The extent of the worldwide group is determined by identifying the ‘ultimate parent’ and its consolidated group (based on IFRS consolidation rules). This group is relevant both for identifying those companies to be included in the net UK interest expense calculation and in identifying the extent of the worldwide group to be taken into account in the restriction ratios which work by reference to the net interest expense of that worldwide group. It is worth noting that ‘interest’ for these purposes includes various other types of finance-like expense, such as payments under finance leases.

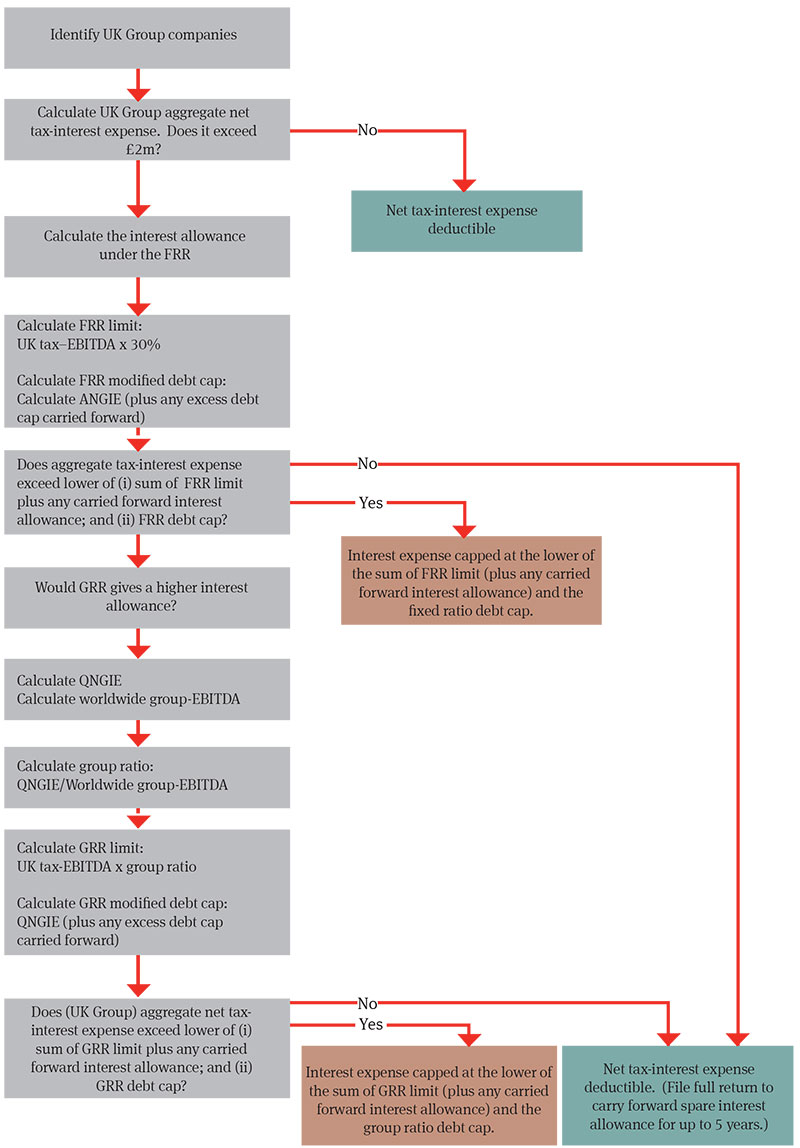

Looked at in broad outline the principles behind the regime are (relatively) straightforward. The difficulty is in their application to specific circumstances and the large number of elections that can be made in respect of the underlying calculations.

The £2m de minimis

The regime allows deduction of up to £2 million of net UK tax interest expense (i.e. tax interest expense less tax interest income) by group members subject to UK corporation tax without restriction (these are referred to as ‘UK Group Companies’ but it is worth remembering that this includes permanent establishments of non-UK companies). The £2 million applies to the group as a whole, not each company and there are rules regarding its allocation amongst members. Tax interest expense is calculated after application of other rules which may restrict interest deductibility such as transfer pricing, unallowable purpose and anti-hybrid rules. This £2 million acts as a threshold de minimis for application of the regime: there is no carry forward of any unused portion.

The fixed ratio rule (FRR)

The starting point is the FRR. The fixed ratio is the default limit and is set at 30 per cent of UK aggregate tax-EBITDA (30 per cent is the highest level contemplated in the OECD’s BEPS Action 4 report). ‘Aggregate tax-EBITDA’ is essentially the UK Group’s profits subject to UK corporation tax after certain adjustments.

The fixed ratio debt cap

In addition to the basic ratio calculation, both the FRR and the group ratio rule (discussed below) include (different) debt cap restrictions which can restrict relief further.

The fixed ratio debt cap works by reference to the gearing of the wider global group, discouraging groups from gearing the UK group more highly than the worldwide group. In that respect the cap builds on concepts familiar from the UK’s worldwide debt cap regime but it is important to note that it operates differently and works by reference to different underlying calculations. There is also no ‘gateway test’ for the new fixed ratio debt cap.

To determine the fixed ratio debt cap you need to: (i) calculate the group’s worldwide net group-interest expense; (ii) adjust this figure for certain items – giving the ‘adjusted net group-interest expense’ (ANGIE); (iii) add any excess debt cap brought forward from the previous period (how this carry forward works is described below).

The group ratio rule (GRR)

The GRR is intended to provide some flexibility to multinational groups which may be highly leveraged but are not more highly geared in the UK than generally. In order to maximise the unused interest allowance figure which is carried forward, even if the FRR does not give rise to a restriction, there may nevertheless be merit in electing for calculation on the basis of the GRR where that calculation gives rise to a greater interest allowance. A GRR election is revocable.

The GRR restricts deductions by reference to the worldwide group’s interest ratio. The calculation can be highly complex due to a number of elections as to the method of calculation that can be made.

The group ratio percentage is QNGIE/(worldwide group-EBITDA ) x 100 and is capped at 100 per cent.

- Calculating ‘QNGIE’: the worldwide group’s ‘qualifying net group-interest expense’. Whilst based on the ANGIE calculation, further downward adjustments are made in the calculation of QNGIE. In addition to excluding some other amounts which would not usually attract relief in the UK such as interest on results dependent securities and on perpetual debt, interest owed to related parties, including in some circumstances debt guaranteed by related parties, is also excluded. The ‘related party’ concept is broadly drawn and includes 25 per cent investments, determined on the basis of broad ‘acting together’ principles so that it is likely that consortium investments will be caught.

- The worldwide group-EBITDA. There are a number of elections to use alternative methods for this calculation which can be made and the appropriateness of which will be highly group-specific.

The interest allowance under the GRR is the lower of the group ratio percentage of the UK aggregate tax-EBITDA and the group ratio debt cap.

The group ratio debt cap

The group ratio debt cap is the sum of QNGIE and any excess debt cap brought forward from the previous period (how this carry forward works is described below). As noted above, a number of expense amount are excluded from the QNGIE calculation meaning that the group ratio debt cap can apply a restriction where the fixed ratio debt cap (based on ANGIE) does not.

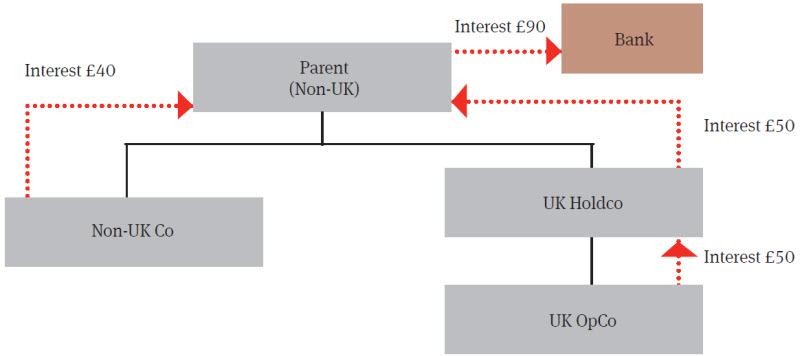

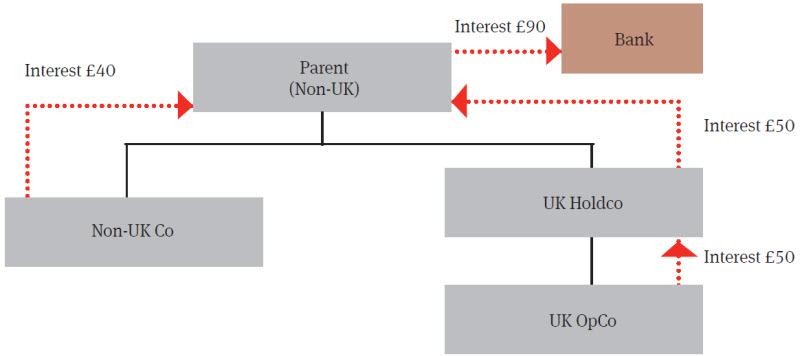

HMRC’s guidance provides a simple example calculation which demonstrates the basic principles for the FRR and GRR calculations and can be applied to the following illustration:

Aggregate tax–EBITDA: 100

Group tax–EBITDA: 200

|

FRR

|

|

30% of aggregate tax-EBITDA

|

= 30% x 100 = 30

|

|

Fixed ratio debt cap (ANGIE)

|

= 90

|

|

Basic interest allowance (lower of 90 or 30)

|

= 30

|

|

Fixed ratio method restriction

|

= 20

|

| GRR |

|

Group ratio debt cap (QNGIE)

|

= 90

|

|

Group ratio percentage = QNGIE / Group tax- EBITDA

|

=90/200 x 100 = 45%

|

|

Group ratio percentage of aggregate tax-EBITDA

|

= 45

|

|

Basic interest allowance (lower of 90 or 45) = 45

|

= 45

|

|

Group ratio method restriction

|

= 5

|

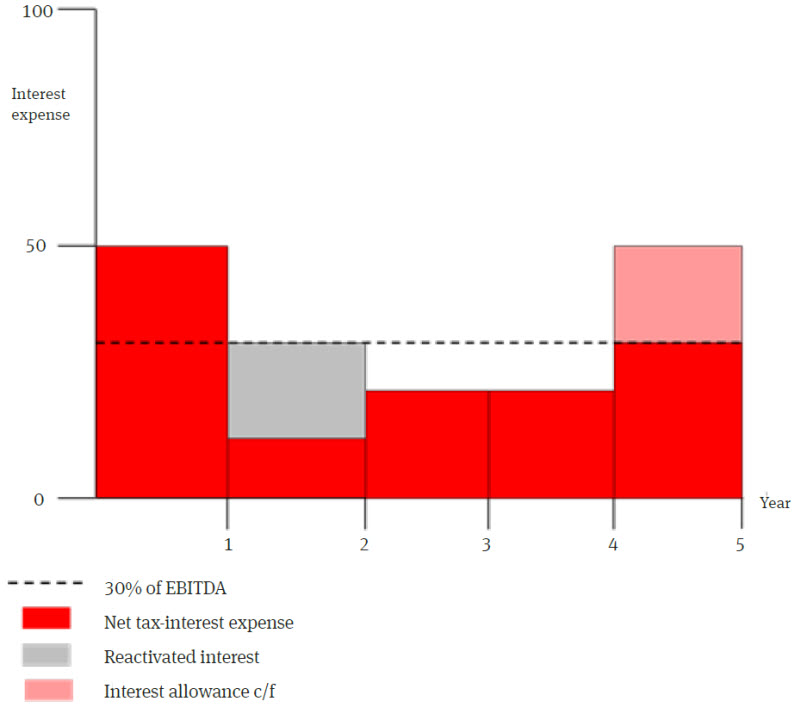

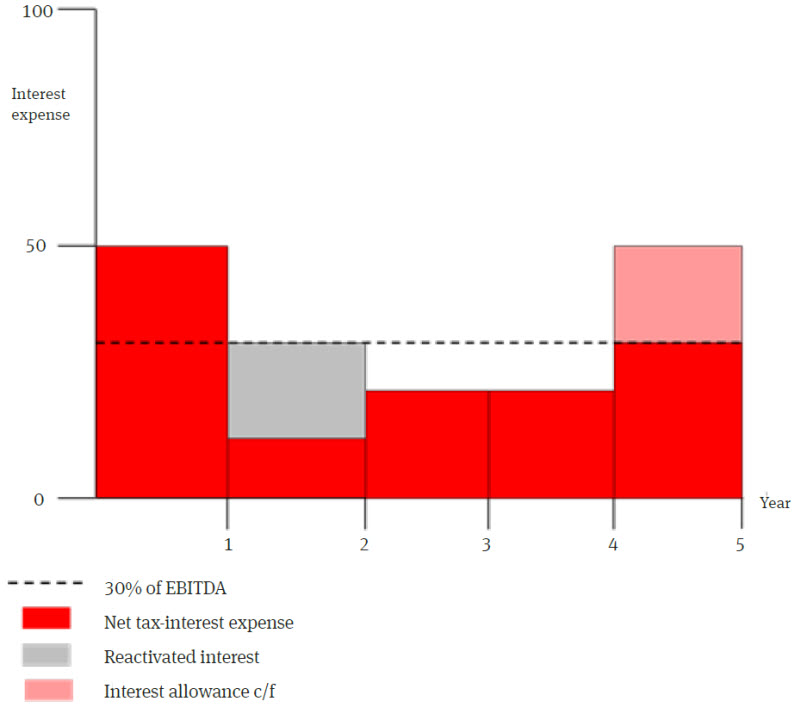

Reactivation of restricted interest and carry forward of unused interest allowance

Where there has been a disallowance, restricted interest (i.e. disallowed amounts) can be carried forward indefinitely at company level. These amounts are then reactivated in a subsequent period to the extent that the group has available unused interest allowance in that period. The group will have unused interest allowance where the group’s interest allowance for the period, calculated applying the FRR or GRR method, exceeds its aggregate net tax interest. Restricted interest is carried forward indefinitely and can be accessed even if that company becomes a member of a different group.

Unused interest allowance is carried forward at group level (defined by the identity of the ultimate parent) and can be used in a subsequent period for up to five years.

Unused interest allowance can only be carried forward where a full interest restriction return has been filed. If an abbreviated return has been filed on the basis that there is no interest restriction, it can be replaced with a full return up to 36 months after the end of a period of account to enable access to unused interest allowance.

By way of illustration, taking a simple example of the FRR restriction:

In practice, the application of these rules, particularly in situations where companies leave or join a group and accounting periods are not aligned or in respect of consolidations of non-wholly owned entities, will be extremely complex.

Excess debt cap carry forward

There is also potential for excess debt cap (i.e. the excess of ANGIE over the FRR limit or of QNGIE over the GRR limit) to be carried forward at group level. This is subject to a ‘carried forward limit’ set at the sum of any excess debt cap from the immediate prior period plus the total disallowed amount for that period.

Administration

Periods of account straddling April 1, 2017 are treated as two notional periods. The worldwide debt cap applies to the period to March 31 and the new regime to the period from April 1.

The responsibility to file the interest restriction return is with the ‘reporting company’, a company appointed by the group (or by HMRC in limited circumstances). The interest restriction return must include details of the composition of the group, computation of interest restriction or reactivation caps and an allocation of disallowances or restrictions. It must also include details of any elections made.

Interest disallowances are allocated by the reporting company at its discretion unless a company has notified HMRC that it is not ‘consenting’. In that case the disallowance that can be allocated to it is capped at a pro rata amount of the disallowance. Specific (detailed) provisions govern the computation of pro rata amounts. Reactivations, in terms of allocating unused interest allowance between group companies are also at the discretion of the reporting company and, again, specific rules determine the maximum amounts that may be reactivated per company. These address a number of different scenarios, including where individual company accounting periods do not coincide with the worldwide group’s period of account.

Elections

There are a number of elections that can be made in addition to the election to apply the GRR. These include two elections that can be made to enable certain items to be included in the underlying Group EBITDA calculations on the basis of UK tax, rather than accounting, principles. A full discussion of these is beyond the scope of this briefing but it is worth noting what these might allow. There is a particular concern for minority shareholders of companies consolidated into another group. The first is a ‘group-EBITDA (chargeable gains) election’ for the calculation of profits and losses on capital assets. The second is a single election incorporating a number of alternative calculations in respect of capitalised interest, pension contributions, employee share acquisitions and changes in accounting policy.

Further possible elections include a ‘blended’ group ratio election which allows the group ratio percentage to be calculated with reference to the group ratio percentage of one or more related party investors; a non-consolidated investment election which allows calculations to be made for the period as if certain specified non-consolidated investments (e.g. joint ventures) were consolidated; and a separate (irrevocable) election which can be made in relation to partnership interests.

There has also been much discussion of the Public Benefit Infrastructure Exemption (PBIE) which takes certain project companies (and in certain circumstances rental property businesses) outside the interest restriction. (We have produced separate materials on the PBIE: see http://www.nortonrosefulbright.com/knowledge/publications/144631/financebill- 2017-corporate-interest-restriction.)