LNG bunkering is growing in popularity as it has a far better emissions profile than traditional petroleum-based sources of marine fuel, which has been particularly important since the ICPPS (see above) came into force this time last year. In addition, although the Paris Agreement made no specific reference to shipping, there is a general movement towards a cleaner, greener future and a 20 per cent reduction in carbon dioxide from shipping emissions (achieved by switching from marine fuel to LNG) is seen as a key component of the strategy to meet this aim. According to a recent DNV-GL study, the number of non-LNG carrier vessels running on LNG will reach 1,000 by 2020. Whilst current low oil prices are expected to rise in the longer term it is likely that low priced LNG out of the US will be available to make the use of LNG as a bunker fuel competitive against heavy fuel oil, even factoring in the conversion costs. The ordering of LNG-fuelled ships is becoming a more common occurrence in Northern Europe – see for example the recent orders of LNG-fuelled ships from Tallink Grupp and Containerships.

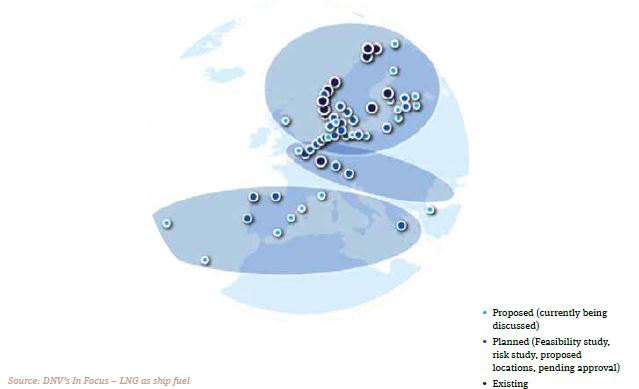

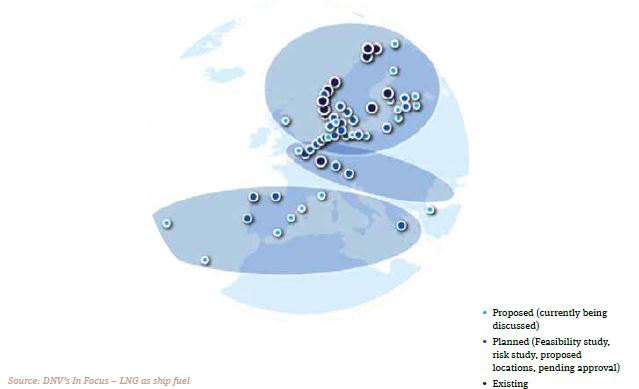

The infrastructure necessary for refuelling LNG-powered vessels is currently limited, but expanding as new LNG bunkering projects come on stream across Europe, with more proposals for bunkering facilities under consideration. So far Europe’s LNG bunkering activity has been focused in the north, notably Scandinavia and the Baltics. Pilot projects have been developed in northern Europe, boosted by strong government support, infrastructure already in place and the ICPPS. However, there are also a number of initiatives underway elsewhere in Europe, including the Poseiden Med II project (see below) and multiple studies focused on Greek waters.

The Port of Rotterdam was the first port in Europe to offer LNG bunkering in 2014. New facilities have been recently announced for the Port of Antwerp (expected 2019), and the owners of many other European import terminals are considering similar expansion. We are beginning to witness a new add-on to traditional project models for LNG terminals, whereby bunkering vessels are granted rights to load LNG at existing terminals and then deliver LNG to arriving vessels. Such bunker delivery will be either at a berth, from road tankers (truck to ship) or via ship-to-ship transfer. There could also be huge potential to expand the sector in the Mediterranean for use in container vessels, tugs and other support vessels operating close to shore, as well as cruise liners and passenger ferries. At a panel session on ‘LNG as a Marine Fuel’ held during London International Shipping Week in September 2015 (during which the issues and solutions surrounding LNG as a marine fuel were discussed) the panel were unanimous in their view that a major change is imminent, and a number of independent industry forecasts indicate that the use of LNG as a bunker fuel offers opportunities for early movers to secure a market-leading position ashore and afloat as global LNG fuelling becomes a mainstream option.

Poseidon Med II LNG Bunkering Project Formally commenced in February 2016 as a continuation of the previous Poseidon Med and Archipelago LNG projects , this European cross-border project, co-financed by the European Union through the Connecting Europe Facility, aims to take all necessary steps towards adoption of LNG as marine fuel in the east Mediterranean and Adriatic Seas, with the aim of making Greece an international marine bunkering and distribution hub for LNG in South Eastern Europe. It encompasses three EU member states (Greece, Cyprus and Italy) and its task is to prepare a detailed infrastructure development plan promoting the adoption of LNG as marine fuel for shipping operations. The final stage of the project (to be completed by 2020) is expected to include a detailed strategy plan for an LNG transport, distribution, and supply network, and define the framework for a well-functioning and sustainable market. The project is coordinated by the Public Gas Corporation of Greece (DEPA) and comprises 26 partners including DEFSA (the Greek gas system operator), Lloyd’s Register, Ocean Finance, all major short sea shipping companies operating in Aegean, Ionian and Adriatic seas, as well as several of the main seaports in the region such as the Port of Piraeus, the Port of Venice and the Port of Limassol.

Norton Rose Fulbright acts on Europe’s first LNG bunkering vessel

We recently acted for NYK, Engie SA, Mitsubishi Corporation and Fluxys SA in relation to the US $45 million debt financing of MV Engie Zeebrugge, a new-build LNG bunkering vessel with a capacity of 5,100m3. The vessel is currently under construction at Hanjin Heavy Industries shipyard, South Korea, with delivery expected towards the end of 2016. On delivery it will be used for bunkering in and around the Zeebrugge port, by loading LNG at the Zebrugge LNG terminal and supplying arriving vessels via ship to ship transfer. United European Car Carriers (a Norwegian automobile carrier) will be the primary user of the vessel under a longterm bunkering contract but the vessel is intended to be multi-user, which aligns with Fluxys’ strategy of supporting the development of the small-scale LNG market.