Publication

Developments in USTR actions on Chinese and foreign vessels

The USTR's Section 301 actions targeting Chinese and other foreign vessels is set to take effect on October 14, 2025.

Developments and market trends in Europe

Global | Publication | October 2017

Author Richard Sheen

In his regular quarterly update Richard Sheen discusses recent trends in the asset management industry.

Since our last update in June, there have been a number of significant political events that have a potential impact on the European asset management industry. Most recently we have had Theresa May’s Florence speech in which she sought to lay out a road map for Brexit including a two year “implementation period” and the German elections which saw a fourth term secured for an Angela Merkel led coalition but also saw the increase in votes for the nationalist party, the Alternative for Germany which may have a destabilising impact on domestic German politics. An air of political instability persists in the UK and plans announced by the UK Labour Party to seize Public Finance Initiative assets have raised concerns amongst infrastructure managers.

Quite how the evolving political landscape will play out for asset managers is still unclear – what is clear is that there continues to be considerable pressure from the City and trade bodies for greater clarity in the negotiations between the UK government and the EU and for greater emphasis to be placed upon preserving some type of satisfactory EU access for financial services. Statements by the UK government around longer term regulatory divergence between the UK and the EU post Brexit (in the context of giving the UK a perceived competitive advantage) have raised further concerns about the compatibility of that objective with preserving access to European markets. As I mentioned in June, it seems that many asset managers are continuing to progress their contingency planning for the “worst-case” scenario.

In the UK, despite the continuing Brexit process, the FCA has reiterated that regulated firms will be expected to implement EU Directives and Regulations that are in the short term pipeline. These include MiFID II and asset managers are continuing to prepare for implementation in January 2018 and to make the necessary modifications to their business models to address issues such as who pays for research and also best execution.

On 21 September 2017, the UK Competition and Markets Authority (CMA) launched its expected anti-trust investigation into the investment consultancy industry. The CMA will test whether issues such as lack of transparency, potential conflicts and barriers to entry have had the effect of reducing competition within this sector. The outcome of this investigation (expected next year) is also likely to have an impact on the wider asset management industry – so it’s interesting that the industry is not only having to adapt to EU led regulatory change but is also very much in the domestic regulatory spotlight.

In short, the asset management industry remains exposed to significant regulatory change and the continuing squeeze on profit margins which is driving managers to look at ways of achieving greater economies through potential M&A activity. The squeeze seems particularly relevant to active managers in the face of hugely increased completion from lower cost passive fund providers – as in North America, the share of equity fund assets represented by passive funds (index trackers and exchange traded funds) has grown very rapidly to close to 50 per cent. However, despite the theme of consolidation amongst mid-tier managers, the recent failure of the Rathbone Brothers and Smith & Williamson potential transaction suggests that the implementation of these deals still presents significant challenges for the parties.

Over the summer, the fundraising themes identified earlier in the year appear to be continuing. In terms of private funds, a bifurcated market has demonstrated that the most successful fund raises are being undertaken in relation to fashionable niche asset classes or by substantial established asset managers.

For listed funds, strong secondary fundraising activity has continued and there have been a number of new launches. As for the past few years, the focus continues to be on income producing funds and real asset strategies with real estate infrastructure and energy amongst the most popular asset classes. Real estate in particular continues to represent a particularly strong asset class with demand for specialist property vehicles remaining buoyant. So far this year, there have been seven new REITs launched all targeting dividend yields in the five per cent plus range.

Over the summer, new initial public offerings included Residential Secure Income REIT which raised £180 million to invest in social housing, Warehouse REIT which raised £150 million to invest in a portfolio of UK warehouse assets located in urban areas and Triple Point Social Housing REIT (another social housing fund) which raised £200 million. Sherborne Investors (Guernsey) C Limited raised £700 million on the London Stock Exchange’s Specialist Funds Segment (SFS) and Greencoat Renewables PLC which raised €270 million on the Irish Stock Exchange’s Enterprise Securities Market. Secondary activity includes placings by Empiric Student Property, life sciences fund, BB Healthcare Trust which raised £64 million in September and the recently announced initial issue and share issuance programme by AEW UK REIT.

Author: Beth Duff

The European Commission is set to shortly unveil legislative proposals regarding a bespoke prudential regime for investment firms. While details of the proposal are yet to be published, preparatory work by the EBA sets some light on the key elements of the upcoming regime.

The current prudential regime to which investment firms are subject stems from the 1990s. Over the last three decades the regime has evolved to address shortcomings in the banking sector whilst introducing exemptions and exceptions to try to cater for the specificities of investment firms. This has resulted in an overly complex and disproportionate framework for investment firms. Implementation of this regime has not been harmonised across Member States. The European Commission (Commission) has been mandated by Articles 508(2) and (3) of Regulation (EU) No. 575/20131 (Capital Requirements Regulation or CRR) to review the existing regime and if appropriate, to present a legislative proposal setting out a bespoke framework for investment firms.

Pursuant to this mandate, the Commission has issued a series of Calls for Advice from the European Banking Authority (EBA). The latest Call for Advice in June 2016 asked the EBA to provide technical advice on a new categorisation of investment firms and the calibration of a new prudential regime to inform the Commission’s drafting of a legislative proposal. On 3 July 2017, the EBA held a public hearing to update stakeholders on its progress on developing recommendations, during which it set out 58 preliminary recommendations which will serve as the foundations of the technical advice.

The EBA recommends replacing the current 11 categories of investment firm with three broad classes:

The EBA is recommending an activities based distinction between Class 2 and Class 3 firms, whereby firms meeting pre-determined thresholds when undertaking certain activities will be excluded from Class 3.

The EBA’s preliminary recommendations propose simplistic minimum capital requirements for Class 3 firms which would be the higher of the initial capital (also referred to as “Permanent Minimum Capital” or PMC) or the Fixed Overheads Requirements (FOR). Class 2 firms, on the other hand, would be subject to minimum capital requirements equal to the higher of PMC, FOR, or an amount determined by the so called “K-factor formula”.

The proposed K-factor formula identifies proxies (K-factors) for various measurable risks which are attributed to three broad types of risk: Risk to Customer (RtC), Risk to Market (RtM), and Risk to Firm (RtF). RtC is proposed to be measured by five K-factors (assets under management, client money held, assets safeguarded and administered, income from giving investment advice and customer orders executed). For firms dealing on own account, two K-factors (net position risk and daily trading flow) will measure the RtM with a further two (trading counterparty default and concentration risk) measuring the RtF. Each K-factor has been assigned a coefficient to reflect the severity of the risk. With this model the EBA seeks to make Pillar 1 requirements as comprehensive as possible to limit the application of Pillar 2. The methodology has been broadly welcomed by industry and the Commission, subject to appropriate calibration.

With regards to liquidity requirements, only Class 1 firms will be obliged to apply the liquidity coverage ratio. Classes 2 and 3 will be required to have internal procedures to manage their exposures, ensuring that they have liquid asset holdings of at least one third of FOR. The EBA also proposes simplified reporting obligations for both Classes 2 and 3. Similarly, whilst maintaining its basis in CRD IV, the proposed governance and remuneration framework for Class 2 and 3 firms is considerably less complex.

Under the current regime, some asset managers avail of the Article 4(1)(2)(c) CRR exemption whilst others meet the conditions of Article 95(1) CRR (so-called “limited license firms”) and therefore benefit from a more lenient regulatory capital regime. Should the new prudential regime be calibrated as proposed by the EBA, it is likely that a high proportion of second-tier asset managers are likely to be classified as Class 2 firms, as they will exceed the threshold for assets under management and under advice allowing for Class 3 categorisation. As such, they are likely to become subject to considerably higher capital requirements than currently applicable.

Preparatory work at the Commission level is ongoing and the services are awaiting the EBA’s technical advice, which should be submitted to them by 30 September 2017. No public consultation is expected in addition to two stakeholder roundtables hosted by the Commission to date to discuss the proposals. The publication of the proposal is expected to take place at the beginning of December 2017.

Authors: Conor Foley

The Commission’s proposed rules target state-owned foreign investors in particular. Whilst controversial, the proposals appear to have sufficient Member State and legislator support to be adopted.

On 13 September 2017, the Commission published new draft legislation that would, if adopted, empower both Member State governments and the Commission to screen and block or unwind foreign investments in the EU on the grounds of “security or public order”. Details of the proposal were outlined by Commission President Juncker in his State of the Union speech.

The legal basis is Article 207(2) of the Treaty on the Functioning of the European Union (TFEU). The proposed regulation would form part of the Common Commercial Policy. Note that draft EU legislation introduced under the Common Commercial Policy is subject to review under the “ordinary legislative procedure” (which means no Member State vetoes).

The proposed regulation would apply to all investments of any kind made or proposed by a “third country” (i.e. non-EU) natural person or undertaking intended to establish or maintain “lasting and direct links between the foreign investor and the entrepreneur to whom or the undertaking to which the capital is made available to carry on an economic activity in a Member State”. Foreign investments in non-EU undertakings may also be subject to screening where the investment facilitates economic activity in the EU.

Most provisions of the proposed regulation concern a common mechanism for each Member State government to screen foreign investments concerning persons established in that Member State. However, the proposed regulation would empower the Commission to screen foreign investments in any Member State “that are likely to affect projects or programmes of Union interest”. Such projects and programmes are broadly defined in the proposed regulation. An indicative list is annexed to the proposal and includes Horizon 2020, the Trans-European Networks for Energy (TEN-E), the Trans-European Networks for Transport (TEN-T) and European GNSS programmes (aka “Galileo”, the global navigation satellite system).

Grounds of security and public order are defined expansively in the proposed regulation as the potential effects of the foreign investment on:

The proposed regulation states that in considering whether a foreign investment is likely to affect security or public order, Member States and the Commission may take into account whether the foreign investor is “controlled by the government of a third country, including through significant funding”. This is a thinly-veiled reference to investments by Chinese state-owned enterprises. The Commission has previously raised concerns about Chinese state-owned enterprises investing in hi-tech and strategically-important sectors in Europe. The Commission is also of the view that the EU’s openness to Chinese investment is not reciprocated in China, a point which was emphasised by President Juncker without expressly referring to China.

The proposed regulation includes provisions that would require Member State governments to report screening of foreign investments under the new mechanism to the Commission and the other Member States. The legislation would also permit a Member State government to formally raise concerns regarding a foreign investment in another Member State where it considers that foreign investment to affect security or public order in its jurisdiction. The proposed regulation would also permit the Commission, on its own initiative, to formally raise concerns where it considers a foreign investment to affect security or public order in one or more Member States. Such concerns do not constitute a Commission objection or veto but would, in practice, be difficult for a Member State to ignore.

The proposed regulation is stated to apply without prejudice to Article 21(4) of Council Regulation (EU) No 139/2004 (Merger Regulation), which permits Member States to protect their “legitimate interests” in the case of a merger or acquisition reviewed by the Commission. The proposed regulation states that where the scope of the Merger Regulation and the proposed regulation overlap, the legitimate interests cited in the Merger Regulation (public security, plurality of the media and prudential rules) and the provisions of the proposed regulation should be applied in a consistent manner and in line with the general principles and other provisions of Union law.

The French, German and Italian governments have openly called for and pushed the Commission to adopt the proposed regulation. Amongst the EU’s “Big 3” Member States, President Macron of France has been most vocal in his support for tougher reviews of foreign investments and a defined competence for the Commission. Member State governments including those of the Netherlands, Sweden, Spain and Portugal have previously expressed opposition to President Macron’s proposals. However, this opposition has mostly concerned a proposed Commission veto. The proposed regulation is carefully drafted to play up the powers of Member State governments and play down the powers of the Commission, thereby softening prospective Member State opposition in Council.

The proposed regulation needs work but should be adopted by the EU’s “co-legislators” – the Council of the EU (comprising the 28 Member State governments) and the European Parliament. In Council, the proposed regulation will be advanced firstly by the current Estonian Presidency of the Council and, from 1 January 2018, the incoming Bulgarian Presidency. Of note, neither of these Member States currently has a national screening mechanism and the Bulgarian government has come under heavy fire previously from the Commission for its perceived inattentiveness to Russian investment in strategically-sensitive sectors of the Bulgarian economy. The proposed regulation will be scrutinised by the European Parliament’s International Trade Committee. Of note, eight members of this committee were amongst ten senior European People’s Party legislators that formally called on the Commission to bring forward legislation on the screening of foreign investments in strategic sectors in March of this year.

The Common Commercial Policy applies to EU Member States only. Whatever the transitional arrangements that may be agreed between the EU and the UK government, UK persons would be considered “foreign investors” under the proposed regulation from 30 March 2019. If the proposed regulation is adopted, any direct investment made or planned by UK persons in or with an EU person may be subject to review on security or public order grounds.

Authors: Mark Simpson and Milagros Miranda Rojas

In the ‘hard Brexit’ scenario, the UK will trade with the EU and the rest of the world on WTO non-preferential rules that do not provide financial services with levels of market access comparable to the EU Single Market

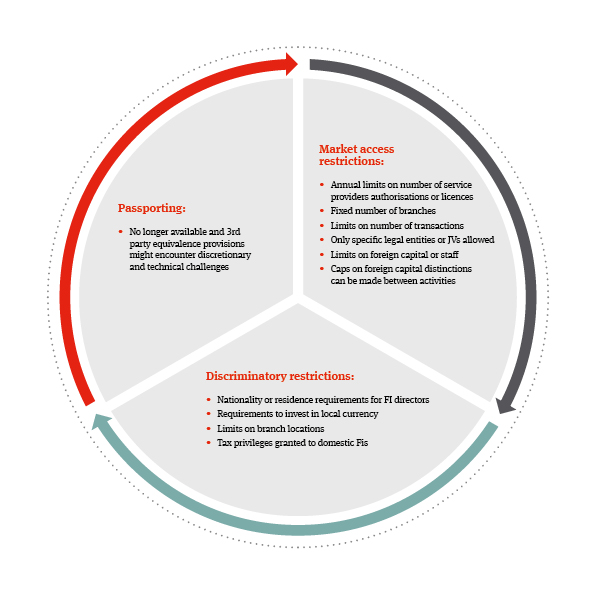

Market access restrictions and other barriers to trade will be an inevitable outcome of Brexit and will appear between the UK and the EU, although their extent will depend on the final outcome of the ongoing negotiations. In particular, the impact of new barriers and restrictions will depend on whether a Free Trade Agreement (FTA) or partnership is in place between the UK and the EU, on the terms of a transitional arrangement or, in the case of a ‘hard Brexit’, a default to World Trade Organisation (WTO) rules. In March 2019, the EU treaties between the UK and the EU will cease to apply. This cut off point could be extended for a period if transitional arrangements are agreed. However, the UK will no longer be part of the EU Single Market, the EU customs union and existing EU preferential FTAs with third countries.

In this ‘hard Brexit’ scenario, the UK will trade with the EU and the rest of the world on WTO non-preferential rules that do not provide financial services with levels of market access comparable to the EU Single Market. This will have a substantial impact on financial services who will lose access to passporting, lose market access and face discriminatory restrictions in operating or offering services in the EU and other markets.

The WTO agreement applicable to financial services is the General Agreement on Trade in Services. This sets out rules that apply to a wide array of financial services:

Even where an FTA has been negotiated and in place, investments, exporting and importing financial services from and to the UK might be affected by those restrictions. The extent of these barriers and restrictions – although they will be improvements on WTO rules – will not be known until negotiations are concluded. However, financial services businesses should ensure that their views and concerns are fed into governments on both sides.

Contingency planning - a case-by-case assessment of your business’s current reliance on EU passporting and equivalence regimes or the EU’s existing FTAs or any other cooperative arrangement with third countries, concerning restrictions to trade in financial services and investments, required mutual recognition or cooperation agreements, existence of regulatory barriers and potential trade opportunities in other countries.

Influencing negotiating positions, financial services need to continue influencing UK’s and EU’s Brexit negotiating positions and trade negotiations with third countries, particularly on:

Author: Simon Lovegrove

A round-up of recent regulatory developments in the EU and UK. To receive daily updates on regulatory developments subscribe to our blog, Regulation tomorrow.

| Title | Date | Comment |

| Commission legislative proposals for reforms to the European Supervisory Authorities (ESAs) | 20.09.17 | The European Commission publishes legislative proposals reforming the European System of Financial Supervision. Among other things the proposals give the European Securities and Markets Authority (ESMA) a greater co-ordinating role in market abuse cases. It will have the right to act in specific cases, where certain orders, transactions or behaviour give rise to well-founded suspicion and have cross-border implications for the integrity of financial markets or financial stability in the EU. ESMA will be able to recommend that authorities in the Member States concerned initiate an investigation and exchange relevant information among each other and with ESMA. ESMA will also have direct supervision of European Venture Capital Funds, European Social Entrepreneurship Funds, and European Long-Term Investment Funds. |

| FCA speech on enforcement | 20.09.17 |

The FCA publishes a speech by Mark Steward, FCA Director of Enforcement and Market Oversight. The speech is entitled ‘A better view’. In his speech Mr Steward discusses recent FCA enforcement trends, particularly in the context of wholesale markets. In the final part of his speech Mr Steward covers the FCA’s enforcement of MiFID II. |

|

PRA and FCA remind firms about ESA guidelines on prudential assessment of acquisitions and increases of qualifying holdings in financial sector |

20.09.17 |

The FCA issues a statement noting that the ESAs guidelines on the prudential assessment of acquisitions and increases of qualifying holdings in the financial sector come into force on 1 October 2017. The FCA and PRA have notified the ESAs that they will comply with the guidelines except for provisions relating to the identification of acquirers of indirect qualifying holdings. Firms should continue to use the existing methodology as laid out in Part XII of the Financial Services and Markets Act 2000 to identify proposed and/existing controllers. The PRA has also updated its webpage on submitting, assessing and determining a change in control to reflect this statement. |

|

FCA speech on culture and conduct in financial services |

20.09.17 |

The FCA publishes a speech by Jonathan Davidson, FCA Executive Director of Supervision – Retail and Authorisations. The speech is entitled ‘Culture and conduct – extending the accountability regime’. Among other things Mr Davidson discusses how the regulator assesses the management of culture within a firm. |

|

FCA Market Watch 53 |

19.09.17 |

The FCA publishes Market Watch 53. In this issue of Market Watch, the FCA focusses on the MiFID II legal entity identifier (LEI). A LEI is a unique identifier for persons that are legal entities or structures including companies, charities and trusts. The obligation for legal entities or structures to have an LEI was endorsed by the G20. |

|

ESMA Q&A on market structure topics |

12.09.17 |

ESMA updates its Q&As on MiFID II market structure topics. The new Q&As relate to the following topics:

|

|

FCA makes market investigation reference for investment consultancy services |

14.09.17 |

The FCA decides to make a market investigation reference to the Competition and Markets Authority (CMA) in relation to investment consultancy and fiduciary management services. This is the first time that the FCA has made such a reference to the CMA.The CMA will now begin a market investigation to review how competition is working for investment consultancy and fiduciary management services. |

|

New Commission proposal on screening foreign investments in the EU |

13.09.17 |

The Commission publishes new draft legislation that would, if adopted, empower both Member State governments and the Commission to screen and block or unwind foreign investments in the EU on the grounds of “security or public order”. The proposed Regulation would apply to all investments of any kind made or proposed by a “third country” (i.e. non-EU) natural person or undertaking intended to establish or maintain “lasting and direct links between the foreign investor and the entrepreneur to whom or the undertaking to which the capital is made available to carry on an economic activity in a Member State”. Foreign investments in non-EU undertakings may also be subject to screening where the investment facilitates economic activity in the EU. |

|

FCA webpage on ICOs |

12.09.17 |

The FCA publishes a new webpage on initial coin offerings (ICOs). In particular the FCA discusses whether an ICO falls with the regulatory perimeter. |

|

UK Finance and AFME paper on the need for post-Brexit contractual certainty on cross-border financial services contracts |

08.09.17 |

UK Finance and the Association for Financial Markets in Europe (AFME) co-publish a paper that examines the impact of Brexit on cross-border financial services contracts. |

|

AFME view on the application of the MiFID II share trading obligation |

06.09.17 |

AFME publishes a paper setting out its view on the scope of the requirement in Article 23 of MiFIR for certain share trades to be carried out only on specified regulated trading venues. The AIFME states: “In our view, the share trading obligation applies only to a MiFID investment firm when it is the final entity in the chain of execution in any given trade flow. Whereas a MiFID investment firm that places an order with or transmits an order to a third party (being another investment firm or a non-EEA firm) for execution, or is a passive intermediary in a chain of execution, should not be caught by the obligation, as it does not undertake the relevant trade.” |

|

ESMA updates Q&As on MAR |

01.09.17 |

ESMA updates its Q&As on the Market Abuse Regulation. New questions and answers have been added on the following topics:

|

|

Commission publishes draft Delegated Regulation specifying the definition of systematic internaliser |

30.08.17 |

The Commissions publishes a final draft of a Delegated Regulation that amends Delegated Regulation (EU) 2017/565 inserting a new Article 16a (Participation in matching arrangements) which states: “An investment firm shall not be considered to be dealing on own account for the purposes of Article 4(1)(20) of Directive 2014/65/EU where that investment firm participates in matching arrangements entered into with entities outside its own group with the objective or consequence of carrying out de facto riskless back-to-back transactions in a financial instrument outside a trading venue.” |

|

Legal implications of Brexit: Customs Union, Internal Market Acquisition for Goods and Services, Consumer Protection Law, Public Procurement |

14.08.17 |

A policy department of the European Parliament publishes a study on the legal implications of Brexit. The study addresses the implications of several scenarios of the UK withdrawing from the EU in relation to the EU Customs Union, the Internal Market law for goods and services (excluding financial services), and on consumer protection law, identifying the main cross-cutting challenges that have to be addressed irrespective of the policy choices that will be made in due course. |

Publication

The USTR's Section 301 actions targeting Chinese and other foreign vessels is set to take effect on October 14, 2025.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2025