On January 1, 2024, the US Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) opened the Beneficial Ownership Information Registry and began accepting the beneficial ownership information reports required under the Corporate Transparency Act (CTA). The CTA was enacted in 2021 to combat money laundering and deter illicit finance, and it requires certain companies that are formed or registered to do business in the United States to report beneficial ownership information to FinCEN.

Could I qualify as a Reporting Company?

If an entity falls within the definition of a “reporting company” under the CTA (Reporting Company), it is required to make the necessary filings under the CTA, unless an exemption applies. Domestic and foreign Reporting Companies include corporations, limited liability partnerships, limited liability companies or any other entity created or registered to do business in the US by the filing of a document with the Secretary of State or similar state or tribal office.

What about exemptions?

Although the Reporting Company definition is broad, if a Reporting Company falls within one of the 23 exemptions under the CTA, it is not required to file a beneficial ownership report. Some common exemptions include:

- Highly regulated industries such as banking, insurance and public utilities

- Certain tax-exempt entities

- Securities reporting issuers

- Large operating companies, which must

- have at least 20 full time employees in the US;

- maintain an operating presence at a physical office in the US; and

- have filed a Federal income tax return in the US demonstrating more than US$5m in gross revenue (or sales).

- Subsidiaries of certain exempt entities

To determine whether an exemption applies is an entity-by-entity assessment, and a one-size-fits-all approach will be insufficient for compliance. Companies should carefully consider each entity within its organizational structure to avoid inadvertent noncompliance. Further, companies should routinely reevaluate their eligibility for exemptions to ensure that the exemption they are relying on will continue to apply. If an entity’s circumstances change, they may trigger CTA reporting obligations.

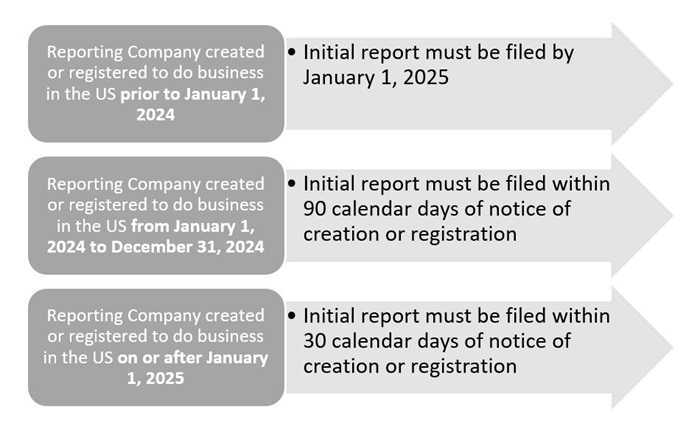

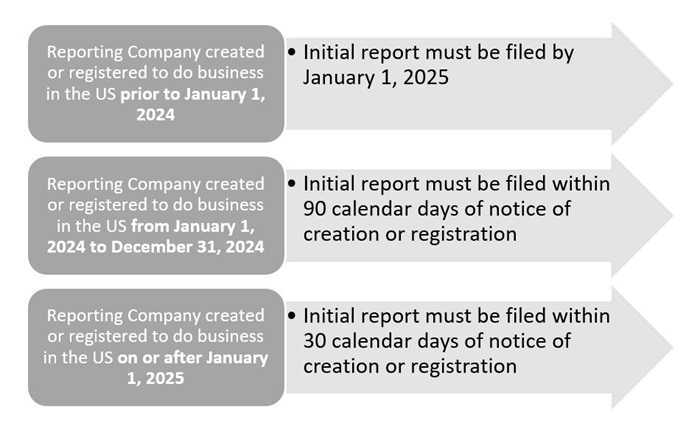

How long do I have to comply?

Who is a beneficial owner?

A beneficial owner is any individual who either directly or indirectly:

- exercises substantial control over a Reporting Company, or

- owns or controls at least 25 percent of a Reporting Company’s ownership interests.

The substantial control test is a fact-intensive analysis and may include the following:

- any senior officer of the Reporting Company

- any individual who has authority to appoint or remove certain officers or a majority of directors of the Reporting Company

- any individual who is an important decision-maker for the Reporting Company, or

- any individual with any other form of substantial control over the Reporting Company.

A Reporting Company can have multiple beneficial owners, and there is no maximum number of beneficial owners who must be reported.

What do I need to disclose?

CTA reporting obligations are imposed on the Reporting Company, the beneficial owners of the Reporting Company and the Company Applicant for the Reporting Company. The Company Applicant is the individual(s) that is primarily responsible for directing or controlling the formation or registration filings with the Secretary of State or similar state or tribal office.

Each Reporting Company is responsible for reporting the following:

- Its full legal name and any trade name or “doing business as” (DBA) name;

- The current US address of its principal place of business or current address where it conducts business in the US, if its principal place of business is outside the US;

- The jurisdiction of formation or registration; and

- The entity’s IRS Taxpayer Identification Number (TIN), including an Employer Identification Number (EIN), or a tax identification number issued by a foreign jurisdiction and the name of such jurisdiction if the foreign Reporting Company has not been issued a TIN.

The Reporting Company must collect and report the following information for each of its beneficial owners and Company Applicant(s):

- The individual’s full legal name;

- The individual’s date of birth;

- The individual’s current residential address (however, for a Company Applicant that works as a formation agent, such as an attorney or corporate service agent, the Reporting Company must report the Company Applicant’s business address). Individuals may not utilize a PO box for this reporting requirement; and

- An identifying number from an acceptable identification document such as a passport or US driver’s license, the name of the issuing state or jurisdiction of the identification document and an image of such document. This cannot be an expired document, and the Reporting Company must update this information if the document changes over time for any reported individual.

Reporting Companies formed or registered to do business in the US before January 1, 2024 do not have to report their Company Applicant(s).

Although the beneficial ownership information does not have to be reported annually, a report must be submitted if any of the above information (other than for a Company Applicant) needs to be updated or corrected. Companies may consider routine communications to beneficial owners to inquire as to any updates that may be necessary (such as address changes, updates in identification documentation, changes in beneficial ownership as a result of tax or estate planning, etc.).

For beneficial owners or Company Applicants with numerous reporting obligations, a FinCEN Identifier could serve as a helpful tool.

Concerned with compliance? Common pitfalls to avoid

Willful noncompliance can result in civil penalties of up to US$500 per day for each day the violation continues and/or criminal penalties of up to two years imprisonment and a fine of up to US$10,000. Further, senior officers of non-complying entities may also be held accountable for compliance failures. Companies should carefully consider the following:

- Companies may fall outside certain exemptions from year to year. For example, a large operating company may fall below the US$5m revenue threshold in a given tax year and therefore become subject to CTA reporting requirements.

- Reporting Companies must update information within 30 calendar days after a change occurs. Routine communications and trainings for beneficial owners may be necessary to remind beneficial owners that updates are required if there are changes to report. The following examples qualify as changes requiring filing updates:

- Company name (including any trade/DBA name)

- Principal place of business

- Beneficial owner residential address

- Beneficial owner ceases substantial control or drops below 25 percent of the ownership interests of Reporting Company

- Non-beneficial owner gains substantial control or acquires 25 percent or more of the ownership interests of Reporting Company

- Acceptable identification document on file, such as US passport or driver’s license

- Smaller companies that are not currently subject to robust regulation will need to develop compliance procedures, which may include helpful tools such as checklists, routine check-ins with beneficial owners and management and internal or external trainings for compliance procedures.

- Compliance when forming special purposes entities or other entities formed for the purpose of carrying out a transaction will be important. A separate analysis will need to be conducted to determine if each vehicle qualifies as a Reporting Company or falls within an exemption.

- Will there be a particular person within the corporate structure to manage compliance? Companies may also consider implementing requirements in the organizational documents to include a CTA reporting provision which requires beneficial owners to comply.

Are there data privacy concerns?

Reporting Companies will be handling very sensitive personal information as a part of this data collection and compliance process. Each entity should consult with its data privacy experts to ensure compliance with all applicable data privacy laws relating to the collection, disclosure and handling of sensitive personal identifying information.

FinCEN will be maintaining the reported personal information in a secure, non-public database that will be disclosed only under limited circumstances (such as a request from a federal agency). There will be rigorous information security controls to protect the sensitive information, and it will be maintained in a secure and confidential manner. See our analysis regarding the recently issued Access Rule.