It is worth starting by defining what we mean by “international tax”. In this context, we mean the body of tax law that governs the way transactions involving one or more countries are taxed between those countries. This includes a mixture of international law (such as double tax treaties concluded between two countries) and domestic provisions (such as the UK’s own transfer pricing rules).

It has always been a general principle of international law that countries are responsible for their own revenue-raising; however, this autonomy has led over time to mismatches in the way different jurisdictions have treated the same transaction. In fact, it is arguable that some jurisdictions have adapted their own rules to exploit these differences and encourage transactions to take place through their jurisdiction.

Broadly speaking, the international law provisions are generally aiming to allocate taxing rights in respect of a particular item of income or gain between two countries that have an interest in a transaction in order to balance the rights of the two countries involved. Domestic measures tend to try and unilaterally protect a country’s tax base.

In each case, the rules are trying to prevent multinational groups from either shifting profits from a jurisdiction where they would be subject to a high tax rate to a jurisdiction that taxes them at a lower rate (or not at all) or from reducing the amount of profit subject to tax in its jurisdiction of operation by paying excessive tax deductible amounts in order to reduce its tax base.

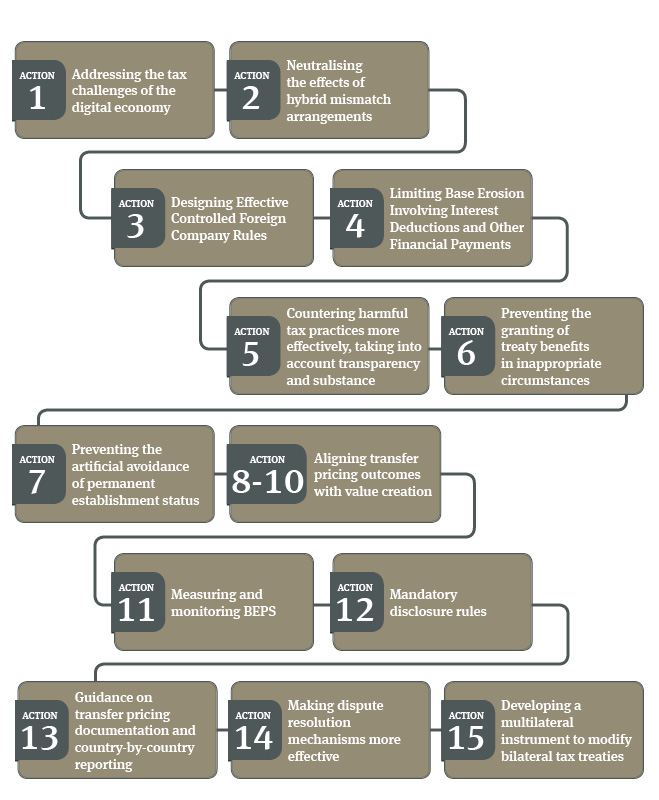

The term now universally given to the activities described above is “base erosion and profit shifting”, which is shortened to BEPS.

As part of these measures, tax authorities worldwide are also formulating plans to obtain information from taxpayers which can then be shared between tax authorities in different jurisdictions. This process began with the introduction of FATCA by the US and has been developed since by the OECD and individual countries such as the UK. It is therefore becoming increasingly difficult for taxpayers to rely on the fact that a tax authority in one jurisdiction will not be able to access details of how a particular transaction is viewed in another jurisdiction.

With the growth in online business and the increase in international mobility, these measures are now of high importance to the jurisdictions concerned and, whilst aviation will not be the primary target of such measures, the international nature of the business means that airlines, lessors and financiers will need to be aware of the possible implications of the changes of rules on their businesses.