Introduction

There have been lengthy discussions as to whether and when China should “establish a foreign investment security review system to conduct a security review of foreign investment that impacts or may impact the national security”, similar to the CFIUS (the Committee on Foreign Investment in the United States) review system in the United States. After a long wait, on December 19, 2020, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) of the People's Republic of China jointly issued the Measures on Security Review of Foreign Investment (the Measures). The Measures will come into effect on January 18, 2021 (the Effective Date).

In this article, we examine the key points in the Measures.

Which foreign investment projects are subject to a security review?

Any investment made by a foreign investor within the territory of China, directly or indirectly, by way of:

- a greenfield investment on its own or together with other investor(s)

- a merger or acquisition of an existing Chinese entity(ies) or assets

- any other form of investment

will be deemed to impact the national security of China and will be subject to a security review, if:

- the investment is made in the military or its associated industries, in national defence and security sectors, or in regions where there are military facilities or military infrastructures

- the investment is made in “important” agriculture products, energy and resources, large manufacturing equipment, infrastructure, transport services, cultural products and services, information technology, internet products and services, financial services, key technology and other important industrial sectors; and the foreign investor will acquire control or de facto control over the proposed investment entity as follows:

- the foreign shareholder will hold 50 per cent or more of the interest in the proposed investment entity;

- the foreign shareholder will hold less than 50 per cent of the interest in the proposed investment entity but its voting rights may significantly affect the resolutions made by the board and/or the shareholders of the proposed investment entity; or

- there exists other circumstances where the foreign investor may otherwise have a significant impact on the proposed investment entity's decisions on business strategy, human resources management, financial and technical matters.

Which governmental authority will be in charge of the security review?

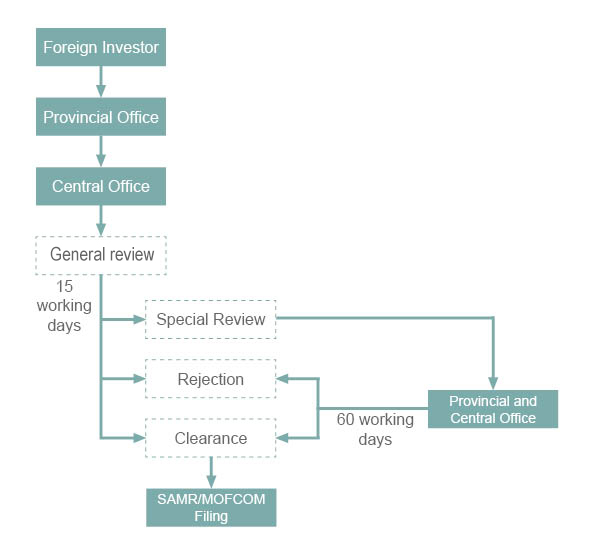

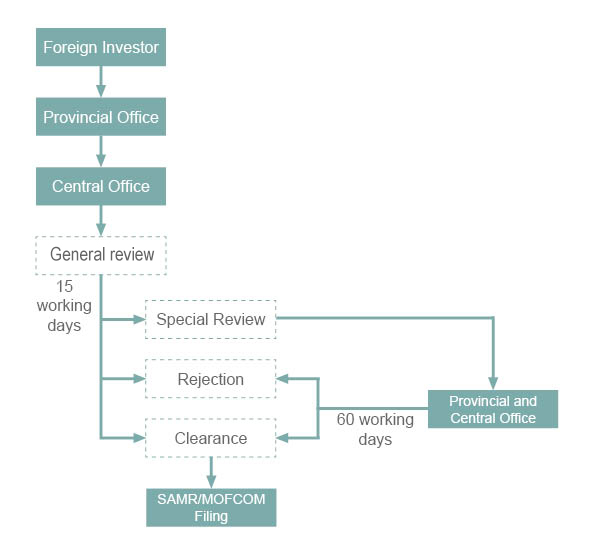

A special working mechanism office will be responsible for organising, coordinating and directing the security review work (the Office). The Office falls under the purview of the NDRC but is also under the joint supervision of the NDRC and the MOFCOM. At the time of writing, it is unclear what the official name of the Office will be and when it will commence operations.

Local offices will also be established and applicants will be able to apply for a security review through a local office as opposed to applying via the central office.

What are the key steps of a security review and what is the timeframe?

China has launched an on-line filing system across the country to simplify and ease the process for registering foreign investments. Under the current regime, any foreign investment project which is not listed on the Negative List can be simply registered on-line via a registration system which is jointly operated by the State Administration of Market Regulation (SAMR) and MOFCOM.

After the Measures have come into effect, if a foreign investment is not listed on the Negative List but is subject to a security review, the investor will be required to proceed with the on-line filing once the project has been cleared by the Office. However, it is unclear whether the security review will be combined with the SAMR/MOFCOM filing and whether the same filing system can be used or whether a separate filing system will be developed specifically for the purpose of the security review.

The key steps and indicative timeframe for a security review under the Measures are set out below.

Notwithstanding the timeframe set out above, the actual timeframe for a security review may be longer because the prescribed periods (as set out above) do not take into account any time spent preparing and submitting additional documents requested by the Office (whether at a local or central level). In addition, the Office has the discretion to extend the prescribed periods of 15 and 60 working days.

Whether a security review will apply to existing foreign investment projects?

It appears that the security review requirement only applies to foreign investment projects which take place on and after the Effective Date. However, it is unclear if a foreign investment project which is underway before the Effective Date will, after the Measures come into effect, be subject to a review initiated by the Office or upon the suggestion by a third party (as discussed below).

Other key takeaways

- In principle, no foreign investor shall proceed with the proposed investment before the project has received security review clearance if it is indeed subject to a security review. However, if a foreign investor does make the investment before a decision is made by the Office, but the investment is not cleared, the foreign investor will be required to divest and dispose of the interest held in the invested entity or the acquired assets. The Measures do not set out the timeframe or any further details on the process or the manner in which the divestment and disposal must take place. In addition, withdrawal of the capital investment is not permitted under the current legal regime.

- The Office is able to grant conditional security review clearance. If granted the investor will need to submit a commitment letter to accept those conditions and take actions to eliminate the impact on the national security as required by the Office in its decision. If a conditional clearance has been granted, there will be a post-clearance review of the investment project which will be conducted at a later stage by way of review of supporting documents and on-site inspections.

- Third party entities including local communities are entitled to “suggest” a security review of a foreign investment project if they are of the opinion that such project may impact national security, notwithstanding that the investor may hold a different view.

- It seems that the Measures only apply to foreign investments in private companies. Foreign investments in public companies will be subject to additional rules to be enacted by the Office with the CSRC (the China Securities Regulatory Commission).

- An investor is permitted to revise or withdraw its investment plan during the course of a review.

- It is interesting to see how the round-trip investments in China made by overseas entities that are ultimately owned or controlled by Chinese entities (especially the State-owned entities) would be treated under the Measures.

What is next?

Although the Measures establish the security review framework, the implementation rules have yet to be published. We expect the implementing rules to be released alongside the publication of other implementation rules relating to foreign investment in China (such as the new Foreign Investment Law, the updated Negative List and the new Unreliable Entities List).