After a pandemic affected 2020, Australian and global markets bounced back strongly in 2021. M&A records were smashed as companies adapted to new ways of working and investors continued to benefit from low interest rates and easy access to capital. In Australia, the frenzied M&A market was driven by strong demand in the technology and healthcare sectors, in many cases resulting in sky-high valuations.

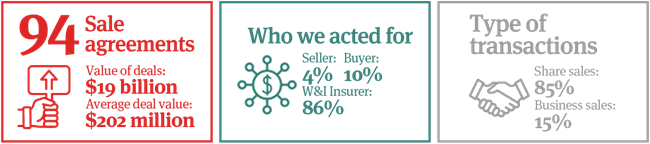

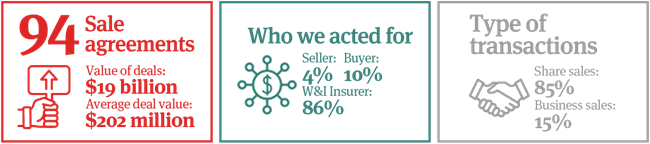

Our 2021 report closely analyses 94 completed private M&A transactions that Norton Rose Fulbright Australia has acted on during the calendar year and is intended to provide an empirical benchmark of Australian market practice for key private M&A negotiation points.

This report covers:

|

|

|

Key Features

- Warranty & indemnity insurance

- Foreign buyers

- Target industries

- Business v share sale

- Form of payment

- Post-completion adjustments

- Locked box

- Earn out

Conditionality

- Material adverse change

- Regulatory approval condition

- Other common conditions

- Warranties and liability limitations

- Monetary liability cap on warranty

- Limitation of liability – time limits

- Limitation of liability – buyer knowledge

- Limitation of liability - disclosure

- Warranties qualified by public searches

- Restraints

Read the full report

|

Deal Protection

- Deposit

- Break fees

- Guarantees

M&A trends to look out for in 2022

- Divestures, demergers – a focus on core capabilities

- Supply chain

- Digital transformation

- Spotlight on ESG

|