Publication

International arbitration report

In this edition, we focused on the Shanghai International Economic and Trade Arbitration Commission’s (SHIAC) new arbitration rules, which take effect January 1, 2024.

Global | Publication | February 2016

Elements of a European directive have recently come into effect which will have significant implications for those documenting financing transactions globally, not just in Europe.

With the aim of facilitating the rescue of failing European Economic Area1 (EEA) financial and credit institutions (EEA FIs) without using tax-payer funded bail-outs, the EU Bank Resolution and Recovery Directive (BRRD) gives regulators “bail-in powers”, which allow regulators to cancel, write-down or convert all or part of the liabilities owed by the failing EEA FIs to creditors into shares. These powers came into effect across most of the EEA in January 2016. Bail-in powers might be exercised to avoid a winding up of a failing institution where necessary in the public interest but the stated intention of the BRRD is that no creditor should, through the exercise of the bail-in powers, be left in a worse position than they would have been had the institution been wound up under normal insolvency proceedings.

Liabilities incurred by EEA FIs in relation to contracts governed by laws of EEA member states will be subject to the BRRD bail-in powers by operation of the governing law of the contract. In the case of contracts to which EEA FIs are party and which are governed by the laws of a non-EEA member state, Article 55 of the BRRD requires the inclusion of a provision under which counterparties acknowledge and accept contractually the exercise of the relevant bail-in powers so that the EEA FI’s liabilities may be written down, cancelled or converted to equity by regulators at a critical point before the institution fails (a Bail-In Recognition Clause, or BIRC).

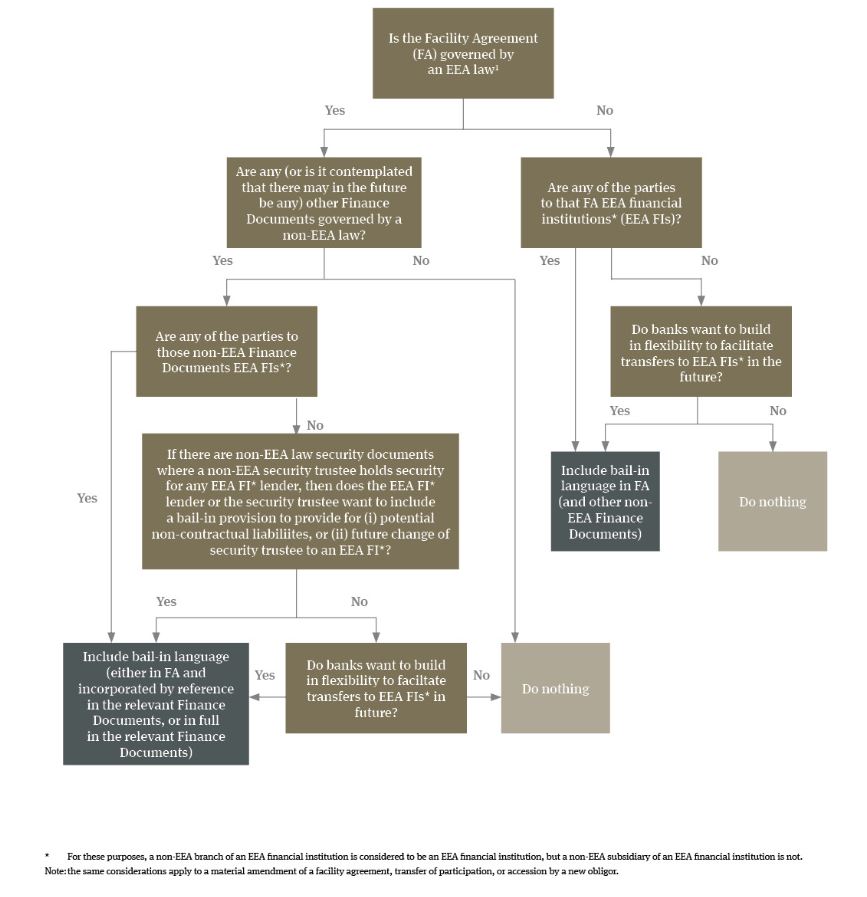

We have designed a decision tree (set out below) as a simple tool to assist parties in determining if a BIRC should be included in a contract in the context of a syndicated loan transaction. This can be applied to any contract, including material amendments to a contract pre-dating 1 January 2016, or where a loan participation is transferred, or additional obligors join an existing financing, after that date (even if the original contract pre-dates 1 January 2016).

The BRRD applies to a very broad spectrum of payment and other contractual and non-contractual liabilities in contracts entered into by EEA FIs on or after 1 January 2016. The term “Liabilities” is not defined in the BRRD, but it is being interpreted very broadly to include payment liabilities, actual and contingent liabilities, liabilities for breach of contract and even non-contractual liabilities which arise as a consequence of a contract having been entered into. The rules of each EEA member state implementing Article 55 BRRD may be more definitive: for example, in the UK, the PRA Rulebook defines “Liabilities” as including “any debt or liability to which the [bank] is subject, whether it is present or future, certain or contingent, ascertained or sounding only in damages”.

There are certain very limited liabilities which are excluded from the scope of the bail-in powers set out in Articles 44(2) and 55(1)(b) of the BRRD. Other liabilities can be excluded from bail-in by a national resolution authority under exceptional circumstances (though the scope of this “exceptional circumstances” exclusion will only be determined at the time the bail-in powers are actually used).

In the UK, the PRA and the FCA have issued certain temporary modifications of their contractual recognition of bail-in rules by consent in circumstances where compliance with them in respect of certain liabilities is impracticable, and other member state regulators may offer similar exemptions.

The European Banking Authority (EBA) has published final draft regulatory technical standards under Article 55 of the BRRD, listing the requirements of contractual recognition provisions but example drafting has not been provided. Broadly (among other matters), the EBA requires the express acknowledgement, agreement and consent by a counterparty that an EEA FI’s liability to it may be subject to the exercise of write-down and conversion powers by the relevant resolution authority, together with a description of those powers as set out in national law and the potential effects in terms of liability under the agreement.

Various bodies are considering the contents of standard contractual recognition terms, and the Loan Market Association (LMA) and the Loan Syndications and Trading Association (LSTA) published suggested BIRCs in respect of loan documentation in December 2015. It is likely that as far as loan transactions are concerned, wording produced by the LMA and LSTA will be adopted by the market.

EEA FIs failing to comply with the requirement of Article 55 are subject to sanctions, which are prescribed by individual EEA member states in their implementing legislation. Depending on the jurisdiction where the institution is regulated, sanctions may include a public reprimand, fines, adjustment of regulatory capital and, in extreme cases, even loss of its banking licence.

The EEA includes the members states of the European Union together with Iceland, Liechtenstein and Norway. As at February 2016, BRRD had been adopted by the EEA but not formally implemented by the EEA Joint Committee. Pending implementation, documents governed by the laws of Iceland, Liechtenstein and Norway should be treated as third countries and include bail-in provisions.

Publication

In this edition, we focused on the Shanghai International Economic and Trade Arbitration Commission’s (SHIAC) new arbitration rules, which take effect January 1, 2024.

Publication

EU Member States may allow companies from countries that have not concluded an agreement guaranteeing equal and reciprocal access to public procurement (public procurement agreement) with the EU to participate in public tenders, provided there is no EU act excluding the relevant country.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023