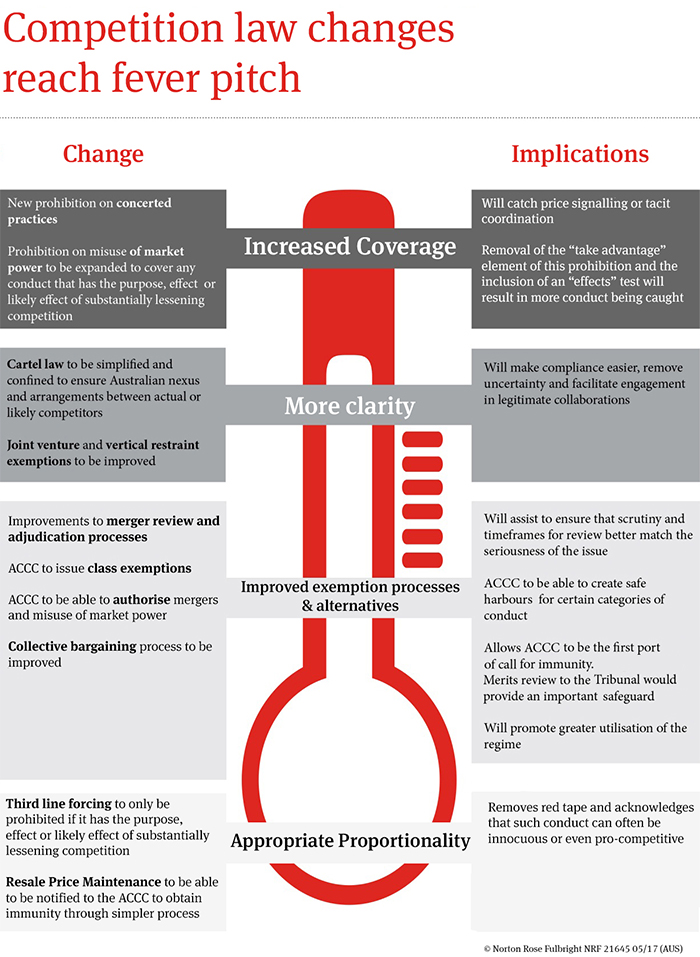

The framework for authorising and notifying conduct under the Act has been improved and the ACCC will be now empowered to make class exemptions and merger assessments, having regard to public benefits, not just competitive impacts.

Merger clearance

Previously the ACCC conducted merger clearance assessment, employing the test of whether or not the transaction would have the effect, or likely effect, of substantially lessening competition. Only the Australian Competition Tribunal could review proposed mergers by considering the public benefit of the transaction.

Now, the ACCC will be permitted to make a decision in the first instance by reference to a net public benefit test, not just likely competition impacts. As the ACCC puts it (in its media release of 18 October 2017):

The reforms also bring changes to the options available to merger parties to have their transactions cleared on either competition or net public benefit grounds. The merger authorisation and formal clearance processes will now be combined and streamlined, with the ACCC as the first-instance decision maker.

Such a change leaves the ACCC better-equipped to consider the nuanced issues often arising in mergers that involve material market consolidations. This also benefits merger proponents.

Class exemptions

The ACCC will now have a class-exemption power. It can pre-judge certain types of arrangements and deem them to be immune from the Act. They can create a safe harbour for certain categories of conduct unlikely to raise competition concerns or likely to generate a net public benefit.

Notification of resale price maintenance

We will now have an alternative simplified process for seeking immunity for a potential breach of the prohibition against resale price maintenance. It is an acknowledgement that sometimes a supplier seeking to maintain resale prices or prevent discounting is not automatically anti-competitive and the strategy can deliver benefits. Notification to the ACCC will often be simpler, quicker and less resource-intensive than going through the in-depth authorisation process. Although, authorisation remains available.