Publication

Navigating international trade and tariffs

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Japan | Publication | September 2021

The Disruption

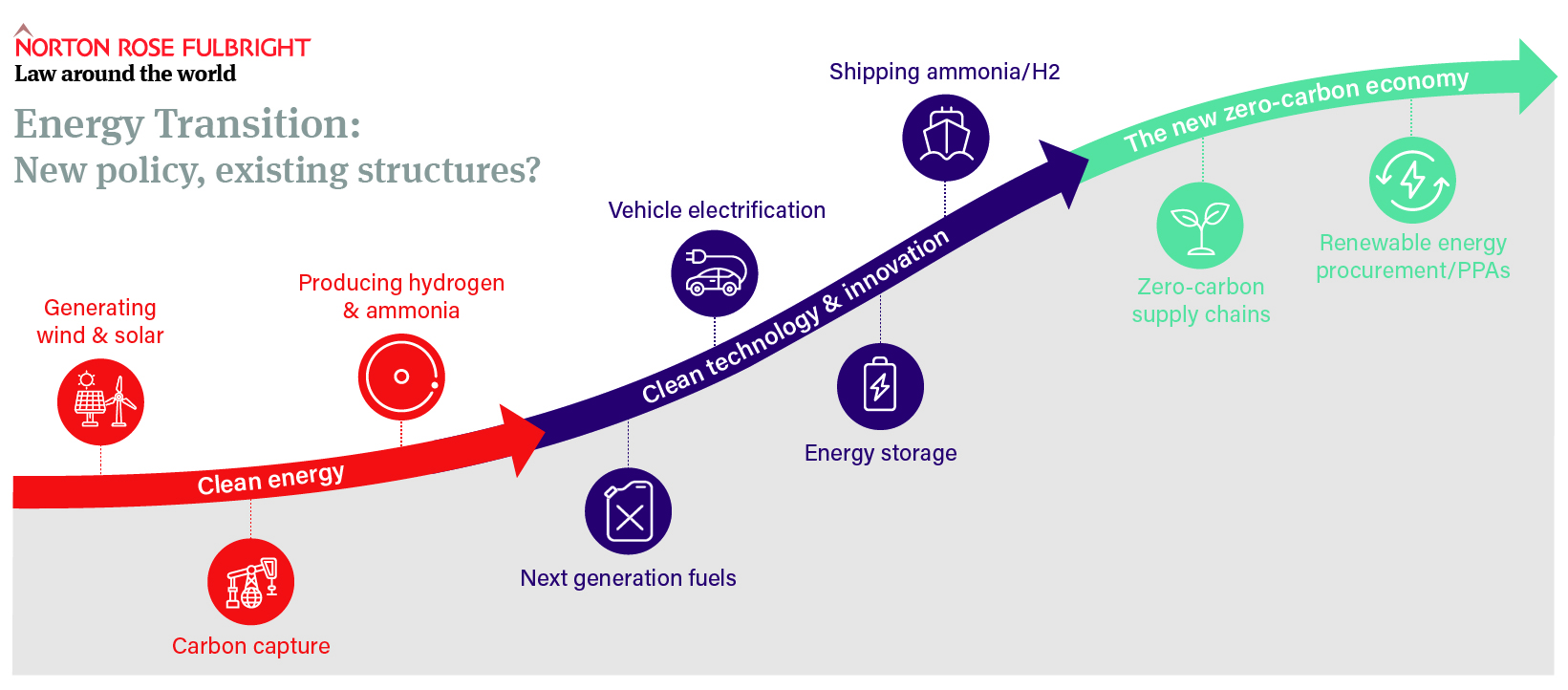

From ice storms in Texas to fires in the Siberian permafrost, there is overwhelming scientific consensus that the global climate is changing due to human activity. With a global focus on Environmental, Social and Governance standards, or ESG, this is resulting in the rapid adoption of the “Energy Transition”1 as industrial policy. The Energy Transition encourages innovation and presents opportunities, but it is also necessarily disruptive and, as with any disruption, businesses will need to carefully assess new ways of working, including through investment in new technologies and practices. The challenge will be adapting that experience and know-how in the context of the Energy Transition.

For example, on the generation side, the development of new offshore wind projects requires substantial capital investment where a combination of debt and equity spread across multiple stakeholders is used to spread the risk. In essence, parties will be familiar with the project financing agreements for such projects because they will be structured in a similar manner to conventional fossil-fuel based power projects. But there is a raft of new issues which arise in developing renewable energy projects, such as offshore wind projects (particularly in developing markets throughout Asia), with many governments increasingly working through the implementation of new regulatory regimes, with the adaptation of models from developed markets being a common theme.

Technology is also key in the growth of these new sectors. For example, there is strong interest among Japanese companies in acquiring Energy Transition-related technologies and businesses. Whether these acquisitions are, for example, related to vehicle electrification, battery storage, hydrogen technology or otherwise, these acquisitions may be made through sale and purchase agreements typical of M&A transactions.

And then there will be businesses that have little or no direct role in making renewable energy but every business relies on energy, directly to power the workplace or indirectly because the supply chain cannot run without it. In these cases, businesses may seek to operate at a net-zero carbon level. In short, given the need to substantially reduce carbon emissions, the impact of the Energy Transition will affect all businesses.

In this article, we use three (3) different factual scenarios and types of corporate transactions to help demonstrate the impact that the Energy Transition may have across various businesses. In doing so, we have given a flavour of some of the commercial and legal structuring issues that need to be considered. Positively, many of the issues presented are very familiar from current legal transactional practice and we hope that, while the impact of the Energy Transition can appear daunting, the legal techniques and practices are already in place to help companies achieve their goals.

It would, of course, be impossible to discuss in a single article all the legal arrangements, issues and considerations for how companies may participate in the Energy Transition. However, irrespective of the extent you are impacted by the market changes driven by the Energy Transition, we hope to leave you with a better understanding of some key legal considerations.

Company A is a Japanese energy company and has substantial experience with nuclear, LNG and conventional coal-fired power plants. Company A wants to expand its capabilities and offer renewable energy in Japan but it is just starting to acquire experience and know-how in the renewable energy sector. The management of Company A considers that taking the lead in a new renewable energy project still carries too much risk and is currently not an attractive option until further expertise is acquired.

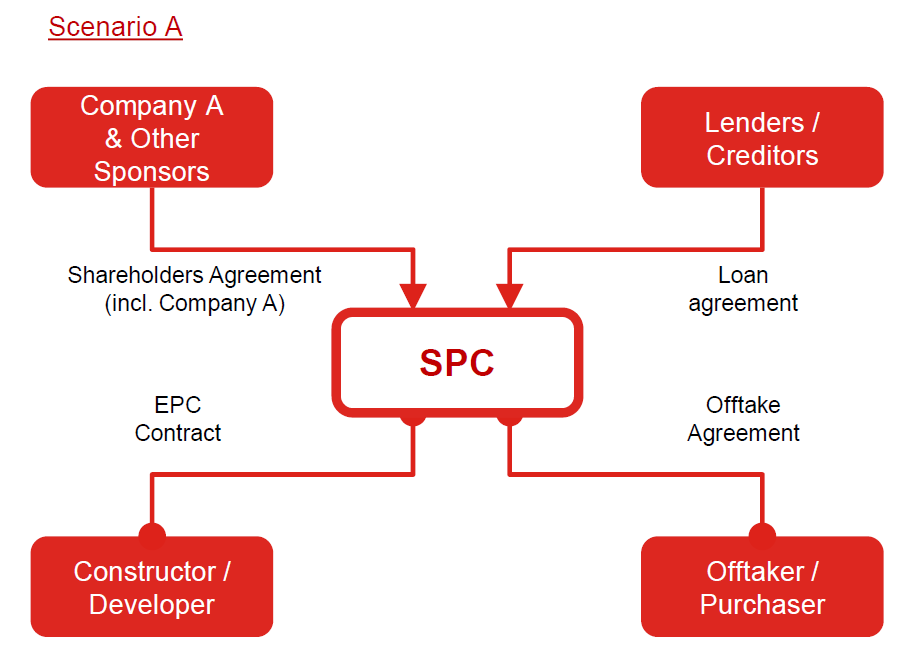

A European wind power company has invited Company A to join a consortium to contribute capital to the development of the largest offshore wind farm in the North Sea through a special purpose company (SPC). Company A is offered to acquire a 25% interest in the SPC and is negotiating the agreements.

Project Finance Loan Facility – Scenario A is a common pattern for the development of large scale infrastructure projects, especially where it relates to the extraction of natural resources such as oil or minerals. The project is typically held through a single company. These projects require large amounts of capital to construct and often take many years and, rather than tie up capital of the owners, a substantial portion of the project costs would be provided by financing, either from commercial lenders, export credit agencies or a combination of both. Closing under a loan agreement is a key project milestone in Scenario A because it means there is a mutually agreed “bankable” risk profile in the development of the project, financing becomes available to start the construction of the project, and construction of the offshore wind farm commences. The point in time when this funding is available is referred to as the financial investment date or “FID”.

Clean energy projects can take many years to complete before they come online and begin generating an income stream through the sale of energy to consumers. From the perspective of the lender, a key issue is whether a proposed project is viable—whether technically, commercially, legally or otherwise—and what the risk is that the SPC fails to complete the project and cannot repay the lenders. For the shareholders (or “sponsors”) including Company A, a major issue is typically whether the lenders’ assessment of the key risks linked to the structure of the project and as reflected in the financing terms on offer are such that they allow the SPC to generate clean energy at a profitable level in accordance with its business plan. The comprehensive review and assessment of all pertinent risks by the lenders is referred to as “bankability” or whether a project is “bankable”.

A key consideration for shareholders in the loan and associated security arrangements is whether the lenders have “recourse” against not only the SPC, but to the shareholders or other third parties for the obligations described in the loan. For example, does the loan agreement include terms requiring any shareholders to guarantee the SPC’s loan in the event of a loan default by the SPC, or to inject additional capital into the SPC if the loan is insufficient to take the project through to completion? No one plans to default on a loan or to have cost overruns but, because these projects span very long time frames and have global supply chains that can be impacted by world events (e.g., COVID-19), the relevant parties all need to agree on what is to happen, and who is liable, if the SPC runs into difficulties. The risks for Company A and the other stakeholders are many and include construction risk, supply & demand risks, force majeure, change in law, political and regulatory risks, environmental risks, social risks and financing risks. Parties and their advisors will need to consider all of the related risks when determining the bankability of the project.

Engineering, Procurement & Construction (EPC) Contract – The EPC contract is between the SPC and one or more construction, design and other related companies that will actually build the offshore wind farm. Offshore wind projects will typically not use a single EPC contractor and contract (i.e., not a lump-sum, fixed price, turn-key contract) but will instead be built using multiple contract packages linked by a framework agreement. The purpose of the loan is to partially fund the SPC’s obligations, notably to pay for the construction of the wind farm pursuant to the EPC contract. The EPC contract starts on FID and mostly ends when the offshore wind farm is in operation. This is referred to as the commercial operation date or “COD”; another key date at which point the value of the project (and related share-value) rapidly increases as the highest risk of the construction period has passed.

From a bankability perspective, both the lenders and the shareholders will conduct thorough due diligence on the EPC provider and the terms and conditions of the EPC contract. As with many capital-intensive projects, cost overruns, constructing on schedule, and building a project as specified are critical issues to be addressed. Key issues related to the Energy Transition include that many of the technologies are still being developed, are untested, or may be obsolete by COD because they are developing at such a rapid rate.

For example, in the past, many offshore wind projects have utilised a “fixed” foundation, which means the foundations of the wind turbines are fixed to the ocean floor. This means that areas available for development are limited to shallow areas, which is a problem for a country like Japan with relatively small areas available for fixed offshore wind developments. Many companies, however, have been exploring floating offshore wind technologies to exploit deeper waters. While we are starting to see market entry of the floating offshore wind technologies, there are still many development and operational risks to be overcome, which may negatively impact the bankability review of such projects.

Offtake Agreement / Power Purchase Agreement (PPA) – The offtake agreement2 is where the SPC agrees in advance with a purchaser to acquire the energy to be generated by the wind farm, where the typical purchaser would be a utility or other power company that would resell the electricity into the grid or directly to downstream consumers. It is critical in the bankability review because it represents the SPC’s ability to generate revenues that will be used to repay the loan and, if all goes according to plan, to return value to the shareholders either in the form of dividends or an increase in value of the SPC’s shares. Project finance lenders typically require that an offtake agreement be in place before entering into the loan agreement.

The sale and purchase of electricity under the relevant power purchase agreement usually commences at a point post-COD. A key “red flag” issue for an offtake agreement is finding a purchaser and agreeing on binding terms and conditions to purchase renewable energy for a project that does not exist and will not be built for possibly many years. For renewable energy sources like solar and wind, another key issue is how to set the amount of energy to be provided (i.e., amount of sun or wind varies on any given day) and the amount required to be purchased. In addition, governmental regulation around renewable energy has not fully matured and there is the risk that a new set of rules may apply by the time that the parties are to perform under the offtake agreement.

For example, to accelerate the Energy Transition, many governments are offering incentives to develop renewable energy projects by guaranteeing the price at which a utility must purchase electricity generated from renewable energy. This was the case with the solar market after the 2011 earthquake when the Japanese government attempted to create new energy sources after shutting down Japan’s nuclear power plants.3

In contrast, another key bankability risk relates to the terms and conditions of the offtake agreements where many proposed power purchase agreements in developing markets do not meet the bankability required by international investors and lenders. Parties’ advisors will need to be knowledgeable about regional issues at an early stage of project investment and can typically provide a benchmark of PPA terms against international standards. One example of bankability risks can be found with developments in some Southeast Asian countries where power purchase agreements are currently not being considered bankable by many international financial institutions. Reasons for this include insufficient government guarantees and support, lack of mechanics to resolve payment risks, lack of protection against retroactive changes in policy and law, and other variables outside the control of the project company, shareholders, and international lenders.

Company A would need to identify such bankability risks at an early stage of development and consider whether the project remains viable to develop and in doing so whether alternative forms of financing or the use of corporate PPAs should be considered (as discussed further below).

Company B is a well-known Japanese maker of machine components used in turbines, engines and other industrial equipment. Company B has just established a new research and development (R&D) department to focus on the Energy Transition. Rather than rely solely on the organic development of new technologies and other intellectual properties, Company B’s management desires to acquire expertise in parallel with transitioning its existing R&D programs.

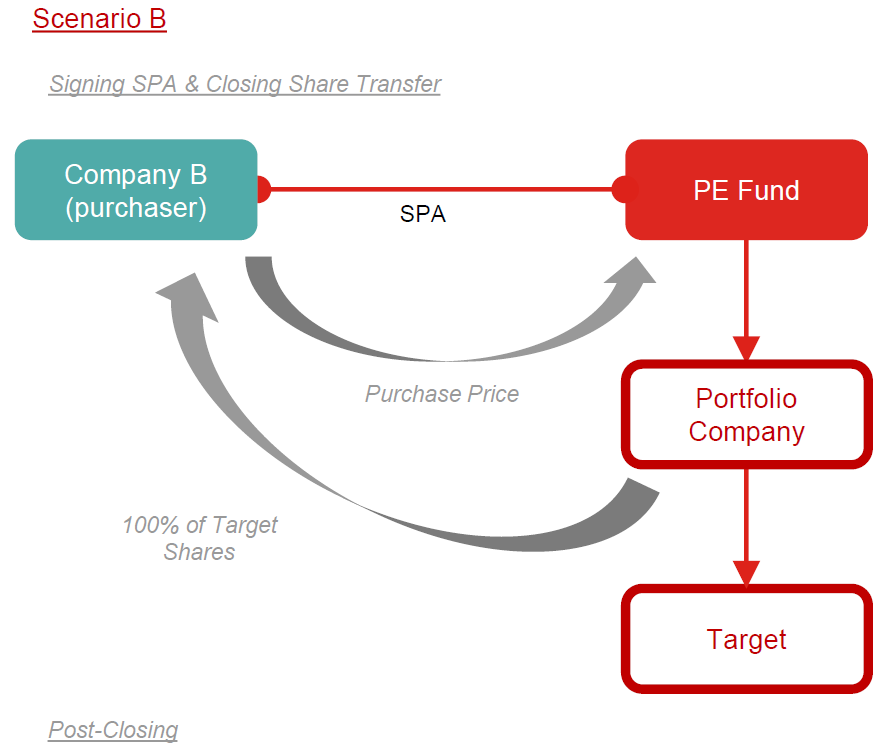

A U.S. private equity (PE) fund has approached Company B to purchase a subsidiary of one of its portfolio companies engaged in the design, manufacture and sale of lightweight components (Target) which are increasingly being used in electric vehicles. Company B is negotiating a sale and purchase agreement (SPA) with the PE fund to acquire 100% of Target from the PE fund’s portfolio company (Seller).

Sale and Purchase Agreement (SPA) – The SPA establishes the terms and conditions on which Company B will acquire Target from Seller and the PE fund. It includes representations & warranties, covenants, conditions to closing (conditions precedent or CPs), indemnities, and perhaps most importantly the purchase price.

Scenario B is a type of “carve-out” transaction because Target is part of a larger business and needs to be carved out and sold to a new owner. A key issue for Company B is that Target can continue its business uninterrupted from the moment that Company B becomes Target’s new owner. This normally requires Company B to conduct a thorough and detailed due diligence investigation, to confirm a diverse area of matters such as intellectual property, employees, customer contracts, and litigation. In addition to lawyers, Company B will need to hire accounting, tax and other experts such as environmental experts and HR consultants, who all have to work in coordination with each other. Due diligence is critical especially in M&A transactions but can also become very costly. The challenge for Company B is how much to investigate and how thoroughly.

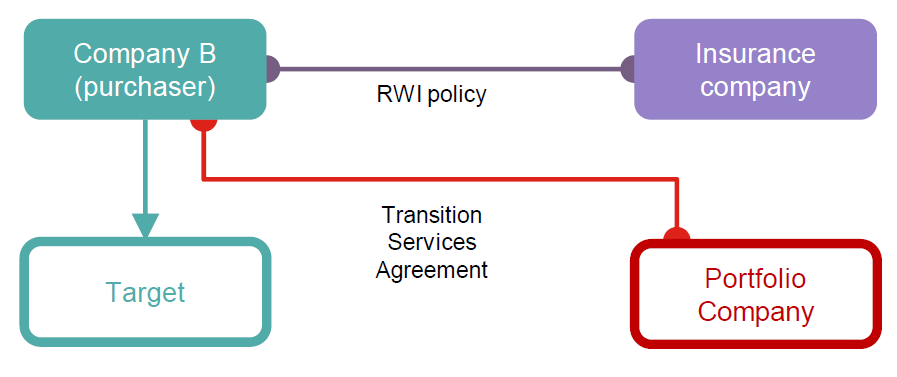

A unique feature of Scenario B is that reps & warranties insurance (RWI) is likely to be part of the picture. PE funds do not accept deal structures where the PE fund may have post-closing liability because, by design, PE funds must usually distribute sales proceeds to their investors after a set period. Because of this tension— buyers wanting protection versus PE funds needing to distribute sales proceeds—RWI is increasingly used as a solution.

Purchasing RWI and having it apply to an M&A deal is fairly common practice now in U.S., U.K. and European markets. However, it is still relatively new for many Japanese companies so additional time needs to be factored into the transaction process as well as the additional expense of the law firms and insurance broker to guide Company B through the process. For parties accustomed to RWI, the process can be done in 7-10 days but, in our experience, the first time can take 4-6 weeks for Japanese companies to understand and be comfortable with how RWI functions especially where the documents and insurance policies are in English.

When transacting with PE funds, another important issue is deal speed. PE funds often sell off assets in an auction to obtain the best price possible. In Scenario B, the PE fund has made a direct offer to Company B but if Company B cannot act quickly enough, for example for failure to obtain internal approvals (i.e., ringi) or be comfortable with how RWI will apply to a transaction, the PE fund may instead try to sell Target through a competitive auction where a combination of price, speed, and closing certainty will yield a winning bidder. In competitive auctions, Japanese companies are often at a significant disadvantage because of the aggressive pace required under the auction rules set by the PE fund. Maintaining competitiveness requires early planning by Japanese companies in identifying approval time pressures, and completing internal reviews to obtain internal approvals to proceed with each stage of an auction.

And yet another timing factor to consider in international investments is the potential that foreign investment approval by a governmental authority is required to close a transaction, especially if a deal has national security considerations. If an investment approval is required in Scenario B, Company B will need to understand both procedural (i.e., how to request approval) and substantive requirements (i.e., what is required to receive approval).

While some businesses may seem non-controversial, such as a component maker of electric vehicles, they can raise security issues if the components made by the target company are also used in military equipment, collect personal data, or if a target business is simply located near sensitive locations. As energy security becomes increasingly important, deals related to the Energy Transition may attract greater scrutiny as climate change poses an increasingly existential threat.

Retention Arrangements – In Scenario B, Company B should also carefully consider what retention agreements are critical to ensure that when Company B acquires Target, the management and any key personnel like engineers or sales managers remain with the business after closing. The ideal case is to enter into long-term incentive arrangements with key personnel. However, M&A deals are usually very confidential and only a select few people at Target would usually know about any potential deal so it can be very difficult to deal with retention issues before signing the SPA. While Company B could propose entering into retention agreements as a condition to closing, the typical PE fund would reject this approach on the basis of closing risk because, if Company B is unable to agree on such arrangements with the target employees, Company B could walk away from the deal by proposing unreasonable terms and vice versa. Often, the purchaser will need to implement retention arrangements as part of post-merger integration or PMI. To mitigate this risk before closing, Company B would be wise to rely on an HR consultant to assess the local employment environment and develop and implement a retention strategy based on those findings.

Transitional Services Agreement – Lastly in Scenario B, Target is being carved out from its parent company, which typically means that administration and other back-office services remain with the parent company. A transitional services agreement (TSA) is necessary to ensure that basic services will be provided to ensure that Target can operate without interruption after Company B acquires control. This can be non-controversial for matters like using a separate office space while a new site is located. However, in an increasingly data driven and IT-dependent world, transition of internet and other technology services can be a very difficult, time-consuming and expensive exercise. Parties can easily find themselves unable to agree on TSA terms and conditions.

Company C designs and manufactures sportswear and directly sells them in Company C’s retail stores in Japan, through third party retail stores around the world, and online through its website. Climate change is affecting Company C’s business because the annual seasons have become volatile, such as long droughts and low snowfall adversely affecting the sale of winter season goods while the beachwear business is growing. In addition, Company C’s target customers are teenagers, college students and young professionals, and they are demanding that Company C embrace ESG goals, especially through the Energy Transition.

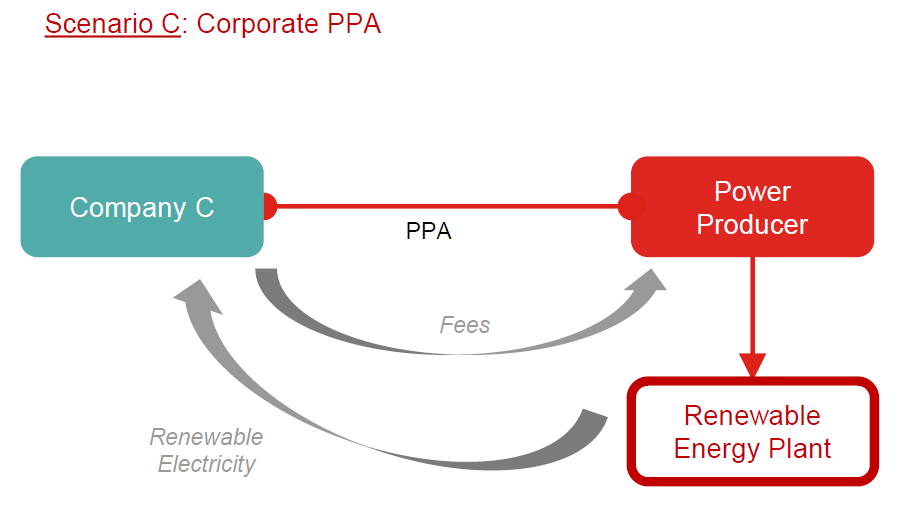

Corporate Power Purchase Agreement (CPPA) – All businesses need electricity to operate and Company C is no exception. For businesses not directly engaged in generating energy or supporting electrification without carbon inputs, an increasingly common practice is to enter into a CPPA for renewable energy. That is, to operate its factories and stores, physical or online, Company C would only purchase electricity from a power producer that generates its energy from renewable sources, whether that is wind, solar, water or other low- or non-carbon based sources.

Whether a CPPA is a “take-or-pay” arrangement is a red flag issue. If a CPPA is take-or-pay, then Company C must purchase an agreed amount of electricity irrespective of whether Company C actually needs or uses the electricity. Basically, Company C is guaranteeing a minimum and regular amount of income to the power producer. Conversely, Company C also needs assurances that the power producer can in fact deliver sufficient amounts of renewable electricity.4

One reason for take-or-pay arrangements is that electricity, under current technology and capacity, cannot be easily stored for future use, which requires supplier and purchaser to agree on commitments in advance. As battery storage technology improves and electricity generated from renewable sources increases, we expect to see more flexibility around commitments to better address the needs of both suppliers and purchasers.

Another red flag issue with PPAs is the price of electricity. Whereas fossil-fuel based PPAs had to address volatility in price of oil per barrel, for example, renewable energy based PPAs have the issue of consistent energy supply due to changing weather and other conditions. For example, solar plants do not generate energy at night and wind farms, of course, need wind.

And lastly, governmental rules and regulations are expected to undergo constant review and amendment throughout the Energy Transition and technology is innovating rapidly, which will affect the terms and conditions of any PPA. One challenge, especially where take-or-pay arrangements apply, is agreeing on the right contractual period in a market that is constantly changing and how to change (or terminate) any PPA when the underlying assumptions no longer apply.

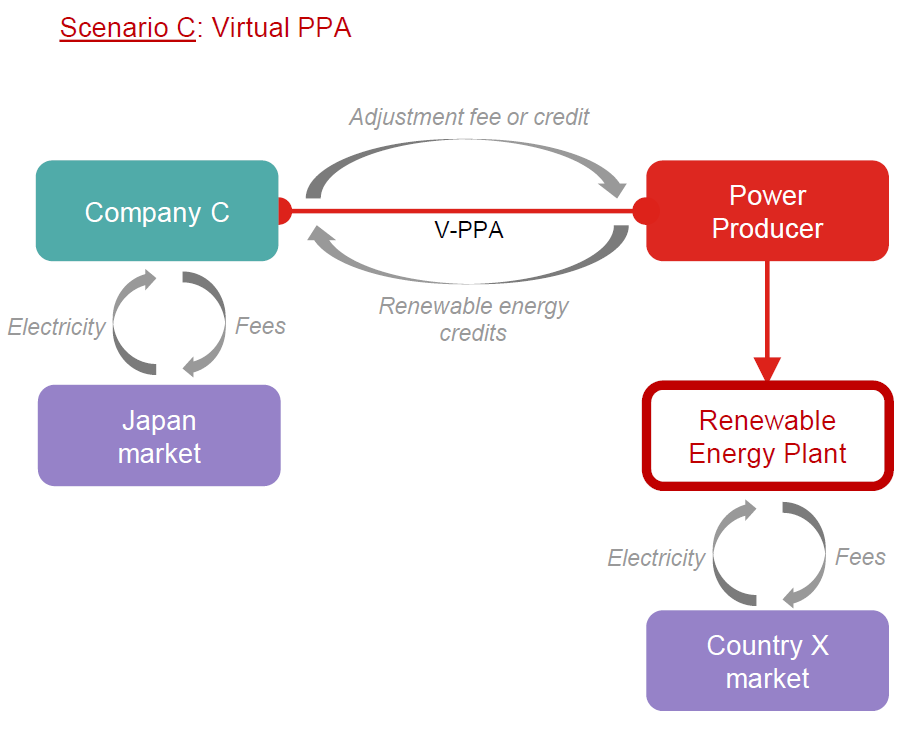

Virtual Power Purchase Agreement (VPPA) – While fossil fuel-based plants are just starting to be replaced by renewable energy ones, a CPPA may not be a viable option especially for Company C based in Japan where the majority of electricity is still generated from coal or gas-fired power plants. That is, it is inevitable that Company C will have to purchase energy from fossil-fuel based power plants in Japan. To offset this, Company C could enter into a VPPA, also called a synthetic PPA. A VPPA is a financial transaction where Company C and the producer of renewable electricity in Country X agree on a fixed price in exchange for renewable energy credits. Then, after the power producer sells renewable electricity in the open market in Country X, the generator gives a credit (or makes payment) to Company C if renewable electricity is sold into the market above the fixed price, and Company C would pay an additional amount to the generator if the renewable electricity is sold below the fixed price.

A VPPA solves the problem where Company C may have operations in areas without insufficient renewable energy resources such as Japan. By entering into a VPPA with a power producer in Country X, Company C can engage in the generation of renewable energy in Country X to offset Company C’s purchase of regular energy from local utility providers in Japan. One key issue is ensuring that the renewable energy credits are recognized in the relevant jurisdictions.

While a VPPA may help Company C to address the demands of its customers to use renewable electricity, it may be more expensive and have an adverse effect on Company C’s financial performance, especially as the market for VPPAs is still maturing especially in Japan.

Supply and Distribution Agreements – Company C makes and sells products for retail consumers, or B2C. However, in the business-to-business (B2B) supply chain, Company C is the end-user/customer and as such has substantial negotiating leverage, allowing it to influence upstream suppliers and other vendors and cause them to support the Energy Transition.

For example, Company C could require that its suppliers use electric vehicles in delivering goods and services to Company C or to use PPA and VPPAs to ensure carbon-neutrality in Company C’s supply chain where manufacture of sportswear and other goods has been outsourced. Challenges for Company C, especially for suppliers of suppliers, is monitoring and enforcing obligations to use renewable electricity where it is not broadly available, is costly compared to other electricity, or a combination of both. Effectively causing the Energy Transition to apply to the entirety of the supply chain may increase overall costs in administration as well as to the underlying cost of raw materials and other components and services.

Until renewable electricity becomes more available and clean technology is developed and adopted in more parts of the global economy (see Scenarios A and B above), it will be more challenging for general purchasers of electricity like Company C to transition fully to renewable electricity. However, as governments increasingly encourage and incentivize the Energy Transition, Company C’s low- or no-carbon supply policies may become a competitive advantage as its retail customers increasingly demand this in the supply chain. While upfront costs may be higher, Company C may be in a better long-term position by causing its supply chain to transition to renewable energy sooner, ahead of its competitors.

At some point, from Texas to Siberia, the journey which is the Energy Transition will be complete when the global economy achieves net-zero carbon emissions on a permanent basis. In the meantime, the Energy Transition is a new focus or goal to achieve. Companies will need to invest, evolve and take risks to be a meaningful part of the Energy Transition. There will be new issues to address and consider but companies should feel confident to apply the legal experience and know-how they have acquired over the years to secure the Energy Transition.

Originally published in the September 2021 edition of Foreign Investment and Finance (“Kaigai-Touyushi”) published by the JOI, Published in Japanese only.

Publication

Recent tariffs and other trade measures have transformed the international trade landscape, impacting almost every sector, region and business worldwide.

Publication

In mid-March 2025, Cognia Law and Norton Rose Fulbright’s Legal Operations Consulting team co-hosted a second roundtable event that brought together senior leaders, including GCs, COO and head of legal operations, from across the legal industry to discuss how to drive meaningful change within the legal ecosystem.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025