exemption will apply or a 99 per cent exemption (i.e., taxation on 5 per cent or 1 per cent of the dividends actually received)1

|

No

|

| Germany |

The recipient company needs to hold at least 10 per cent of the shares in the entity at the beginning of the year

|

No |

A 95 per cent tax exemption will apply

|

No |

| Luxembourg |

The recipient company holds at least 10 per cent of the entity, or the acquisition price of the participation amounted to at least €1.2 million2

|

The qualifying participation was directly and continuously held for at least 12 months on the date the dividends are distributed (or the Luxembourg company commits to hold the participation for at least 12 months)

|

A 100 per cent tax exemption will apply but connected expenses shall be treated as non-tax deductible (notably by application of the so-called recapture mechanism)

|

Yes, potentially |

Example: mismatch with the Dutch participation exemption

The conditions for the Pillar 2 exemption do not entirely align with the participation exemption conditions in the Dutch Corporate Income Tax Act 1969 (CIT). The CIT participation exemption stipulates that, provided the recipient holds an interest of 5 per cent in the nominal paid-up capital of the dividend issuer (there is no minimum beneficial ownership period under CIT), regular benefits and disposal benefits are generally exempt from corporate income tax. However, for the application of the Pillar 2 participation exemption, the recipient must hold at least a 10 per cent interest for a minimum of one year for a dividend to be excluded from net qualifying income.

This could result in the adjusted covered taxes (as per the ETR formula above) being exclusive of dividends from an issuer in which the recipient held a 5 per cent interest, whereas the net qualifying income would be subject to the Pillar 2 exemption regime (i.e. would be inclusive of dividends from an issuer in which the recipient held a 5 per cent interest).

Due to the differences between the determination of qualifying income or loss for the purposes of Pillar 2 and the Dutch corporate income tax base, dividends may be taken into account in the determination of the net qualifying income (the denominator of the fraction in the formula) while, due to the application of the Dutch participation exemption, there is no corporate income tax in the adjusted covered taxes involved (the numerator of the fraction in the formula).

This is illustrated in the following example:

M Co is resident in the Netherlands and is the ultimate parent entity of an MNE subject to Pillar 2. M Co's normal yearly income is €200. B Co is resident in State B and is not related in any way to M Co's MNE. On 1 January 2024, M Co acquired a 5% interest in B Co.

FY 2024

On 1 July 2024, B Co pays €400 dividend to M Co. As a result of the participation exemption, this dividend is exempt for corporate income tax purposes in the Netherlands. However, the dividend is part of the net profit in the financial reporting of M Co. This net profit is the starting point for calculating M Co's qualifying income or loss. Since, in this case, M Co's interest in B Co is categorised as a portfolio interest and this interest is held for less than a continuous period of one year at the time of dividend payment, the dividend is not an excluded dividend for the purposes of Pillar 2 and no adjustment is made in respect of the dividend for the calculation of M Co's net qualifying income.

For calculation of the ETR, M Co's net qualifying income is therefore €600.3 Assuming M Co is subject to the Dutch CIT rate of 25.8%, in 2024, the ETR will be 8.6%.4

Due to the differing participation exemption criteria, the Netherlands would be required to impose a significant amount of additional top-up tax on M Co, as its ETR is below the 15% Pillar 2 amount.

FY 2025

On 1 July 2025, B Co pays another €400 dividend to M Co. Again, the dividend is exempt for corporate income tax purposes in the Netherlands. Whilst there is still a portfolio interest, that interest has now, at the time of dividend payment, been held for longer than a continuous period of one year and as a result the dividend qualifies as an excluded dividend. This leads to an adjustment in calculating M Co's net qualifying income.

For calculation of the ETR, M Co's net qualifying income will be €200.5 For 2025, this results in an ETR of 25.8%.6

The dividend payment is now treated in the same way for both domestic law and Pillar 2 purposes despite the differing participation criteria, resulting in an ETR above the 15% Pillar 2 level, and so no further top-up taxes would be applied to M Co.

Practical Guidance

If dividends or other profit distributions are exempt under domestic participation exemptions but do not meet the Pillar 2 criteria for excluded dividends, additional tax could be due under this new legislation. This mismatch in the exemption criteria and the potential classification as a low-tax group entity could lower the effective tax rate and lead to top-up tax liability. Careful consideration and strategic planning are crucial to mitigate such risks.

Situations like this may arise in joint ventures, where a person's shareholding may be below 10 per cent, either wholly or as a result of share transfers. In such a case, the minority shareholder may prefer to defer receipt of a dividend until it has a qualifying interest for Pillar 2 purposes.

To secure exemption under Pillar 2, companies must ensure that dividends or other distributions fulfil the criteria for being classified as "excluded dividends." This necessitates confirming that on the vesting date of the dividend or distribution, the group’s members, between them, have qualifying interests that entitle them to 10 per cent or more of the entity’s profits, capital, reserves, and voting rights and that this interest has been held (without any intra-group transfer) for at least one year.

It is worth noting that, even if the 10 per cent criterion is not initially met, dividends or other distributions can still qualify as excluded dividends if paid when the interest has been held for one year. This means that dividends can be paid after the one-year period, allowing the dividend to be considered an excluded dividend for tax purposes.7 This strategic approach ensures not only compliance but also reduces the risk of additional taxation.