Introduction

The Stock Exchange of Hong Kong Limited (HKEX) has published its consultation conclusions on backdoor listing, continuing listing criteria and other rule amendments (Consultation Conclusions).

HKEX has decided to amend the Listing Rules to tighten restrictions on “backdoor” listings and other related matters.

The Listing Rule amendments, together with the three new guidance letters (GL104-19 to GL106-19) on the application of the revised Rules, will take effect on October 1, 2019.

Background

The Consultation Conclusions mark the HKEX’s latest effort in addressing concerns over “backdoor” listings and related “shell” activities in Hong Kong.

Backdoor listings have been the subject of regulatory scrutiny as they are often associated with attempts to list assets with quality or suitability issues in circumvention of the new listing requirements. Demands for listed “shell” companies as vehicles for backdoor listings can also lead to “shell” activities which are not in the interests of the investing public or the market as a whole.

To combat these issues, HKEX has already tightened its suitability review of issuers with “shell” characteristics, introduced an enhanced regime for delisting issuers engaging in “shell” activities and has also been taking a robust approach in regulating transactions with “backdoor” listing concerns.

From October 1, 2019, the regulatory regime for listed “shells” and backdoor listings will be strengthened further.

In addition to codifying HKEX’s guidance letters and practices in recent years, the revised Rules will widen the regulatory net for HKEX to crack down on “shell” activities, tighten the qualification requirements for “backdoor” listings, enhance the continuing listing criteria to tackle listed “shell” issues and will also broaden the scope of transactions that can be caught under the new regime.

Key features of the revised framework governing backdoor listings through reverse takeovers (RTOs) and related matters and the enhanced continuing listing requirements are set out below.

Part I: Amendments relating to “backdoor” listing issues

Overview

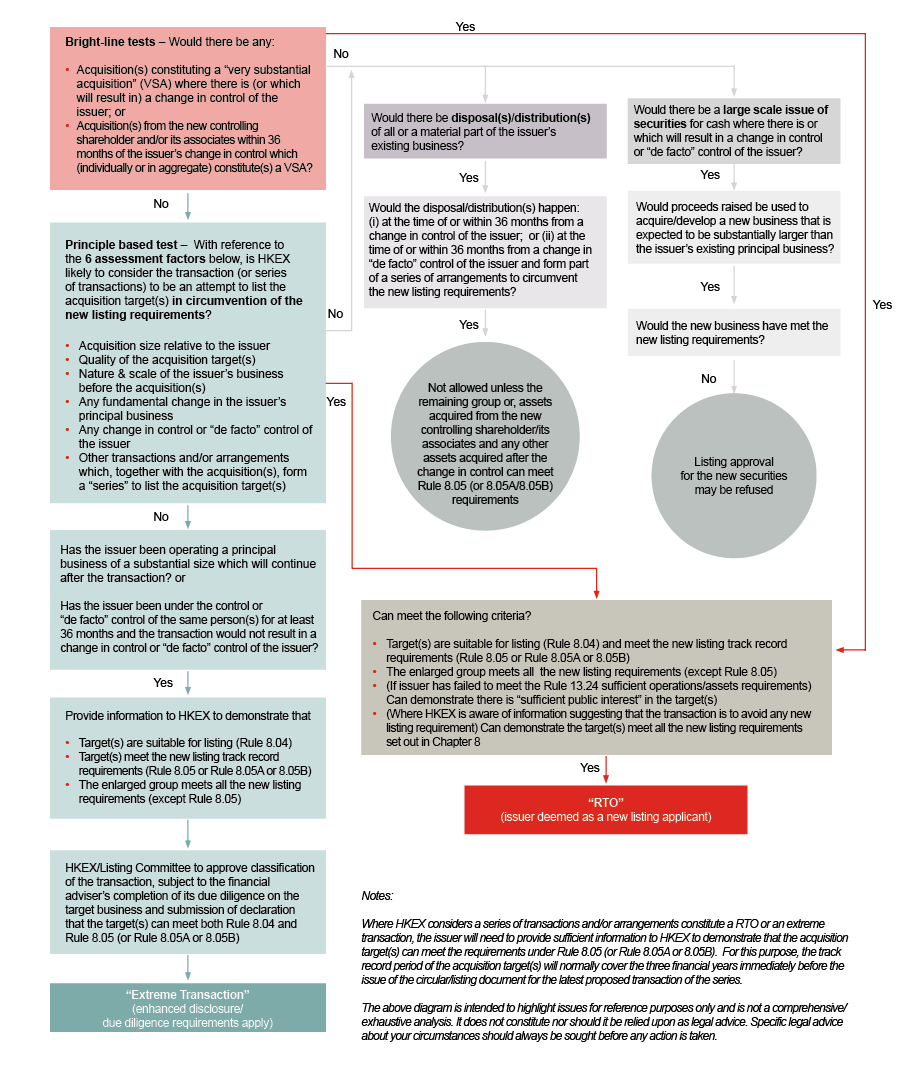

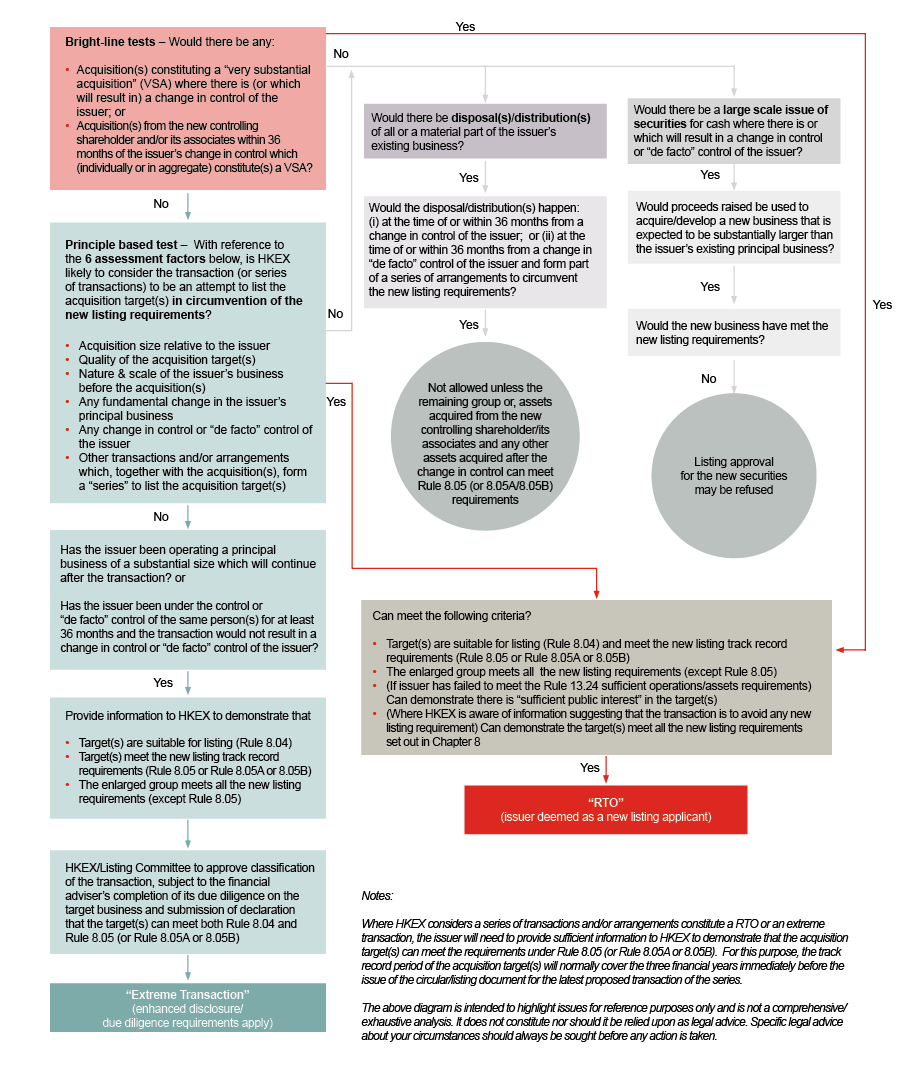

The diagram below illustrates some key issues to consider under the revised “backdoor” listing governing regime.

Key features

1. Deemed new listing – “RTO” definition modified

(a) Principle-based test

| Current regime |

New regime |

- “Principle-based test” in Rule 14.06(6) – acquisition (or series of acquisitions) which, in HKEX’s opinion, constitutes an attempt to achieve a listing of the acquisition targets and a means to circumvent the new listing requirements will be regarded as a “RTO” (hence, deemed as a new listing)

- In assessing whether an acquisition (or series of acquisition) would be a RTO under the “principle-based test”, HKEX will have regard to the 6 assessment factors set out in Guidance Letter GL78-14

|

- The “principle-based test” for assessing whether a transaction is a RTO will be retained and set out in the new Rule 14.06B

- The following 6 assessment factors (previously in GL78-14, with modifications made to the last two factors) for the “principle-based test” will be codified in Note 1 to Rule 14.06B:

- Acquisition size relative to the issuer

- Quality of the acquisition target(s)

- Nature and scale of the issuer’s business before the acquisition(s)

- Any fundamental change in the issuer’s principal business

- Any change in control – this factor will be extended to cover any change in “control” or “de facto” control of the issuer

Indicative factors of such change include a change in the issuer’s controlling shareholder or its single largest substantial shareholder (who is able to exercise effective control over the issuer, as indicated by factors such as a substantial change to the issuer’s board of directors and/or senior management) or, an issue of restricted convertible securities as a means to allow the vendor to effectively “control” the issuer

- Other transactions/arrangements which, together with the acquisition(s), form a “series” to list the acquisition target(s) – this factor will be extended to allow HKEX to deem transactions and/or arrangements (such as change in control or de facto control, acquisitions (including completed acquisitions) and/or disposals) as forming a “series” if they take place within reasonable proximity of each other (normally within a 36 month-period) or are otherwise related. As stated in the new guidance letter on application of the RTO Rules GL104-19, however, transactions outside the 36-month period can still be caught if there is a clear nexus between the transactions or if specific concerns exist about circumvention of the RTO Rules. In considering whether the transactions and/or arrangements amount to a RTO, the “series” will be assessed in totality and treated as if they were one transaction

|

(b) Bright-line tests

| Current regime |

New regime |

- “Bright-line tests” in Rule 14.06(6) – this refers to the two specific forms of RTO below:

- Acquisition(s) of assets constituting a very substantial acquisition (VSA) where there is (or which will result in) a change in control of the issuer; or

- Acquisition(s) of assets from the incoming controlling shareholder and/or its associate(s) within 24 months of such shareholder gaining control, which (individually or in aggregate) constitute(s) a VSA

|

- The “bright-line tests” will be retained as Note 2 to the new Rule 14.06B

- For the second “bright-line test”, the aggregation period for acquisition(s) from the incoming controlling shareholder(s)/its associate(s) will be extended from 24 months to 36 months

|

2. Codifying restrictions on backdoor listing through large scale securities issue

| Current regime |

New regime |

- Guidance Letter GL84-15 sets out HKEX’s practice of disallowing a large scale issue of securities where the funds raised would be used to start a greenfield operation which, in HKEX’s opinion, is a means to circumvent the new listing requirements and to achieve a listing of that greenfield operation

|

- The practice in GL84-15 will be codified (with modifications) into the new Rule 14.06D to disallow a large scale issue of securities (including any shares, warrants, options or convertible securities) for cash to acquire and/or develop a new business which, in HKEX’s opinion, is a means to circumvent the new listing requirements and to achieve a listing of the new business

- As an anti-avoidance provision, Rule 14.06D is intended to apply to a proposed large scale securities issue where:

- there is (or which will result in) a change in control or de facto control of the issuer;

- the funds raised are to be used to acquire and/or develop a new business expected to be substantially larger than the issuer’s existing principal business; and

- the effect of the proposal is to achieve a listing of the new business that would not have otherwise met the new listing requirements

- New guidance letter on large scale issues of securities GL105-19 states that in applying Rule 14.06D, HKEX will not just be looking at the size of the fundraising but will assess all the relevant facts and circumstances of the issuer. GL105-19 also includes examples of fundraisings which will normally be caught by Rule 14.06D

|

3. Retaining the restriction on disposals with modifications

| Current regime |

New regime |

- Rule 14.92 disposal restriction – to deter circumvention of the RTO Rules through resequencing of transactions, Rule 14.92 restricts a listed issuer from disposing its existing business for a 24-month period after a change in control

- Dis-apply the restriction if the assets acquired from the incoming controller/its associates and any other assets acquired after the change in control would meet the listing requirements under Rule 8.05

|

- The disposal restriction will be retained in the new Rule 14.06E with the following modifications:

- the restriction will ban disposals or distributions of “all or a material part” of the issuer's business at the time of or within 36 months from a change in control of the issuer

- HKEX will have discretion to apply the restriction to disposals at the time or within 36 months from a change in “de facto” control of the issuer (with reference to the relevant principle-based test factor) if it considers the disposal(s) or distribution(s) may form part of a series of arrangements to circumvent the new listing requirements

- Dis-apply the restriction if (i) the issuer’s remaining group or (ii) the assets acquired from the new controller/its associates and any other assets acquired after the change in control can meet the Rule 8.05 (or 8.05A / 8.05B) listing requirements

|

4. Codifying the “Extreme VSA” category with new requirements

| Current regime |

New regime |

- Guidance Letter GL78-14 provides that, where an issuer can demonstrate that the target business would meet the Rule 8.05 minimum profit requirement and that circumvention of the new listing requirements would not be a material concern, the transaction may be classified as an “Extreme Very Substantial Acquisition (Extreme VSA)”

- Issuer proposing an “Extreme VSA” will need to prepare a transaction circular under an enhanced disclosure and vetting approach and to appoint a financial adviser to perform due diligence on the acquisition target(s)

|

- The “Extreme VSA” transaction category will be codified (with modifications) and renamed as “Extreme transactions” in the new Rule 14.06C

- In addition to demonstrating to HKEX’s satisfaction that it is not an attempt to circumvent the new listing requirements, new eligibility criteria will be added to require an issuer to fulfil one of the following criteria before the “extreme transactions” category will be available for its use:

- the issuer must have been operating a principal business of a “substantial size” (as a general guidance, this may include an issuer with annual revenue or total asset value of HK$1 billion or more based on the latest published financial statements) which will continue after the transaction; or

- the issuer must have been under the control or de facto control of the same person(s) for a long period (normally not less than 36 months) and the transaction will not result in a change in control or de facto control of the issuer

- The enhanced disclosure and due diligence requirements will be codified; accordingly, an issuer proposing an “extreme transaction” must comply with the enhanced disclosure requirements in its transaction circular and must appoint a financial adviser who will perform due diligence on the acquisition target(s) and make a declaration to the HKEX in respect of its due diligence

- The Listing Committee may, in principle, allow an issuer to classify its proposed acquisition as an “extreme transaction” based on its written submissions, draft circular and other information requested by the Listing Department. However, that classification will be subject to the completion of the financial adviser’s due diligence and submission of a declaration that the acquisition target(s) meet the Rule 8.04 (suitability for listing) requirement and the Rule 8.05 (or Rule 8.05A or Rule 8.05B) new listing track record requirements

|

5. Additional requirements for “RTO” and “Extreme transactions”

| Current regime |

New regime |

- Issuer proposing a RTO will be treated as if it were a new listing applicant – the issuer is required to show that the enlarged group or the assets to be acquired can meet the Rule 8.05 requirements and that the enlarged group is able to meet all the other basic listing conditions in Chapter 8

- Similarly, in an “Extreme VSA”, the issuer’s financial adviser is required to conduct due diligence and confirm to HKEX that the assets to be acquired are able to meet the minimum profit requirement in Rule 8.05 and that the enlarged group is able to meet all the other conditions in Chapter 8 (except for those Rules agreed with HKEX)

|

- Eligibility requirements for RTOs and “extreme transactions” will be tightened to require that:

- the acquisition target(s) in a RTO or an extreme transaction must be “suitable for listing” (Rule 8.04) and meet the new listing track record requirements in Rule 8.05 (or Rule 8.05A or Rule 8.05B); and

- the enlarged group must meet all the new listing requirements in Chapter 8 (except Rule 8.05)

- If the RTO is proposed by an issuer that has failed to comply with Rule 13.24 (i.e. failed to have sufficient operations and assets to warrant a continued listing), the acquisition target(s) must also meet the “sufficient public interest” requirement in Rule 8.07

- If HKEX is aware of information suggesting that a RTO is to avoid any new listing requirements, the issuer will be required to demonstrate that the acquisition target(s) meet all the new listing requirements set out in Chapter 8

|

Part II: Amendments relating to continuing listing criteria

Listing Rules governing the continuing listing criteria and “cash company” will be tightened to better tackle listed “shell” issues – key features of the amendments are set out below.

1. Enhanced continued listing criteria

| Current regime |

New regime |

- Rule 13.24 requires that a listed issuer must carry out a sufficient level of operations or have assets of sufficient value to warrant its continued listing

|

- Rule 13.24 will be tightened to:

- require a listed issuer to carry out a business with a sufficient level of operations AND have assets of sufficient value to support its operations to warrant its continued listing (new Rule 13.24(1)); and

- exclude proprietary trading and/or investment in securities of an issuer (other than a Chapter 21 company) in considering the sufficiency of its operations and assets under Rule 13.24(1) (subject to limited exceptions for trading/investment by members in the issuer’s group which are banking or insurance companies or securities houses mainly engaged in regulated activities under the SFO)

- Compliance with the new Rule 13.24(1) is a qualitative test, HKEX may regard an issuer to have failed to meet the requirement if it does not have a business that has substance and/or that is viable and sustainable. Where HKEX raises concerns, the onus is on the issuer to address HKEX’s concerns and demonstrate its compliance with Rule 13.24(1)

- New guidance letter on sufficiency of operations GL106-19 sets out HKEX’s general approach in applying the new Rule 13.24(1). If Rule 13.24(1) is not met, HKEX may suspend the issuer. The issuer would generally be given a period to remedy the issue, failing which HKEX may cancel its listing

|

2. “Cash company” Rules modified

| Current regime |

New regime |

- Under Rule 14.82/Rule 8.05C (commonly known as the “cash company” rules), an issuer (other than a Chapter 21 company) whose assets consist wholly or substantially of cash or “short-dated securities” (e.g. securities such as bonds, bills or notes which have less than one year to maturity) will be regarded as a “cash company” not suitable for listing

- Exemption from the “cash company” rule is available to an issuer which is solely or mainly engaged in the securities brokerage business

|

- Scope of issuers falling into the “cash company” category potentially broadened by:

- the revised Rule 14.82/8.05C(1), which will extend the “short-dated securities” (to be renamed as “short-term investments”) definition to cover investments that are easily convertible into cash. In addition to bonds, bills or notes with less than one year to maturity, “short-term investments” can also include listed securities held for investment or trading purposes and investments in other financial instruments that are readily realisable/ convertible into cash; and

- the revised Rule 14.83/8.05C(2), which will confine the exemption from the “cash company” rule to cash/short-term investments held by banking companies, insurance companies or securities houses within the issuer’s group

- A “cash company” will not be regarded as suitable for listing and trading in its securities will be suspended by HKEX. Application to lift the trading suspension will be treated as if it were an application for listing from a new applicant

|

Part III: Other amendments

In addition to the above, amendments will also be made to Chapter 14 (notifiable transactions), Chapter 14A (connected transactions) and the annual report disclosure requirements of the Listing Rules to enhance investor protection and better address “shell” activities issues.

Key features of the changes are set out below.

(a) Securities transactions

- Confining the “revenue exemption” for securities transactions:

- Transactions that are of a revenue nature in the issuer’s ordinary and usual course of business are fully exempt from the disclosure and shareholders’ approval requirements for notifiable transactions under Chapter 14 of the Listing Rules (revenue exemption).

- To deter securities transactions from being used in “shell” maintenance activities, the “revenue exemption” for the purchase or sale of securities will be confined so that the exemption will only be available where the securities purchase or disposal is carried out by a banking company, an insurance company or a securities house (which is mainly engaged in regulated activities under the SFO) within the issuer’s group in its ordinary and usual course of business.

- Disclosure of significant investments in annual reports:

- To enhance transparency, details of each securities investment that represents 5% or more of an issuer’s total assets (calculated based on the value of the issuer’s investments in the investee company as at the year-end date) will need to be disclosed in the issuer’s annual reports.

(b) Significant distribution in specie

- For significant distributions of unlisted assets, the requirements in Listing Decision LD75-4 will be codified into the Listing Rules. Accordingly, where an issuer intends to conduct a distribution in specie (other than HKEX listed securities) and the size of the assets to be distributed amounts to a “very substantial disposal” under the Rules:

- the issuer must obtain prior approval for the distribution by independent shareholders in a general meeting;

- the controlling shareholders (or if there is no controlling shareholder, the directors (excluding independent non-executive directors) and chief executive) and their respective associates must abstain from voting in favour of the resolution;

- the approval must be given by at least 75 per cent of the votes attaching to any class of listed securities held by holders voting (in person or by proxy) at the meeting, and the number of votes cast against the resolution must not be more than 10 per cent of the votes attaching to any class of listed securities held by holders permitted to vote at the meeting; and

- the issuer’s shareholders (other than the directors (excluding independent non-executive directors), chief executive and controlling shareholders) should be offered a reasonable cash alternative or other reasonable alternative for the distributed assets.

(c) Other matters relating to notifiable/connected transactions

- Disclosure requirements in the notifiable/connected transaction Rules will be extended:

- to require (i) disclosure on the outcome of any financial performance guarantee of an acquisition target (irrespective of whether the guaranteed financial performance is met) in the next annual report; and (ii) disclosure by announcement (including directors’ views) if there is any subsequent change to the terms of the guarantee or if the acquired target’s actual financial performance fails to meet the guarantee; and

- to require (i) disclosure of the identities of the parties to a transaction in the announcements and circulars of notifiable transactions; and (ii) disclosure of the identities and activities of the parties to transactions and of their ultimate beneficial owners in the announcements of connected transactions (in addition to the existing disclosure requirements in connected transaction circulars).

- Amendments will also be made in Chapter 14 (notifiable transactions) and Chapter 14A (connected transactions) to make it clear that, where any calculation of the percentage ratios produces an anomalous result or is inappropriate to the sphere of activity of the issuer, HKEX (or the issuer, with HKEX's prior consent) may apply an alternative size test that it considers appropriate to assess the materiality of the transaction.

SFC’s approach to backdoor listing and shell activities

In tandem with the Consultation Conclusions, the Securities and Futures Commission (SFC) has also issued a statement on its approach to backdoor listings and shell activities, emphasizing that it will not hesitate to utilise its statutory powers (e.g. powers to investigate or to object to a listing application or direct a trading suspension) where appropriate and that the following factors are likely to be relevant in considering whether there are “red flags” in cases involving backdoor listings/shell activities:

- whether there are any red flags indicating concealed arrangements or understandings (such as one involving a change in control or de facto control) between the parties involved, including the directors, shareholders, intermediaries and advisers

- whether the listed issuer or the listing applicant has disclosed the true nature or extent of its business, affairs and plans

- whether there are any fundamental issues relating to the new assets or businesses being injected or to be injected that would lead to concerns as to whether these assets or businesses should be allowed to be listed and have access to public investors' capital

- whether there are any concerns that the directors might not have fulfilled their fiduciary duties and acted in the interests of the shareholders as a whole

- whether sufficient due diligence has been conducted on the assets or businesses acquired, and whether the scope of due diligence is appropriate

Way forward - Actions required?

The revised Listing Rules, together with the SFC/HKEX’s robust enforcement approach, should serve as a strong deterrent to those looking to skirt the new listing requirements by a “backdoor” listing and help stem tide of “shell” activities. At the same time, the increased regulatory risks and hurdles involved in backdoor listing-related transactions may also make “front door” listing (IPO) a more appealing option for companies seeking to list their assets on the Hong Kong bourse.

On the other hand, in view of the broad scope of the revised Rules, issuers should be careful not to inadvertently trigger the tightened rules or the extended restrictions under the new regime. Early advice should be sought, particularly in transactions where substantial changes to the issuer’s shareholdings or existing businesses are contemplated.

Issuers should also be mindful of the continuing requirements in the revised Rule 13.24 (sufficient operations and assets to warrant a continued listing) and Rule 14.82 (“cash company” rule) as mentioned above. A 12-month transitional period from the effective date (i.e. October 1 2019) will apply to issuers that do not comply with the new Rule 13.24 or 14.82 strictly as a result of the Rule amendments. The transitional arrangement, however, would not apply to issuers that do not comply with the current requirements under the existing Rule 13.24 or 14.82, or become non-compliant with the new Rule 13.24 or 14.82 after the effective date. Issuers should therefore conduct an internal compliance check as soon as possible and take necessary action to ensure that the enhanced requirements are met before the expiry of the transitional period.