Global offshore wind: France

Global | Publication | January 2024

Information correct as of 10 January 2024 .

- Introduction

- Offshore wind projects under development on the French coastline

- France: Spotlight on calls for offshore tenders

- France: Shareholdings in awarded offshore wind projects

- France: Obstacles and challenges

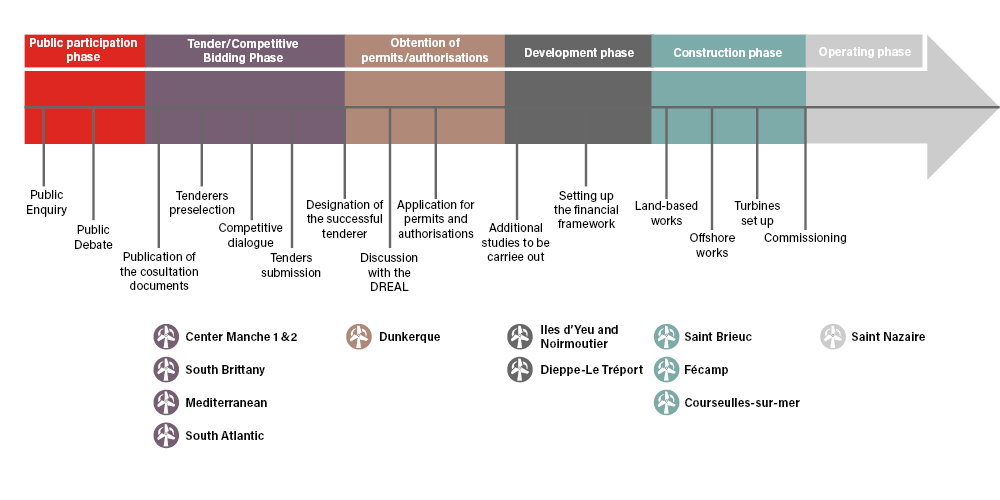

- France: Overview of the development process of an offshore wind farm

- France: Legal framework and recent developments

- France: Market outlook

Introduction

Despite its advantageous geography, boasting 3,500 km1 of coastline and one of the best wind resources in Europe, France has been lagging behind its European neighbors in terms of installed offshore wind capacity. Indeed, the first offshore wind projects awarded in 2012 faced significant delays in their development and commissioning due to numerous challenges, including permit-related issues and tariff renegotiations.

As of January 2024, France has two operational offshore wind farms, one of 480 MW off the coast of Saint-Nazaire and one of 496 MW in the Saint-Brieuc bay2. One more wind farm off the coast of Fécamp, with a capacity of 497 MW, was awarded through the same tender process (i.e. AO1) and should be commissioned in 2024.

Obstacles encountered have prompted significant actions, resulting in substantial legal and regulatory advancements aimed at reducing delays and speeding up the process of awarding, constructing, and commissioning. Specifically, the law on accelerating the production of renewable energies (loi relative à l’accélération de la production d’énergies renouvelables3 or APER Law) and the law on a green industry (loi relative à l’industrie verte4) are expected to significantly boost progress in the offshore wind sector. France has set itself the target of achieving an installed offshore wind power capacity (both bottom-fixed and floating) of 40 GW by 20505. In addition, the national strategy for energy and climate (stratégie française pour l’énergie et le climat) includes the ambition to reach the award of 10 additional GW per year by the end of 20256. It is highly expected that this goal will be incorporated into the 2024-2033 multi-year energy plan (PPE 3), which is a crucial roadmap for driving the energy transformation in France.

France's determination to bridge the time gaps in project award and commissioning, as well as the implementation of a legislative and regulatory framework that greatly favors offshore wind energy development, makes the French market a highly compelling one with immense potential for investment opportunities

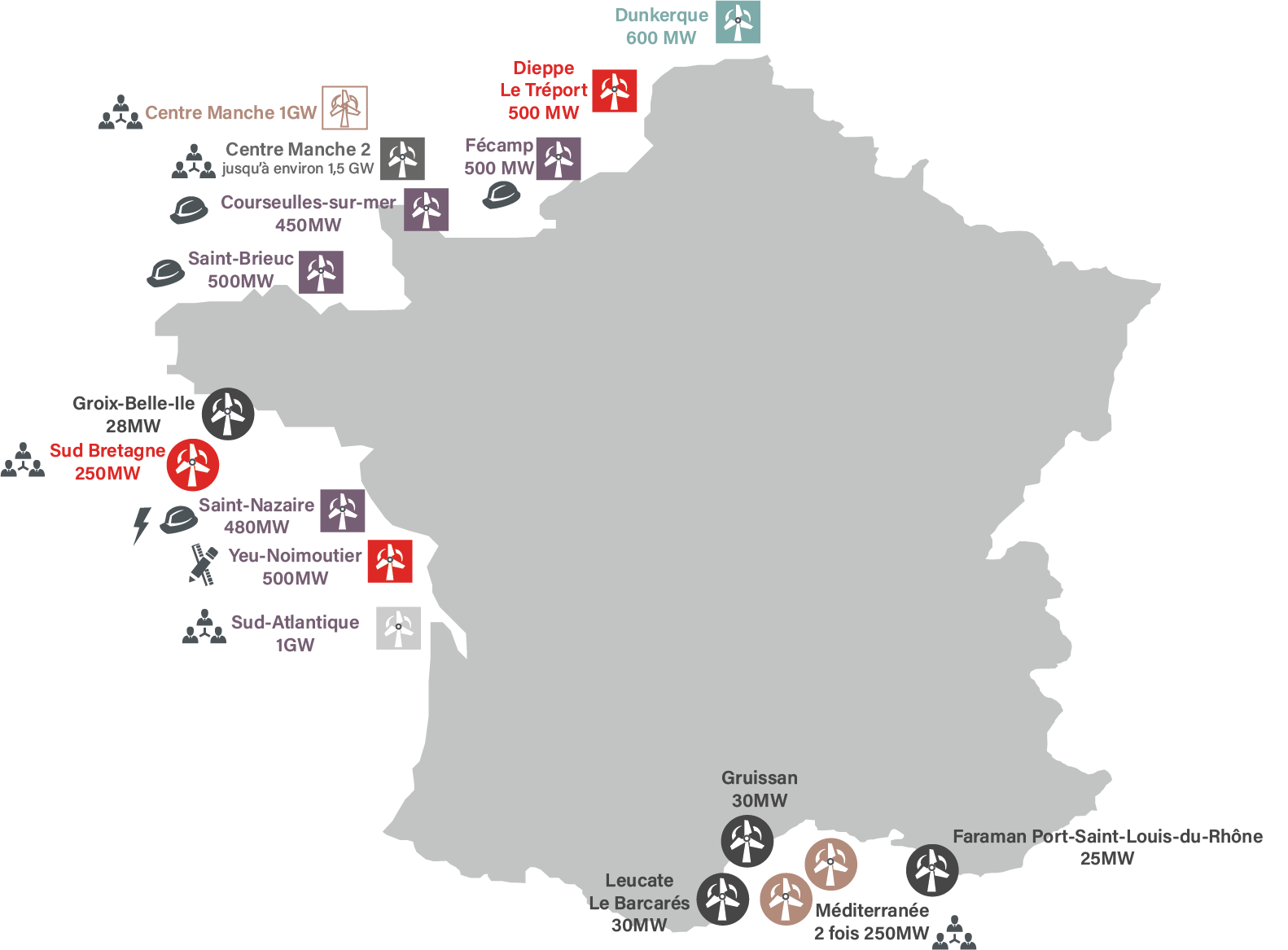

Offshore wind projects under development on the French coastline

|

Call for tenders 1 (full commissioning expected in 2025, 3/4 wind farms operational in 2023) |

|

Call for tenders 2 (commissioning expected in 2025 |

|

Call for tenders 3 (commissioning expected in 2028) |

|

Call for tenders 4 (commissioning expected in 2030) |

|

Call for tenders 5 (commissioning expected in 2030) |

|

Call for tenders 6 (commissioning expected in 2030) |

|

Call for tenders 7 (commissioning expected in 2030) |

|

Call for tenders 8 (commissioning expected in 2031) |

|

Floating turbines (pilot projects) |

|

Public Enquiry/Concertation |

|

Tender/Competitive bidding |

|

In development |

|

Obtention of authorizations and permits |

|

In construction |

|

In operation |

Source: Eoliennes en mer en France7

France: Spotlight on calls for offshore tenders

France has made significant strides in the offshore wind industry, from three rounds of call for tenders in 2020 to eight today. By 2035, the offshore wind power capacity should reach 18 GW.

In order to meet the national objectives, the offshore wind industry is advocating for a faster award and development of wind farms. This is made possible by the implementation of the APER Law and the law on a green industry, which provide for expedited administrative procedures and a more consistent offshore planning.

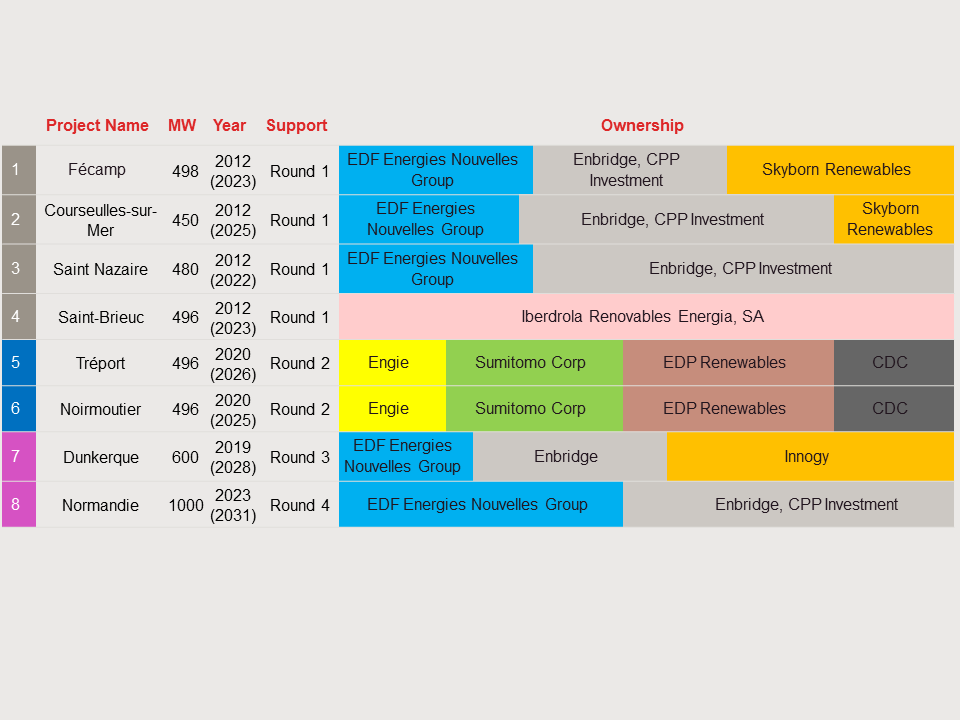

Round 1: Awarded in 2012, full commissioning expected in 2025

2 GW

Four projects (Saint-Nazaire, Saint Brieuc, Fécamp and Courseulles-sur-Mer) awarded in 2012 to EDF Renouvelables, EIH (held by Enbridge Inc. and CPP Investments), Skyborn Renewables and Iberdrola.

The Saint-Nazaire wind farm was commissioned in June 2022 and the Saint-Brieuc (held by Iberdrola) in December 2023. The Fécamp wind farm is expected to be commissioned in winter 2023-2024. The Fécamp project and the Courseulles-sur-Mer project are expected to be operational respectively in 2024 and 2025.

Round 2: Awarded in 2014, full commissioning expected in 2026

1 GW

Two projects (Iles d’Yeu et Noirmoutier and Dieppe Le Tréport), awarded in 2014 to Ocean Winds (Engie and EDPR), Sumitomo Corporation and Banque des Territoires (Caisse des Dépôts). The construction phase began in 2023 and marine works are set to begin in 2024, for a commissioning expected respectively in 2025 and 2026.

Round 3: Awarded in 2019, full commissioning expected in 2028

600 MW

One project (Dunkerque) awarded in 2019. The EDF-led consortium (including Innogy and Enbridge) won the tender with a bid of €44/MWh. It is currently obtaining the required authorizations and expected to be operational in 2028.

Round 4: Awarded in 2023, commissioning expected in 2031

1 GW

1 GW in Normandy off the coast of Barfleur. EDF Renouvelables and Maple Power (Enbridge and Canada Pension Plan Investment Board) won the tender with a bid of €44.9/MWh. Commissioning is expected in 2031.

Round 5: To be awarded, full commissioning expected in 2030

250 MW

Installed capacity of between 230-270 MW in South Brittany. 10 tenderers were shortlisted and the awardee will be selected early 2024.

Round 6: To be awarded, commissioning expected in 2031

500 MW

Launched in March 2022, it aims at awarding 2 batches of 250 MW floating wind turbines. 13 tenderers were shortlisted and the awardee will be selected early 2024.

Round 7: To be awarded, commissioning expected in 2030

1 GW

Two projects in Oléron (South Atlantique) for 1 GW each. 9 tenderers were shortlisted after the call for tenders for the 70 wind turbines representing the first project.

Round 8: To be awarded, commissioning expected in 2032

1.6 GW

Installed capacity of around 1.5 GW in Normandy (Centre Manche II) is contemplated. 7 tenderers were shortlisted and the awardee will be selected early 2024 with a view to commission the offshore wind farm in 2032.

Pilot floating turbines projects

72 MW

Following the 2015 call for tenders by ADEME8, four 24 MW floating offshore wind projects were awarded to EDF, Engie-EDPR-Caisse des Dépôts, and Qair Marine and Eolfi-Shell-CGN for the Faraman, Leucate, Gruissan and Groix sites respectively. Commissioning is expected in 2024 for the first 3 projects. However, Shell and its partners have withdrawn from the Groix project because of the increased costs.

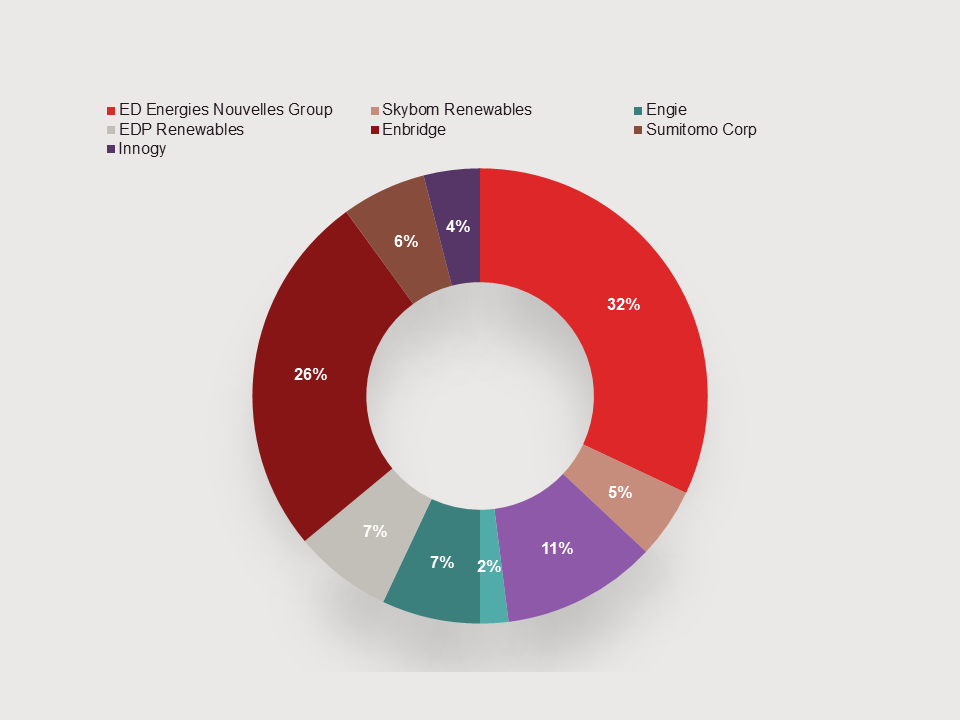

France: Shareholdings in awarded offshore wind projects

France: Obstacles and challenges

The offshore wind sector in France is currently facing typical difficulties for a new industry:

Regulatory challenges

The definition of an adequate legal framework, especially concerning permitting, the support mechanism, and the definition of an appropriate allocation of risks between stakeholders and the State and between stakeholders themselves.

Development challenges

Conflicts between the users of the maritime public domain. The impact of offshore wind farms is being challenged by other sea users such as fishermen.

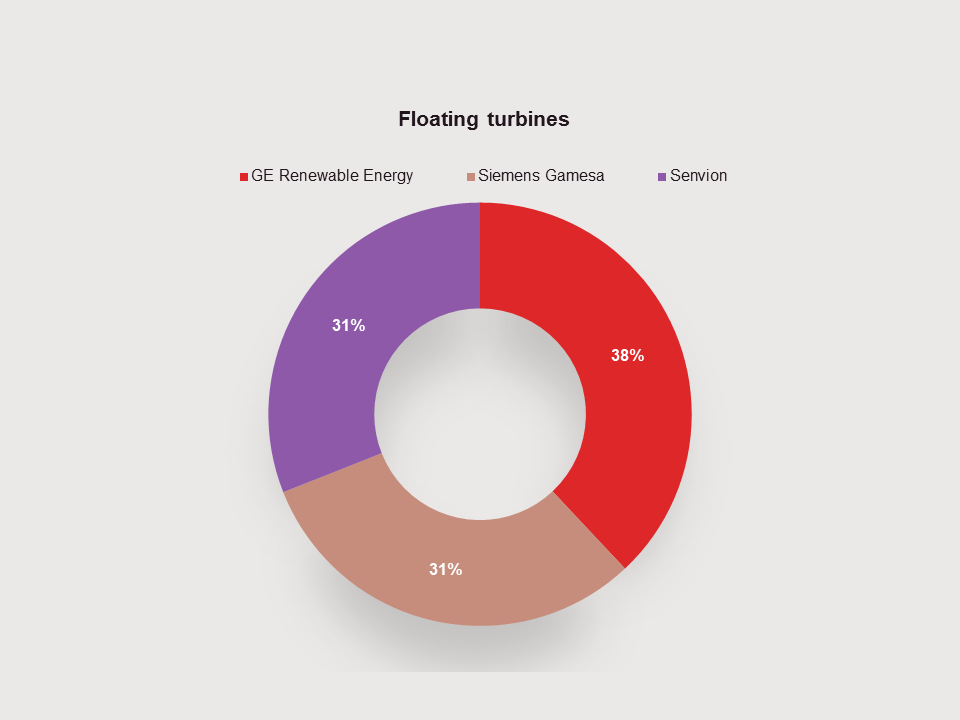

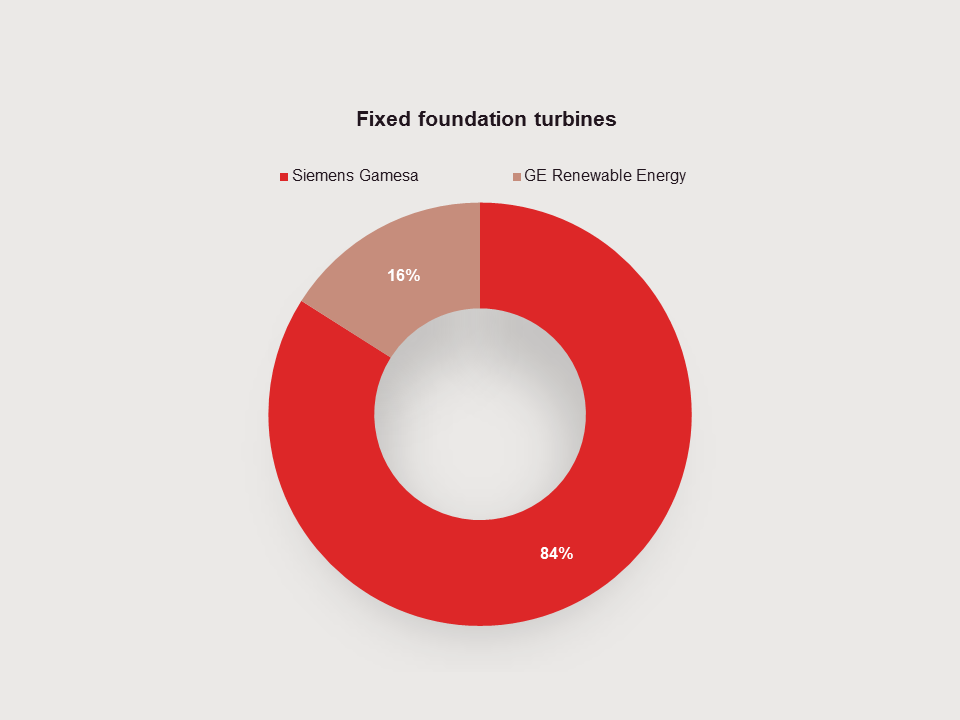

Turbine Suppliers – share by MW

France: Overview of the development process of an offshore wind farm

France: Legal framework and recent developments

As an emerging market in France, the offshore wind industry needs a reliable legal framework to underpin rapid and balanced development and operation of offshore wind farms. The current legal framework in France is highly conducive to the progression of offshore wind projects, including solutions to

- Accelerate the tender process:

- Introduction of a new competitive dialogue process to develop tender proposals between the administration and preselected bidders before issuing the tender specification (cahier des charges)9;

- Possibility for the minister in charge of energy to launch the competitive bidding procedure before the end of the public debate (being specified that the competitive bidding procedure may not begin before the report on public participation has been submitted) (law on accelerating and simplifying public action dated 7 December 2020 or ASAP Law10).

- Decrease the duration of appeals:

- Granting the Conseil d’Etat jurisdiction to hear, in first and last instance, appeals against decisions relating to offshore renewable energy production facilities. Indeed, it is not possible to appeal a decision of the Conseil d’Etat, but only lodge an appeal in opposition or revision. The entire litigation process should now take half the duration (ASAP Law).

- Provide developers with more flexibility and greater project security:

- Introduction of an "envelope permit" laying down variable characteristics for the facilities within the limits of which the projects are developed, allowing the number of wind turbines, their power, cable layout, foundations, and other aspects to evolve within the permitted limits. Once these permits are granted, developers can modify their projects, such as changing the wind farm's technologies or number of turbines, without needing additional authorizations (ESSOC law dated 10 August 201811).

- Optimize the development of offshore wind energy:

- Launch of the first public debate including not only offshore wind energy, but a wider planning of the coastlines, in the framework of the ESSOC law and the ASAP Law. Started in November 202312, this debate includes discussions and the participation of citizens regarding all maritime activities, i.e. the marine environment and biodiversity, offshore wind energy, cohabitation of maritime economic players (shipowners, fishermen, etc.) and the coastline.

- Anticipation of the grid connection works with a view to secure the energy supply until 2035. DGEC13 has launched a working group led by RTE14 in order to simplify and standardize the cahier des charges of the calls for tenders to provide developers and RTE with greater visibility.

The offshore wind industry received a significant boost with the introduction of the APER Law, which ratified several methods the industry had been awaiting, and driving progress towards the goal of achieving 40 GW by 2050.

- The APER Law simplifies the status of wind turbines and other “floating objects that produce energy” to speed up obtaining the relevant authorizations. The government is also currently considering a simpler bidding process. The provisions of the aforementioned law regarding the offshore wind sector include:

- The mutualization of public debates on the location of offshore wind farms to improve spatial planning and accelerate their development has been agreed. The objective is to enhance transparency for the diverse marine players, the public and the industry, and to simplify the execution of grid connection projects. The first map is anticipated to be released in 2024, followed by public consultation procedures;

- The priority given to suitable areas within the exclusive economic zone, i.e. c.370 km beyond the territorial sea, which itself ends c.22 km from the coastline, and outside national parks with a maritime section;

- Means to regularize authorizations during pending claims, to avoid cancellation and the necessity to restart the permitting process;

- Hybrid remuneration mechanisms for future projects, allowing to diversify and increase return on investment;

France: Market outlook

The 2019-2024 and 2024-2028 PPE (PPE 2) provides for an installed capacity target of 5.2 to 6.2 GW in 2028. At Government level, there is an apparent willingness to develop the offshore wind energy sector over the next few years.

The PPE’s objectives are in harmony with those of the European Commission, particularly the Green Deal15, which aims at making Europe the world’s first climate-neutral continent by 2050. The French PPE also aligns with the revised EU Energy Efficiency Directive16 published in September 2023. It establishes a 2030 EU energy efficiency target of 11.7%, which overrides the Commission’s original ‘Fit for 55’ proposal. It also urges EU Member States to collectively ensure a further reduction in final and primary energy consumption compared to 2020 energy consumption forecasts. France is currently making strides towards this European target.

Subsequent to the APER Law, the Government has published a five-year energy programming document that will serve as the foundation for the national low carbon strategy and a 3rd PPE for 2024-2033. To comply with upcoming climate laws, the targets outlined in the PPE 2019-2028 will need to be superseded by those in the PPE 3. The 2024-2033 PPE is therefore expected to play a vital role in the development of the offshore wind sector over the next decade. Industry experts suggest that a tender for 2.5 GW of capacity be awarded in 2024, followed by another tender for 10 GW in 2026, to ensure the availability of a substantial amount of energy and avoid potential market instability and investment slowdown. The remaining capacity of approximately 12 GW would then be allocated in a single block, with the ultimate goal of achieving 40 GW of capacity by 2050.

Key players Rounds 1, 2, 3 and 4 (fixed MW)

Questions have been raised regarding the EDF-led consortiums’ success in securing 5 out of 8 tenders17 and whether this may dissuade its competitors. In a decree recently examined by the Conseil Supérieur de l'Energie, the Government plans to amend the cahier des charges for future tenders, to limit the capacity or the number of projects awarded to a single candidate. To ensure fair competition, allotment will be a crucial tool.

Consequently, there are plenty of future investment opportunities throughout the French offshore wind market.

Footnotes

Subscribe and stay up to date with the latest legal news, information and events . . .